Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

First, I would like to thank everybody that gave us good comments and have helped us so far in our quest to bring you the best articles we can provide. Encouragement along with your comments help us know what you want to read and guide us in our writing.

This week, I realized that the last month of trading has been pretty harsh. As Forrest Gump philosophically told the stickers guy while running, “Shit happens”. First, we were wrong on 3-4 specs. Then, we had a bug in our bots' buylist and were attacked twice, resulting in buying cards at prices much higher than we were willing to. Finally, it seems like we underestimated the 6th set effect (Dragon Maze's release) in conjunction with a Limited MOCS season on the value of Block and Standard staples.

In brief, we are glad June has come! There are times, just like in the poker world, when you seem to take rational decisions but always end up with the wrong read or the bad beat. I know that at the end of the year, the month of May will only be one among the twelve other months of the year, and that we will close the books on positive final results come January.

This week's topic addresses Return on Investment (ROI), but more precisely, we'd like to ask you: how big of a return do you need to be satisfied with your initial investment? Many people will answer the sky is the limit and that it’s never enough. Sébastien and I had a meeting about this. As anyone else, we would love to make infinite money. But we think that establishing a goal is a good motivation.

After giving it some thought, we came to the conclusion that doubling our entire bankroll over a year is a good target. Once the goal was established, I thought about a tool that could be useful to keep track of the efficiency of each trade, to better figure out whether the trade was helping us reaching our goal or holding us back. Let's call it Jeff’s ratio. I don’t know if there is already a ratio like that out there, but if not I would like my name to be on it! To make sure we fully understand the Jeff ratio, we first need to understand the basic theory.

Return on Investment (ROI)

Here is the definition of ROI from a popular investment site, www.investopedia.com:

A performance measure used to evaluate the efficiency of an investment or to compare the efficiency of a number of different investments. To calculate ROI, the benefit (return) of an investment is divided by the cost of the investment; the result is expressed as a percentage or a ratio.

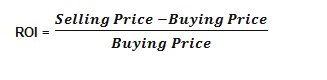

The return on investment formula goes like this:

In the above formula, the ratio you obtain refers to the percentage of profits obtained from selling the card. Return on investment is a very popular metric because of its versatility and simplicity. That is, if an investment does not have a positive ROI, or if there are other opportunities with a potentially higher ROI (given limited resources), then the investment should be not be pursued.

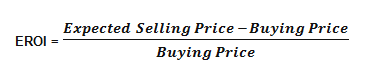

Similarly, we might want to calculate an expected ROI before investing. This can be calculated simply using the following formula:

To calculate the EROI, we could also use the Expected Value (EV), which we talked about in this article.

What is Considered a Good ROI

Now that we know how to calculate ROI, we need to evaluate what should be considered a good ROI. It’s weird sometimes how one point of view can differ drastically from another, depending on the field you work in. If you talk about ROI with a bank owner, he will probably tell you that a return of 5-7% over a year is huge nowadays. But if you talk to a poker player, he could say he has earn 300-400% of his initial stack to consider it a good night of work.

So what should we consider a good ROI as Magic traders? It all depends on what kind of trader you are. There are three main kinds.

The Positive-Is-All-I-Care-For Trader

Many traders don’t really think about ROI. As long as the spec ended up profitable, no matter by how much, they are okay with their move. I remember a good friend of mine watching me play poker a few years ago. He always told me that a positive night in poker is a good night! He would probably be this kind of trader. This is a good strategy for relaxed trading but certainly not the optimal strategy. While your tix are locked on a spec, you might miss on a better target because you're short on tix. In such a case, your investment will actually have “cost” you money. This is the opportunity cost of making a particular investment.

For example, you have a 200$ bankroll and invest every last cent of it in GTC boosters. You wait 30 days and sell everything for a $30 profit. In the meantime, the same $200 could have been invested in RTR boosters for a $50 profit. Your GTC investment was not bad, but it actually involved an opportunity cost of $20.

Note here that if you always apply our 5% rule and keep liquidity, this should not happen, but keeping an eye on EROI is still a good way to choose your spec.

The Long-Term Trader

Some traders prefer real estate to meta-calling, and they simply go for the safest targets possible to achieve profits. For example, you could always limit yourself to investing in lands, boosters and mythics just after rotation. These are the blue chips of Magic trading. These traders will be looking for a good ROI (usually higher than 25%) because they will invest the money for a (relatively) long time.

The Meta-Caller

This type of trader is on the look-out for the latest news to catch the next good hit. He will be looking for a shorter margin of profit (meaning a shorter ROI) but will usually sell shortly after. In the end, he will buy and sell many more times than the long-term trader, implying a greater number of transactions.

