Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

In previous articles I often cite sealed MTG product as one of the safest investments one could make within Magic finance. It’s fairly straightforward to identify a set with upside potential, and there are always ample boxes available in the $85-$90 price range even for those of us with no retailer connections. Sit on a few such boxes for a couple years and BAM! You make money.

I continue to stand by the above statement. If I had to put my entire life savings into one asset right now and I didn’t want to lose any sleep, it would be difficult for me to decide between an S&P 500 Index Fund and Return to Ravnica Booster boxes. The latter will never go down in price unless the game of Magic collapses (and even then casuals will want to draft this set… maybe Magic dying would be good for sealed boxes?).

“If you’re so confident, why don’t you buy dozens of RTR boxes?”

Believe me, I ask myself this question frequently. But recent developments and observations has caused me to question the booster box investment strategy as a whole. Allow me to explain.

Stop the Madness!

Newer QS Insiders may not be aware that I’ve gone through this mental exercise before. Over a year ago I decided there was no way to lose money investing in Innistrad Booster Boxes. After reading up on a gambling concept called “Kelly Betting”, I was inspired to make a large wager on the fan-favorite set. Nineteen booster boxes later I had myself a sizable position.

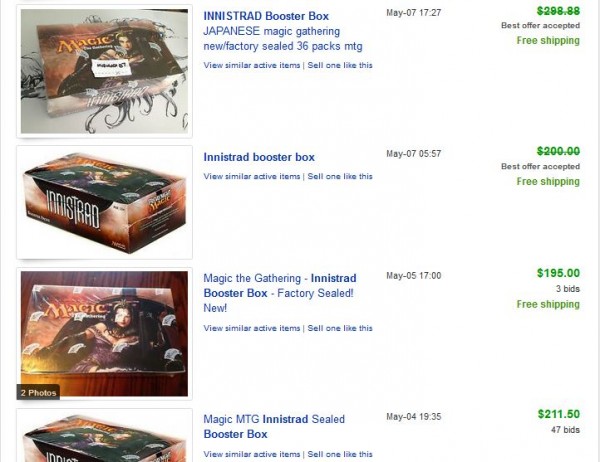

You may have noticed that I said “over a year ago” and not “over two years ago” – I got in on the Innistrad Booster Box investment a little late. Actually, it was more than a little late. My average buy price was probably around $150 per box. Still, better late than never right? Oh and hey, look, boxes are now selling on eBay for over $200. I should be singing and dancing to the bank right?

Not quite. A bit of math will quickly reveal that this sell price includes almost no profit for me. A $200 sale price on eBay equates to $20 in eBay fees, $6.10 in PayPal fees, and $12.35 for Priority Flat Rate shipping. Thus total proceeds from selling a $200 booster box on eBay equates to about $161.55 of net proceeds. With a $150 entry price this means my profit is a measly $10 and change, or 6.7% return.

Let’s compare that to some key cards from the Innistrad set itself:

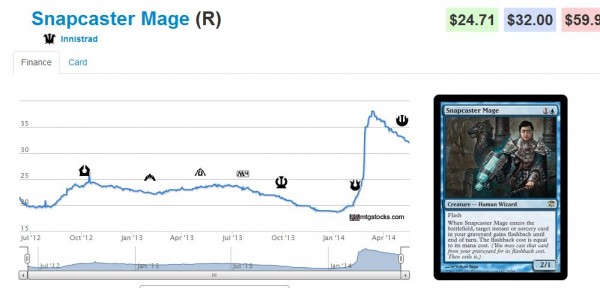

Snapcaster Mage could have been purchased for about $20 less than two years ago and now they readily sell for $27. What’s even more interesting is the recent peak in price, where the Human Wizard buylisted for $27 and retailed for nearly $40. By selling at the peak one could have netted 30% in gains while also paying no PayPal fees and no eBay fees by simply buylisting their copies.

