Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Note: Last week I broke my hand on the pinky side. My typing is much slower as a result and so my next few articles will be a bit shorter as I recover. Apologies for the inconvenience.

Happy New Year! I’m sorry for the lack of article last week--my broken hand has been quite the inconvenience, and with friends and family visiting around the holidays I was not confident I could write up a worthwhile article in the limited time I had. Alas one more week with this cast and I’m moving to a small splint, which should be a much smaller inconvenience.

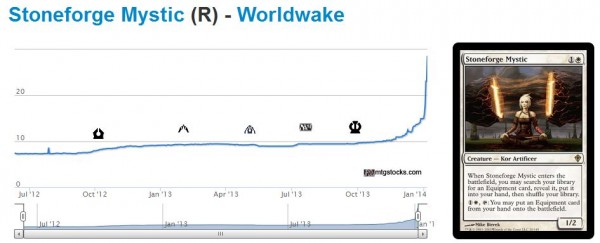

I was still thinking MTG finance last week despite my lack of article. It seems MTG finance didn’t take the holidays off as I had anticipated. We saw many new card spikes, including the staggering rise of Stoneforge Mystic.

My projection has been $20 on this one, so when I bought in I neglected a number of copies in the $14-$16 range, in my mind “not sufficiently profitable” after fees, shipping, packaging, etc. Had I known $30 was the right price target perhaps I wouldn’t be kicking myself right now.

Still, I fully expect this one to settle down at a lower number than its peak…like every other spike these days. Example: Phyrexian Obliterator.

Resolutions

Through a year of roller coaster rides in MTG finance, I’ve developed a couple of 2014 new years resolutions. Much like last year, I pledge to become a better MTG finance speculator / investor heading into the New Year by focusing on a finite number of specific practices.

It becomes difficult to focus on a set of best practices when hype flies by on a daily basis. But by focusing on a few hard-and-fast rules, it becomes easier to remain focused and disciplined with our speculation strategy. Without further delay, here are my 2014 MTG finance resolutions.

1. No More Sealed Product

Did you hear the funny story about that guy who bought like 30 booster boxes of various sets like Innistrad and Return to Ravnica, and then had to move 850 miles with all these boxes?

This was poor planning on my part.

It’s not that these purchases are poor decisions in the absolute. Innistrad boxes will still appreciate in time. But the hassle of moving all these boxes is taking its toll--I plan on bringing them with me in my car for the final drive to Cincinnati. Call me paranoid, but keeping these boxes in my sights throughout the move will comfort me much more than having packers and movers handle them.

Then there’s the whole opportunity cost thing. These booster boxes are meant to be an alternative investment. In other words, I’m not looking for quick flips or hype-based speculation here. I’m attempting to capitalize on a reliable trend (but no guarantee) in the MTG market.

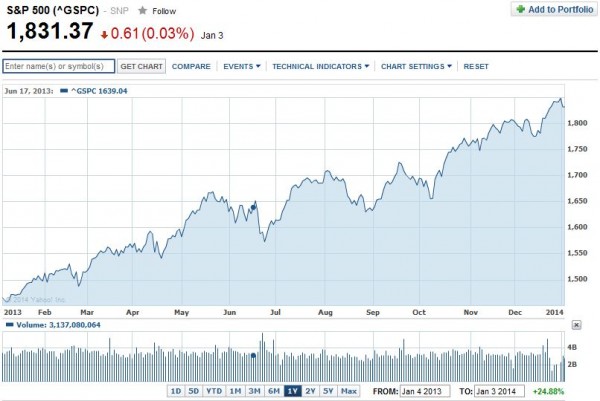

But I could have just as easily (actually more easily) bought some S&P 500 fund with this same capital. And while Innistrad boxes have actually dropped about $10-$15 on eBay last year, I’ve watched the stock market hit all-time highs.

From an opportunity cost standpoint, I made the wrong decision. Not anymore. I’ve learned my lesson for the time being. In 2014 I do not intend to grow my sealed product portfolio--there are just too many other opportunities out there with faster payoffs. And the logistics of a few clicks at the computer to buy stocks are just easier than receiving and shipping sealed booster boxes.

2. Trim Back My MTG Portfolio

Sealed booster boxes are a large portion of my overall MTG holdings, but I also have a collection of shocklands, Modern cards, Standard cards, etc. I do not want to sell out of an entire format, as I did last year with Legacy. Instead, I hope to trim back holdings proportionally.

