Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Last week I began reading a new book on investing, titled The Intelligent Investor written by Benjamin Graham. Warren Buffet, chairman and CEO of Berkshire Hathaway and one of the world’s wealthiest people, described this book as “by far the best book on investing ever written.”

Last week I began reading a new book on investing, titled The Intelligent Investor written by Benjamin Graham. Warren Buffet, chairman and CEO of Berkshire Hathaway and one of the world’s wealthiest people, described this book as “by far the best book on investing ever written.”

I won’t attempt to summarize the book here – this isn’t a book review column and many of the concepts don’t translate to MTG Finance seamlessly. One distinction is made in the work, however, which has enough relevance to merit an entire article.

I am referring to Graham’s distinction between speculation and investing, and the associated behaviors and predicted consequences of them.

Speculation vs Investing

I anticipate most, if not all, readers of this column can define both speculation and investing with sufficient accuracy. To do so here would be a waste of space. Most could also identify examples of each and described key characteristics that define the two strategies.

Despite this awareness, the terms “speculation” and “investing” are incorrectly interchanged on a regular basis. Even the title of this website can sometimes be misleading. Quiet Speculation to me defines what we do (although recently our voice has gotten stronger), but Graham suggests that true profits arise from proper investing instead of speculation.

Speculation implies a degree of risk – a dependence on market factors which cannot be controlled. Just because momentum is favorable on a given investment does not guarantee further price appreciation in the days to come. Sometimes the magnitude of risk does vary. When Sphinx's Revelation broke out in Standard, we had high confidence the price would rise and remain elevated.

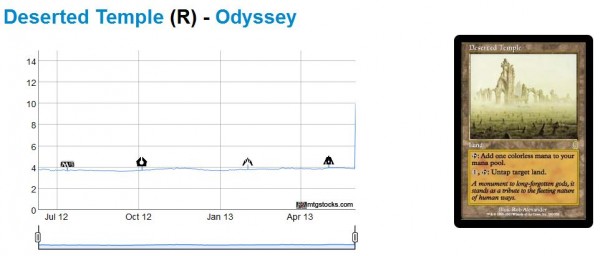

But there were no guarantees. The fact Wizards prints new cards every couple months means there is a constant threat to the viability of any dominant card in Standard. That being said, the card continued to prove itself and the price quadrupled in a month. Sphinx's Revelation certainly carries less risk than something like Deserted Temple, which doubled overnight for an unclear reason.

Both these cards made people money. Both these cards carried a degree of risk. To buy these cards with intent of selling days or even weeks later at a higher price implies speculation.

Then What’s Investing?

I’m glad I asked. To invest in something is to believe in its equity. You truly view the asset as underpriced versus what it should be worth, not what the price may reach. Magic’s lengthy history enables us to identify trends to make fair valuations. Much like identifying a company’s value based on its key metrics, Magic Cards can also be valued with a similar approach.

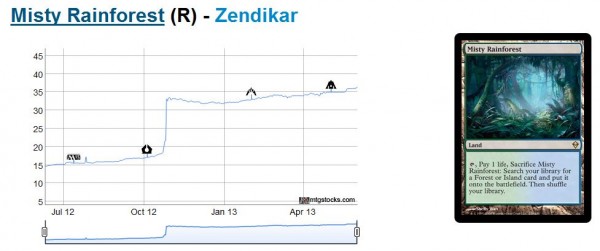

Consider Zendikar Fetch Lands, for example. Remember when these traded under $10 each because they were leaving Standard?

Everyone and their mother knew that Zendikar Fetch Lands would increase in price once the initial rotation dip wore out. These cards are critical in many formats. The creation of Modern was a lucky event for the Zendikar Fetch Land investor. But even without that sudden jump in the middle of the plot, these lands were still a great investment. The opportunity was so great on these cards that speculating on most other targets seems pointless in hindsight.

Other examples of investments (as opposed to speculation targets) include foil Zendikar Basic Lands, foil Unhinged Lands, foil Jace, the Mind Sculptor, Legends Legends, and Gaea's Cradle (before the Legendary rule change). Each of these cards had compelling reasons to invest in them. Whether it’s their ubiquity across formats, their casual appeal, or their presence on the Reserved List, these cards were undervalued at some point in time and merited a higher price tag eventually.

Priorities

We know these opportunities exist. We even buy into some of them when we feel compelled. Investing in underpriced cards seems so obvious in hindsight, but when presented with the opportunity in the present we don’t fully commit. Why is that?

