Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

As the holiday season approaches, MTG finance always falls to the back burner. People focus more on spending time with friends and family rather than what the next MTG speculation may be. This makes perfect sense, and in a way it’s consistent with Wall Street investing as well, where volumes always come in a little lighter around the holidays.

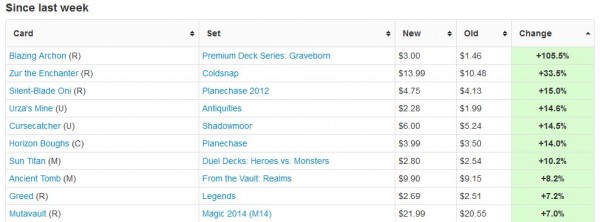

What does this mean for those of us who are still seeking opportunities? It means we need to exhibit patience. Let’s face it. There just isn’t a lot going on right now. Last week’s interests from mtgstocks.com helps to illustrate this point.

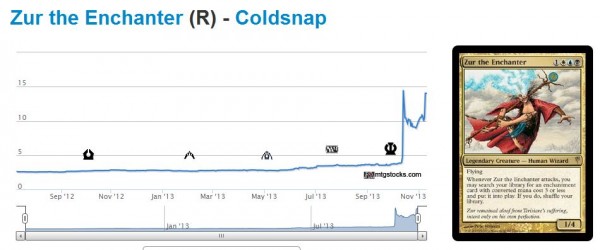

Graveborn Blazing Archon aside, only one card has grown by more than 15% in the past week. And Zur the Enchanter hardly counts, since he’s been fluctuating up and down like a maniac these last couple weeks. It almost feels like people want this card to be ridiculously expensive, but there are too many savvy speculators who know they should sell into this hype.

Looking closely at this top ten list, I’d argue there are only two cards worth noting.

First, it looks like Corbin’s dream may come true (pun not intended) thanks to the recent printing of True-Name Nemesis. This card may give Merfolk new life in Legacy, leading to the recent jump in Cursecatcher’s price. I’d suspect the other mainstay Merfolk may follow a similar trend. Perhaps it’s time to reacquire cards like Merrow Reejerey and Aether Vial.

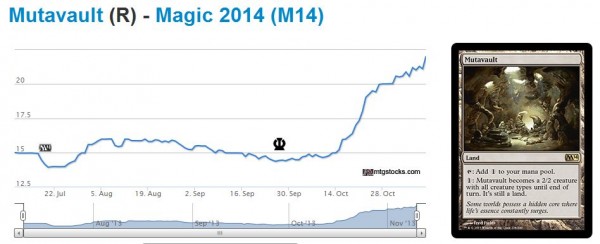

The second noteworthy card is Mutavault, which not only sees play in the Legacy Merfolk deck but also sees plenty of play in Standard as well. After jumping up so much in price, I feel Mutavault may be nearing a short term peak--I am looking to sell for profit, taking advantage of this recent spike.

Patience Is a Virtue: Buying

Other than these two cards, I see little of note in MTG finance right now. The Commander decks are a hit it seems. I went to Target to try and find these the other day, only to find exactly zero copies in stock. Here’s hoping shipments continue to come in so I can eventually get my hands on these.

This leads me to my “patience is a virtue” rule number one for the holiday season: don’t rush to buy anything now when sales will inevitably lighten up as the New Year approaches.

This is one anecdotal difference between Wall Street and MTG finance. On Wall Street, light volume means that both buying and selling is light. Therefore, prices could fluctuate higher or lower, but these price fluctuations should not be trusted. With MTG finance, light volume typically leads to fewer buyers on the market. This usually leads to slight dips in price, which are also usually superficial and temporary.

In other words, you may want to watch eBay on Christmas and Thanksgiving. Those who are reckless enough to list auctions that end on these days may find themselves disappointed with low winning bids. Their loss could be your gain.

