Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

The summer is often a slow time for MTG Finance, but due to the crazy card spikes we saw a few months ago, there has recently been more downside to holding Magic Cards than in the past. Other than a few M15 cards and reprints adjusting to settle at their market price, there havn’t been many inspirational price movements.

At least Modern Staples are finally leveling out some.

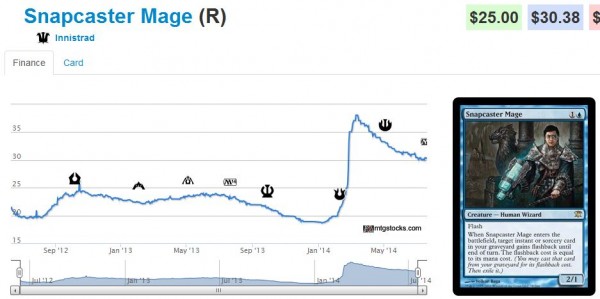

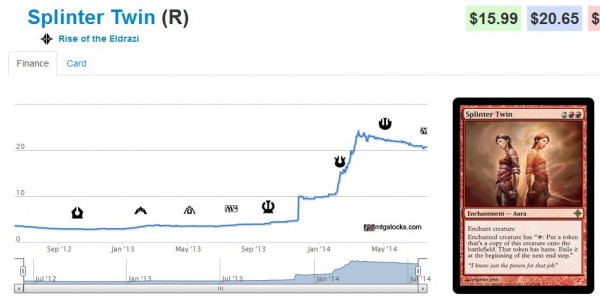

I’ve already discussed my anticipated trend for Modern at length, and I still maintain that Modern PTQ season’s end will apply some more downward pressure on Modern staples. Play in other formats can help a card like Snapcaster Mage. But stuff like Splinter Twin, mostly playable in one format, is destined for a gradual downward drift for a while longer.

Instead of droning on and on about Modern (again), I want to take a step back and analyze Legacy and Standard for their health before making any sweeping conclusions about MTG Finance.

How Is Legacy’s Health

Recall a few months ago that Star City Games suddenly jumped their buy and sell prices on Underground Sea and Volcanic Island. The rest of the Dual Land market followed higher, causing quite the impressive spike in an already established asset.

But if you zoom in on the trend over the last few months, Dual Lands have given up some of their ground as well. This is likely due to the Summer slowdown of MTG in general and I don’t expect to see the same downward pressure on Duals continue as I do on Modern cards.

But it is worth at least acknowledging the downward trend. While the negative slope on Splinter Twin and other Modern staples scares me, the recent pullback in Dual Lands could represent a buying opportunity. I’m not eager to drop a thousand dollars to pick up five or six blue Duals, but I may shop around for one or two cheap copies to add more weight on Duals in my portfolio.

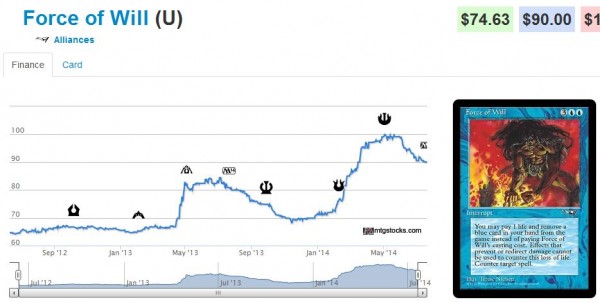

Other Legacy staples outside of Dual Lands have also pulled back noticeably this summer.

The downward curve on Force of Will is a bit sharper, but even this chart appears to be leveling out. Similar trends can be identified in other Legacy staples such as Wasteland and Stoneforge Mystic. Others are still in decline, such as Show and Tell and Karakas.

