Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

If you haven’t already noticed, I absolutely love the thrill of MTG speculation. The rules of economics have always been a hobby of mine. And while actively trading on the stock market can be fun and rewarding, I simply do not get the same level of enjoyment out of owning digital representations of shares of a company as I do physical trading cards.

The lucrative aspect of the hobby is also appealing. I can seed my competitive decks while remaining active and relevant in the MTG community, often without setting foot outside my apartment (besides walking to the post office).

But even though I’ve been doing this for a couple years, I still don’t feel my “MTG funds” are as high as they could be. I’m making solid profit on most of my speculative plays, so where is all my money going?

Recently, much of my profits have been getting reinvested into additional speculation targets, but I’m starting to have trouble keeping up. Especially with the activity in the QS Forums, I’ve felt some unwanted strain in trying to dabble in all the viable speculation targets discussed.

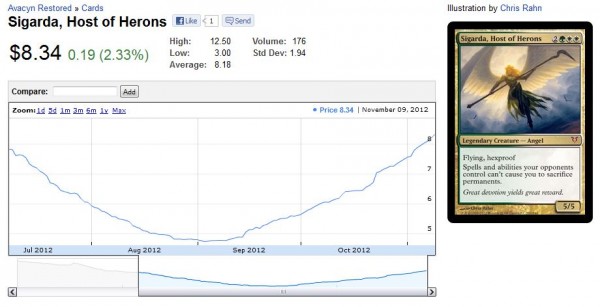

Just this past week or two we’ve seen talk of Vengevine, Bloodghast, Zendikar Fetch Lands, Might of Old Krosa, Goblin Electromancer, Sphinxs Revelation, Rakdos' Return, Thundermaw Hellkite, Sigarda, Host of Herons (chart from blacklotusproject.com) and even more.

I simply do not have the excess funds (nor the guts) to go deep in all of these cards. To do so would risk the majority of my “MTG funds” and lock me out of future opportunities which may have even more upside.

So how do I proceed? This week I will discuss how I weigh whether or not to buy into a speculative card and how deep I should go. While my approach may not be a one-size-fits-all, hopefully those of you with limited funds and time will find these guidelines useful in some capacity.

The News Hits

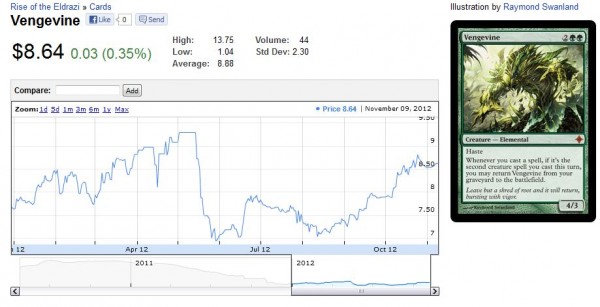

It’s happened many times already. I take a quick peek at the Quiet Speculation Forums or my Twitter feed and I see discussion on a new card. Most recently it was Vengevine (chart from blacklotusproject.com).

Seems like a practical choice – the card used to be a $30 Mythic in Standard, it was the third set of its block, and it has started making a splash in Modern. But after reading discussions on the forums I see that the early buyers were grabbing this card at $9 and now the cheapest copy online is $12. Is this still a buy?

Factors to Consider

Before pulling the trigger, I do some quick and dirty research. First, I see what the cheapest copies are selling for on eBay, Card Shark and Amazon. If I find any cards still priced low I do pull the trigger on those right away. It’s no surprise that most of the time this isn’t the case.

So I look at the average selling price and see that indeed $12 is the card’s value at this instant. My next step is to head over to StarCityGames.com and check a) what they are selling at, b) what they are buying at, and c) how many they have in stock. All three data points indicate a different piece of information you should weigh before buying into a spec.

The selling price tells you what you can hope to trade the card away at should you be unable to sell for profit. Cash is always king, but sometimes getting an inflated retail value on an overhyped card can also be profitable if the right trades are made. Currently the sell price on SCG is $17.99 for NM copies – a solid 50% premium above average sell prices at auction.