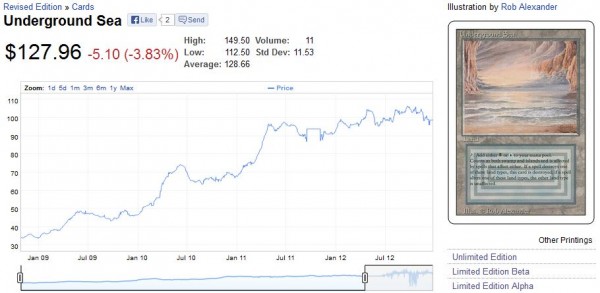

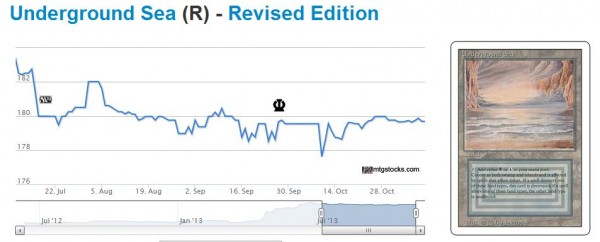

While I don’t usually cite blacklotusproject.com these days, their chart on Underground Sea demonstrates my point nicely due to the longer time period provided. Also, I believe these data are somehow tied to eBay which makes the chart all the more relevant.

It seems that the months leading up to every January since 2009 have yielded a slight dip in price on this Legacy staple. While never significant, the trend is definitely noteworthy. As an aside, it’s also worth noting that at least for Underground Sea, prices typically increased significantly during the first half of every year. This means there could be profitable opportunities on such November/December acquisitions as early as the Spring.

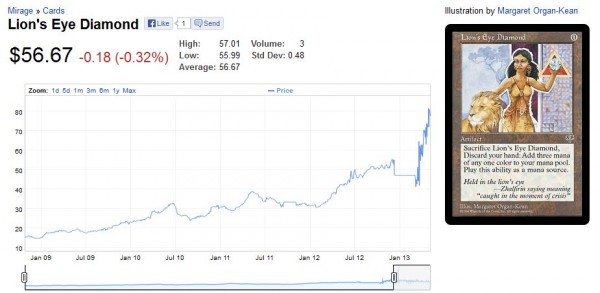

The trend of fellow Legacy staple Lion's Eye Diamond is quite similar, though the surge of Legacy kept downside to a minimum in Fall 2010.

Even if this doesn’t happen, the bottom line is you won’t see many price jumps in the next two months. Therefore there is little need to feel pressed to make purchases during this time frame. Rather than rushing to buy out TCG Player, this is a great time to throw some auctions onto your eBay watch list and attempt some last minute bids to try and find a steal or two. If you fail, you won’t miss out much on opportunities since I don’t anticipate a whole lot of price movement in the interim.

Patience Is a Virtue: Selling

From the buyer’s perspective, we are approaching a lull in prices. This means an opportunistic time to acquire cards for cheap by patiently watching eBay listings and making strategic bids. Auctions that end Thanksgiving afternoon may yield especially advantageous prices.

On the seller’s side it is important to avoid these same pitfalls. Every year it’s tempting to cash out of some expensive cards to raise more cash for holiday spending. This is especially true for those (like myself) who have young child(ren), and who wish to provide countless gifts to their young one(s) and celebrate a fruitful year. Often times I wonder if my spouse truly appreciates the additional income I’m generating from this “hobby” simply because she doesn’t see any material gains from the endeavor. I try to reassure by emphasizing the reinvestments taking place.

I must emphasize extreme caution when selling during this time period. Natural price dips during the holidays will make prices unfavorable for sellers. While I’ve been emphasizing eBay, I have to imagine volumes are light all across the internet. Even if we look at Underground Sea again, it’s easy to spot a downward trend as the summer ends and fall progresses. I expect this downward trend to continue, albeit slightly, for November and December.

This could be yet another factor working against shocklands, causing their prices to decline even further in recent weeks.

