Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Some of you may already know that I am a stock market investor first and MTG investor second. I probably spend more time on the latter simply because I enjoy it more (plus you can’t play EDH with stocks). But in terms of retirement planning and true investing, most of my funds are in the stock market.

That doesn’t mean I don’t have sizable investments in Magic cards. A few MTG trends are predictable enough that I’ve decided to make measurable bets on them. I try to write about these ideas each week.

It’s one thing for me to read a stock market analyst’s recommendation of a list of stocks-–opinions are a dime a dozen on Wall Street. Sometimes all I really want to know is where the experts are putting their money.

What is Warren Buffet’s latest position? What is Carl Ichan up to now? Which company should I avoid because Bill Ackman just recently bought one percent of its value?

I don’t claim to be an MTG (or Wall Street) finance expert. But I always appreciate it when others disclose their positions. The old adage “Put your money where your mouth is” comes to mind.

My intent this week is to do just that. I will present part of my MTG portfolio so you have an idea of where I’m placing my bets in the MTG market.

Breaking it Down

To try and ensure this article is relevant to most readers, I’m going to summarize my top holdings from multiple categories. These categories include sealed product, Standard, and an “other” category consisting of Modern/Legacy/Vintage/casual formats.

Each category will be treated as a separate portfolio totaling 100%. I will also try to provide relative size of each of these separate portfolios as well.

Finally I want to emphasize that although I am very eager to make money from this hobby, I also have a soft spot for certain cards. My “not for trade” binder of casual goodies will not be factored into these percentages. That includes a few graded Alpha Rares, some of my favorite old-school cards like Shahrazad and Island of Wak-Wak, and my 125 copies of Jaya Ballard, Task Mages. Some of these cards do have value but I have no desire to sell them.

Sealed Product

Roughly half of the value in my Magic collection lies in sealed product. I have advocated for these investments in the past because they perform very consistently. By finding a popular set with Eternal-playable cards, you can rest assured an investment in sealed boxes of that set will increase in value eventually.

My sealed product portfolio can be broken down into two categories: Innistrad booster boxes, comprising roughly half of my sealed product in value; and other.

I have written my opinions on Innistrad booster boxes on multiple occasions. The set was a huge hit, casual players enjoyed it, drafters enjoyed it, and the set contains the most-played planeswalker in eternal formats--Liliana of the Veil. Taking my own advice, I went deep on this investment with the hopes of doubling up in a couple years. Progress has been slow while I anxiously await this eBay listing to finally sell out:

If I would have known someone would list dozens of these boxes at $149 each shipped, I would have been eager to wait before pulling the trigger. Instead I’m left holding some boxes I overpaid on while I wait impatiently for the price to go up. It’ll happen eventually, of this I am confident. By the way, if you’re interested in building up your own position in Innistrad Booster Boxes, my recommendation would be to buy these.

After my Innistrad position there is a steep drop off in percentages of my sealed portfolio. Modern Masters and Return to Ravnica boxes are second and third, representing roughly 15% each of my sealed portfolio. Next would come New Phyrexia and Avacyn Restored booster boxes at about 5% each. I also have a small position of Scars of Mirrodin Fat Packs. Lastly I own a single box of a few sets including Dark Ascension, Dragon’s Maze, and Magic 2012 (hey, this box was only $65 shipped).

Standard

My Standard collection is much smaller than my sealed product holding--roughly one-third in value. I struggle with buying into Standard heavily because I’m not an active trader. I haven’t been to an FNM in months and I probably haven’t even played a game of Magic since I met up with QS’s very own David Schumann in South Carolina while traveling to visit family.

In short: investing in a highly-liquid, ever-evolving format is tricky for me.

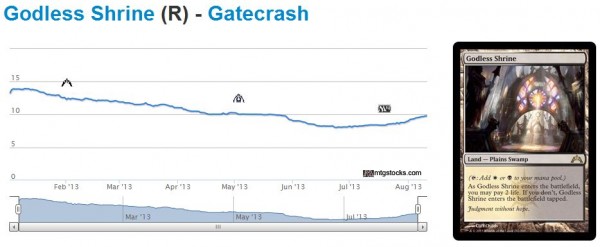

That being said I still do own a few sizable positions--most of them are in staples which I expect will increase in value in the coming months. The top of the list should come as no surprise: over half of my Standard collection’s value comes from shocklands.

These have finally turned the corner and are now on an upward trend. We may have missed out on the perfect storm because Modern season no longer overlaps with Standard rotation. But Standard rotation alone will send these higher as they disappear from trade binders everywhere. The big decision will come this fall--do I sell out or do I hold through Modern season next year? I’m open to your thoughts on this one.

