Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

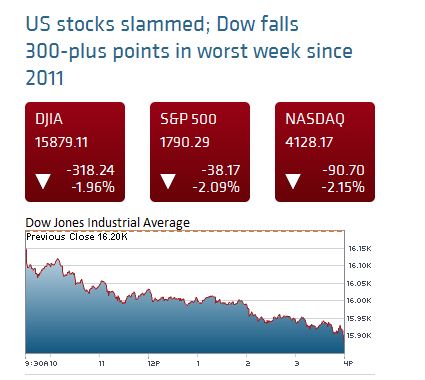

If I learned one lesson last week, it would have to be some tough love from Wall Street. As crazy as MTG finance can be, I was ill-prepared for this surprise:

Talk about a bad day. But with every major stock market event like this one there is a valuable lesson to be learned. If we do not improve our strategies from these happenings we can never become stronger investors.

The lesson this time: as the market becomes inflated it’s always okay to sell, especially for hefty profits.

The thing is, selling on Wall Street is so easy that there’s almost no excuse not to take profits on occasion. With buy/sell spreads being fractions of a penny, you’re guaranteed to obtain a fair market price. Or if you’d rather wait for your own price, it’s easy to set a limit and have your broker sell your stock the moment someone else is willing to pay your price.

Application to MTG: Some Limitations

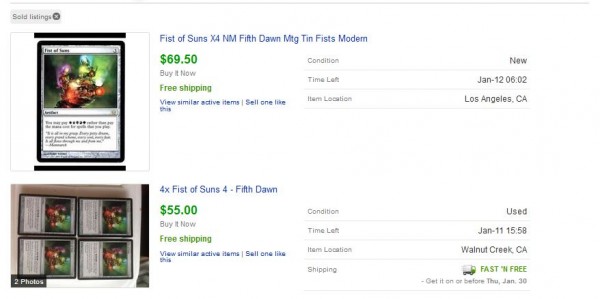

The world of MTG finance isn’t set up as conveniently. I have no option to set a limit sell price on my Fist of Suns so that the moment they hit a peak during a spike, my copies sell. Believe me, if this was an option I would have been ecstatic…like these two sellers probably were:

Talk about a nice sell price.

But we all know this isn’t an option. The average individual has to rely on quick wits, tools like TCG Player and eBay, buylists, and a little luck in order to obtain highly favorable prices. And even still, only a few of us sellers can really capitalize fully on a price spike. Once word gets out, everyone digs out their old copies and/or receives their recently acquired copies online and the race to the bottom begins.

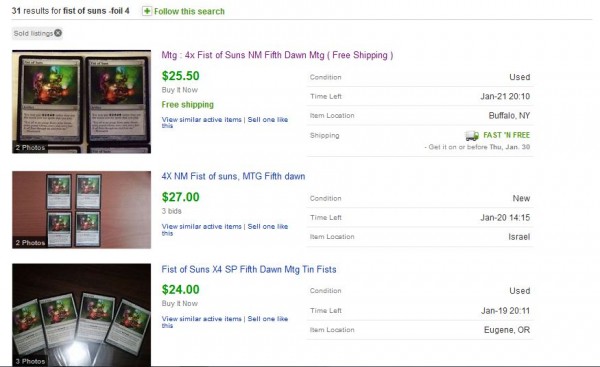

Here’s what the market for Fist of Suns is now:

Quite a bit different, right? We’re looking at a price difference of over 100% between the peak prices and the selling prices one week later. If you had acquired a set at $12, you are looking at a profit drop from $50 to $10 in seven days time. Clearly the prepared are most often rewarded.

There Is Hope

Although we can’t readily set limit orders with Magic Cards like we can with Wall Street brokerage firms, there are some measures you can take to increase your chances of capitalizing the most during buyouts.

First, make sure you keep up with Insider forum discussions, Twitter, and mtgstocks.com. These resources will help you learn about any sudden price movement at the earliest. If you rely on word of mouth at your LGS, you could completely miss a jump and sudden decline. Remaining in touch with the community through digital media is a must nowadays.

Once a spike does occur, you have to be prepared to sell any copies you currently own. Fast. There have been occasions when I have woken up to my 6:30 am alarm on a work day and checked mtgstocks.com only to observe a buyout had occurred the night before. Within 30 minutes I will have my copies listed on eBay.

I recently did this with a handful of Serra's Sanctums I had speculated on when Theros was rumored to be enchantment-themed. The buyout was delayed, but the moment these spiked my cards were listed and quickly sold out.

Within days these began their retreat, and copies were selling more and more slowly online. While I still couldn’t quite hit the exact peak sell price, I know I was better off listing my cards that morning at 7 am than I would have been even if I had waited until the end of the day.

This effect is magnified with newer cards, where copies are so readily available. At least with Serra's Sanctum there are far fewer copies in circulation, and the Reserved List provided me with even greater protection.

Now if only I could get a similar buyout spike from Wheel of Fortune. I’m sitting on a dozen or so copies, and I cannot wait for someone to decide Revised copies of this card need to be $20+. My copies will be the first ones to hit eBay when this happens.

Aside over, the next piece of advice I have involves a clever way of passively monitoring demand for a particular card you’re speculating on. I’ve seen others in the QS Forums refer to this strategy in the past, and I personally think it’s a clever idea. Simply put: list one set of your speculative card online for sale at a moderately high price--high enough so that people won’t be likely to buy until most the cheaper versions sell first.