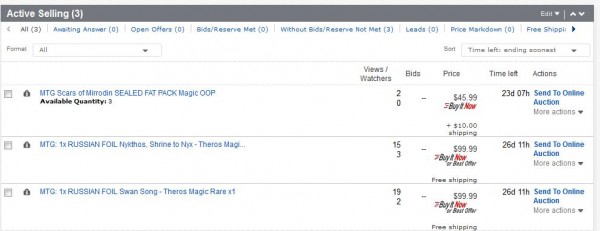

In short, selling here just isn’t favorable. After the recent surge in prices triggered by the Pro Tour, my selling has been near zero. I sold a set of Mutavaults for the reasons mentioned earlier and I sold a lone copy of Hallowed Burial just because. Other than that, the cards I have listed for sale are near zilch. In fact, here they all are on eBay:

Summarizing

tl;dr here: Wait a little longer and then begin your MTG Speculation shopping for early next year. Prices have a tendency to drop during the November/December time frame due to light volume, which could mean favorable buys for the observant and patient speculator. Conversely, selling during this time period may be suboptimal and for the most part I’d recommend against it.

…

Sigbits

- I plan to acquire the new dual land cycle in Theros: Temples. But I’m going to wait for their prices to come down a little further. While they have little Eternal playability, they should follow a similar pattern as all other mana fixing lands in Standard. You’ll likely see me write more about these in the coming months.

- True-Name Nemesis is still sold out at SCG with a price tag of $39.99. This just isn’t sustainable in the short term (long term is a different story). My hope is to finally acquire the Commander decks as the holidays approach and buying becomes a little lighter.

- Heliod, God of the Sun continues to disappoint, and his retail price is down to $7.99. My hope is that this underappreciated god gets some love come Born of the Gods, since white has plenty of powerful cards and Heliod himself seems strong. I’m sitting on my Nyleas as well for similar reasons, although they at least see competitive play. These retail for just two bucks more at $9.99.

BLP is indeed tied to ebay, they use the MOTL price guide as source (or maybe they have now implemented their own price crawlers, been a while since I was on BLP).

I believe that usually around this time you have Black Friday and Cyber Monday sales coming up in the US? You preach caution in this article, but maybe you can make recommendations on what to look for in these sales in a future article?

This is a great idea, pi, thanks for the comment. Black Friday / Cyber Monday sales are consistent with my general rule of thumb – prices tend to drop in November/December, and stores slash prices to attempt to drive sales higher for the holiday season. An article about how to approach such deals is definitely worth writing!

Sig,

You spoke about Temples, what kind of buy in price are you looking to be at realistically? I’ve already begun stockpiling any I can find under $2. Can we really expect these to continue to trend downward during the holidays? I feel like they are a very safe place to put money right now. While they certainly have no eternal appeal they are one half of the duels available in Standard for the next two years. They will always have a consistent demand.

Wes, where are you getting these for $2? I would buy 100 of these at that price if I could easily do so. I agree completely that the upside on these is measurable at such a low entry point. Many Standard mana fixers tend to go up after their first year in Standard and these will not be an exception in my opinion. Please share your sources

MERFOLK!

Great article Sigmund. It’s important to look at general tendencies when it comes to buying/selling during this time frame and you hit the nail on the head.

Thanks for the comment, David! This time of year always gets to be a little slow, and we should all be aware of the market trends that result from the lighter volume. This also makes me feel better about not selling a whole lot right now – there just isn’t much that can be sold favorably this season. That will all change soon enough though, and I want to make sure I stock up appropriately in the coming weeks to take advantage of the inevitable bump.

Be careful about about investing in rares from Theros. If my theory is correct, you won’t want to be deep on any rare in the set. Basically my opinion is this. Theros is incredibly profitable to open because virtually all the mythics are worth money. Because more Theros will be opened, the total value of the rares in the set should be less than from a normal set. I still think getting some temples is a good idea, but I wouldn’t be buying 100 copies of any if I were you.