Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Fall Standard rotation is almost upon us, with Innistrad (ISD) block and M13 set to head out of Standard. In the meantime, some players are still playing with Bonfire of the Damned, Huntmaster of the Fells and Snapcaster Mage but really they are thinking about how they'll be turning on devotion or hoping to complete their play set of Thoughtseize.

For online speculators, it's the best time to have a few tix handy, so it's time to consider our standing positions, and whether or not it's a good idea to sell out for some tix.

One position that every speculator should have taken in the past six months is with shocklands. As pointed out by many writers and commentators in MTG finance, real estate has been a steady and rewarding vehicle for speculation in the past. Lands that produce more than one colour of mana make Magic more fun and are essential for the competitive player. This past winter, the consensus was that speculating on the Return to Ravnica (RTR) and Gatecrash (GTC) shocklands would be a no-brainer.

There was a brief bit of terror around the time when the land slot of Dragon's Maze (DGM) boosters was announced to be carrying the shocklands, but in general speculators have held a consensus that it would be a sound strategy to pick up shocklands. The message, loud and clear, was to accumulate shocklands, any and all of them, hold until the Fall and then to profit.

Recently more dissent from the majority opinion has cropped up. Jason Alt wrote about it in his article this week. Be sure to check out the comments as well; many of the best financial minds of the QS community chimed in with their thoughts. Forum user koen_knx also came out with a forum post this week saying they had recently completely sold out of their speculative shockland position.

These dissenting opinions should be taken seriously, but I disagree with their conclusions.

The Trend

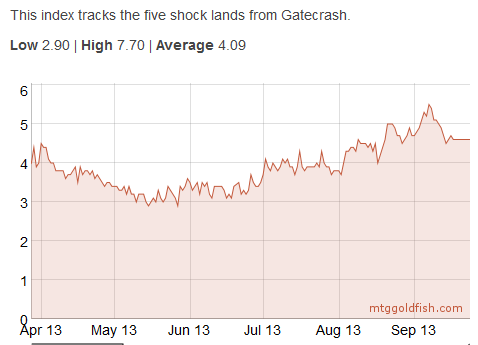

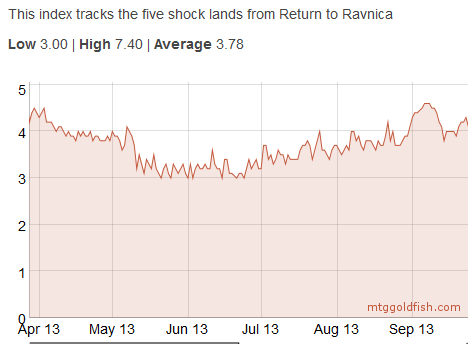

Let's investigate how the shocklands are performing overall. In the two charts below, we can see that the trend for both the GTC and RTR shockland indices is up since June. After finding a bottom of around 3 tix, both indices have started uptrends, with a series of higher highs and higher lows. This tracks the expected pattern of price correlating with supply from drafters. As Modern Masters was released, and then subsequently M14, this took interest away from RTR block draft. As supply from drafters fell, prices stabilized and then have been trending higher.

I'll draw your attention to the price peak in early September, followed by a substantial drop. I hypothesize that this was a round of late buying by some combination of speculators and players, followed by some speculators deciding to take profits. For my own portfolio at that time, I decided that it was worthwhile to sell some of the GTC shocklands, and I sold off a few play sets at attractive prices.

Lastly, it's important to recognize that some of the recent drop might be attributed to the throwback Ravnica-Guildpact-Dissension (RGD) draft queues which are associated with the latest round of Cube draft. Players might have reacted by panic-selling their shocklands due to the fear of a market flood.

My experience suggests that Cube drafts do not award enough product to encourage a lot of drafting. Usually to get a substantial amount of product into the market, you also need a high expected value from the associated draft queues.

In this case, the presence of Dark Confidant, Chord of Calling and four of the shocklands in Ravnica: City of Guilds suggests that that pack does offer some value to drafters. However, these are rares from the pre-mythic era, meaning they are harder to come by than rares today. For every Glimpse the Unthinkable there's a Warp World, Woodwraith Corrupter and Agrus Kos, Wojek Veteran, among others.

