Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

I frequently write about how we can compare the stock market of Wall Street to the MTG Finance market. The same principals of supply and demand, cyclical behavior, emotional influences, overbought/oversold behavior, etc. can often be learned from Wall Street and reapplied to MTG Finance.

I’d like to introduce a new concept this week: A Bear Market.

According to Wikipedia, a “Bear Market” can be defined as

a general decline in the stock market over a period of time. It is a transition from high investor optimism to widespread investor fear and pessimism. According to The Vanguard Group, ‘While there’s no agreed-upon definition of a bear market, one generally accepted measure is a price decline of 20% or more over at least a two-month period.’

MTG Finance’s Bear Market

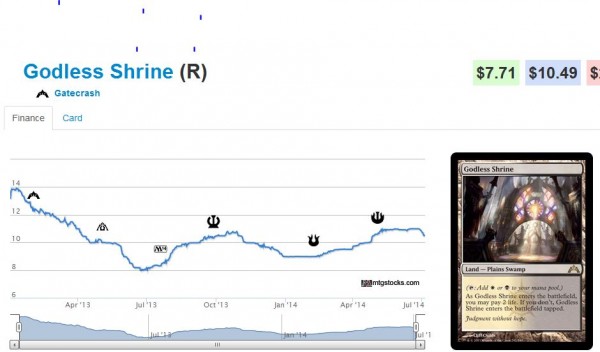

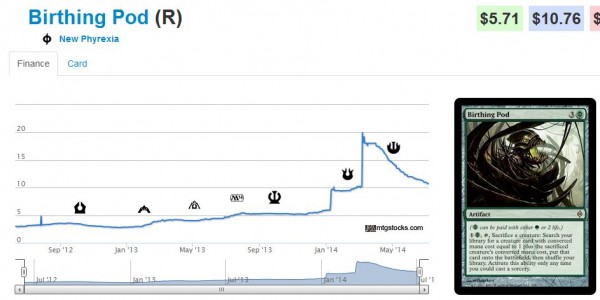

The Modern card market officially fits the definition above, even though the definition itself isn’t official. Not only has euphoria over easy money in Modern turned into fear of reprints and price declines, many Modern staples have dropped more than that 20% threshold. Consider the powerhouse Snapcaster Mage, which is even played heavily in Legacy, as a grand example:

Notice how the card peaked in value a couple months ago at $38 and is now trading at $30, a solid 21% decline? As I’ve written over the past couple weeks, this Modern trend is common across a wide variety of staples.

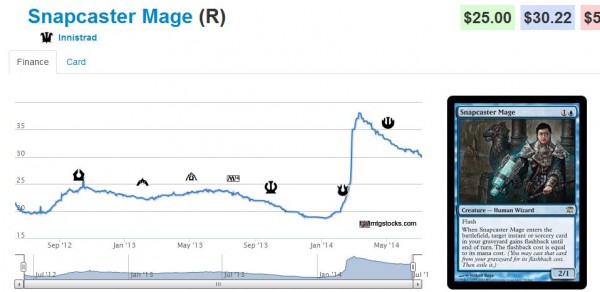

Many of these Modern staples, which once made speculators easy profit through 2012 and 2013, are now in a decline of 20% or more.

Sigmund’s Bear Market Corollary

As an active trader on Wall Street, I have developed my own definition of a “Bear Market”, although mine is more qualitative than quantitative. I consider a market to be a “Bear Market” when positive catalysts, which are supposed to drive prices higher, have no effect or a negative effect on prices.

The reason I adopt this definition is because it helps me identify the overall sentiment of the market without having to track specific numbers. Generally, when people are pessimistic about the market, this is reflected when even positive market data can’t drive the market upwards.

It just so happens that in the MTG Finance world there are now two catalysts which should be driving the Modern market higher: Modern PTQ season and SCG’s recent announcement of Modern support. Despite these occurrences, the Modern market continues its decline. This is a pure indicator to me that we’re truly in a Bear Market.

Okay, You’ve Scared Me Enough. What Should I Do?

I, unfortunately, don’t have a definitive answer for you, but I’ll gladly share my thought process and my own decision.

