Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Yet another year is nearly complete and 2013 was a wild ride in the world of MTG finance.

We saw Modern shoot up in popularity even further, Standard rotate, and the rise and fall (for now) of shocklands. Commander is still a hit, driving prices up on random cards even further, pleasing casual players and collectors everywhere when they find out their Wheel of Fortunes are now nearly $20 cards.

In this article I’d like to take a step back and consider all the valuable lessons I’ve learned about MTG finance throughout the year. Here are the top five tidbits of data and facts I’ve internalized along the way, in no particular order…

Tip 1: Standard Is Still Profitable

There are more MTG players now than ever before. As a corollary, I’d propose there are more MTG finance speculators now than ever before as well. This means there is both more supply of newer cards as well as more speculation--which seems like a recipe for disaster.

Fortunately much money was made by our community in anticipation of Standard rotation in spite of these developments. The traditional strategy can still work--find cards powerful enough to be relevant in a smaller Standard format once rotation occurs and invest in those before the bump.

The star child for this year was probably Jace, Architect of Thought. This card made many of the QS community a good deal of profit (in addition to Supreme Verdict, Ash Zealot, etc.).

I’m definitely going to be cautions with Standard speculation in the future because I know supply is higher with newer sets. But there is definitely still value to be made in this space and I hope for a repeat performance next year.

Tip 2: Sealed Booster Boxes Are an Opportunity Cost Trap

Most of you already know about my significant investment in Innistrad Booster Boxes. I fully expect this strategy to pay out in the future, but the wait has been painful. Very painful.

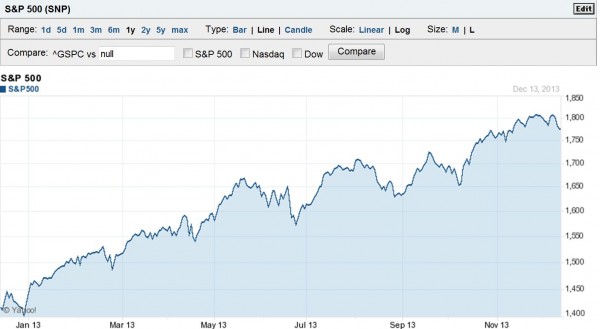

Consider this: my boxes have done nothing but gather dust throughout the year. I’m getting no dividends and if anything these boxes have depreciated slightly as stores unload their boxes of this no-longer-Standard-legal product. Meanwhile I’ve watched the stock market hit record highs.

Yeah…probably should have just put the money into the market. Hindsight is 20/20, but it would be a travesty if I didn’t learn anything from this lesson.

Sealed product can be one of the safest investments in Magic and I stand by this, but the opportunity cost involved and physical space requirement are causing me to seriously rethink this strategy. And again, increased print runs to meet higher demand will also likely hurt the potential of these investments in the future.

Tip 3: A Small Reprint Won't Drastically Hurt Modern Prices

In a way we could call 2013 the year of the reprint. With Modern Masters we have finally learned Wizards’ intent to keep Modern an affordable eternal format.

Except so far they’re not doing their job effectively. It seems their reprinting strategy is barely keeping pace with Modern’s growth. Consider the recent reprint of Tarmogoyf for example:

The price has actually settled a tiny bit, but we’re still much higher at the end of the year than we were at the beginning. Modern Masters has definitely driven higher the interest in this infant format, but it hasn’t necessarily generated enough copies for the community.

Even set reprints aren’t 100% effective. We saw Mutavault reprinted in M14 and the card is still worth nearly $30.

I do expect these to drop back down again once they rotate out of Standard. I don’t see them going below $20 though.

Barring a major reprint, such as the Scavenging Ooze promo or perhaps Theros’ Thoughtseize, I don’t anticipate small print run stuff will have nearly the effect Wizards wishes it would on the secondary market.

I wonder now: will Modern Masters 2 have a larger print run than the first? Will Tarmogoyf and Dark Confidant make reappearances? How will Zendikar fetchland reprints be handled? Many questions to be answered, hopefully in 2014.

Tip 4: Selling out of Legacy Left Me with Little Regret

The proceeds generated from my selling out of Legacy went right into an investment fund for my son’s college education. The market has been kind to me this year, generating returns that have easily beat most Legacy staples.

In fact, this time of year Legacy staples tend to drop in price. Tarmogoyf’s chart above reflects this, but even Underground Sea is not immune to this trend.

Will Legacy staples take another leg higher next summer? Time will tell, but I’ll continue to put my proceeds to good use in the stock market attempting to compete with Legacy’s growth (which I personally feel will stagnate soon enough).

My one regret: I do miss slinging some of the most powerful spells in the game. But I must be completely honest: playing Modern and knowing that if my opponent is tapped out he won’t be countering my spells is so very refreshing.

I fully embrace the Modern format and I’m not turning back…unless they ban something to hose Melira-Pod. Then I may just quit competitive Magic altogether.

Tip 5: Buylisting Is a Great Way to Cash Out

Trader Tools has introduced me to so many different buy lists and I’ve leveraged these a ton this year. Each retailer pays more on some cards than others, and it’s rewarding to take advantage of all the key players to make the most amount of cash possible.

