Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Last week there were definitely some growing pains in the switch to the new client. That said, they made some big improvements in the newest build. The increased stability is key, and a number of the User Interface (UI) tweaks are improvements.

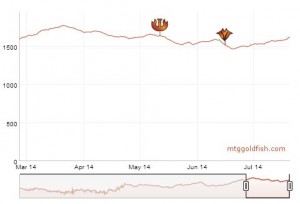

Despite the many complaints on social media, the sky has not fallen, and there has been no collapse in card prices like many people had predicted. In fact, we saw this:

Prices have actually gone up on all three major indices: Standard, Legacy, and Modern Index. What's going on here?

Perhaps an analogy from the finance world might shed some light. Earlier this month Citibank agreed to settle an investigation by the U.S. government into the bank’s sale of toxic mortgage-backed securities six years ago. The settlement price? A staggering $7 billion, which essentially wiped out the bank's profits from this year. Yet in response, Citibank stock shot up 4% the next day.

First, the market was relieved that the settlement wasn't even larger. But more than that, the market was rewarding certainty. The prospect of the settlement had been looming for so long that that risk was built into the stock price; once a clear settlement cost emerged, investors felt comfortable buying back in and the stock rose.

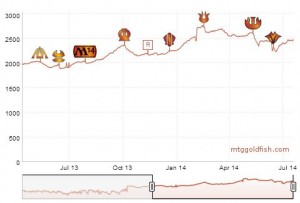

The v4 transition has not been an easy one, but it could have been much worse. For months, a lot of players and speculators sat on the sidelines and did not commit their capital because they were concerned about a fiasco akin to the v2 to v3 transition, which led to drops of 20% or more across the board. I was personally quite cautious to commit--the downside seemed much lower than the possible upside.

So far, things have been stable. But that's not to say we're entirely in the clear. This last week was a nightmare for many botters, and the lights were out at a number of major chains as they scrambled to update their software. Casey Stewart of TheCardNexus noted on Twitter that there are "680 classifieds post right now... compared to 2500 normally." That means that a ton of bots were having difficulty making the transition (Scott Bianco has a good list here.)

What were the implications of these bot troubles? So far, not much. However, if these bot chains cannot resolve their software issues and get back online there will be a couple serious consequences: 1) less competition will mean wider spreads between buy and sell prices; and 2) if some of these foundering bots start selling off inventory it could flood the market with additional cards and lower prices across the board.

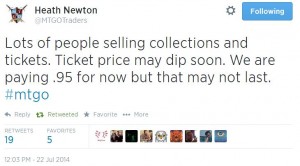

Moreover, MTGO Traders mentioned in a series of tweets on Wednesday that "lots of people [are] selling collections and tickets" and predicted that "with the amount of people quitting prices will drop," though "prices will recover and it won't be anything like V3 launch."

Keep an eye on M15 release as a danger zone. The M15 release will be a good test of how players enjoy the new client, how stable it is with large numbers of players, and how people will respond to a new client in the context of low liquidity. The demand for tickets could lead prices to slip, and if that is coupled with sell-offs we could see the MTGO equivalent of a “run on the banks”.

If people see the value of their collection declining, they could rush to sell off before things get worse, and trigger a recession in the MTGO economy. This is essentially what happened in the v3 switchover several years ago. Please note that I do not see this as a likely outcome, but it is an outside possibility that we should be prepared for.

I am waiting before investing heavily because I still have concerns. But it may well be safe to go back in the water.

Getting the Most Out of M15 Release Week

M15 launches online with the prerelease, July 25. In general, release events are a great time to load up on singles you need, since the “tix only” entry of the on-demand sealed events will lead people to sell the cards they open and suppress prices across the board. The rest of this article will talk about a couple specific opportunities available during the M15 release.

Prospects for Rotating Cards

Pro Tour Magic 2015 (Aug 1-3) will be the first showcase for M15 Limited and the new summer Standard. The Pro Tour is a swan song for rotating cards, and RTR block all-stars like Sphinx's Revelation and Pack Rat will take the stage one final time before fading into oblivion (or, for the lucky few, into Modern.) There might be one last mini-bump on these prices during the Pro Tour, since Standard will have the spotlight and people will buy cards (and intriguing decks) that appear on coverage.

But right after we should see a continued slide into irrelevance for our old stalwarts. By now you should have sold M14 or RTR cards you don’t urgently need, but if you missed the window you may get a final shot to sell during the Pro Tour (you can pick up your Modern/Legacy playsets in the bargain bin this fall.)