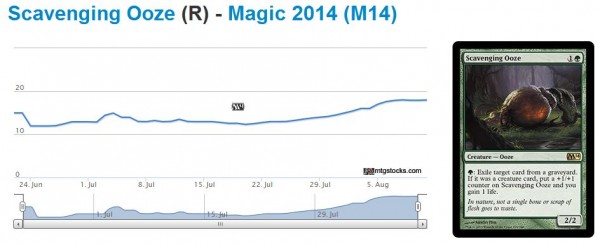

After shocklands there is a significant drop-off in value (I hope you’re noticing a trend here--I like to buy deeply when I’m most confident). Scavenging Ooze is my most recent position and it already represents almost 20% of my Standard portfolio. This card is everywhere in Standard thanks to Kibler’s popular deck. We already know Ooze is Legacy-playable and I am fairly confident this creature will impact Modern as well. This is a solid holding.

The next 10% of my Standard portfolio are my foil and nonfoil Abrupt Decays. I don’t own many since I always seem to trade these away, but I am doing my best to sit on a few. I also own one foil Liliana of the Veil, but because she is so expensive she actually is a noteworthy position in my portfolio. Other holdings above 5% include my foil and non-foil Avacyn, Angel of Hope and my collection of Supreme Verdicts.

Other

If sealed product makes up roughly half of my total MTG portfolio and Standard is about 20%, this would leave the last 30% in other formats, including Modern, Legacy and casual. In this realm I don’t have concentration in many positions. Last week I discussed the criticality of portfolio diversification, and I am living that suggestion actively. I will do my best to touch upon some of the noteworthy cards I’m holding.

Before Modern became big, I went out and purchased a handful of Zendikar fetchlands. Not nearly as many as Corbin, mind you, but still a decent amount. Most of them are now sold, but I still own my personal set of twenty. Because I play Melira Pod in Modern, I have a set of Misty Rainforests and Scalding Tarns seeing no play. My unused Zendikar fetchlands make up about 15% of my “Other” portfolio. I wasn’t going to sell these, but the threat of a reprint is so high that I may be tempted to in the coming months.

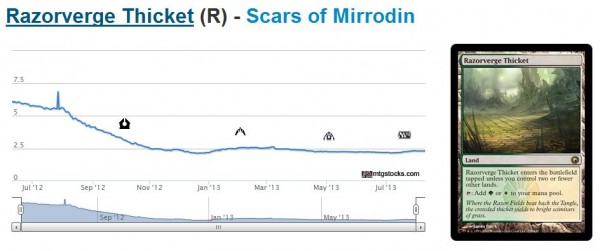

I still believe in Scars of Mirrodin fast lands, although these haven’t really moved lately. Modern season is surely going to drive a price increase on these, but now we need to wait another ten months for this to happen. Until then, these will remain in a binder--they make up about 10% of my “Other” portfolio.

With the recent announcements around Theros block I purchased seven copies of Serra's Sanctum. This is probably the next largest position in the “Other” category. I’ll likely be sitting on these for a while, it being on the Reserved List and all.

Other than these lands, I don’t really hold significant positions in anything else. Instead I have a smattering of other small positions that add up to a nicely diversified portfolio.

A few other Modern bets I’m sitting on include Birthing Pod, Inkmoth nexus, and Spellskite. But these positions are miniscule.

In short, I am well-set up for any reprints Wizards wants to throw our way. There is no way they will reprint enough product to significantly damage my “Other” portfolio. I feel relatively safe sitting on all of these at least into Modern PTQ season.

That’s About It

Hopefully this was a useful exercise--I know it helped me digest where my largest bets are and where I may want to strengthen a bit. I’m content with my sealed product exposure, but I could probably benefit from a little more exposure to dual lands. I’m also content with my number of shocklands, but I don’t have a specific exit strategy. I need to work on that.

Sometimes I wish Wall Street analysts would be this transparent. Quit recommending stocks for just one second, and tell me where you’re placing your bets! I don’t have enough money to buy every stock my favorite Wall Street pros are recommending. If I bought just one share of every stock Jim Cramer suggested I would likely run out of money in under a week. By sharing specific details of their portfolio, I feel experts would showcase their confidence a lot more effectively.

In essence this is what I’m attempting here. I encourage you to share your own portfolio distributions. Hopefully this will be helpful. Let me know what you think in the comments. If this was a useful article structure let me know and I’ll try to reapply it (I have some interesting ideas brewing). If you would rather I go back to older article formats please let me know too. My primary goal is to make everyone money so their hobby pays for itself.

…

Sigbits

- Another artificial spike? The chart pattern for Horizon Canopy sure has the pattern. This card sold out overnight on TCG Player, but the price has already dropped significantly from the peak as people attempt to undercut the market and sell their copies at the newly-inflated price. If you have spare copies I’d sell them now. Buying into this hype seems bad.

- I wish people would stop messing with Land Equilibrium. This card is up and down every day it seems. Buy one copy for EDH and move on--manipulation of this card’s value seems incredibly risky.