The buy-price is your safety net, but only to a degree. In general, I try to buy any cards I find online that are at or below SCG’s buy price, but even this can be a fallacy. Star City Games has way more selling outlets than I do and they can afford to overpay on some cards. Even though the buy price is subject to change, I use it as a general rule of thumb for what my downside risk is for this speculation. Currently the SCG buy price is $8, indicating a 33% risk should I purchase Vengevines at $12.

The number of copies in stock is the wild card – it often tips the decision for me in one direction or another. Since Star City Games always has their fingers on the pulse of the market, they are quick to modify their available quantities to reflect demand. If there are many in stock, chances are they have excess copies they are happy to unload.

If SCG’s website is out of stock, it means they are likely waiting to see where the price settles at, and a price change is more likely. For Vengevine, SCG currently has 16 non-foil copies in stock. Not a huge number, and the fact that the quantity is a multiple of 4 indicates to me they may be rationing copies out by playsets. There is no doubt in my mind that they are watching this card closely.

Exit Strategy

Vengevine is a hot card right now, many speculators are buying in. But I missed the price bottom, is there still room to grow? I could always trade them at $18 if I can’t sell for profit, but what if SCG adds more to their stock? Perhaps that $8 buy price isn’t too low after all…

These thoughts all run through my mind as I try to decide if I want to buy and how many copies I should acquire. But before pulling the trigger, there is one other part of the strategy I should consider: the exit strategy. How do I plan on unloading these cards?

The best scenario is when the card increases so much in price that I could sell to buy lists for easy profit – even if I had 50 copies. You may be able to get more, but working directly with a retailer, especially at a premier event, can net you easy cash with minimal effort. The best kind of profits are the profits you had to work very little to acquire.

Most often, I sell my cards online via MOTL, eBay, or other MTG listing site. This approach enables me to get the most for my cards albeit with some investment of effort. For more expensive plays, this can often be the favored route.

If I buy 50 copies of Might of Old Krosa (chart from blacklotusproject.com) at $0.50 each and I sell them on eBay for $4/set, it may look like I’ve doubled up on the investment. But with fees and shipping costs I’d be lucky to break even. Simply put, not many people will want to buy all 50 copies at $1 each. Retailers will, however, and even if you only get $3/set selling to a buy list, you may net larger profits.

Going back to the Vengevine example, I need to realize that a buy list bump is not likely in the near term, and even if it did happen the next logical buy price would be $10. This is still not profitable. That means we’re either hoping for a significant jump in price or we plan on selling to other players / trading them away. This means more effort and more risk.

The Decision

Ultimately, the decision is yours. If you feel Vengevine is destined to return to its former glory and reach $30 again, then you would of course buy heavily. My conclusion was that I think the card could have legs but there’s not a ton of near-term profit to be had. As a result, I purchased a few copies at $11 each and I’ve put a hold for now. I figure I can sell them on eBay and at least make my money back if not earn a 10% profit.

It’s all about opportunity cost. My funds are limited and I can’t chase every card that may have legs. To help me decide, I move motion aside and weigh costs/risks as best as I can. This objective approach often (but not always) prevents me from making foolhardy investments simply because of an emotional reaction.

And even after all of this analysis, the card still has to perform to make you money. This is often the unknown part and yet the most crucial. When I ran through this analysis on Nivmagus Elemental I realized there was a chance for major profit. I acquired 25 copies at around $1.25 each knowing that the card could hit $2 or even $3 on retailer buy lists. All I needed was for the card to perform well at the Pro Tour… which just didn’t happen.

…

Sigbits – Booster Box Edition

A while back I wrote an article about how sealed booster boxes could be a solid, safe investment. Today I want to revisit some of the calls I made in the April 2012 article and compare them against recent completed eBay auctions.

- Unhinged: In my article I discussed how purchasing two boxes of Unhinged at $144 had paid off since boxes had just cracked $200 on eBay. Looking at eBay auctions completing now, I see that the price has risen even further. They have approached and in a rare instance even broke the $300 barrier. The ride isn’t over yet.