After the Pro Tour we enter a good window for picking up rotating cards. In principle these should be lowest after Khans of Tarkir, but redeemers and speculators often start buying in late summer. Sylvain’s article provides some good ideas for targets, which include Abrupt Decay, shock lands, and Deathrite Shaman. Just make sure you don’t buy in too early.

M15 Cards

During the first few hours of prerelease events, M15 cards will be in high demand. Players will want them for their decks and bots will want them for their inventory. Within 24 hours or less the demand will be sated, and most cards will have dropped to half or their release price, or less. Rares without clear Constructed applications will be hit hardest and will be worth pennies. Sell anything that hits your binder until these cards hit the floor.

This crop of M15 mythics is hard to evaluate (see Sylvain’s article here), which means they are likely to stay out of “bulk mythic” range. If there is a breakthrough mythic it could easily spike from a few tix to 20 or more (this is what happened with Sphinx's Revelation, Geist of Saint Traft, and a few other breakout all-stars.) Don’t overextend. The general price pressure will be downward until about 8-10 days in, and you will be “swimming upstream,” as I discuss in my last article.

During release events there will be a lot of M15 entering the market. One to two weeks after the release starts will be a great window to load up on a basket of cheap rares and mythics.

You can take the Sylvain approach of buying an “index” of the set with the understanding that everything is underpriced. Or you can be more selective and try to pick winners. Either way, the set has basically nowhere to go but up, and the index will be 20% lower than it will be in a few months. So it’s pretty safe to buy a cross section of cards. This is a good example of “swimming downstream”.

M15 Wildcards

There are two wildcards surrounding this release that make it different from the past.

The first wildcard is the new client. If it is poorly received by players this could actually benefit the long-term value of M15 cards since there will be less drafting than expected. However I don’t expect volume to be down significantly since the client is pretty draft friendly. Indeed, because the deck building and trading functions can be rough around the edges this may push MTGO players even further away from Constructed and toward draft.

The second wildcard is the free prerelease voucher that was provided to all accounts. I expect the volume of people who play this prerelease higher than ever. I also expect to see a lot of "zombie" accounts—i.e. people who enter queues for free just to get the cards, and then drop. This will lead to unpleasant play experiences. It will also mean that M15 prices drop much faster than under usual circumstances.

Notice how I didn't talk about any specific M15 cards? As discussed last week, one of the most common mistakes is to try to "pick winners" among the newly released set. Unless you have an inside track, it's best to wait for a week or two before making any M15 purchases.

Eternal Cards

During release events almost everything goes “on sale”. Keep an eye on prices, since this is a great time to pick up those playsets of older cards you’ve been holding out for.

The discount won’t be huge—usually between 5 to 10%--and will be proportional to how much a format is on people’s minds. Right now, for example, Modern and Pauper are not occupying a lot of our mind space so the index for these cards could experience a deeper discount than Vintage/Legacy/Standard.

Because each account will be gifted a free prerelease voucher, fewer tickets will leave the system than in a traditional prerelease. So I expect this effect to be muted somewhat.

Booster Plays

What about Boosters? Once the Sealed Release Events start firing, booster prices will crash—there is just too much product entering the system and demand for tickets is too high. (Traditionally the highest EV events are the Sealed Release queues which only take event tickets.) M15 boosters should quickly fall to 2.9-3.0 tix.

That said, there may be a brief window in which M15 boosters will rise. As Matt Lewis puts it:

I think there will be an opportunity on boosters on the Saturday and Sunday when prereleases open. Boosters will not be in demand as players need tix to enter these events. But boosters are awarded as prizes. This puts downward pressure on the price of boosters. Once release events open on the Monday, draft queues start up, priming demand. But boosters won't be awarded in DEs and such until the Wednesday. So, there's a quick flip on these 'a brewing. If you can buy for 3.5 or less on the weekend, they should jump to around 4 tix on Monday/Tuesday.

Note, this trade is something I explored last year with the THS prerelease. I made the call on Twitter, and it worked out. I think they key part is that the draft format needs to be a TTT or M15M15M15, i.e. drafts are using three of the same set. This means that drafters put a lot of demand on the supply of boosters. It won't work as well for a second or third set booster, so it's not worthwhile in those cases.

Keep an eye on this dynamic. It’s no slam dunk because of the wildcards discussed above, but it seems a reasonably safe way to earn yourself a free draft or two.