Notably though, the last two packs in the RGD draft, Guildpact and Dissension, do not have anything equivalent to the money cards in the original Ravnica. Each have an expected value less than half that of Ravnica: City of Guilds. The combination of awarding phantom points for Cube draft and the low expected value on RGD drafts suggests to me that there will not be a lot of repeat drafting and that shocklands will not be flooding the market as a result of these events.

The Exit Strategy

As of today, prices have not yet recovered to the recent peak earlier in the month. But, we are entering a period of renewed interest in Standard with the possibility of multiple shifts in the metagame. Standard of October is going to be substantially different from the Standard of December, and then there will be a further shake up of the format with the release of Born of the Gods at the beginning of February. On top of that, the Standard PTQ season might provide a slight premium to RTR block cards come January.

This gives a substantial five month window where anything is possible, where a hot deck can easily drive the prices up on singles for a few weeks. This is the type of interest that I will be attempting to sell into. Most of the shocklands will probably trundle along in the 3.5-4.5-ticket range for the coming months, but if one breaks out into the 6+ tix range, that would be an opportunity to sell.

However, in the short term, Fall Standard is not yet even upon us. Selling before rotation has even occurred goes against fundamental principles of speculating in the MTGO economy. In my experience, many players are short-sighted and have not been acquiring the cards they need to play Standard in the Fall. The urge to draft and the need for tix trump many future considerations for online players. Demand for shocklands has not yet peaked.

When players are impatient, it's up to the speculator to apply patience in order to maximize profits. If you've acquired a bunch of shocklands in the summer, you've got some more waiting to do. RTR, M14 and Theros Standard has plenty of time to run its course, and I'll be there to sell into the big spikes in demand.

Some of the early price increases will no doubt be met by speculators unloading their stock. The biggest gains will come after most speculators have sold down their shocklands, and supply becomes much scarcer. If prices haven't increased substantially on a given shockland by March, it will be time to consider selling the stragglers at market prices. The goal will be to make outsized profits on the hottest shocklands, and to make small profits on the rest.

Taking small profits on all of the shocklands right now is a strategy which will ensure a gain, but I feel confident that no shockland will breach it's price floor over the coming months, and that speculators will be better served by waiting for periods of high demand.

Can you explain why rares of the pre-mythic era are harder to come by than current rares? This is the second time I’ve read this on QS and for the life of me, I can’t figure out why it’s not the other way around. If you sometimes get a mythic instead of a rare, doesn’t that make today’s rares more rare?? Thanks to whoever can clarify this.

I guess the simple explanation is that Magic wasn’t as popular 5 years ago as it is today. Therefore, print runs (and online availability) was much lower.

This is a big reason why we see Modern cards pre-Alara spiking so hard on the back of any kind of playability.

Basically, there were a lot more unique cards printed then. Ravnica has 88 different rares! So you had a 1/88 chance. You have a 2/121, or about 1/60 chance of opening a given RTR rare.

Back in the day there were more rares per set, and the sets tended to be much larger. Additionally, the player base on modo was a lot smaller than it currently is. If it weren’t for the fact that Wotc slips in older sets for players to draft from time to time, I think you would see a much greater disparity in card prices. It isn’t that old, but when Rise of the Eldrazi was re-introduced to the draft queues, a lot of rares and mythics in the set decreased in value.

There are 53 rares in Theros, so the odds of getting any rare are 1:53 because you obviously get one per pack. Because not every booster has a mythic, the odds are 1:8 of opening a mythic, making the odds 1:120 of pulling a specific mythic.

Thanks, that makes sense, I was assuming the same number of rares were in every set.

Thanks for clarifying! And Matthew, if you google, “magic list of sets” the top link is a nice wikipedia page detailing all the sets that have been released, including number of cards and rarity breakdown.

For instance, 5th Edition was a whopper of a set with 449 cards, with 132 distinct rares!

http://en.wikipedia.org/wiki/List_of_Magic:_The_G…

Thanks for the great content. Do you believe paper shocklands will follow the same trajectory? I missed the boat months back, but I think now is a good time for players to be filling out there playsets as I have been because I agree we’ll see the upwards trend you’ve described. Shocks may at some future point be lower than they are now, but I think the next year will go by without seeing it happen.