I’d encourage you to consider your goals and strategies in order to determine whether following my lead is appropriate or if you want to adopt a different approach.

As I see it, there are two options.

On the one hand, perhaps this Bear Market has reached a 20% correction point and will finally settle down. Once value seekers – those looking to acquire cards recently discounted by market trends but with positive long-term fundamentals – start buying up copies of Snapcaster Mages and Birthing Pods, then the Bear Market could end. This is a possibility any time there is a rapid rise in prices followed by that 20% decline. People who missed the first price spike get their second chance to buy into their favorite targets, and this speculation buoys the market.

On the other hand, prices can always drop further. One phrase that always makes me chuckle sounds something like “it’s already dropped so much, it can’t drop much further”. A card’s price can always drop further. Take it from this guy, who bought a couple dozen copies of Scavenging Ooze when they were initially reprinted in Magic 2014. I saw a decline of over 50% and I started acquiring. Now I’m left with 20 Oozes and a terrible loss.

As always, I remind readers I am generally risk-averse when it comes to MTG Finance. I don’t like the concept of losing hard-earned money, especially when this money is pegged for my son’s college education. Therefore I am taking the conservative approach and cutting positions back significantly. This could be the 100% wrong decision, mind you. Plenty of people will be acquiring aggressively, thinking this market weakness reflects opportunity to buy and not panic. They will be greedy when others are fearful.

You know what? I don’t care about those people. I know prices can decline further – in fact, I strongly believe they will. PTQ season will end and demand may even drop further. Fear of a Modern Masters II set can further reduce prices. Other than the 75 cards I use to play Modern with week to week, I have very little need for other Modern staples.

What was once a slam-dunk investment for easy growth has become a toxic position carrying significant risk. I’m selling accordingly.

What I’m Moving

In list form, here are some of the cards I’ve decided to move out of fear of further price declines and increased risk of reprint:

- My Scars of Mirrodin Fast Lands – I felt these would get a nice bump this year and my thesis did not pan out. I could not develop another thesis that encouraged holding onto this position, so these are gone for a small gain thanks solely to Razorverge Thicket.

- My non-blue Man Lands – Stirring Wildwood, Raging Ravine and Inkmoth Nexus are all gone. They aren’t getting any price support this Modern season and the risk of reprint outweighs any slow, long-term gains.

- Restoration Angels – This card was supposed to be played more than Tarmogoyf in Modern, yet it has been largely unimpressive price-wise. Quick profit was achievable buying when this card left Standard, but the peak wasn’t nearly as impressive as I would have hoped and the trend is downward now.

- Other smaller sales I’ve made include Phyrexian Revoker and Chord of Calling, for obvious reasons.

Much of my Modern position was fortunately already liquidated during GP Cincinnati so I don’t have much left to move. I’m still sitting on a playset of Snapcaster Mages, which I hope will get some price support thanks to its ubiquity in Legacy. I also have a few Glimmervoids, Cavern of Souls, and Gemstone Mines, which I hope will dodge reprint and get some price support very soon.

I maintain my hold rating on these cards, along with Foil Shock Lands.

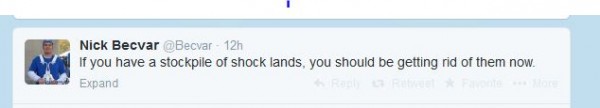

Speaking of Shock Lands, what is to be done about these mana-fixing Modern staples?! It’s pretty obvious what finance mind Nick Becvar thinks:

Nick’s right: Shock Lands have been dipping. Pressure from Standard rotation is imminent and this will knock prices down by a couple bucks.

Is the answer here a flat out liquidation? I have no clue. I am sitting on nearly 100 non-foil Shock Lands and I can’t help but wonder if a rapid liquidation here is merited. These do have room to drop 15-20% before hitting their bottoms, and it may be nice to avoid riding this downward trend. Once again, this money could be better served in a Bull Market where things are on the rise and not the Bear Market we are currently operating within.