Fear of losing is a strong factor here. At the end of the day, we are all still placing significant bets on a game which isn’t regulated in the same way the stock market is. There’s no governing body to keep Wizards in check. If they want to end Magic or reprint a million new Dual Lands, there are no laws against it. Fortunately, however, the scenarios where Magic dies are far-fetched.

If you want the honest truth, I think there’s a bigger factor at play here that is preventing us from making significantly higher profits from this hobby. That factor is speculation. We all wake up every day and eagerly digest the overnight MTG Finance news. Thanks to the creation of mtgstocks.com, we even have a daily ticker to review so we can understand what cards are moving. No one wants to miss a beat. Players, dealers, and speculators all lose out when they miss an event like Mox Opal.

These occurrences are exciting. The discussion is engaging. The community’s dedication to card values is addictive. This all feeds into why speculation is so much fun. But we neglect to acknowledge all the risk we are taking when we deal in this space.

I guarantee there are dozens of speculators out there who bought into Mox Opal at $25 each because of this news thinking they could profit handily. Here’s the problem: even if these people sell their Opals for $35 each, after fees and shipping the profits are marginal. And the amount of risk taken on to achieve such small profits cannot be defended.

In fact, Mox Opal would have made a terrific investment back in October 2012 when Scars block rotated out of Standard. The card is played heavily in a strong Modern deck and a weaker Legacy. What’s more, Corbin put it best when he said Mox Opal was a good investment simply because “it has the word ‘Mox’ in it.”

I know speculating can be fun and addictive. We all get a huge thrill out of buying a dozen copies of something and selling it one week later for more money. But with the amount of risk and effort this takes, it is impossible to claim that this is an easier, lower risk way of making money from Magic.

If profit is your primary goal, you should be investing and not speculating. Do your homework, look at historical trends, and identify which cards are underpriced vs where they should be in a year or two. When you identify an opportunity, invest heavily and wait patiently. While everyone else is floundering around trying to flip their Deserted Temples, you can sit on the sideline and enjoy the craziness.

What Are Today’s Solid Investments?

This is a loaded question. While it’s easy to speculate (everyone has an opinion), and it’s even easier to identify trends as they’re happening, it’s much more difficult to identify numerous solid investment opportunities. When the Legendary rule changed, it was easy to tell people to speculate on Mox Opal. The rationale is obvious.

To recommend true MTG investments requires a greater deal of effort. We need to assess the long-term view of the game and make complex predictions. Often these predictions involve a macroeconomic view of the game such as the growing player base, a shift in format support, and likelihood of reprinting. Finally, I also hesitate to make investment recommendations because they require larger capital and a lengthier timeline. I would hate to tell people to invest $1000 in something for three years only to witness no appreciation.

With these disclaimers stated, the least I can do is list out my most current investments. Many of these won’t surprise you – it’s likely you have positions in these targets as well. I encourage you to think deeper on them and decide whether you want to truly invest here. Here’s the list of my top holdings, in order of decreasing dollar-value invested:

- Legacy (Duals, Onslaught Fetches, Jace, Lion's Eye Diamond, etc.)

- Innistrad Booster Boxes

- Return to Ravnica Booster Boxes

- RTR Block Shock Lands

- Graded, NM Alpha Rares

- Scars of Mirrodin Dual Lands

- Foil Abrupt Decays

I could easily go on about how to manage these investments, how to ensure diversification, and how to put emotions aside while making bank. For example, now that I’ve made significant profits on my Legacy collection (albeit by luck – my intent when acquiring these cards was to play Legacy, not to make money), I intend to sell out. While this may be a difficult decision emotionally, I am eager to take some profits off the table and free up capital to invest elsewhere.

It isn’t about making the maximum amount of profit possible – this would drive you crazy trying to achieve. Instead, it’s about making significant money in a low-risk manner.

My suggestion is to decide what your priorities are. Perhaps you are after the same goals as I am: to make money while enjoying an awesome hobby. If that’s the case, I strongly recommend making a few investments rather than playing the speculation game. You may not have the same level of adrenaline in your bloodstream, but you’ll increase your likelihood of achieving your goals.

And if you insist upon doing the dance and aiming for quick flips, then at least sequester your “speculation money” in a separate place. Recognize those funds as fun money for quick flips and do not withdraw from your “investment money” to feed your speculation fund lightheartedly. Making this distinction will help you manage the emotions of your investments so that you can still profit handily while still participating in the speculation game.

Making this distinction is crucial so that “speculation” and “investing” don’t get confused. It's important to ensure that we also consider investing when we think about speculating in Magic.