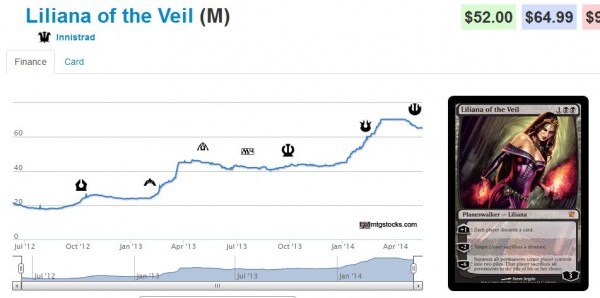

The price trajectory on Liliana of the Veil is even more impressive! A $20 investment could be netting you well over $50 now – a 200% gain! Foils have also jumped nicely.

Numbers Don’t Lie

I was so attracted to Innistrad Booster Boxes because of their safety. As a risk-averse investor, I didn’t want to roll the dice on a possible Liliana of the Veil reprint in M15 (no matter how unlikely) or Snapcaster Mage reprint in a Modern Event Deck (which didn’t happen). While individual cards from Innistrad could be reprinted at any time, Wizards of the Coast will never print new booster boxes of Innistrad. With a fixed supply, I figure boxes will gradually dry up buoying prices higher and higher.

While this is still 100% true, I am now realizing the shortcomings of my investment decision. Because of fees and shipping I can barely eek out a profit on these boxes even after nearly two years of holding. Meanwhile, Eternal staples from the set itself have risen much more significantly. Let’s face it – it’s not like we didn’t know which cards in Innistrad are the Eternal staples. I could have just as easily put that same money into foil Lilianas and Snapcasters to earn a much healthier profit.

Even random stuff like Gavony Township and Sulfur Falls are leaving me with regret as these lesser Rares have also yielded significant gains.

Even More Bad News

But wait, there’s more, unfortunately. I love surfing buylists to see what I can unload for profit with minimal effort. Sometimes Twitter followers will criticize me for buylisting so much to vendors at GP’s because I’m leaving money on the table. I see GP’s as opportunities to sell cards for immediate profit with no fees, shipping or questions about condition.

As recently as GP Cincinnati I happily buylisted Snapcaster Mages at $27 + 25% trade-in credit for some played Dual Lands. The decision has paid off nicely.

Guess how many stores listed Innistrad Booster Boxes on their buy list? When I specifically asked about selling Innistrad Boxes, the number offered would be below what I’d net from eBay after fees and shipping. Ouch.

So then I take to the interwebs! Surely between the QS forums, Twitter, MOTL, and Facebook groups I can find buyers for my sealed boxes right? Well, let me check my QS thread right now to see if anyone’s expressed interest in my Modern Masters and Innistrad Boxes... nope.

Turns out it’s difficult to move booster boxes – especially older boxes which have gone up in price significantly since they were printed. I had not anticipated this at all. A few years ago I discovered the Booster Box investment by moving funds into a smattering of older sets – two Unhinged Boxes, one Onslaught Box, one Zendikar Box, two Coldsnap Boxes, and a couple others. These all sold without much effort believe it or not, and this gave me the confidence to go even deeper on the newer sets.

I believe the flaw in my logic here is that older boxes were all printed before Magic’s recent surge in popularity. Naturally older sets would be much rarer, meaning I had a lot less competition when selling. Also key cards from the above sets (well, maybe not Coldsnap… that was just a severely underprinted set) drove demand for Booster Boxes. And while there are plenty of key cards in Innistrad worth opening, the number of sellers of these is much greater and the set is much newer. These factors have made selling for sizable gains fiercely competitive.

It’s even more difficult to sell Modern Masters Booster Boxes right now. For some reason everyone’s deciding that now is the time to unload these, and prices have been dropping notably on eBay. During the recent peak in Modern prices, I saw Booster Boxes selling in under 24 hours with a price tag of $410. Now I see $375 boxes sitting on eBay indefinitely. While these should pick up again come Modern season, there has been a gigantic opportunity cost to sitting on these boxes. Just three boxes ties up over a grand – a grand which could have been put to work elsewhere in better, more liquid investments.

If I wasn’t sitting on Modern Masters Booster Boxes, I could have made a sizable purchase of Tropical Islands the week after Underground Sea and Volcanic Island spiked. This was one of the safest bets in recent MTG history, and any investment in $100 Trops would have netted significant gains. As it stands I managed to acquire a total of two copies before they spiked. I’m severely disappointed in this missed opportunity because guaranteed profit with minimal time horizon occurs less frequently than you’d think in MTG finance.