They have been doing a great job with Core Set Limited in recent years. Enjoy the new set, and don't worry too much about EV if you are having a good time.

-Alexander Carl (@thoughtlaced)

M15 boosters quick flips. I’m all in this weekend!

Currently you can buy them via offer on the Classifieds for 2.5 Tix/booster, just insane.

As of now I bought around 40 packs in 1h.

Cardbot has been selling them for 2.3-2.6 since last night. Goatbot had been buying between 2.4-2.6. I am up to 128 M15 packs.

I also have been buying Journey into nix for 1.4-1.5, and Born of the gods for 2.33 or less.

I have 272 BTG, 132 Jou, 405 and 128 M15.

“The v4 transition has not been an easy one, but it could have been much worse.”

Honestly, I’m pretty shocked at how bad things are. There are horrible design decisions (have you SEEN the foils?!), unintuitive UI (did anyone else have some trouble finding the m15 events?), and obvious bugs EVERYWHERE. I am very concerned for the future of the client it appears it’s already a spaghetti code mess.

For example, I used a bunch of new accounts to play sealed events. I’m trying to transfer the cards to a central location in order to sell them. When I “select all” in my collection to add them to my active binder, multiple seemingly random sections simply aren’t selected. This forces me to trade 3-4 times just to finally get everything to transfer. Can you imagine trying to code a bot to work with this??!

There are certainly a lot of issues, and I sure don’t want to sound like an apologist for the new client.

That said, compared to the previous transition–where things literally shut down for a week and card prices tanked–this has not been the seismic event some predicated. The market seems to be responding positively now that the worst-case scenario did not materialize.

I’m using the client for more than one year, and still didn’t quit. So, how buggy it can be, I keep playing. So will everyone else.

zombie accounts, only a few on the forums here, but I never had a zombie player in my prereleases I played. (and I played quiet some rounds already). So I don’t think we’ll see those that much.

That’s good to hear, I was worried about a zombie invasion. I was out of pocket this past week so will be using my phantom tickets for future cube events.

I made a great zombi this weekend. Pretty much dropped in at 3-0 of a competitive sealed because of baby issues :/ I bet my opp who didn’t answer my split proposition was pretty happy.

I also open/drop from another event, just to get the product.

My approach is small fry compared to you guys but this and the earlier article had great advice – I played 6 free preRelease tournaments and netted around 17x M15 boosters as prizes. Sold some of the rares pulled to buy in more boosters, and now waiting for the booster/singles spread to widen into this week to cash out & buy back a full set. If done right I should be able to redeem a full paper set for around 50 bucks and that includes redemption fee!

Nice work Shoey!

Went in 200 packs deep @ average 2.52 selling for 3.33 nicely right now. Not mad at all. Easy flip if you had the liquidity.

Glad it worked for you, Jordan! All credit goes to Matt Lewis and the QS forums.

Thanks for the great tip with M15 Boosters. My month subscription was ending on 25th June and I had been decided not to continue with it (I am running a small store so more effective way to make money for me is to buy for buylist prices and sell with profit). However, I decided to prolong for a month. And day after, you came with this article. I went into approx. 250 boosters with about 0.75 on a piece in average. I am probably going to use the money to purchase an annual subscription now (instead of closing it, haha). Once again, well played, sir!

I have also one question. I have a foil black lotus and I am not sure whether hold it or sell it (probably for about 380-400 now) and use the money to go for other vintage masters staples, most likely these? (Beside that I think Mana Vault could be a good target)

https://www.quietspeculation.com/2014/06/insider-v…

Where do you see the normal / foil Black Lotus in a half year (I know it’s a difficult question when the cards have no precedent at mtgo) ?

Thanks a lot, I will keep an eye on your articles!

Thanks Roman, glad you continued as an insider, and glad we were able to add value! The insider-only forums are a great way to find timely tips like these.

I don’t have a good sense for foils, but I think that a regular lotus will be substantially higher in six months than it is now. It will probably go down again in August before it goes up, but in the medium to long term it seems to me like a safe play.

Part of the future value for P9 and other Vintage and Legacy staples will depend on whether MTGO will continue to support the format. Right now, Vintage and Legacy constructed are some of the highest EV events out there, which drives players to collect the necessary pieces. What will happen after VMA ends? Will MTGO continue to support good payouts for these formats? That’s the risk factor here. That said, I expect an iconic card like Lotus to hold its value into the future.