Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Modern cards are still on the move. Throughout the past couple weeks I’ve been slowly adding to my positions in Inkmoth Nexus and Birthing Pod. Phyrexian Obliterator just saw a significant spike this morning.

As I mentioned last week, Phyrexian Obliterator may be a powerful card when paired with the devotion keyword, but it’s yet unproven in a major Modern event. I think there’s potential here, but I must confess I am tempted to unload my two copies into this spike.

Many people have predicted around $30-$35 for this card come Modern season, and that trajectory may have been accelerated just now. But I’m not delusional enough to believe this is a $50 card--buying here seems foolish unless cheap copies (<$20) can still be found. I much prefer selling into spikes. While the chart on Phyrexian Obliterator is still evolving, other price trends are more mature and thus more easily analyzed. This week I’ll look at a couple recent trends and try to identify their near-term trajectories applying basic technical tools, mostly trends and rough estimates. But the discipline of using historical data to identify reasonable price targets is still far preferred over emotional gut-reactions. Thus the tools will be useful even qualitatively.

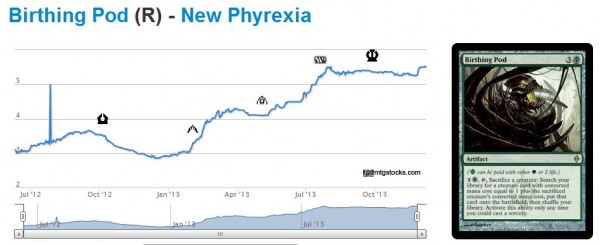

Example: Birthing Pod

I love the price chart on Birthing Pod because a basic technical analysis suggests to me a bullish sentiment. Examine the uptrend in the card’s price throughout the past year and a half.

This card has established a sequentially higher price floor three separate occasions in the past year: Jan 2013, May 2013 and Oct 2013. Now we see the price starting to tick even higher throughout the last couple weeks.

As Modern season approaches I expect this trend will continue and a new price floor will be established. If I were to extrapolate, I’d say the next price floor is likely to be around $6.50 with a potential spike to $8.

To me this suggests I should be open to acquiring more copies under $5. On the other hand, paying cash for copies which are more expensive may be reckless if I seek short-term profits. This card does not strike me as a candidate for a massive, speculative buyout. Instead, the price is more likely to gradually rise in a similar fashion. Needless to say I’ll be monitoring this trend closely.

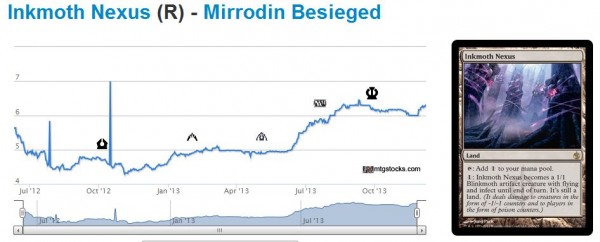

Inkmoth Nexus – A Similar Story

My analysis of Inkmoth Nexus brings me to a similar conclusion.

Notice how the price has steadily risen since last winter, with a similar price stabilization pattern. In late Spring 2013 and late Fall 2013, the price on this card remained flat for months at a time only to move sequentially higher. Once again I noticed a small uptick in recent weeks which I expect is the beginning of the next step higher.

In the case of Inkmoth Nexus the next price floor is probably in the $8 range with a possible spike to $10. The growth on this one is slightly more accelerated than Birthing Pod, hence the higher price target. Consistent with this are the top buy prices on Trader Tools: $3.20 for Birthing Pod (42% spread) and $4.41 for Inkmoth Nexus (30% spread).

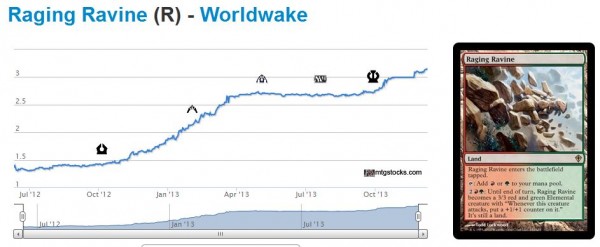

The upward trend characterized by steady rise paired with periods of consolidation can be found on numerous Modern cards. Raging Ravine remains one of my favorites, and Spellskite displays a positive trend as well.

But rather than list out more, let me shift gears to a trend that isn’t as favorable.

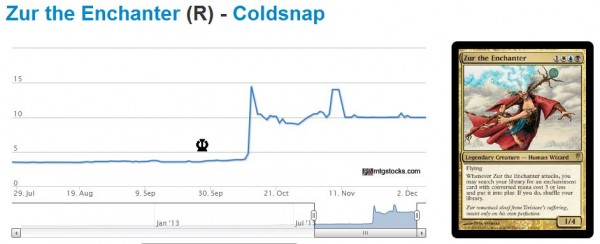

Zur the Enchanter – A Different Assessment

Here’s an interesting price history:

I’ve trimmed the timeline of this chart because literally zero interesting things happened to this card’s price from July 2012 to September 2013. Then when Theros was launched and super-amazing-God-Enchantment-Creatures were printed, Zur’s popularity spiked. Modern deck brews also led to speculative buying, which caused a buyout. After spiking to $15, Zur the Enchanter leveled out at around $10.

This seems like a huge success story for speculators everywhere. But I would argue this is true only for those who bought up the $5 copies looking for quick profit. On the other hand, buying this card for long-term potential seems like a poor play. Allow me to explain.