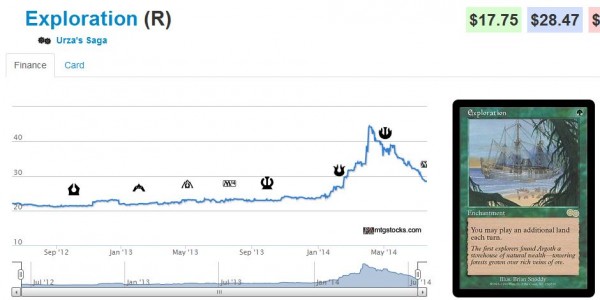

Overall, it's really difficult for me to advocate buying into Legacy staples with much vigor. They’ve all become so expensive and the format only becomes more financially prohibitive with every price increase. If I were to make a recommendation here, I’d advocate sticking to staples on the Reserved List. Especially with Conspiracy randomly bringing us Exploration and Misdirection reprints, we should remain cautious when it comes to investing in expensive cards that may be reprinted. When that happens, the resulting price hit is drastic.

There will be some better buy opportunities within Legacy over the next couple months, but for now I’d advocate patience. Some downward pressure on prices has alleviated recently, but many staples are still on the same path. At minimum, it would be wise to wait for a card’s price trajectory to level out before acquiring if you have the time. Dual Lands may already be in that sweet spot, but other Legacy staples–especially those not on the Reserved List–could drop a bit further still.

Standard

I hope everyone has been acquiring their Theros block Temples over the last month or two. These are very likely to bottom right about now, with upward trends moving forward. There are few Standard cards I have such high confidence in, and Temples are my second largest bet heading into rotation.

We’ve seen the mana-fixing Standard Land trend before: Scars of Mirrodin Fast Lands, Worldwake Man Lands, Innistrad Check Lands, etc. I don’t see why Theros Scry Lands would buck this trend. We are already seeing sets of Temples being played in various Standard decks.

The departure of Shock Lands from Standard–even with new lands being printed–will drive Scry Land demand higher. Players are always seeking to play the best cards across multiple colors in a format, and Temples will play a key supporting role in this trend.

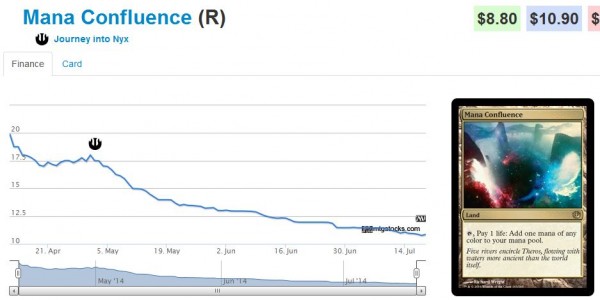

Speaking of mana-fixing Standard Lands, what happened to Mana Confluence?

I never expected this card to hold a $20 price tag, but, at this point, even a $10 price tag seems high. Luckily I have not purchased any of these for my portfolio yet, and I hope you’ve been waiting for this card to bottom as well.

I can see rotation driving some upward pressure here, but I think the jury is still out on this card. It isn’t seeing a ton of play at the moment and, as long as the next block brings us new mana-fixing lands to replace Shock Lands, I don’t know how Mana Confluence will fit into mana bases.

I’ll keep to the side lines for now and watch mana base selection carefully come rotation.

Which leads me to my favorite Standard rotation play: Thoughtseize.

The downward trend on this card has nearly flattened out. Even with key Mono Black Devotion cards rotating come fall, I’m still optimistic that black will have a strong influence on the new format. Additionally, these will remain powerful in Eternal formats for years to come, and further reprints seem unlikely.

In fact, I may like foil copies of this discard spell even more. But for now I’m focusing on non-foils as a focused play on Standard rotation.

And that’s really the name of the game right now in Standard: try to identify powerful cards that will remain relevant once the format rotates. It’s the same strategy every year, and, in general, the strategy has worked out nicely.

My only other suggestion with Standard is to watch metagame evolution very closely when the format does actually rotate. There should be a one to two week window of opportunity to identify and purchase cards appearing well-positioned in the new Standard.

Expect more articles on this topic once that time comes.

Vintage? Casual?

These are the only formats that have NOT been experiencing price pullbacks lately. Power remains strong and Star City Games cannot keep stuff like Mana Drain in stock.

I’ve been focusing a lot of attention on Vintage deals lately, and they’ve paid off for me rather well. It has been possible to negotiate towards “older” Vintage prices only to sell nearer to the “new”, higher prices. This strategy can’t last forever, but as long as players sell Unlimited Moxen for under $500, profits can be made.