Moving Forward

I’ll have a decision on Shock Lands by the end of this month. While I still believe in their long-term performance, I’ll admit that my original thesis on them has not pan out exactly as hoped. These were supposed to get support from the Modern explosion, the PTQ season and the departure of Innistrad block from Standard. These forces did have a small positive effect, but the downside of Standard departure is much too great.

Other sectors within MTG Finance have not been suffering as greatly. Tarmogoyf and Dark Confidant prices remain near all time highs. Dual Lands have pulled back from their recent all-time highs, but they are not close to that 20% decline. As always, Vintage staples continue their rapid rise. Perhaps money is better spent in these formats.

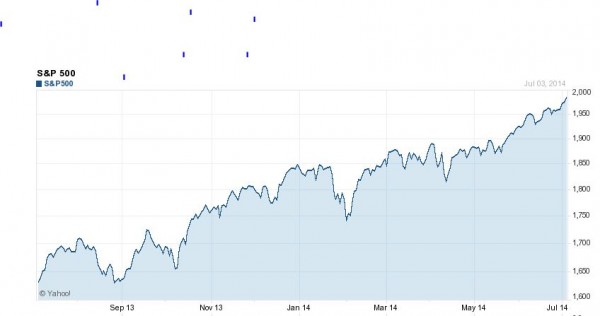

It is also worth mentioning that, as Modern goes through a killer Bear Market, Wall Street has been experiencing an incredible Bull Market. Stocks were up about 25% last year and are up again around 8% this year.

That’s quite the inspiring chart, and I find myself retrospectively regretting not placing a bit more of my cash in stocks rather than Modern speculation. Making money on Wall Street has certainly been easier than in Modern cards over the last year, and it raises the question “am I doing it wrong?”

It’s certainly possible. Modern has been exploited heavily for its easy profitability and now reality is setting in. Reserved List, Eternal staples once again become the blue chips of MTG investing.

Thus I present my new strategy going forward: significantly reduced Modern exposure, increased Wall Street investing, and a few pieces of Power. Even my Innistrad Booster Boxes represented undesired risk. Not because I fear significant downside, but because the opportunity cost of such a slow-growing investment is too large. I would much rather park the cash in a dividend stock paying 5% for easy compound growth. Shipping, handling and eBay fees are just too great to enable the easy profits I had expected out of the investment.

Lesson learned, and moving on.

But things are not all doom and gloom!

…

Sigbits

Outside of Modern, there are plenty of cards exhibiting growth.

- Elspeth, Sun's Champion has bounced off her bottom and should have upside potential come Standard rotation. SCG has just a few copies in stock at $27.49.

- Vintage Staple Mana Drain remains near its all-time high and SCG is still sold out with a price tag of $199.99.

- Pact of Negation and Slaughter Pact have dodged this Modern Bear Market so far. Star City Games has just a couple non-foil copies of the zero mana counterspell in stock at $9.99, despite the Modern Masters reprint. Slaughter Pact is virtually sold out with a $4.99 price tag on Modern Masters copies. Both should be expected to move higher despite Modern’s lull.

This Modern index confirms = http://www.mtggoldfish.com/index/MODERN#paper

(But you can see the same kind of dip in the Legacy one tbh…)

Whoa, really? This indexes price performance of the Modern and Legacy format in paper? If so, then this is very telling. Thanks for sharing the data!

I missed the SCG announcement about supporting Modern. When did this happen?

And when will Modern events start? If this is true, there will be a price uprise for sure.

Not now of course, it’s summer.

Modern support begins at SCG Baltimore if I remember correctly. It’s just a 5k on Sunday, but it’s still something. If they make this a regular occurrence then I’d consider that “support” for Modern in my book.

When do you think the uprise would happen? Fall? That is hard to believe because that’s when Modern PTQ season ends. I would think SCG’s announced support for Modern + Modern PTQ season would result in the most Modern support, but the recent bear market suggests otherwise.

Calling this a bear market is off centre. This is a market correction after a drastic run-up, lead by speculation, with prices falling back towards true demand directly thereafter. The correction is a buy signal for mid term and beyond and is not indicative of future trends. That being said, I do believe that we may be plateauing on player growth and that the broad modern index will likely curve up by no more than 15-20% from here to Xmas ’14. Further, the stock market has been only mildly up this year so far, and we’re far from the halcyon days of 2011-2013. I’m moving out of stocks and into physical/digital assets (toys, mtgo, mtg), not the other way around.