…

Sigbits – Investment Edition

I listed above my largest positions. But I have other ideas which I haven’t acted upon yet. I thought I’d mention them to see what the QS community thinks. Are these valid investments?

- Thespian's Stage: This card started at $6 and promptly dropped down to less than a buck. In the past couple weeks the card has steadily risen, mostly thanks to the Legendary rule change. Rules aside, could this be a solid investment? Is the casual appeal enough to merit a $5 price tag perhaps?

- Invoke Prejudice: This card remained flat-lined at a $40 value for years. Recently it’s been getting attention from mtgstocks.com. Being a Legends Rare on the Reserved List, is there an opportunity for growth here? Considering how much Chains of Mephistopheles, Nether Void and The Abyss have appreciated lately, I wonder if there’s an eventuality here despite Invoke Prejudice’s lesser play?

- Eladamri, Lord of Leaves: This Legendary Elf is also on the Reserved List. His ability is a powerful one, and there are plenty of casual players who enjoy brewing up elf decks. But Eladamri has been flat-lined with an $8 price tag for years. Is there any other direction for this powerful, Legendary elf’s price to go but up?

I wonder who got you thinking about Invoke Prejudice ;).

I think it will be a few years before Stage is $5 based on casual interest alone. However, if the Dark Depths interaction turns out to have a (minor) place in tournament Magic I would expect it to get there much sooner and when it does it will likely stay there.

For me the choice between investing and speculation is simple, I don’t sell often and I cannot do a quick flip. Nearly anything I get is investment rather than speculation or building my collection.

I believe the Deserted Temple jump makes sense btw, I find I play it a lot. Obviously someone bought them out, but I think the price should indeed be higher than $4. Expect Winding Canyons to jump at some point too, which is on the reserved list to boot. In fact any land not tied to a specific color is worth keeping an eye on because of EDH.

Yes, Pi, I should thank you for the Invoke Prejudice idea.

I’m really warming up to your idea of investing vs. speculation. Even though I do have a more fluid market here in the US, there are still some major inconveniences and risks when speculating. Buying safer cards to hold for years can often yield a safer, more reliable return. And just because an investment carries less risk doesn’t mean that the returns aren’t as large. This is a fallacy people often accept as fact. Risk is not the same as profit potential. Foil Jace’s were very low risk when they became banned in Standard, yet the returns ended up being amazing.

Winding Canyons is next, eh? I’ll have to look more into it!

Not sure which’ll be next, Yavimaya Hollow and Thawing Glaciers are other prime candidates, while Lotus Vale and Scorched Ruins or not inconceivable either if the right kind of card is printed. If you consider non-reserved cards Kor Haven, Dust Bowl and most of the Kamigawa block legendary lands aren’t too bad either. If you want to invest a bit more there’s older lands too. You know how I feel about Island of Wak-Wak…

Foil Jaces were very low risk in hindsight perhaps, but it’s not a gamble I would have liked to take at the time (and not just because they are foil). I never went beyond completing a playset of Jaces as I always felt a reprint could hurt the card a lot. That still holds through even if in the mean time people have made good money on Jaces. I’m just happy to have my set that I got at about $50 each and leave it at that.

I would have liked a head’s up on you using the Invoke Prejudice idea, now I’m never going to complete my set at a reasonable price with everybody buying in now… ;).

*through = true, wouldn’t it be nice if we could edit comments…

pi, i love these picks and comments. thx

You’re welcome.

I guess MTGO market is really different since we have no fees and and it’s really easy to buy and sell card in the same day…

Still, I prefer to manage my bankroll in a way that I can do both (speculate and invest). Also, there is always a bit of speculation in investment…

I really liked your article Sigmind and we were talking about something similar Sebastian and I during our meeting last week. We call that blue chips. On MTGO we have this kind of investment too. Mostly mana, boosters, and rotation mythics…

Good job

Thanks for the kind words! The MTGO market definitely has separate factors to consider. The fact cards can be flipped within the same day for small gains on massive scales kind of makes MTGO feel more like day trading in the stock market. That being said, there are some “blue chip” investments which carry such small risk with still-sizeable upside. Those are the buys I’m advocating here. Speculation is fun, don’t get me wrong, just don’t let it get the best of you. There are more tried-and-true methods out there with much lower risk. My hope is that people keep this in mind

Another good article for casual mtg enthusiast/investors like myself who don’t have the desire anymore to follow the quick flips.