The EDH and Casual market has become a Craps shoot. Identify the right trend and you can watch your $0.25 Teferi's Puzzle Box hit $2. But predicting the next such spike seems more like a guessing game than one of actual economics. If you have a personal interest in a given card then, by all means roll the dice. But I wouldn’t advocate focusing funds here as it could take years for a payout.

Lately I’ve been moving funds out of the MTG Speculation game and into Wall Street. Something about Wizards’ recent reprinting behavior has intimidated me a bit. This is also why I’ve moved my recent purchases in the direction of Vintage (and possibly Duals soon) rather than my usual Modern and Standard focus. I just have a gut feeling that Wizards is stepping up their reprint game significantly and playing this guessing game may be a losing proposition.

Will there still be ample profit to be had in Magic speculation? Absolutely. But now there are enough people on the bandwagon that it becomes a bit tougher to score large gains. As with any asset, as soon as everyone finds a good buy, prices rise to meet this new speculative demand and suddenly the buy isn’t as favorable anymore.

This happened with Modern and, to a lesser degree, Legacy. True demand may ultimately drive prices higher again, but it will take much longer to retake previous peaks. This is a waiting game I don’t particularly like, as Wizards seems to be aggressively reprinting cards left and right.

So, for now, my MTG Finance strategy is focused and reduced. I’m buying and selling Vintage staples as described above: I’m sitting on roughly 30 Temples and 16 Thoughtseizes (including 2 foils), and I may dabble in a Dual Land or two going forward.

Other than that, this summer has largely been about reducing MTG exposure and reallocating funds into the Stock Market. When Standard rotates, I’ll be on the front lines snapping up buys where it makes sense. Perhaps when the summer slowdown turns around this will change my approach quicker. It may depend heavily on the success of Khans of Tarkir. Time will tell.

…

Sigbits

It has traditionally been easy to find cards sold out at Star City Games, but with the summer slowdown that list has shortened. Here are a few that remain:

- Star City Games is still 100% sold out of Slaughter Pact. It appears likely a price bump is in the near future. This could be one of the only Modern cards seeing an upward trend lately. But be aware that a reprint in Modern Masters II is always a possibility. For now though, I’d say this is a safe bet–though returns may be slow in coming.

- Library of Alexandria, another Vintage card, is also completely sold out on SCG. I know that triple digit cards like these are less relevant for many subscribers, but it is definitely worth highlighting the price action taking place in the Vintage market.

- The new M15 Chord of Calling climbed in price fairly quickly out the gates. I’m going to monitor this market closely, as I need to replace the three copies I sold from my Modern deck. Hopefully, as packs are opened, supply will outweigh demand (from those who probably sold their original copies upon announcement of the reprint). Still, it’s worth mentioning that foils are already sold out at $29.99.

watch out with the temple predictions. You should learn from the shockland specs last year. Everyone expected them to double in price too, but that didn’t happen.

I wouldn’t be surprised if the same happens for the temples.

Supply is higher now because a lot more product is opened. And the demand is smarter, everyone now knows they need to get their temples now.

Temples weren’t a reprint and were not suddenly included in extra quantities in another set (like Dragon’s Maze). I’m bullish on them still, despite the risks. Innistrad was opened plenty and Check Lands still spiked nicely. While Theros may have been opened more, I have to imagine the greater supply is matched with greater demand.

In any event, you could use the “greater supply” argument with any Standard spec nowadays. Are you suggesting Standard isn’t a good place to bet anymore (I wouldn’t be disagreeing btw).

Not to mention, I think moving Modern season to the summer also hurt alot of the potential shockland gains.

This is a good point, Justin, thanks for adding!

Another important alert, this decline in Modern prices is not visible in Europe.

Shops keep upping prices, and MCM shows no decline for these prices.

I keep selling modern cards very easy.

Did Modern cards spike in Europe as they had here?

They did in anticipation of the US prices going up, but the impact was less.

Both markets seem yo converge now…

It’s possible the European market spiked less, and therefore the ensuing pullback was less.

Agreed