Although buy lists are often below TCG Player pricing, the avoidance of significant fees and allure of not waiting for a buyer makes buylisting a popular practice. I intend to take advantage of Trader Tools 2 and all it has to offer in the year to come. And arbitrage can still happen and it still leads to easy money!

So Much Learned

MTG finance is still evolving and growing, and it is my intent to continue to refine my strategies to keep up. As I learn more and find new ways of making money both in Magic and in “RL Investing” I will continue to relay this information to the community through the forums, my articles and Twitter.

If you have some additional tips you’ve acquired throughout 2013, please feel free to add them in the comments section below!

…

Sigbits

Hopefully you paid attention to my Nekusar Sigbits from last week. If you bought into Wheel of Fortune you are now sitting on some easy profits. My advice here: wait. Even if Nekusar doesn’t gain further in popularity, Wheel of Fortune is still a casual gem on the Reserved List. It’s going nowhere but up in the long term.

Here are some other Reserved List cards worth watching…

- Academy Rector gave us a nice quick-flip opportunity in the fall of 2012. Since then the price has done nothing but drop--so much for breaking Legacy, right? But this is still an incredibly powerful card, and eventually it could become cheap enough to be worth buying again. And looking at the price chart on mtgstocks.com, it does look like the $20 price floor is holding for now.

- Volrath's Stronghold is a powerful land that belongs in every black Commander deck. After running up to $23 earlier this year the card has settled back down to $20. Once again this looks like a price floor to me, and an increased player base along with more Commander players could drive this card’s price even higher.

- I still think Tithe is a powerful card. In multiplayer Commander play it is easily an instant-speed card that gets you two dual lands. In Legacy the card may be too slow because it doesn’t actually provide ramp, but it does provide card advantage. Either way, being on the Reserved List and being so old I still believe this one is worth watching very closely. It’s not likely to drop in price anytime soon so the only real drawback is opportunity cost while you wait.

“I don’t anticipate small print run stuff will have nearly the effect Wizards wishes it would on the secondary market.”

This assumes Wizards wished for a large effect. The one way they could absolutely mess up is by overprinting (Chronicles anyone?). They are more likely testing the waters and erring on the side of caution. Remember that they are in it for the long haul, they can aim for an impact in several years just as long as they don’t mess up terribly somewhere along the way. Sure, it might take a little longer before Modern prices are at a level more people are comfortable with, but, as long as things are going well for them that’s not really a problem.

“Volrath’s Stronghold is a powerful land that belongs in every black Commander deck. After running up to $23 earlier this year the card has settled back down to $20. Once again this looks like a price floor to me, and an increased player base along with more Commander players could drive this card’s price even higher.”

Winding Canyons! What kind of gains are you expecting on the Stronghold? 20% seems reasonable, maybe 40% at best? Now look at Canyons, it’s at about $5-$6, it’s probably (slightly) more rare and it’s more widely playable. What it has working against it though is that it’s not as well known. Over the long run I can easily see Canyons double from its current price, most of which will likely come at a sudden spike. Admittedly you probably have time to wait for the spike, but the same could be said for the Stronghold.

I only assumed Wizards wanted to have some kind of effect because they claimed Modern would be an affordable format. Do you think they intended the price of Tarmogoyf and Dark Confidant to go UP with this reprint? Highly doubt it. I strongly expect these will get reprinted again somehow and that they will be cheaper 2 years from now than where they’re at today.

Yes, Winding Canyons I suppose is another one. But Volrath’s Stronghold is more powerful, is it not? More rare and more playable, yes, but less in demand maybe?

Maybe the effect was that they did not become double what they are now because there are more copies on the market? Of course they didn’t intend them to go up, but, that doesn’t naturally lead to any conclusions on how far they wanted them to go down.

I think the Canyons is as good as, if not better than, the Stronghold and as such I feel it has a lot more growth potential. Don’t discount that it’s playable in every EDH deck rather than only those with black. Give me $20 to invest and I’d much rather get 3-4 Canyons than 1 Stronghold. In my view we only need to wait for Canyons’ spike.

EDH in most groups is about fairly long or longer games. Frequently your creatures are getting blown up by Wrath or one of its brethren. Besides that in multiplayer there is a good chance of unexpected attacks and of wanting to have the ability to have mana to protect yourself on other players’ turns. Winding Canyons helps considerably with both, in the first scenario it gives your creatures a kind of pseudo haste that allows them to attack before anybody has the chance to Wrath (barring Rout or Starstorm), while in the second scenario you can just keep your mana open looking way more threatening to potential attackers and then during the last opponent’s turn drop your creatures. Sure, you can’t always spend 3 mana on this(2 + the Canyons), but with the long games more often than not mana is not the problem.

Stronghold is great for its recursion, but, not drawing new cards can be a trap as you might get stuck in a loop that doesn’t cut it, but stopping will get you killed immediately. With more opponents not drawing new cards will be considerably more relevant as they are already outdrawing you. It will definitely help to have the card in your deck and it might be played over a Canyons in a deck with black (though which I’d prefer would be a toss up), but that still leaves all other decks that don’t have black.

