Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

It’s a rare occasion when I have the opportunity to attend a large MTG event these days. Family obligations and a full-time job tend to absorb the vast majority of my time, and rightfully so. That being said, I still maintain a passion for this game. Any time a large event is held within thirty miles of my home, I always make an effort to attend for at least a few hours to trade and network. The information gained at such events often justifies the trip.

This past weekend the event I managed to attend was the Star City Games Cincinnati Open. It’s quite convenient that the “Cincinnati” open is actually about fourteen miles north of the city and therefore about ten miles from my house. Even I can make such a short trek to have an opportunity to trade with dozens of grinders and sharks alike.

Taking a Step Back – Preparation

This was only my second time at a Star City Games Open. I’ve never prioritized these events in the past, and so I was a little unfamiliar with the financial landscape of this event. Surprisingly enough there are some significant differences between these Opens and Grand Prix, of which I’m more used to attending.

At Grand Prix there are often upwards of 2,000 attendees along with over a dozen vendors. If you don’t like a dealer’s buy price, you can politely decline and move to the next. It’s also much easier to negotiate with vendors and players – the phrase “So-and-so dealer is buying/selling this card at XYZ dollars, so we need to value it at such-and-such price”.

My advanced research usually consists of identifying which vendors are paying most for buy lists and which cards recently spiked so I can try and find them at older prices. This is very much in-line with my daily research of MTG Finance, so the transition is easy.

Negotiation takes a much different shape at SCG Opens for one obvious reason: they are the only vendor there!

Because of this different dynamic, the research one should do beforehand can also differ significantly. Instead of leveraging dealer prices on the floor for trades, nearly everyone was valuing cards at SCG’s prices. Unfortunately, I was ill-prepared in this regard. As an eBay buyer/seller, I’m admittedly unfamiliar with SCG’s retail pricing.

My lack of knowledge beforehand took me off of any trading advantage. If I had planned better, I would have done my homework the week leading up to the event. Normally I love trading at SCG’s prices because it enables me to trade hyped cards at full retail for less-popular, but still valuable, cards at a discount.

Additionally, trading small cards into one large card is very favorable because SCG has a lot of random $1 - $3 cards which elsewhere wouldn’t sell on TCG Player for a worthwhile amount. It’s almost like rounding up on all your cheap cards.

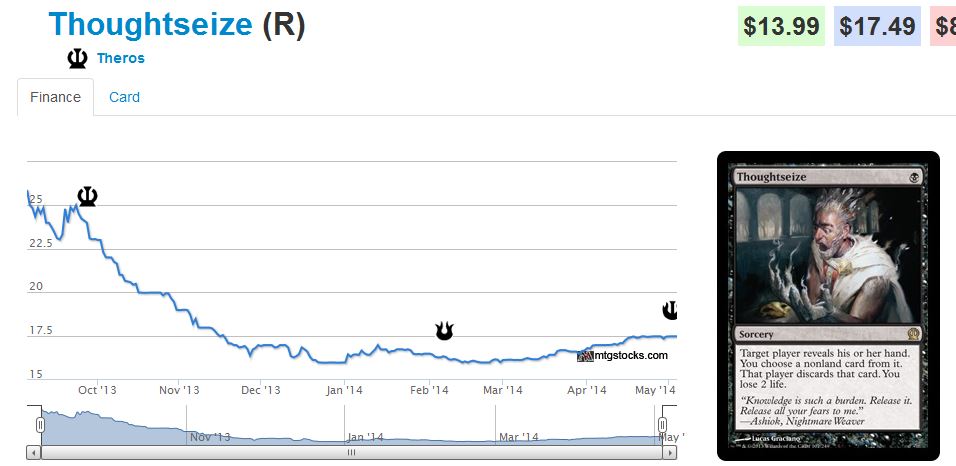

Without knowledge of which cards have the smallest spread between eBay pricing and SCG pricing, I was left with only my instincts. Normally those work well because I at least know what’s hot and what’s not. But when I have to acquire Theros Thoughtseizes at $20 in trade, I struggle to identify whether or not it’s worth my while. I know this card will rise in price going forward, but giving such a premium on a $14 card (in my mind) is a tough pill to swallow.

