Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

The MTGO-to-Paper metric has proven a useful tool for analyzing the potential of speculative investments in digital cards. It appears as if Star City Games (SCG) is having a sale in March, so the current prices for complete sets are discounted. In order to preserve the usefulness of the metric, today's table simply uses last month's price from SCG.

When the baseline price from SCG changes, such as during the current (assumed to be) temporary sale, it's best to use older data. If the sale continues, then I'd have to adjust to the new baseline price and recalibrate the metric. Looking at how the metric changes over time provides a guide for identifying value but if the baseline is shifting it loses a lot of usefulness.

Rotation + Redemption = Profit

If you consider where the ratio stood for the Scars of Mirrodin sets back on November 14th, the signal was to buy Scars of Mirrodin (SOM) and Mirrodin Besieged (MBS) mythics over New Phyrexia (NPH) mythics. In terms of a percent return before transaction costs, a basket of every SOM mythic rare would have yielded a 97% return, an MBS basket would have yielded a 97% return as well and a NPH basket would have yielded 46%. Indices for these sets can be found at mtggoldfish, which tracks historical pricing data from MTGO. Each of these returns is calculated by taking the index value for today and dividing it by the value of the index on November 14th, 2012.

The big caveat in all of these numbers is that mtggoldfish transitioned from using Supernovabot prices to MTGOtraders prices in January. This probably biases the calculated percent returns higher by some amount due to the relatively higher prices of MTGOtraders in comparison to Supernova. However, this change or shock to the data occurred for all three sets. Thus comparing returns between sets is still a valid way to judge the results of the ratio metric. In this case, the digital/paper metric appears to be performing very well.

| Set | MTGO to Paper Ratio (Nov 14th) | MTGO to Paper Ratio (Feb 14th) | MTGO to Paper Ratio (Mar 14th) | Supernova | SCG | Trend |

| Scars of Mirrodin | 0.45 | 0.56 | 0.74 | $92 | $125 | Up |

| Mirrodin Besieged | 0.39 | 0.60 | 0.66 | $66 | $100 | Up |

| New Phyrexia | 0.57 | 0.84 | 0.90 | $99 | $110 | Up |

| Magic 2012 | 0.36 | 0.52 | 0.61 | $91 | $150 | Up |

| Innistrad | 0.51 | 0.48 | 0.59 | $162 | $275 | Up |

| Dark Ascension | 0.64 | 0.62 | 0.77 | $116 | $150 | Up |

| Avacyn Restored | 0.76 | 0.64 | 0.71 | $178 | $250 | Up |

| Magic 2013 | 0.50 | 0.52 | 0.56 | $139 | $250 | Up |

| Return to Ravnica | 0.39 | 0.44 | 0.57 | $158 | $275 | Up |

| Gatecrash | N/A | 0.39 | 0.35 | $105 | $300 | Down |

The ratio metric suggested that NPH was the most expensive of the rotating sets (note that I am ignoring M12 in this analysis due to the presence of reprints). From a value perspective, the goal is to seek out cards from sets that are cheap and thus promise value. In this case, the metric correctly identified which were the cheapest and thus value-laden sets. Three months later the value in SOM and MBS has been realized through increased prices.

For those that have been following along and have a few copies of Koth of the Hammer or Consecrated Sphinx tucked away, selling now would be a fine move. Demand from redeemers looks like it should be slowing down as prices have risen substantially since November. For the 2012 round of Standard rotation, the bulk of gains have been made. Personally I will be selling down my supply of Scars block mythics over the coming months.

ZZW Follow Up

Last week's article looked at a couple of market laggards from Worldwake (WWK) in Jace, the Mind Sculptor and Eye of Ugin. In this case, these two mythic rares had dropped in price in a similar way when compared to the Zendikar (ZEN) fetchlands. The bounce back in the price of the fetchlands suggested that the market had temporarily overreacted to the injection of new supply from the ZZW queues. When the market is overreacting, either through delirious price increases or drastic price drops, it's time for speculators to pay attention.

While the fetchlands bounced back in price for their own reasons (namely they are Modern staples and the Modern PTQ season was in process), all cards from ZEN and WWK had dropped for the same reason. In a counter-factual scenario, if the fetchlands had not bounced back in price, then pursuing laggards would have been a mistake. A failure to bounce back would indicate that the supply injection for fetchlands was large relative to the demand.

Timing the buying and selling of the fetchlands in and around the ZZW queues would have been a neat trick. I didn't touch them at all because I had no data or experience to guide my buying decisions. If you managed to time the market perfectly on a regular basis, I'd love to hear how you do it. But, once the fetchlands did bounce back in price, this provided a strong hint at how much supply had actually been added into the MTGO market. With this hint in hand, I started looking at other cards from ZEN and WWK.