That doesn’t contradict though that the Stronghold is more widely known, but, isn’t speculating all about identifying tomorrow’s popular cards?

Ugh….I really dislike how people bring up Tarmogoyf’s prices as an example of how Modern Masters (MM) supposedly failed to bring down prices. With the exception of Tarmogoyf and Dark Confidant, almost every single other big Mythic/Rare in MM went down in prices. Check out Cryptic Command or anything in the Robots deck. Or Kira, which lost half of its value.

Furthermore, Tarmogoyf and Dark Confidant are also Legacy-staples, which most of the cards in MM are not. If anything, that is the main reason why they went up so much. Some of the other Mythics in MM barely budged (Vendilion Clique) or went down a lot (Vedalken Shackles, Progenitus, Sarkhan Vol).

So please, as a somewhat respected voice of the finance community, please stop spouting this non-sense of “Modern Masters failed to keep Modern-staple prices at an affordable level”.

Agree whole-heartedly with Tu Ta

Vendilion Clique is certainly played in Legacy plenty. Progenitus and Sarkhan Vol, seriously? These barely see any play. I suppose the useless Kamigawa Dragons also dropped in price, too…

Shackles is perhaps the one good example, but even this card sees very little Modern play.

So maybe the conclusion is Mythic Rares printed in Modern Masters but don’t see Modern play dropped in price, while Mythics that see Modern and Legacy play did not. Would that be a fair statement?

Don’t forget – I’m in the camp that Modern Masters WOULD help reduce prices and I expected this to happen. I just didn’t expect Goyf and Bob to go UP instead of down. That’s what perplexed me.

What do you think of Mutavault? Is this just high in price now and showing resilience because of Standard? That’s my assessment.

Needless to say, I’m no longer going to see a reprint and automatically assume it means price drops coming – the situations are far more complex nowadays.

If we’d known how small the modern master’s print run would be, we could have guessed that Tarmogoyf, Dark Confidant, and Vendillion Clique would go up in value simply because the demand for them would likely go up by a large amount thanks to WoTC’s promised support for modern as well as the existing demand increase from Legacy alone these cards were bound to go up. And for those who didn’t make it out to Vegas, props to SCG for being the first people to make the connection because they were buying at TCG low prices in Vegas to build a stockpile.

My comment was only toward Modern Masters and its effects on the cards in the set. That’s why I didn’t mention Mutavault.

Modern Masters DID reduced the prices on almost everything EXCEPT for Tarmogoyf and Dark Confidant. In fact, I do not think any non-bulk rare in Modern Masters that went up or at least stay near around the price pre-MM.

If you read my comments again, I attributed the fact that both Tarmogoyf and Dark Confidant are also Legacy staples, so that’s why they went up. Certainly, none of the other Mythics are Legacy staples, with the exception of Vendilion Clique as a fringe card. Perhaps that’s why Vendilion Clique is only the only Mythic to hold its prices instead of going down.

So again, my conclusion is that MM DID reduced prices on most of the cards printed. The fact that both Tarmogoyf and Dark Confidant increased does not equate to “MM failed to keep Modern staples at an affordable price levels”.

This is a separate discussion below regarding Mutavault:

It is the MOST played card in Standard at the moment (according to MTGTop8) but I think the reason is that it was printed in a core set, which means that the supply is very small compared to a big set like Theros or RTR. That’s why Thoughtseize is hitting closer to $10 and Mutavault is hitting closer to $25 even though both are reprints. Granted, Mutavault does see more play than Thoughtseize, but the difference is not large to enough to explain an almost 150% gap between the 2 cards.

On the other hand, Thoughtseize will not drop at rotation while Mutavault should since it’s played mostly in Standard. So the play is definitely to sell Mutavault here.

Is Thoughtseize worth acquiring here or was the print run too large?

I agree with selling Mutavault now. Heck, I sold my Mutavault when they were $20 TCG and not $25.

Regarding Thoughtseize, I wouldn’t buy in now. Theros set the record again for best-selling set of all time, so there are likely a ton of them out there. If you really want to invest in Thoughtseize, I rather target the FOIL at $25-$30.

I really like the Volrath’s Stronghold call. I’ve been meaning forever to get one for my EDH deck, looks like I should pull the trigger.

Indeed it’s probably noteworthy.

You may want to think about Winding Canyons as well, as Pi mentioned above It’s a lot cheaper after all.

It’s a lot cheaper after all.

To be fair, I have about as many spares set aside, I also have as many extra Deserted Temples and Thawing Glaciers. Probably have 10+ copies of each of them just for decks. I’d consider them all for speculation, but I think the Canyons are the hidden gem here.

I love Deserted Temple (aka Gaea’s Cradle #2). If I had a dime for everytime with Wort the Raidmother it was conspired Crop Rotation for Temple and Cradle, conspired Sylvan Scrying for the same, Primeval Titan (before it was banned), etc…

Every weekend i used to visit this site, because i want enjoyment, since this this web site conations genuinely nice funny material too.