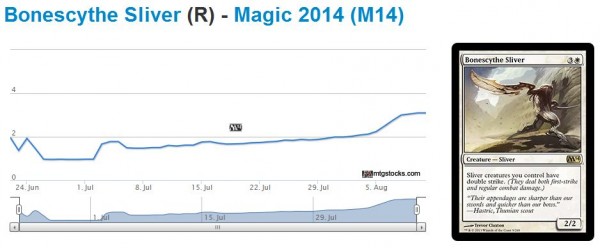

- I have a growing hunch that rare slivers in M14 are going to be casual gold in the coming months. They likely won’t end up in bulk bins, and I’d encourage you to hold onto even your common and uncommon slivers after drafting. These may never break the bank, but they are going to be easy buy-list fodder as time goes on. Case in point, look at the trajectory of Bonescythe Sliver:

-Sigmund Ausfresser

@sigfig8

This was great, Sig. I’ll make a forum post with my portfolio too.

Thanks for the comment and for sharing! It will be very helpful to see where others are placing their bets with real money.

Ditto.

Do you still have the foil Voice of Resurgence? I liked that pick too. What about your stock portfolio? Do you follow Buffett’s principles there? Would be interested in that as well.

I traded away the foil Voices for Scavenging Oozes :-). It was a tough call, but I think I can get faster returns on Oozes than I can with foil Voices (although foil Voices are solid bets). My foil Voice play was a little dependent on Modern season driving demand, but with Modern pushed back 6 months I felt there may be some time to acquire these again near the same price as now while Oozes are on an upward trajectory.

I follow Buffet to a degree – in some ways I buy some stocks that he buys, and in other ways I develop my own theories of well-run, under-valued companies. If you ever want to talk stocks let me know!

Thanks for commenting!

What sealed product makes sense to invest in now? It’s too late to innistrad I imagine.

Return to Ravnica seems like a strong candidate.

I also like RTR boxes. Or INN boxes at $149 shipped is pretty solid…just saying

Where is the cheapest place to get RtR at the moment? Like if I want to go deep and get like 20. What do you see them being worth in 5-6 years ?

reading this post made me pull the trigger on the INN booster box. i always felt like it was a good deal, but i was hesitant. also massdrop just started an rtr booster box drop for a great price of 87.99 shipped for the lowest group buy.

I’ve heard mass drop boxes are resealed after possibly mapping or opening.

i’ve only received sealed booster boxes in wizards shrink wrap. the topic has been discussed multiple times. http://www.reddit.com/r/magicTCG/comments/19pyq6/…

Cool great to know.

You may also have some luck acquiring cheaper boxes on MOTL. There are a handful of shop owners on that site who are sitting on sealed product but can’t move them optimally because of shipping/eBay fees. If a box sells for $90 on eBay, you should be able to post an offer for $85 shipped and find some sellers. I have had success with acquiring RtR boxes this way.

Once you make a purchase of a couple cheaper boxes, keep that communication channel open for future opportunities.

Obviously going to write about this this week, great idea! I’ve done “What I’m Buying” columns in the past, but this seems like a perfect next step.

Corbin, thanks for the comment! I tend to write a bit much about what I think people should acquire and not enough about what I’m actually acquiring. The perspective is hopefully helpful!

Next article could be what I am actually selling, perhaps?

Have a Rise of Eldrazi box I’m sitting on- I anticipate Eldrazi being reprinted in MM 2. If you agree on reprint would you sell the box?

I would say sell the box, but not because of potential reprints. Rather, this box has appreciated A TON in price (hopefully) since you bought it.

Put another way: which would you rather invest in? 1 box of Rise or 3-4 boxes of Return to Ravnica? I’d rather sell the expensive box and buy cheaper boxes with greater potential. I used this same rationale to sell my Unhinged boxes and Zendikar Box. I also sold a box of Coldsnap after making 50% profit. Upside just becomes limited on the high end.

buys collection 25k cards density of MM and NEM but those rep about 1.33 to 1 other sets though worldwake: 772$ (-78$ of cards sold since purchase)

8 sets of each of planeschase 2012 boxes (4) en espanol: 600$

2 izzet v golgari /10 sorin v tibalt :208$

trading from collection into (mostly):lands/deathrite s/ snapcaster/ olivia/ d sphere/ faithless looting/ supreme verdict

it is still very useful to build portfolios you won’t buy into so :you’ve something to compare results with; test assumptions about portfolios in general (they hedge,etc.); get used to grouping cards that meet particular strategies. the last bit helps identify cards you can suggest for others that suit their interests.

looks like i’m 50-50 in terms sealed/singles, but i have sold 225$ of sealed. w no plans to reinvest that 225, prob not worth mentioning outside of highlighting intent, maybe?