I definitely think the time is past to be actively acquiring these for speculation, both in paper and on modo. If you need to fill out your paper play sets though, the risk is that you’ll be paying higher prices down the road. If you are a player, grab them now so you don’t pay more when Standard starts warming up, and definitely before the Standard PTQ season.

Exactly this…the time to speculate on these has passed, but if you need them to play they will be more expensive later…just not a lot more.

I have great respect for your insight and the way you can explain them, but in above article there is a sentence that makes my eyebrows rise : “when most speculators sell their stock, supply becomes much scarcher”.

Now we all know speculators are holding thousands of shocklands; if half of them sells to bots, how can botsupply get scarcher ? The usual-suspects-answer of ‘new players’ doesn’t convince me on this one.

I know there are a lot of players who don’t think ahead and just buy the cards they need for their deck-of-the-week, but seeing that number overrun the supply when speculators start selling seems a bit radical.

Time will tell…

(and I’m happy I sold on the spike of first week of september; for your payroll i hope you’re right!)

Well, the way I think about is like this. And it’s important to note that supply and demand are somewhat ambiguous terms. Usually when I am talking about these, I am talking about available supply and current demand. If there’s someone (bot, speculator, player) who is looking to buy a card, that is part of current demand. If there’s someone looking to sell a card, that is part of available supply.

The bot chains operate in such a way as to move volume over time. They try to be reliable suppliers of cards in order to win customer satisfaction and repeat business. In order to do this, they need to maintain their inventory.

When demand is high, they raise prices in order to keep enough copies in stock. When supply is high, they lower prices in order to sell excess stock. When demand and supply are roughly equivalent, they maintain prices. Competition among bots keeps the spread between buy and sell prices small, but the spread is where they try to make their money.

Ok, so what happens when you mix speculators in? Then, as current demand increases, pushing prices up, available supply increases as speculators sell their copies in order to catch the price increase. All of a sudden, bots are seeing more copies coming in than going out, and prices start decreasing.

This is roughly how things work, I think.

But, over time, speculators will have less and less of their own stock to unload. Eventually there will be current demand that is not met by supply from speculators. This is when prices will start spiking more aggressively.

The things we cannot know are a) how many copies speculators are putting into the market and b) what demand will look like. These things we just theorize over, but have no real data. As long as a > b, prices will not move very high. If a > b into the Spring, there will be a shockland recession as their is always available supply to meet current demand. If a < b, then demand will push prices higher.

I think that a) will fall over time, and the last speculators will make higher profits than the early sellers. Again, there is no data to support this, it's just my thought on the matter.

Hope this helps! It will be a very interesting winter in MTGO Finance!

Matt,

Not sure if you covered this already, but do you have a POV on the most expensive shocklands by color? Fetches obviuosly skew towards blue b/c of legacy / brainstorm. I was wondering if there was teh blue trend for modern, but it doestn seem like the case.

If we’re going off of popularity, I’d say invest in OG tombs as jund/rock/melira pod are dominating GPs. But RTR is one of the most opened sets ever so I’m skeptical about tombs – I’d look at either breeding pool or watery grave from Gatecrash because they’re less opened.

Obviously it’s just good to evenly diversify your portfolio but do you think any colors are more profitable than others?

I was thinking about this and it seems that the GTC shocklands generally hold a small premium over RTR shocklands. That’s the first thing to keep in mind. This might come from the relative amount of drafting between the sets. I doubt it’s due to relative playability of the lands.

Next, the other thing to consider is the supply of the original lands. Prior to the release of RTR, Dissension shocklands could routinely get to 30+ tix during Modern season, while Ravnica shocklands often struggled to get to 10 tix. Guildpact shocklands were somewhere in the middle. Combined with the historic playability of blue, this meant that Hallowed Fountain and Steam Vents were two that I liked to favor as targets.

With the original Ravnica draft structure and relative prices in mind, this suggests to me that the RAV shocklands have some excess supply compared to the others (Overgrown Tomb, Temple Garden, Watery Grave and Sacred Foundry).

Overall though, playability in current Standard will be the primary driver of current prices. So don’t over think any position here. If you can predict what the top decks in Standard will be, then go with that info! For me, I am not smart enough to predict this type of thing.

Thanks for commenting!