I bought my legacy collection before a lot of the craziness happened a couple years ago, with the intent of using it. With Modern taking center stage as the “eternal” format that is most featured by Wizards of the Coast, I’m also contemplating selling off my Legacy playsets. Perhaps I should just pull the trigger, since feels like a lot of people are waiting around to do the same but love the cards too much.

I think these are common sentiments for us legacy players…it’s amazing how much I could make by selling my staples right now (I’m guessing the average profit % is close to 50% across the board), but like you I enjoy the format too much. My lack of love for standard/modern would mean that selling out of legacy (even for massive profit) would probably knock me into the casual/occasional player group who enjoys EDH and cube drafting…but that would probably be the beginning of the end of my MTG days..But even with all the extra $…I wouldn’t know what to buy or what would give me as much enjoyment as playing with some of the most broken interactions and watching new player’s faces light up when they watch two good legacy players duking it out…

Personally, I love Modern. It’s the only format where I don’t play blue and there’s a relief in knowning that if my opponent is tapped out, I can definitely resolve a spell. Plus Melira-Pod is such a puzzle – there are always questions of how to win in a given scenario and every game feels different to me.

Between that and my lack of time to play competitively, it seems so logical to sell out of Legacy. And if we expect SCG to slowly phase out their Legacy support in favor of other formats, then it’s the way to go. Personally I will be selling out of Legacy this weekend in Providence. My only doubt is Dual Lands – should I sell out of these as well? I never use them anymore, so it’s just a matter of investment. Are these destined to rise endlessly (kind of like Power and Vintage staples)? Or will these pull back if Legacy fades in popularity?

Well logic would dictate that while duals are played in EDH decks as well..their primary value is in the Legacy format, so why would they rise endlessly if the format itself begins to decline? It’s good to know that some are finding modern enjoyable (I know I tried it, but perhaps it’s because I’ve done the ridiculous things in legacy..so modern feels too tame..this may also be why I’m not that big into standard)

If I was cashing out of legacy, I would dump the ones that are related to legacy (underground sea). I think cards like taiga can continue to rise due to EDH.

Karthik, this coaching makes perfect sense. My emotions will prevent me from doing this, however. I either want to cut Legacy altogether or not. Holding onto some of my Dual Lands will make me feel like I couldn’t sever the ties fully. I know it’s not a rational mindset, but it’s the one I’ve come to accept for myself. I’m in or out – not half way

While I can understand that Taiga is in the lesser played dual category it’s value is still heavily propped up by Legacy..not casual/edh. Should SCG decide to stop hosting Legacy events and the format die, ALL the dual lands will drop in value…drastically…they would then begin to rise to the price point that the casual players are willing to pay for them, but if Legacy begins to decline it would be wise to unload ALL of the staples.

Yeah, I would expect that a Legacy decline would hit Dual land prices in the short term. Long term, though, they are an iconic part of the game so I can see a gradual incline.

I honestly don’t believe the Dual Lands value still resides to a high extend in Legacy. Competitive players have always been a minority relative to casual players. EDH is encouraging many of them to track down Duals and even if they only need single copies, they do tend to build many decks and each will need single copies. A given EDH player might need less copies of any different Dual, but there might be just as many Duals among the decks he actively plays as there are in a Legacy player’s deck. Of course not every casual player has the money, but, there are many more of them.

I believe that if Duals drop there will be casual players waiting to gobble them up at lower prices. Sure there will be a drop at first if people bail out of Legacy en masse, but I cannot see it being a big drop and I certainly cannot see Duals having trouble recovering. I also have a hard time seeing it happen en masse, but that’s a different discussion.

I f you ever see Duals drop drastically there is only 1 thing you can do: buy till you run out of funds.

If Legacy went the way of Vintage- do you think some of those players would move to Cube / Commander ? Hard to see a hardcore Legacy player enjoying Modern- some will. In any event I would keep one each dual for Cube / Commander but that is a personal choice.

I also think the casual crowd is much larger than the legacy players crowd.

Great article again Sig! Like Jeff mentionned, the Limited MOCS on MTGO has affected our confidence lately, given an overall devaluation of cards value, and we decided to reconsider some of our positions. We realized that we were too inclined towards speculation and we will reorganise towards safer investments. Right now the safest targets seem to be shocklands and we will be working on building stronger positions there.

Your article basically confirms our approach towards profitable investments

Thanks for the comment, Sebastien! I’m not that familiar with MTGO – what is the “Limited MOCS” and what are the implications that cause you to doubt overall value of cards?