This strategy requires minimal effort and costs you absolutely nothing. Yet it provides you with a passive way of making sure you never miss a spike. When I sell cards on eBay my eBay phone app immediately makes a satisfying cash register sound. When this occurs I promptly check the device to see what sold.

If your “tracker” playset sells, you know a spike may be occurring. Then with this new information you are free to relist the remaining copies you have at an appropriately higher price.

No Substitute for Being Ahead of the Game

Of course in order to follow this advice you need to already have copies in your possession. This goes back to a previous article I wrote--it does you no good to buy cards after they’ve spiked in the hopes that you can find a “greater fool”. The dwindling reward is simply not worth the increasing risk.

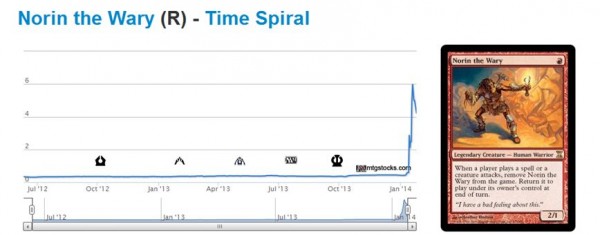

Let’s face it, if you didn’t get copies of Norin the Wary for under $2 you didn’t do so well.

Naturally having cards in your possession before they spike is much more useful, enabling you to capitalize most on these buyouts. If you find yourself buying copies in response to a spike, even if your buy price is favorable, you will immediately have to settle for below-peak pricing.

By the time your cards arrive in the mail, the spike is already passed and the race to the bottom has begun. In these cases, you cannot be greedy--list your copies as the cheapest online and sell them immediately before someone undercuts you.

As for the times when you do already have cards in your possession during a buyout, it is always fine to sell into that hype. You may not time your sale perfectly, but your copies will move much more quickly and at a price dictated by you rather than a plummeting market. It is your right to sell these cards at higher prices while people go crazy over the buyout--execute it effectively and you’ll be on your way to bigger and better profits. After all, no one wants to be left holding the hot potato when this happens…

…

Sigbits (Yay It’s Back!)

- A while back I surprised even myself when I wrote about how foil Eldrazi had all shot up in price. Turns out nonfoil copies were also a wise investment. Our friend Kozilek, Butcher of Truth now retails for $49.99 and foils will set you back $119.99…if SCG wasn’t sold out!!

- There aren’t many foil Melira, Sylvok Outcasts on eBay or SCG these days. The cheapest Buy It Now on eBay is $7 shipped, and retail is only slightly higher at $7.99. I expect these to hit $10 retail during Modern season easily.

- Remember when I used to warn people that SCG had over 100 Force of Will in stock and that they were dropping in price rapidly? Yeah, that warning doesn’t have merit any longer. Expect a move higher on these after all.

” I have no option to set a limit sell price on my Fist of Suns so that the moment they hit a peak during a spike, my copies sell.”

You actually do have this option…sort of. I’ve heard several of our other members mention that they’ll often list a card at their desired sell price on ebay/tcg player as an “alert” during a spike. You can be “that guy” that lists their card at $5 more than everyone else and just let it “ride” especially now that ebay allows you to set an automatic relist for free. When it sells you know it’s spiking and/or you can just set and forget it.

David,

I could most certainly do this if I already have copies in hand. But even if the card’s price does continue to go higher, I still need to wait for someone to specifically purchase my copy. With sell limits on Wall St., it’s much faster and more automatic to have a limit order trigger. Similar in nature, but with subtle differences.

To be sure, I will follow this practice should I have copies in hand when a given card spikes.

I don’t think this applies to fist of suns, but one thing I have been noticing recently is that some of the played cards that buyout spiked, depressed quickly as some raced to the bottom, but now most didn’t fall that far, and have turned the corner, and started gaining again. I was looking at this on some copies I have of Infernal Tutor, Cabal Therapy, Commander Skullclamp, Norin. I think other then Norin most will continue growing, and could spike again as the low end gets bought out by demand. Now I got the Tutors at 5.5 CT at 6/9 for GB Clamp at 2 Norin at .5, so since I have very little room for bust on this, I am happy to sit for a little bit, and get my price on them if they are going to climb more, since right now even though they are trending up, a lot of people are undercutting the market who bought into the spike. I think several are just price corrections upwards, since they see play, and the rebounds on spike cards that are used in eternal after the initial spike decline seems like a real thing.

This was the same technique I used to sell 3x playset of ironically Fist of Suns –

Were you able to sell well above current prices, into the spike to $70/set?

bought at 8 a set sold btw 39.99-36.99 still have 2 playsets to move will probably buylist those.

That’s how I moved my copies – buy list.

This is somewhat off-topic, but I want to update my current positions for Standard.

I’m sold out on Demon, Reckoner, Jace, Domri, Garruk, Mutavault, and Master of Waves.

I’m currently selling Blood Baron, Nykthos, Underworld Connections, and Ajani.

I still have Revelation, AEtherling, Advent, Rakdos’s Return, Trostani, Obzedat, and Mizzium Mortars, and I will be selling these starting mid-February.

Detention sphere is less than azorius charm. I like both. This was a nice read thanks Sig.

Thanks!