And yet again, selling Tropical Islands has to be easier than selling water to a dehydrated wanderer in the desert. Price it right and it sells with the snap of two fingers. Meanwhile, Modern Masters Booster Boxes continue to rot in people’s closets as buyers hide their head in the sand. It pains me to even think about the lost opportunity.

Looking Ahead

Life is all about the accumulation of experiences. Fortunately I can be a fast learner when I make poor investing choices with my resources. I can guarantee you that after I finally move some of these booster boxes, they will never dominate my portfolio ever again. Even though they can yield safe, easy profit, I have been severely burned by their slow growth.

I shouldn’t beat myself up too much though. I certainly did not predict Magic’s sudden growth spurt and I’m not sure who did. I saw the game increasing in popularity, but I hadn’t considered the impending, profound impact on the singles market. Even investments in Power could have yielded me much greater gains while maintaining better liquidity. The lessons learned here are invaluable, and at a minimum I can share my experiences with the broader community to help others make better-informed decisions than I made.

While buying Zendikar booster boxes three years ago could have been a home run, getting a series of bunt singles with Innistrad Booster Boxes has been a slow, grueling process. And it’s not even over yet – eventually I’ll need to actually move these boxes and this will take significant time and effort. And the longer I wait, the more opportunities pass me by.

Rest assured, this is not a mistake I will make again.

…

Sigbits

- If you think for two seconds that Vintage isn’t growing in popularity in paper, let me direct your attention to Nether Shadow.

Outside of Vintage Dredge I’m not sure who plays this card, yet Star City Games has exactly 4 tournament-legal copies in stock across all printings. - We are largely in a lull right now with many cards drifting downward in price. This is especially true with Modern staples, which have largely pulled back from their peak a couple months ago. This isn’t the case with Linvala, Keeper of Silence, however. The Legendary Angel is climbing higher and higher, and SCG has just 1 SP and 1 MP copy in stock at $37.49 and $34.99. This is below TCG Mid, however, and I see SCG restocking their NM copies at a higher price point.

- Nick Becvar recently alerted his followers to the sudden movement SCG has made on Sword of Fire and Ice. The world’s largest MTG retailer now has NM copies from both sets listed at $49.99 with a $30 buy price. Any other swords not reprinted soon will surely be going higher in the future (looking at you Sword of Light and Shadow and Sword of War and Peace)!

It has been brought to my attention that Nether Shadow is played in Manaless Dredge in Legacy. I’m really struggling to identify a Vintage only card that isn’t Power or close to Power that I can use to indicate any sort of growth in paper Vintage. Open to suggestions, but every one I name gets some push-back.

What about Mana Drain?

I thought I mentioned Mana Drain in the past and I was corrected in that instance as well. I don’t remember for certain, but Mana Drains have been on the rise have they not?

I’d argue EDH likely makes a contribution there. I think the only cards that would be good indicators are the ones you find both on EDH as well as Legacy banlists. Tolarian Academy perhaps?

What was your buy-in on the MMA boxes?

As for a Vintage only card, I’d probably go with Oath of Druids.

My buy in was fine on the MMA boxes. I paid $300 for one box and about $245-$250 on the other two boxes. So I will make a proft on these for sure. But MMA boxes are a special case, whereas the INN boxes are really growing at a painfully slow rate. Plus MMA boxes have really leveled out and then dropped some (much like the Snapcaster Mage chart). Modern as a whole has followed this trajectory, but Snapcaster Mages are always easy to trade. MMA boxes not so much.

Foil Waterfront Bouncer’s 🙂

The fact I don’t even know what Waterfront Bouncer is indicates to me your comment is silly. 😛

Actually Waterfront Bouncer is (and used to be more prevalent) a 1 of in a few Vintage sideboards. He’s the masques block spellshaper that turns any card you draw into an unsummon, but I’ve never seen him in legacy. So I wasn’t actually being facetious.

I once built an all common deck around the bouncers. They are actually pretty strong.

On the innistrad boxes, it looks to me like it was a case of a buyin that was too high/late, rather than an inherently bad target. Paying 150 for a box so recently in print is akin to buying a good card after a spike. It’ll go up more but take more time than you like. If you’d paid 100 or whatever they’d look pretty good.

