Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

As a set, it appears that Return to Ravnica (RtR) has found a price bottom in recent weeks. The chart below is an index produced by mtggoldfish.com which tracks prices from supernovabots.com. Prices have been fairly stable since mid-December, but the latest price increase has brought the price of headline mythics either above their lows or to new highs.

For instance, Jace, Architect of Thought was bouncing up and down between 15 and 16 tix, and as of January 10th, 2013 is at 17.3 tix on supernova. Sphinx's Revelation has been down to 23 tix, but now is closer to 24 tix. The less-played RtR shocklands were generally below 3 tix since the start of December, and they are all above 3 tix today.

The chart below represents RtR prices as an index. In the last week, the index value dipped to it's lowest level and then rebounded. With Gatecrash on the horizon, players are looking towards a shift in the Standard metagame and interest in RtR cards is rising.

Also, Gatecrash previews have appeared to be less powerful than RtR previews did at this point in the spoiler season. To put it bluntly, Gatecrash previews have been underwhelming. If this trend continues, RtR will dominate block constructed and recent price strength in block staples such as Armada Wurm might signal increased interest in that format online.

To sum up, if you have been interested in speculating on RtR cards, they will not be cheaper in the coming months than they have been in the last six weeks. Hopefully you've been accumulating the shocklands as these are some of the lowest risk speculative targets from RtR. Let's look back to what happened to some other dual lands from previous years to get a sense of what we can expect from shocklands as a speculative bet in the next 12 months.

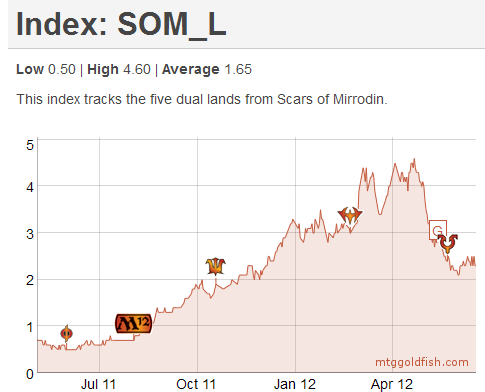

Scars of Mirrodin

The fastlands from Scars of Mirrodin (SoM) were released in the shadow of the Zendikar fetchlands. For this reason, they were not fully appreciated until after Zendikar block rotated out of Standard. Looking at the price history of the fastland index, a bottom occurs at the release of New Phryexia (NPH). The flood of supply from NPH release events depressed prices on all cards from SoM and the fastlands suffered too.

Once M12 was released and drafters shifted focus, prices on the fastlands started upwards, and this trend intensified with the Standard rotation of Fall 2011. Prices really took off once Delver decks started asserting themselves in Winter months of that year. The subsequent highs typically came at different times in the following year, after the release of Dark Ascension but before the release of Avacyn Restored. In the table below you can see that most of the fastlands were very profitable.

| Card | Low | High | % Change |

| Blackcleave Cliffs | $0.5 | $3.0 | 500% |

| Copperline Gorge | $0.3 | $2.8 | 817% |

| Darkslick Shores | $0.6 | $8.0 | 1233% |

| Razorverge Thicket | $0.2 | $1.8 | 775% |

| Seachrome Coast | $0.5 | $8.8 | 1650% |

| Index | $0.5 | $4.0 | 700% |

These types of returns are unlikely with the shocklands this year, but this is a guide to what is possible for under-appreciated dual lands. For a more realistic sense of the gains that might be seen on shocklands, let's look to a more recent example.

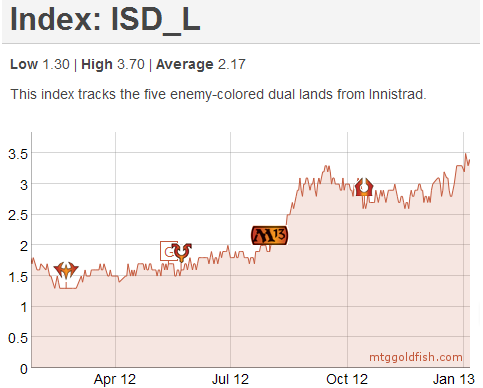

Innistrad

The duals lands from Innistrad (ISD) follow much the same pattern as the lands from SoM. There's a price bottom in and around the last release event during which they were opened widely, followed by a relatively flat period leading up the Summer release of the Core Set. At that point prices start rising as supply from drafters dwindle and players start looking out to Fall Standard.