The bounce back in price suggested the supply added to the market was small relative to the demand and that prices had fallen too low. Speculators should have been looking to pick up market laggards such as Jace, the Mind Sculptor and Eye of Ugin. Although demand for these cards is not as high as the fetchlands, demand for them is non-zero and value is value.

Other Laggards

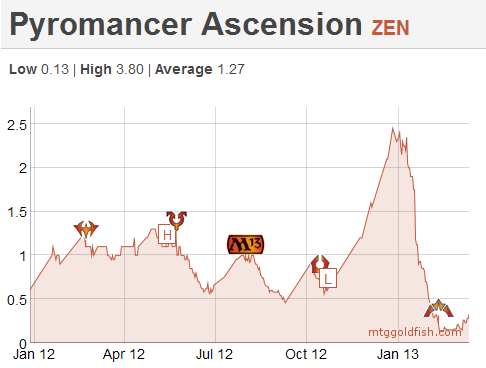

There are other laggards from ZEN and WWK that still offer good value for the patient speculator. Pyromancer Ascension took a double hit due to the ZZW queues and the banning of Seething Song. Now, I don't have a good idea whether Pyromancer Ascension decks are any good in Modern, but I do know that Seething Song was not an integral part to the deck. Buy Pyromancer Ascension at prices less than 0.4 tix if you are looking for value and are willing to hold for 8+ months.

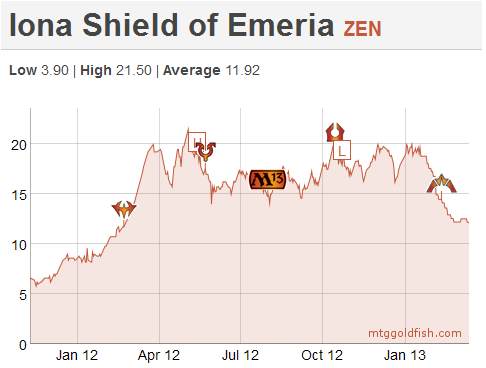

Another card which holds value from ZEN is Iona, Shield of Emeria. This card has been stable in the 16-to-20-tix range for most of the last year. It's an occasional reanimation target in Modern Gifts Ungiven decks. Also an angel! Although redemption no longer supports the price of ZEN mythic rares, Iona is another card that took a big hit from the ZZW queues and has not bounced back. Buy this laggard at current prices of 12-13 tix if you are willing to hold for 8+ months.

Developing new techniques for identifying value is a must for any serious speculator. Don't take what I have said here for granted; bring a critical eye and your own experience when considering any speculative bet. Do the analysis. Think about how things have gone in the past to see if they offer any guidance in the present. When it comes down to pulling the trigger on a new position or selling out of an older one, ultimately each speculator has to make that decision for themselves.

“Seething Song not an integral part to the deck”…this seems wrong, I was under the impression that Storm is pretty much dead as a deck without it.

Pyromancer Ascension based decks are not necessarily building storm count in the same way as Past in Flames. Here’s an example.

http://i.imgur.com/8tET5pt.jpg

Great article–thanks for the insights into how to analyze these markets!

Thanks for reading!

“If you consider where the ratio stood for the Scars of Mirrodin sets back on November 14th, the signal was to buy Scars of Mirrodin (SOM) and Mirrodin Besieged (MBS) mythics over New Phyrexia (NPH) mythics. ”

So… The “signal” you mentioned was that 0.45 (SOM) and 0.39 (MBS) were low? I don’t get it… Lower than what? RTR was 0.39 as well, why wasn’t that good value?? Obviously you were right, but I don’t quite follow what you mean by “signal”.

Great question! Admittedly it’s not obvious from the table here and that’s my mistake. But if you go back to my Aug 17th 2012 article, there’s a longer list that has the ratio for ZEN, WWK and ROE. Find it here,

https://www.quietspeculation.com/2012/08/insider-w…

Those numbers are what guide me for how sets that have rotated out of Standard but are still available for redemption might move in price. Back then, ZEN was at 0.54, WWK at 0.74 and ROE was at 0.77. Comparing where SOM and MBS were in November suggests that they. had room to rise in price. At their current ratio levels, there’s probably not much upside left.

Hopefully this clarified where I was coming from. All ratio values need to be compared to sets that are similar. In other words, comparing where the ZEN block sets were last summer suggested to me where the Scars block sets might be going. When thinking about the ratio values and the signal implied, this is what I had in mind.

Is that a bit clearer?

Ok, that link doesn’t work properly. Just look up my Aug 17th article manually if you are curious.

Yes, completely, thanks!

I always like how you compare past with present to draw conclusions on the future. Much more helpful than “x doesn’t seem like a $2 card IMHO I bought up 50 and u should too”.

Ta again and keep up the good work.

Was the january-zendikar-draft the first ZZW since the set rotated out ? Otherwise would be interesting to look at the price charts at the time of the first newdraft.

To the best of my memory, yes, they were the first ZZW queues since ZEN block rotated out of Standard.