I truly believe this is a bear market for the reasons I outlined above. All this positive news and support for Modern yet prices continue to drop. What’s more, WOTC has really stepped up their reprint game, meaning it will be trickier to make money with mid and long term speculation. This will deter some people from getting into the game. I, for one, am scaling back my MTG position and focusing on my proven strategies (Standard lands, etc.) and stuff like Power, Duals, etc.

Time will tell which way things go for sure. But I don’t think the downward trend is over just yet.

I do have to agree that calling this a Bear Market its being a bit sensationalist. Given the index provided by Sven, the price drop is barely 10%. True, people are not buying staples because the same pessimism and caution that has been outlined.

I would only state that the stock prices remain cautious, whether it becomes a bear market or not, that still needs to be determined and I do think prices will settle in late Q3 early Q4.

I personally I am preparing myself to buy sets of shock lands 1 or 2 months after rotation and other interesting Return to Ravnica staples. I will follow your advice into buying Pact of Negation or Slaughter Pact. Lets see how that goes.

You make some fair points, J.R. The index does show a 10% drop and not quite a 20% drop. Some staples that are key to both Modern and Legacy haven’t dropped. Tarmogoyf and Dark Confidant are prime examples. So not ALL Modern staples are participating in this pullback. I still think the trend is downward, but perhaps “correction” is more accurate than “bear market”…for now. I think when Modern season ends, things may drop further but time will tell.

Noting the stable prices of Tarmogoyf and Dark Confidant, what do you think will happen to the price of Modern Masters Boxes? Should we sell or hold. I was sticking to the Chas Andres prediction of $500 by summer, and I think we can all see that isn’t going to pan out. So, having 4 that I got at $240, should I hold, sell 2 or sell all?

For me, Booster Boxes can be one of the safest investments out there. That being said, they also carry some of the largest opportunity cost possible. They aren’t very liquid and moving them at a favorable price is quite difficult. I sold my Modern Masters boxes not long ago and have no regrets. The cash there has enabled me to move into various pieces of Power, which I am able to sell/trade for quicker gains by simply leveraging my network combined with the recent spike in Vintage interest.

The proceeds from my Innistrad Boxes will go into stocks on Wall Street. Perhaps 1 year from now I’ll be writing about how my stock investment compares with Innistrad box performance!

We’ve obviously hit some price resistance — not surprising, given the psychology of “doubling up,” which is roughly possible at the current price (assuming you bought around MSRP and are selling on a platform that charges typical fees).

I don’t see anything in the near future that seems likely to push this up past current levels (though I also don’t really see it going down). I’ve got just one box, bought at about MSRP, which I should probably move but just haven’t gotten around to doing yet.

Insofar as you believe this is a market correction from overhyped speculation, how many speculators do you think the market will lose from this downturn? I have been interested in considering how the speculators themselves (especially from the MTG finance subreddit) have affected this market. Do you think that everyone who wants to play modern has their deck now and won’t want others, or is this just the beginning of players building a large modern collection.

My process was 1: get affinity 2: get UWR 3: get Melira pod and other assorted staples because modern is gonna be huge.

People do similar things in legacy. They get one deck, learn to love the format, and then want to get a larger legacy collection. I also have the strong sense that a fetchlands reprint will actually drive the price of every other non-reprinted modern staple higher, as people who waited to get into the format until the fetch reprint finally launch their “get deck now” routine.

I replied basically the same to Becvar on Twitter: don’t forget that Shocks will be playable in casual forever. People are used to them being about $8-$10, I wouldn’t expect them to go down much more than $1 and I expect them to recover too.

I am trading my spare Shocks for bulk rares. I am getting about 80-100 bulk rares each for them and interest remains strong. I would be holding them if I wasn’t getting amazing rates for bulk rares. I’m more than doubling up and I could trade for my preferred shop’s Shocks at about 30-40 bulk rares each to replenish should I want to. Should they go any lower at the shop I’d probably start doing that.