Either way, I like Shock Lands a ton here. Barring reprint they are one of the safest investments one can make. Of course, reprints are possible at any time and we must keep this in mind. We cannot become complacent simply because we choose to invest and not speculate. There are too many factors at play here we need to read up on.

Glad our thinking is aligned. They say great minds think alike! Any other targets solid for MTGO and paper? I really like sealed booster boxes too.

As a matter of fact, the only very consistent profits we have made were on MTGO boosters too (RTR and GTC yielded close to +1.0 tix per pack, for a total of 450 packs). Patterns in booster prices is definitely something worth to monitor closely in the future. There is some speculation involved, as in anything, but there is a point where EV and booster prices are disaligned, and this indicates we must buy the boosters if they are underpriced and if the prize structure of drafts creates rarity. Matt does a great job monitoring this as well.

Limited MOCS means that for a whole month players have to cumulate 15 Qualifying points, and the season’s finale is Limited, so players seem to need increased amounts of tickets. Combined with Dragon Maze drafts and upcoming MM, there seems to be a generalized deflation of the market, and we have “lost” a lot of value at the moment. I’ll make sure to remember that a Limited season can have a huge impact when it occurs in combination of a set’s release (in this case, 2 sets), to avoid speculating on too many targets.

For now, potential good investment targets (meaning I’m watching these, waiting to acquire them), in a 12-month or less horizon are: Inkmoth Nexus, Fetchlands, RTR removal (abrupt decay, supreme verdict) and Deathrite Shaman (cross-format playable), Jace the Mind Sculptor (at 43-44), MM mythics, possibly MM rares, shocklands. THe rest is more speculating: Obzedat, Jace Architect, and other currently drafted playable mythics… I’d had redeemable SOM mythics there too.

Sebastien,

Thanks for the ideas. It sounds like you and I are on the same page here. I love Inkmoth Nexus as a great buy-and-hold target. Same with RTR removal, DRS, and Shock Lands. Despite the drastically different markets, there seems to be some consistency when it comes to solid “investment” targets!

Keep me in the loop if you identify any new opportunities, and I will do likewise.

Sig, Ben is a great model for mtg investment imo, but singles rarely fit his mold. looking for cards on par or only (up to) 30% higher than buy lists is a place to start. Legacy staples are no safer because they maintain their value than any other mtg card that has done the same. in other words a long price history of 1$ is worth as much as one @100$. that isn’t what you get with most legacy prices anyway (as David’s and other’s comments suggest with their low entry points).

the only reason i can think to turn my cash into staples is if i am then turning those staples into euros. otherwise i feel like i am parking my money.

trading into stable prices with other cards makes a lot of sense, but then it’s about extracting cash and buying sealed product.

all this of course just my thoughts and practices. i suppose you could use tcg/ebay as fair value and buy things at a discount to those numbers versus worrying about buy list values…

It’s all a balance and a matter of what your priorities are. I would argue that with enough patience, you are more likely to accumulate your euros consistently by investing rather than buying. Of course the parallel to Graham isn’t perfect, but I think there is enough overlap to justify considering the strategy. But it all depends on your own goals and priorities of course. Thanks for the comment!

One of the great investments I ever mande, and didn’t saw you guys talking about it, was on ON fetchlands on modo. 1 and a half year ago delta was around 5 tix and all the other had lower prices.

YES!!! I completely forgot about these. In fact, I’ll be selling my ONS fetches this weekend. I paid around $20 each for my Polluted Deltas when I got into Legacy and these have blown up. I wish I had invested in more than just my own playsets.

After looking up the price of the ONS fetches, I think it’s time to take some profits on those, especially since they’re not on the reserve list. Wouldn’t that be fun for Modern/Standard? Reprinted ONS fetches in this next block.

I’ll be selling mine during next week too. Don’t know if legacy is a bouble or not at the time, but the cards don’t have much room to grow. They are just too expensive in my opinion

Speaking of onslaught fetches, am I the only one who hopes that when they do return to zendikar, they reprint onslaught fetches, and give us enemy manlands?

Awesome article. I much prefer the investing side, because it’s less time-consuming (important for me since a lot of what I do is local trading) and because it’s more low-risk.

Thanks, Corbin! I agree with you 100%. I may not get the wild 1000% gains on speculative targets, but I can confidently shove some boxes of Innistrad under my bed and know that in 1-2 years time I’ll have made a steady profit. Low effort, low risk, solid gains. Seems like a winning combination to me.

And so it starts…

Invoke Prejudice (R) – Legends $45.00 –> $51.00 (+13.3%)

Actually it’s been bouncing around like that for a while with an absurd high on the 18th of May.