My motivation here is threefold. First, recall that my endeavors in the realm of MTG finance are strictly to build up funds to support my son’s college education…albeit 16 years from now. It doesn’t hurt to start saving early, right?

Second, I continuously evaluate opportunity cost with my investments. Last year the stock market was much more generous to investors than many MTG investments. While small wins in MTG speculation are difficult to realize on Wall Street, my primary focus continues to be “long haul.” Thus I need to make investing decisions accordingly.

Finally, I am growing distrustful of the financial stability of Magic cards. This statement is bold and will likely require a separate article on its own to provide detailed explanation. For now, I will cite increased market instability, manipulation, and speculation as my primary motivations for growing discomfort with MTG investing.

Granted momentum has mostly been positive thus far, but we must remind ourselves that true prices should be driven by supply and demand in the long term. Market manipulators can drive movement for so long, but eventually true market value should shake out. I don’t want to be on the wrong side of the line when that happens.

3. Pay More Attention to the QS Forums

Twitter has alerted me to a number of speculation targets. MTG Stocks is an especially valuable tool when it comes to looking back at trends and market movers. But often times it’s the QS Forum that is ahead of the curve, identifying targets before they are bought out. This is where a lot of money is being made right now.

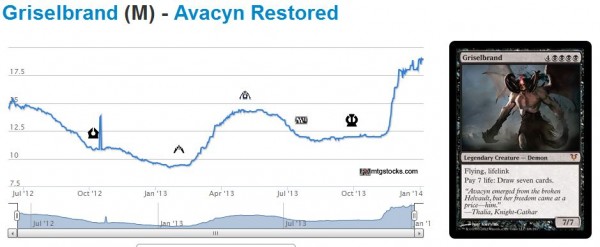

Good examples include Phyrexian Obliterator and Griselbrand, but there are many others.

What’s more, the active community in these forums is always sharing their thoughts on whether or not a market buyout is hype-driven or based on fundamentals. Valuable advice such as price targets, when to sell, and where to buy are also benefits of this community.

But these last couple months I’ve fallen behind on reading this valuable information. With my upcoming move, this will get worse before it gets better. But once I’m settled in my new location I do intend to visit the forums regularly, sharing my own thoughts on occasion. I’m simply missing out on too much money should I fail to keep up.

Three Is Enough

I wish I could list out all the ideas flying through my head as I write this article. But I believe that in order to ensure success in following my resolutions, I need to keep the priority list short and manageable.

The first resolution is easy to execute, as long as I maintain discipline. The second will take time, and to be successful here I’ll need to pay attention to my incoming cards relative to the outgoing ones. The third resolution will be most difficult of all to maintain, but it also may be the most important one. With buyouts happening left and right, I need to make sure I stay ahead of the curve.

What about everyone else? Do others in the community make similar commitments to strive for improved speculation practices? If so I am eager to hear what you're embarking on for 2014.

Have a Happy New Year, and here’s to a bright, profitable, disciplined 2014!

“I am growing distrustful of the financial stability of Magic cards”. This statement is both disturbing and profound. A lot of us love this game and it’s proving itself a profitable enterprise, however, as you mention people are starting/trying to manipulate the market for their own advantage. While there are lots of cards in print, the number for sale at any given time is only a small fraction of all those available, however, a buyout by one person can cause a ripple effect big enough to cause card values to increase through artificial demand (created by said buyout). The individual costs of cards is starting to become a concern for the playerbase (I’ve talked with many players who won’t go outside of Standard/EDH because they fear they will be unable to play competitively due to cost).

That sounds a lot like me. I will probably sell/trade my standard esper list soon and stick to EDH. That is also the reason I’m here, to cut on deckbuilding cost. I’m not that short on cash but with a baby coming, you have to cut somewhere.

David, I am glad you agree with the severity of the statement. My goal is not to imply there is doom and gloom ahead necessarily. I just want to point this observation out because I have seen this behavior lead to bubbles in the past.

Actually I just finished reading a book about the bubble leading up to the Great Depression, and a lot of the same language and behaviors overlap with the MTG Finance market today. Statements like “this card has to go up” reminds me of the over-confidence people had in the stock market. Likewise shady activity of market manipulation was also at a peak right before the Great Depression, and I see manipulation occurring today as well.

I suppose as long as people don’t take out loans to invest in MTG cards, we won’t be in as bad a shape as the Depression, but still I see some warning signs that lead me to believe that trimming back exposure and taking more profits off the table isn’t a terrible thing.