Transitioning Into Observations

I did decide to pick up a couple Thoughtseizes despite the premium I had to cough up on them. While they currently retail for $20, I wouldn’t be surprised if they sold for $20 cash come this summer. In a similar vein, I was not dissatisfied in valuing Swan Song at $1.50 and foils at $10 because I am also a believer in their growth long term.

What I really wanted to pick up last weekend, however, were various Temples from across Theros block. Temple of Epiphany is an especially great pick-up in trade because it retails for $5.99 yet sells all day at $5 – a small premium to pay! In fact, TCG Mid on the U/R Temple is $5.93, so you’re essentially giving less than 2% in premium when valuing the card at SCG’s prices.

Compare this to TCG Mid of Thoughtseize, which at $17.49 vs. SCG’s $20 price tag means a nearly 15% premium must be sacrificed in trade.

Unfortunately for me, everyone was on the Temples plan. I mean everyone. I really should have taken those out of my trade binder as I acquired them because as soon as I’d pick a Temple of Epiphany, someone's attention would be gouth. Throughout the day I had at most three or four of these in my binder.

But somehow at the end of the day, all the U/R Temples were gone – traded away. One person was willing to mark down his smaller cards significantly to obtain one. Another person had a set foil Jaya Ballard, Task Mage (I couldn’t pass that up). Next thing I knew, the U/R Temples were all gone.

It comes as no surprise that the U/R Temple, newly printed in Journey Into Nyx, was one of the hottest Rares in the room. So few copies have been opened so far and people are just now starting to get their hands on them. Hype should settle down in the coming weeks as more and more are opened.

I must emphasize however, the short duration for which the two Temples in Journey Into Nyx will be opened. As part of a Large/Small/Small Block format, the U/R and B/G Temples will be opened in much smaller quantity relative to those in Theros. As a result the window to acquire these as a Standard rotation play is small. Plan accordingly.

Other Temples were popular as well, and I had no qualms giving others full retail on their copies (besides Temple of Enlightenment). Swan Songs were also an easy pick-up for me and I love the two foils I grabbed at $10. Keep in mind, all these prices are retail and the cards I gave up were also valued at retail. I’m sure I didn’t gain maximum value, but I did my best to acquire cards I felt would continue to rise in price – this knowledge was my only ammunition when dealing with the Sharks.

Big Ticket Items

Besides Temples, the only other noteworthy cards that got much attention were the “pimp” Staples. Textless Lightning Bolts, Promo Cryptic Commands, and Foil Gaea's Cradles all changed hands multiple times last weekend.

Not surprisingly, foil Legacy staples from newer sets were also hot. Most of my trade partners expressed interest in my foil Abrupt Decays and foil Liliana of the Veil. These are very popular right now, and players are realizing their prices will only rise unless they are reprinted.

Speaking of reprint risk – this disclaimer needs to be on many Modern staples nowadays. While this risk ranges from “definitely will be reprinted someday” (Fetch Lands) to “Unlikely in the near term but not impossible” (Liliana of the Veil), I am so risk averse when it comes to dealing in cardboard that I am inclined to shy away from holding these valuable cards for too long.

Don’t get me wrong – acquiring these now for a quick flip come Modern season seems strong. But I tend to like a portfolio where I can sit on cards for some time. This should be well-reflected by my investments in Booster Boxes, graded Alpha Rares, and RtR Block Shock Lands. And now I have a new member of the long-term hold family:

Last weekend I traded away my Foil Liliana of the Veil along with a couple other Foil Modern staples for the Reserved-List, Vintage-Staple, and EDH-legal Bazaar of Baghdad. Which pile will rise more quickly in the short term? Probably the Foils. Which one is virtually guaranteed to rise and can never be reprinted? Bazaar.