In the table below, the highs and lows are presented for each of the Innistrad duals. It's quite possible that these cards will make new highs in the coming months, but generally they have been profitable speculative positions for those that were accumulating the cards in the first half of 2012. These returns are less dramatic than the SoM duals, but probably closer to what we'll see with shocklands.

| Card | Low | High | % Change |

| Clifftop Retreat | $0.7 | $3.3 | 364% |

| Hinterland Harbor | $1 | $3.4 | 240% |

| Isolated Chapel | $1.6 | $3.0 | 88% |

| Sulfur Falls | $1.3 | $3.2 | 146% |

| Woodland Cemetery | $1.1 | $3.5 | 218% |

| Index | $1.3 | $3.0 | 131% |

The Shocklands

Let's apply the index change from the ISD duals to the recent lows of each of the shocklands to yield a projected increase. The Projected Price column in the next table is calculated using the Low price and applying a simple increase of 131%, the increase observed from the ISD dual land index. The Projected Gains columns are calculated by first taking a 15% cut from the Projected Price (to represent bot margins) and then subtracting either the Low price or the Current Price for the respective Gains column.

Current Prices in tix are taken from supernovabots on January 10th, 2013, and the Low is taken from historical supernovabots data, most of which comes from December of 2012.

| Card | Low | Current Price | Projected Price | Projected Gains from Low | Projected Gains from Current Price |

| Blood Crypt | $2.5 | $3.4 | $5.8 | $2.4 | $1.5 |

| Hallowed Fountain | $3 | $3.1 | $6.9 | $2.9 | $2.8 |

| Overgrown Tomb | $2.8 | $3.3 | $6.5 | $2.7 | $2.2 |

| Steam Vents | $2.5 | $3.2 | $5.8 | $2.4 | $1.7 |

| Temple Garden | $3 | $3.3 | $6.9 | $2.9 | $2.6 |

| Index | $3 | $3.3 | $6.9 | $2.9 | $2.6 |

The Trouble with Projections

Keep in mind these are projections and individual price peaks on the shocklands will vary. At all points I have used conservative estimates in order to avoid potential disappointment down the road. As a whole, shocklands have more utility in more formats than the ISD duals, so the projected increase of 131% is probably a low estimate. Gains of 150% or higher is probably more realistic, but the fact that the shocklands are reprints muddies the water somewhat.

From a historical perspective, Hallowed Fountain and Steam Vents are two of the more valuable and played shocklands online, and the relatively low availability of their earlier printings suggest that higher price targets are possible. Similarly for Overgrown Tomb and Temple Garden, the greater availability of the earlier printings of these cards suggest to revise expectations on these cards downward. Blood Crypt falls in the middle somewhere in terms of historical playability and relative scarcity of its earlier printing.

Hopefully this analysis will make you confident in what is possible when speculating on in-print dual lands. You can expect another dip in price in these cards when Dragon's Maze is released, but how large the dip will be is unclear as there is no historical precedent for this year's novel block structure. If you've been on the fence about picking up some RtR cards, it's not too late to grab a few shocklands for some small, low-risk gains over the next twelve months.

I’m unlimitedly buying Hallowed Fountain, Blood Crypt and Steam Vents @3 Tix, as thus for the last 3-4 weeks.

With these 3 combined, I’m 99% certain to gain between 50% and 300% total.

This is probably the most profitable and no risk bet for the coming year.

“In the last week, the index value dipped to it’s lowest level…” <– Should not have an apostrophe.

Thanks for that!

Bit confused, I thought prices would rise during Gatecrash’ prime (can I put an apostrophe there ?)(rofl), and now I hear you say to expect another drop during Dragon’s Maze months. There will be more RtR opened but only one pack a draft, so do you expect that pricedrop to counter the rise during Gatecrash ?

I’m not sure where prices will go when Dragons Maze comes out. Worst case scenario that I can imagine I’d that prices come down to their December lows. Most likely is there will be a dip, but prices stay above where they have been lately.

Matt, when are your projections for? Lifetime peak at some random point? Or do you foresee these prices in, say, a year?

Prices peaks for SoM duals were observed during Dec 2011-Feb 2012, and prices on ISD duals look set to make their own highs in a similar period this year. I think it’s reasonable to expect the shocklands as a group to follow this pattern, so yes, I expect the projected prices for the RtR shocklands as a group to materialize this time next year.