Many bots works this way. Some only keep a 2.5-3% margin, but if they generate enough traffic they end up making huge amounts of money.

Jeff’s Ratio

If I make money with a spec, even if it’s a tiny amount, I can’t really be angry. But I’m not a Positive-Is-All-I-Care-For trader. Sébastien and I try to mix some of the other two strategies. That’s where my ratio can be useful.

The basic idea is to set a goal for yourself over a given period of time. We think that 100% for a year is really good (we doubles our money). To reach our goal, we need to earn a certain amount of money every now and then, to eventually double up. Since 100% is our main goal (yours can certainly be different), I’ll make my calculations with our personal objective in mind.

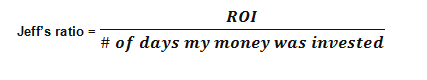

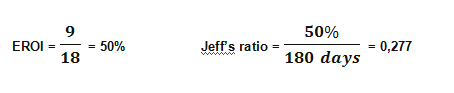

There are 365 days per year and I need 100%. That makes a rough total of 0,27% per day if I want to reach my objective. In order to calculate if a spec was a good one, I simply need to consider my ROI and how much time my money was invested and locked into this transaction. Then I use this formula to calculate the ratio:

If the ratio is better than 0.27, then my ROI was okay. Let’s look at an example. Say I invest 200 tix in RTR boosters. After two months (60 days), I’m able to net a nice $50 profit. So my ROI here is 50/200 = 25% and Jeff’s ratio = 25% / 60 days = 0.416, which is well over the ROI I needed. If all our investments turn out this good, we end up with a yearly ROI of more than 100%.

Note that you will actually need less than a 0.27 ratio to double up since you’ll have more money to reinvest in the next target. I don’t want to get too technical here, so let's just say that the tool I propose is a good approximation and will help you stay focused on your goal.

This ratio could be included in your spreadsheet after each spec. You could then classify each spec from best to worst and see where you actually make money. Is it more in the long-term specs? Short-term? Standard vs. other formats?

The more targets you invest in and the more you trade, the harder it gets to evaluate how good your specs are for the period you held them. This is where the ratio really becomes useful. It can actually help you determine whether or not it is time to sell out of a position.

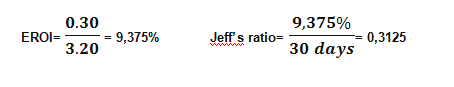

For example, let’s say you are now out of tix (or really short). You bought 100 GTC boosters at 2.65 and they are now worth 3.20. You ask yourself if you should sell them to buy a bunch of Vendilion Clique that are low right now (let’s say 18 tix because that’s the amount I paid for mine this week), due to the panic-sell from Modern Masters spoilers. You are pretty sure that GTC boosters will be 3.5 each in one month, but you are also sure that Vendilion will be a 27 tix card again in less than six months. Should we sell the GTC boosters?

Jeff’s ratio for boosters is calculated like this:

We will do the same for Vendilion Clique:

Note here that both specs would meet my requirements to double my money by the end of the year, but the boosters are still a keep. If we think that Vendilion Clique will only take five months to reach 27 tix, then Jeff’s ratio would be 0.33 and it would be better than boosters.

If the ratio is really close (like 0.33 vs. 0.3125), you should always opt for the shorter-term target. This way your money will be available sooner, and you can then reinvest somewhere else to generate more money. We could use a similar reasoning to evaluate if we better take a loss on one of our spec to reinvest the money on another target.

Jeff’s ratio can also help keep some things in perspective. First of all, it helps evaluate your specs in an impartial way. Your ratio is either good or not, period. You can’t lie to yourself.

Secondly, it can help you realize that oftentimes we are too impatient. We want our specs to make money right away. For sure, traders want movement. We read lots of articles, we spend time on the forums and chat with other traders every day. So we would like steady results. But if you set yourself a goal on the ROI you wish to obtain a year from now, and then calculate your own Jeff's ratio, you’ll see that you don’t need an astonishing profit per spec to reach your objectives. And even more important: a good spec can involve a long wait. Just try to remember that if trading would be like running, it would be a marathon, not a sprint!

So with this in mind, I guess we will have to wait for Thragtusk and Restoration Angel to make their last spike!

Thanks for reading and I hope my ratio will help you see things in a slightly different way...even when shit happens! Smile!

The Mathematician,

Jeff Goupil

P.S. As a side note, I’ll be running my first semi-marathon this summer (15 miles)! It's time to prove that my mind can be victorious over my body, so wish me luck!