The trade was a significant one for me, but it’s 100% in line with my general investment strategy and I was glad to take it. Converting gains from popular foil investments into a Reserved List Vintage staple is exactly what I was hoping for. I hope to repeat this process again in the future.

One last thought – isn’t it interesting how rapidly Bazaar of Baghdad has risen so far in 2014? Many Vintage staples have followed a similar trend, and I have developed two theories that explain the recent movement.

- Theory 1: Upcoming Vintage Masters and the Bazaar of Moxen tournament spiked interest in the format.

- Theory 2: The recent spike in Legacy prices is enabling players to trade into Vintage. I read on Twitter that the number of Vintage players in the Bazaar of Moxen tournament increased from 152 players last year to 214 players this year.

I sense a whole separate article coming out of the chart above. These theories require further elaboration, but those will have to wait for another article.

…

Sigbits

- I wasn’t kidding about Vintage spiking. Bazaar of Baghdad is sold out at SCG with a $399.99 price tag. When they inevitably relist more copies, I expect something closer to $449.99 or even $499.99 for NM.

- Foil Abrupt Decay is also on the rise. It’s sold out at SCG at $69.99 and there aren’t many copies on TCG Player below that price. I see an $80 value come this summer.

- Another card that’s been on the move is Karakas. I see this showing up on mtgstocks.com’s Interests page now and again. English copies are retailing at $179.99 now, and SCG currently has no NM copies in stock. They do have a few SP/MP copies and some Italian copies, but NM English versions should demand a healthy premium in trades.

Also, last fall there was eternal weekend which was the largest sanctioned vintage event ever with over 250 people. I attendees a ten proxy event this weekend with 50+ people and lots of people were picking up the real cards to play with instead of proxying.

I completely agree that vintage masters is having an impact on the market as I bought in before it hit like many that I know. Once it comes online, it will boost attendance by a little bit at these events and a little boost in interest means a lot with the price of these cards.

Matt,

It’s amazing to me that a $350 card like Bazaar of Baghdad can suddenly “spike” to $400 within a couple months. Now things are adding up – the reason why SCG upped their prices on Black Lotus is probably also related to this sudden uptick in Vintage staples.

Perhaps the time to acquire other gems like Mana Drain and Vampiric Tutor is now? Some gains may have already occurred, but Vintage Masters hasn’t even launched online yet. Perhaps post-launch we will see an influx in events. Even 10 proxy events imply the need for stuff like Drain and Bazaar since Power is the logical place to use Proxies.

I think there are a number of cards to watch.

Mishra’s Workshop as it’s EDH legal (not for spec. but if people want them)

Vampiric Tutor – I think this is the best card to look at for a jump.

Mana Drain

Oath of Druids (easy jump in for people with show and tell decks in legacy and is a 4-of)

Bazaar is EDH legal as you said but the rest of the Dredge deck is cheap.

Mana Crypt already saw a jump

Vamp Tutor Judge foil just jumped

But the foil was probably driven by EDH, right?

Probably mostly that, coupled with the recent forum discussion about Judge Promos and potential renewed interest in Vintage.

For the record the uptick in Lotus and other power at SCG was caused by one buyer buying close to $50k worth in one day last week.

Can you share some more details on this? You think there is something behind this, or is it just a store who felt SCG’s prices were favorable?

He is one of several who are buying up all the power they can get their hands on.

What is the release date for Vintage Masters?

June 16th. http://www.wizards.com/magic/magazine/article.aspx?x=mtg_daily_other_10212013_vintagemasters

So I take it you’re happy with the Bazaar? 🙂

I am, though I hope you kept your foil Abrupt Decay. It’s apparently $90 now. Yikes!

Yeah that’s the only one I didn’t trade. I managed to trade up several times after our trade to an unlimited Sapphire in MP+ condition. Unfortunately it was from Ogre who went buylist-for-buylist for it but in the end it was worth it.