This is perhaps the case, though written another way you are saying if I had been willing to tie up my money for even longer I would have made more profit. This could have increased the absolute gains made but would not have improved the rate of return on an annualized basis. Also the challenge of shipping these boxes still remains and eBay fees / shipping of booster boxes can really eat into profits.

Don’t blame your investment in Innistrad for the opportunities you missed. There’s an opportunity cost, sure, but it’s not quite as drastic as you think it is.

Your rate of return in holding those boxes will probably be in the 10-15% range. That’s pretty amazing. Actually, if there was enough scale, that kind of investment would have Wall St. investing in droves right now. What you did was lock in a great IRR on some of your capital.

Now as it relates to other investments, you’re saying “if I hadn’t invested in those boxes, I could have bought X or Y.” Well, if you were **so** sure about Tropical Islands, you had several options.

(1) you could have taken money out of your bank account

(2) you could have borrowed money from friends or family and offered them 10% interest per year and they would have been thrilled to get that because no investment these days guarantees that much

(3) you could have simply bought with credit cards knowing that you’re borrowing at a horrible rate, but that your return would be even greater

You probably didn’t do any of those things…so don’t blame your Innistrad box investment.

Re: Tropical Islands

The concept of taking out a loan to buy those did come up on Twitter. I am just very uncomfortable with trading on a Margin – whether it be for Magic cards or for stocks. Borrowing money to invest always has greater risk associated. Perhaps this is technically the best way to proceed, though.

Perhaps “blaming” the INN box investment was too strong. But opportunity cost is a real thing. I learned that booster boxes can yield a 10% return annually. I also learned that smart purchases of singles can earn 200% return. If I am more confident in the singles, those seem to be the better buy. Plus the concept of unloading singles being easier than unloading boxes still stands.

If you think you can consistently earn 200% buying and selling singles, you’re either (a) a dealer, (b) blinded by the abnormal returns we have seen due to the Modern craze and it’s output (converting those gains into Legacy and Vintage), or (c) have the time to do HARDCORE grinding.

Also, if you think you can consistently earn 200% returns with scale, you should be borrowing as much money as you can. You should be pitching this to all your friends and family to try and put together a $50,000 magic card hedge fund, GUARANTEED TO BE WORTH $150,000 IN A YEAR!!! The reason you aren’t doing that?? Because you know that 200% returns are the abnormal, not the normal.

Ok, so 200% was an exaggeration. But 20%? Have you seen returns on Black Lotus over the last 20 years?

Scale is a whole different story. It’s difficult to scale anything in MTG. Hence why I put the vast majority of my money in the stock market and not MTG cards. Plus it’s much less effort to buy/sell stock than it is to buy/sell physical assets like cards.

All I’m saying is that while opportunity cost is real, it’s only as real as you let it be. Having your money tied up in Booster Boxes prevented you from making a killing on X, Y, or Z speculation is only true if you *literally* have no other way to get capital…which we all know is not true. That capital does come with a cost, so your opportunity cost of having money tied up in boosters is not necessarily the gains you lost out on by not investing in Trops, but rather the cost of access to more expensive forms of capital (be it borrowing from friends, using a credit card, taking money out of the bank account, etc).

I think 2 years is not long enough to wait, you’re too impatient. Sealed product doesn’t ripen that fast. People have to get nostalgic for the set first, before they will start outbidding each other.

Perhaps. Then this may not be the best investment for me because I’m too impatient. It’s one thing to watch slow/steady growth of something and think “OK, this investment is in line with the broader market”. It’s another thing to see some singles take off like crazy and see your portfolio look relatively stagnant in comparison.

In reality a combination of the two could be best. I think I went too heavily into the boxes though. But I still have 18 of the 19 boxes I bought, and I’ll be sitting on them a bit longer. I sure hope we get to that nostalgic period soon!

Hi Sig,

Great article! I enjoyed your insight on this. I also am a big investor in sealed booster boxes. What I tend to do is buy a case of most current sets as they come out. I wait until their selling price is a little more than double and then I sell three or four boxes on ebay which gets me my initial investment back. The remaining boxes stay in the closet until I sell them for whatever profit.