This card tried to spike again back in November. The price approached $15 only to be beaten back down to $10 for a second time. To me, this indicates that demand is fairly inelastic.

As the card’s price goes up from $10 to $15, suddenly people are eager to sell their copies, which drives Zur’s price right back down again. This type of phenomenon suggests we’re near a long-term price plateau. Growth is possible, but I would not expect upside heading into Modern season as I do for Raging Ravine and Inkmoth Nexus.

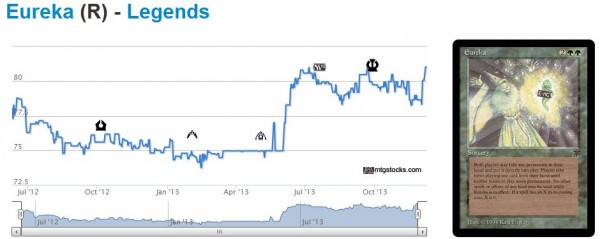

Believe it or not, the trend on Zur reminds me of Eureka.

Legacy demand caused a sudden spike on this card, followed by a wave of selling. Then the card rose again only to fall back down again. As I write this article, Eureka is up near its peak for a third time.

While a breakout is certainly possible (even inevitable given Eureka’s age and casual appeal) the above chart leads me to invest my funds elsewhere. If you want to invest more safely based on technical analyses, the cards mentioned at the top of this article are much preferred.

Of course…if Eureka does break through that $80 price barrier the card’s next price ceiling could be substantially higher. But for $80 that’s a risk I’m not really interested in taking.

Art vs. Science

Doing these qualitative technical analyses on Magic Cards is more art than science. History does tend to repeat itself, but we can’t always rely on past performance to predict the future. Too many other factors can come into play: reprints, shifting metagames, dramatic changes to PTQ schedules, etc.

The key message here is that many tools are at your disposal to enable logical investment choices. Emotions are almost never the way to go--especially if you’re looking for slow-and-steady growth with a low risk profile. Sure, you can go and buy out additional copies of Phyrexian Obliterator and Forced Fruition. But these price trends are not reflective of a stable investment.

Don’t get me wrong. I like flipping spiking cards for immediate profit just as much as the next guy. But when it comes to buying cards with cash to place in my binder and forget about for a few months, I like to use whatever data I have available to make an informed decision. These price trends can be useful to estimate what may happen in tomorrow’s uncertain world. Emotions are never a good basis for investing.

…

Sigibts

Forced Fruition and Wheel and Deal are still keeping their higher prices thanks to the new Commander 2013 card Nekuzar, the Mindrazer. Here are some other cards on the move, likely due to this general.

- Wheel of Fortune has always been a fun card. Who doesn’t like ditching their old hand for seven new cards? But with Nekuzar out your opponents will be much less happy having to take seven damage to draw that new hand. The trend is obvious--this card is on the move, and with Wheel of Fortune being on the Reserved List, it seems like a sweet buy here. I may pick up a set myself as an investment because $20 is not out of the question. Also note the 14% spread between TCG Mid and highest buy price. This is definitely a strong buy.

- How about something outside the box, like Winds of Change? Sure, it’s been reprinted a couple times and it’s not on the Reserved List. Plus it’s not as powerful as Wheel in the late game. But it’s also much cheaper (price and casting cost), and Legends copies did show up on the Interests list last Sunday. Also, the Portal artwork is pretty sweet on this card. Definitely a stretch, this one is worth at least watching.

- I could really reach here and suggest Timetwister, but the illiquidity of such an investment makes this buy unattractive. Instead I’d prefer something like Wheel of Fate, which is much more likely to gain traction should Nekuzar continue to influence the market the way it has been.

I enjoyed the article and I’m in full agreement on Obliterator. There’s a chance mono black devotion could be good in modern, but even then he’s not a $50 card..he’d still be a $30 card (long term..even with a possible spike to $40-45). The right play definitely seems to be unloading him.

Thanks for your comment! Yeah I generally love selling into hype and I hope to do so here with Obliterator. So far I’ve dropped the price on my 2 copies on eBay down to $29.90 and still no bites. I have a feeling very few people are actually buying at this price. Expect to see TCG Mid dip below $30 again in a week. Just my estimates.

I’ve listed mine on TCG at $27. No buyers.

Shucks – I did everything right here by trying to sell into the hype. But it appears I was a tad bit greedy…and perhaps slightly late to the party. I may keep my listing up in case another buyout occurs.

The Eureka chart can easily confuse people: it’s easy to overlook that it simply bounces around between $75 and $80, so it’s just 6-7% movement in any direction in 1.5 year. The other charts all start at 0, if this one did you’d barely notice the fluctuations. You can buy into Eurekas when there’s a real spike (which I did before it spiked to over $100 a couple of years ago, getting a playset for $25 each from a shop that didn’t get the memo).

I’m still not a long term fan of Nekusar. He promotes a strategy that’s not fun to play against. Time is likely going to show people abandoning their Nekusar EDH decks after a while because they’ll risk being shunned for playing them. Wheel of Fortune is always a good buy, but I’d quickly move out of any others.

Thanks for pointing out the axes on this chart. Sometimes they can be misleading!!

We’ve talked at length about Nekusar on Twitter. Seems like there are varying opinions in this matter. But either way, I am sitting on my newly purchased Wheel of Fortunes since they are on the reserved list. Besides, I want to play 1 in my Diaochan EDH deck anyways :-). Wheel of Fate just doesn’t cut it sometimes.