Excellent article congrats !

I really like the concept of “Jeff’s Ratio” – it’s very relevant.

Now let me see. If I have an Underground Sea I can sell now for $150 and in 1 year I can sell for $160. That makes Jeff’s ratio 1.82 x 10^-4, or .000182. Seems bad. Does the calcualtion or “acceptable” value differ for paper Magic?

Hey Sig!

I’ll let Jeff provide his own answer, but I felt like I could refer to your last article, about investing in underpriced cards.

Let’s take this Underground Sea at 150$ for example, and let’s presume you can acquire 17 Hallowed Fountains at 9$ each (round numbers to simplify things as much as possible. You want to use EROI and Jeff’s ratio to determine where you will stand in a year from now, whether you keep Underground Sea, or sell it to move that 150$ into Hallowed Fountains.

If you expect selling Underground Sea at 160$ in a year, you have an EROI of 0.067 (6.7% ROI when you actually sell it) and a Jeff’s ratio of 0.00018.

Let’s say that a year from now, you can sell (no matter how, maybe buylisting them) your Hallowed Foutains at 12$ each. Selling them for 2$ profits each means a return of 34$. Without any further calculations, we know you are better off with the shocklands. But let’s use Jeff’s ratio to fully exploit its power. So, our EROI would be 184-150/150 = 0.226. At the end of the year, Jeff’s ratio is : 0.226/365= 0.0006. This is somewhat better. But what if you can sell those same cards at 12$ each earlier during the year?,It is somewhat likely with the next Modern season. Then Jeff’s ratio changes to 0.0012, which is still better. And you make your money available again for a future investment.

Will there even be movement on any of these cards prices? We all presume there will. What proportion is investment and how much of this is based solely on speculation, it’s hard to tell. But if you feel shocklands are underpriced and that they represent a sound investment, Jeff’s ratio tells you that you should be inclined to sell your Underground Sea now and move your money towards shocklands.

Yup!

Sebastien,

Thanks for the follow-up comment! Your message reads loud and clear and I am 100% in agreement with your assessment. Makes perfect sense, and I just may do exactly what you prescribed above.

Keep up the great work!

Sig

you should adjust your roi on most stable cards. Don’t expect a land (out of t2) to double it’s price each year. If you expect 10 or 20% rise each year, the ration will be much lower.

Some excellent information in this article! I have included the ROI calculation into my MTG card speculation spreadsheet for some time now, but had never considered adding in time as a factor (i.e. Jeff’s Ratio). All these little nuggets of helpful information go a long way in making a better Magic investor! Thanks for the article!

Great article guys. It seems Jeff’s Ratio is actually just a goal you’ve specifically established (which is always better than generic like..we want to make a lot of money). As you mentioned having the ability to compare and monitor your progress is huge (with all goals). Just as I hope Jeff set’s goals for his semi-marathon training (like 5 mile runs, 10 mile runs, 15 mile runs, and 18-20 mile runs) (I’ve heard from many friends who’ve run full or half marathons that it’s critical to actually “over run” your distance for proper training..also don’t overdo it when you first start and good luck)

Great article guys.

The Jeff’s Ratio is something I was looking for, how to estimate/evaluate my ROI compare to time. And that a great formula to put numbers on investment, and makes it easy to compare.

As for the Underground Sea example, and paper Magic, there again the main different between Mtgo and paper investment is enhance: no fees and instant transaction. ROI and Jeff’s ratio are easy to calculate and to forecast on mtgo. In the paper world shipping, handling and other paypal/website/listing fees apply making you Jeff’s Ratio or ROI less accurate.

Good luck for you run!

Ty everyone

Sorry for the late answer, but I’m quite busy with work. (May and June are crazy months for teacher!)

I’m so happy to see that the ratio will help you.

@ Sigmund , Sebastian had a good reply…If you don’t expect to play Legacy (like you wrote in your last article) I think you should sell your dual now to invest in modern master staples…I’m pretty sure you’ll get better results. I don’t know the paper world enough, but I guess that Tarmogoyf, Dark confidant and vendilion clique will be 3 good safe targets.

@David, it’s starnge, because I heard the opposite about running a semi-marathon. You should never actually run the full semi before…The main idea is to run one long run per week (between 13 and 18 km) and lot of shorter run with different objectives. My best run so far was 15 km and I’ll be doing 18 soon. Ty for the encouragement!

Also, don’t forget that your own ratio is easy to evaluate….So you can fix your own goal!