I agree that you went maybe in too late on the Innistrad boxes. If you had bought a case of them at the very beginning you could have probably recouped your investment by now.

And as QED2 said above, yes…sealed investments take quite a while to reach fruition. It’s very slow, but at least it is virtually risk free. 😀

Thanks for the comment! It is definitely almost zero risk to buy sealed boxes in popular sets. And I cannot lose money on my INN investment right now. Buying in earlier would have meant a better cost basis for me, but it also would have meant that I had the money tied up for even longer! Catch 22 of sorts.

I did things “correctly” on RtR boxes. I have 9 boxes, and I paid between $85 to $89 for each of them. But to echo my previous point, I’ve been on these for nearly a year now and selling on eBay would enable me to just about break even. Hopefully these rally once the set leaves Standard, but the process is just painfully…painfully…slow.

Net: I like booster box investments, but I’m not putting 50% of my MTG portfolio into them anymore. Maybe 25% is a good balance.

I really appreciate your engagement with the practice of self criticism. The big takeaway for me has been about the high overhead on actually moving boxes. I bought 4 MM boxes at $250 and I am reluctant to sell until they hit $500. I never thought so many of these would have been held by speculators, but I have to keep reminding myself its less than a year since the set was printed. Chas Andres is sticking by his prediction of $500 a box by ptq season. Do you have thoughts on this given the recent correction?

This definitely is food for thought and another reminder to diversify. I agree that you may have gone too heavy at $150 on INN to expect a rapid rate of return. Here’s another question: under what circumstances would you open a sealed box like Innistrad or MM rather than selling it outright? Obviously drafting with your friends doesn’t count here. Although, come to think of it, that could be one way to get a return on this type of investment instead of selling on ebay and mailing. Arrange a draft and ask people to pay X per booster and keep their draft cards.

I personally do not see MMA boxes at $500 by PTQ season, which is very close now. These should peak over $400 again, but I think the market was really overbought a couple months ago, hence the recent correction we’ve seen lately. The price chart of Snapcaster Mage is not unlike many other Modern-related cards. The peak prices will hopefully be obtained yet again at the peak of Modern season, but the boom of the new format seems to have subsided. Growth should be more…natural…now I think.

I learned a very valuable lesson here. I saw INN boxes on the rise a while back and that’s when I decided it was a guaranteed profit. But I didn’t stop and assess what the remaining upside was in the short term.

Rather than selling boxes outright, I do like the idea of drafting it (if I had the time). Another alternative could be to crack the box and sell/trade individual packs. If people at your LGS trust you to not search the box, you could possibly get decent trades. I recently traded a few MMA packs this way. Some people like to gamble, and I don’t feel too bad trading someone a MMA booster pack for 2 random Shock Lands because I’m not the gambling type.

Thanks for the comment!

Do we do this to become rich? It’s entertaining while also profitable. Tying your funds

up in sealed products is much less risk, but be honest, it’s boring. Speculating on MTG

feels a lot like gambling to me, but the cards are stacked in my favor. The thought of taking a loan out or maxing a credit card on a “sure thing” is when you’re going to hit bottom. It is after all a game…?

I’m really not in speculating for huge profits. I play a lot of different formats and Magic is really not cheap. My main goal is to make enough so I don’t have to pay for my cards or tournament fees.

It’s much easier on my marriage too when the wife knows the money I’m spending on MTG isn’t coming out of our joint account. 😛

Greg, I agree with you 95% of the way. Speculating on cards is a ton of fun, and making money from such speculations is even better.

The 5% where I disagree lies in my ultimate goals from MTG Finance. My hope is to generate enough cash to significantly offset future costs of my son’s college education. With this in mind I tend to make more conservative choices to preserve capital and reduce risk. This is why the boxes seemed like such a great buy – they represent no downside with guaranteed upside with a long enough wait. I just need to be patient I guess.

I bought a bunch of Commander 2013 boxes for $105-110 on average. It will be interesting to see whether those outperform booster boxes. I suspect too many people did the same following the Commander 2011 hype.

Possibly. Please keep an eye on this for us as a community so we can all learn from your experiences here. I’ve never dabbled in non-booster boxes sealed product.