This is a good point, and it’s why I am on the fence and not completely against Shocks. I’m looking at doing a covered call on my Shocks and it may actually happen. Expect to see more in next week’s article.

I’d be interested to hear any and all thoughts on Modern Masters sealed boxes, especially noting the stability of ‘Goyf and Bob. I have speculated more on these than any other position I have. I sold a lot of stuff this Winter and Spring in the peak, and I will have to figure out what to do with my shocks, fastlands, etc. but I think I have enough info from this article to make good decisions. Basically I am going to keep my 4 modern decks and any legacy-also playables and basically move out of everything else. I haven’t gone too deep on anything, and I still consider most of my cards “collection” rather than “inventory.” That said I’d like to move deeper into MTGO, and it seems like this is a good time to move out of paper.

As to whether or not this is really a “bear market” its tough to say. I do agree with the main point that 2 things that should have supported the market have basically done nothing. I think if we start to consider cards individually we have an opportunity to actually make money here by “being greedy while others are fearful.” That said, the hit that snapcaster has taken is surprising. Perhaps the “large set rare” factor has hit it harder than we might have expected? Liliana has not tanked nearly so hard.

Finally, what can we learn for the future from these trends? It seems like the modern peak has taken magic speculation to new audiences, and that speculators selling to speculators has driven the market harder than any other factor. How can we do the math to actually predict future demand for modern staples?

I think the takeaway is the old lesson of selling into the hype. Those spikes in early spring were obvious sell signals. Unfortunately I only sold about half my modern stock at that point.

I think a big part of the declines since the spring has been the uncertainty regarding MM2. All of these specs are only good if they aren’t reprinted before the next modern season, and no one knows when MM2 will drop or what will be in it. I assume that Zendikar and Scars blocks will be in, so I’ve dumped most of my specs from those two blocks. I’m on the fence about Innistrad, although the longer it takes for MM2 to hit the more likely it will be included. RTR seems safe.

There is now way to predict the future of modern staples B. Roome. The only thing we can do is check the popularity index of certain “Tier” decks.

Metagame trending and the same offer and demand of a card and of course to new coming factors such as new sets with new cards. Unfortunately, the later we can’t do anything since that depends completely upon Wotc.

Popularity has also been a factor. Certainly WotC marketing has done a great job to keep a base of loyal players, now with a larger base than when I started playing (almost 13 years ago) I remember very well that Sneak Attack was about 10-15 USD and Black Lotus was sold at 300-500 USD (InQuest prices at that time).

Now, I think there are even rumours of a movie of MTG and if this movie is well executed, you can expect a significant growth of players (thus demand) of staples. That is of course, provided that they don’t do a Sharknado of a movie.

I am also collecting modern and legacy staples (the later more for commander) so I think this article is a superb note of advice on the current status of modern.

Great job, Sigmund.

The quality of an article is proportional to the number of discussions it can start.

Agreed. This article and the comments are excellent. Sigmund – For the record I find your articles by far the most illuminating, well written, and most carefully thought-out on the subject of magic finance anywhere on this site or the internet in general.

I sincerely appreciate the work you do and the high level discussion that issues from it.

Don’t stop rocking.

B. Roome,

Thank you very much for the kind words! It really means a lot to me. Because I do so much real world investing in Wall Street, I truly enjoy discussions that relate MTG Finance with “RL” Finance. Even though some may point out flaws in my logic, the discussion that stems from such comments can compound the value of my articles. Our community is very sophisticated in their Finance understanding, and I truly enjoy reading others’ opinions. Even if they are not the same as my own!

Hopefully the guys in charge see your comment

Damn it!

I was queuing up to write this exact article, almost to a ‘T’. Well played sir, well played

Lol, sorry to take your thunder Dylan. This is an advantage of being the Monday article.

That being said, the more other financial minds are thinking along these same lines, the more I want to trim back my vulnerable MTG position.

So Dylan, do you agree with all Sigmund’s points?

Are you selling all your positions across the board, or is there anything you think we should hold?

How do you respond to the arguments above that this is just a market correction and not a bear market?