- Coldsnap: I talked about purchasing a booster box of Coldsnap due to being Modern legal and being underprinted. The average price I paid was around $110. Recent completed listings have been in the $150 range. I don’t expect to see a whole lot of Coldsnap in Modern Masters, and boxes of this mostly casual set may slowly increase. Upside from here may be limited though.

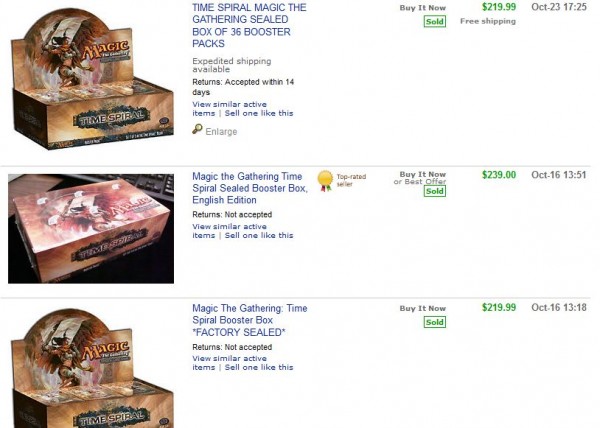

- Time Spiral: In the article I cite that I was happy to purchase an English Booster Box of Time Spiral for $160. Looking at recent completed listings on eBay, I see that the price on English Time Spiral boxes range from $200 - $240.

-

A solid $50 increase, this investment has also paid out fairly well. The casual appeal of the set combined with a few Modern/Legacy playable cards should help keep this set’s sealed product pricing stable. Without a major catalyst, however, I’m fairly confident there could be a set with higher upside potential right now (Avacyn Restored, New Phyrexia).

-Sigmund Ausfresser

@sigfig8

The prices on sealed product are still astounding. Are you finding those boxes in hobby stores? Buying them on one corner of the internet to sell to another?

Also, buying on the margin of difference between buylist and retail price is a great way to figure out how to spend limited speculation funds. I\’m glad you mentioned it here and it really helps a person figure out their risk tolerance. Buying Vengevines at $10 when they buylist for $8 (and probably Ebay for a little more than that) is low-risk, but getting to $12 and above gets dicier. I\’m going to earmark this article so I can send it out with other Insider alerts!

Doug,

Thanks for the comment! For sealed product, I camp out on eBay. Many of the eBay buy it nows are overpriced on sealed product. When someone lists an auction for an out of print sealed booster box, that’s when I watch closely and snipe. I have found this is where I get the best price. For selling, I would recommend using eBay and listing as buy it now (the opposite). It takes longer to sell, but it’s amazing how people want instant gratification.

Funny story – a while ago I bought an Italian SoK booster box for cheap, thinking it would go up. It didn’t. Then SCG listed like 40 for sale at $59.99. So I went to eBay and noticed there were 0 on eBay. I listed mine at $64.99 + $10 shipping, ABOVE SCG prices, and it sold in a couple days. This is definitely the way to go when selling sealed product.

Glad the risk tolerance analysis is helpful. I use it all the time (just did when picking up Sphinx’s Revelation). It’s good to look at the numbers and let those guide an objective decision. I get caught up in the emotion of hype way too often!

I understand the value you can take from investing in sealed product….but it seems like you have to wait too dam time to cash from it. I prefer to rather invest that money in singles…because you can cash from them in short/medium term (and use it the profits to re-invest once again). Also, I think that the profit margin is a bigger in singles.

This can be true. But I always strive for a diverse portfolio. In the stock market, I don’t concentrate all my money in individual stocks. I like to invest in Bonds, ETF’s, etc too. The potential for profit may not be as high but the likelihood of profit may be higher and the downside risk is less. To me, booster boxes are a great way to stabilize the portfolio. They are the slow and steady growers of my MTG portfolio and they almost always pay out.