Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

This summer has brought significant shifts in Magic market prices. Some cards were overbought and so their prices have dropped over the past few months, while other cards, such as some casual staples, were unnoticed during the Modern and Legacy boom and received attention through these summer months.

And of course with Standard rotation approaching, changes to PTQ schedules, major reprints, the risk of Modern Masters II, and overall shifts in the Pro Tour format schedule, there are a number of factors likely to influence the market in the coming six months.

Naturally, all of these shifts give good cause to reevaluate one’s MTG portfolio. Because of some significant changes I’ve made over the summer, I thought it best I reveal my current investments to give everyone a glimpse into where I’m focusing resources most these days as well as where I’m deemphasizing my attentions.

Some of this may be a rehash of my previous articles, but my intent here is to summarize all of my portfolio shifts in one convenient location. As the summer winds down, hopefully this summary will be useful to readers because they will see where I’m prioritizing my own cash as we prepare for more significant changes in Magic ahead.

(Note: all percentages are approximate and best for relative comparisons)

Modern – 28%

This portfolio breakdown exercise has already been completely enlightening to me. Despite my efforts to significantly trim back my Modern position, these cards comprise over one-fourth of my entire MTG portfolio!

You know why I overlooked this? Two words: Shock Lands.

I keep my Shock Lands investment in a separate binder – over half of my Modern position is solely in foil and non-foil Shock Lands. The fact that I maintain a Modern deck also feeds into this number. In reality, if I subtract out Shock Lands and my Modern deck, the actual dollar value of my remaining Modern collection is very small.

With changes to the PTQ schedule, constant reprints, and the risk of a Modern Masters II on the horizon, I actually prefer it this way. I’m not completely ignoring Modern speculation, but I am going to be very careful with my cash. Before I make any purchase of Modern cards, I ask myself a couple critical questions: When’s the next time this card could feasibly be reprinted? Why will demand increase, driving prices higher? How much upside is available versus the downside risk of a sudden reprint?

Not many Modern cards pass this litmus test with flying colors right now because I see little upside to demand. The Modern PTQ season is winding down and there doesn't appear to be an upcoming official “Modern PTQ” season. Sure, Star City Games is lending their support to the format and this does make a difference, but I’m going to remain highly selective here.

Legacy – 27%

Nearly two years ago I made the difficult decision to sell out of Legacy. This choice was made based on a number of personal factors, and I stand by the decision with little regret.

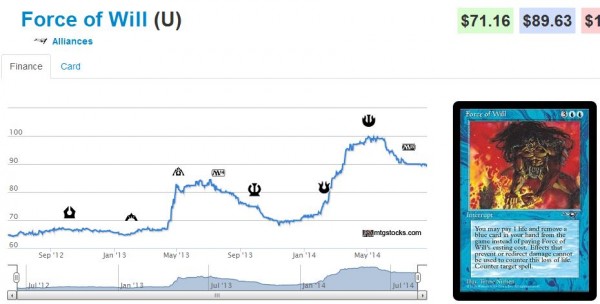

Since then, we saw prices of Legacy staples drive higher only to pull back modestly this past summer.

I see a load of opportunity in this pullback. I’m not going to buy just any Legacy staple now, even though many are cheaper now than they were three months ago.

Instead my focus will be cards on the Reserved List. But I will get even more specific than that. My true focus of late is on Dual Lands, which are selling for very favorable prices on eBay. Tropical Islands and Tundras are at the top of my list because they are selling for around $130 at auction, even for NM/SP copies. This is a significant discount to recent history and it also gives you arbitrage opportunity when trading for value – especially if you’re using TCG Mid pricing!

With this recent drop-off in prices, I’ve begun acquiring. I’ll check eBay a couple times a week for auctions ending soon for these blue Duals. If any are still below $130 and their auction ends within about 24 hours, I’ll throw them on my watch list with the intent of bidding.

Mind you, I don’t go chasing. If the auction exceeds my target price of $135, I stop bidding. I’ve admittedly lost more auctions than I’ve won. But with enough patience, I’ve acquired two Tropical Islands and two Tundras at what I’d consider to be favorable pricing.

These recent acquisitions, along with my currently built Legacy deck, makes up the vast majority of my Legacy portfolio. By focusing on Dual Lands I dodge any reprint risk and gain upside potential from more than just Legacy. Dual Lands are played in casual formats and Vintage, so any increase in player base for these formats can also bump the price of Duals higher.

There are only so many of these in existence and Wizards of the Coast has pledged they will never print more again. I’ll maintain a diversified approach, but I really like the story on Dual Lands right now and I plan on continuing to invest here.

Booster Boxes – 15%

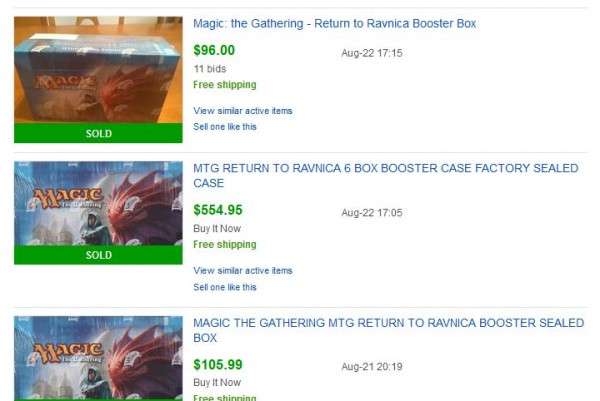

I have gone through great lengths to significantly reduce my exposure to Booster Boxes. These are still the safest investment you could make in MTG Finance, but returns are so slow and moving these can be cumbersome. Shipping a Booster Box is a pain, and the $12 cost really reduces profitability. Combine shipping cost with fees and you need to see a solid 20% appreciation in a booster box investment before truly becoming profitable.

Most of the time a 20% increase is inevitable… it may just take years. I’m not interested in waiting years anymore. So I sold most of my booster box investment.

I still own a good collection of Return to Ravnica boxes alongside two Avacyn Restored boxes.

I’m fine with holding these for another year or so. There is enough eternal and casual gold in these sets to justify a higher and higher price tag. But once they are gone, I may not invest heavily in sealed product ever again. It’s just so much easier to make money elsewhere.

Casual – 15%

This catch-all bucket comprises my “keeper” cards. These are things like my Jaya Ballard, Task Mage collection and angel collection. Also included are a handful of older cards like Island of Wak-Wak and Shahrazad that I keep because of my love for their flavor. It’s likely I don’t sell these cards until I quit Magic for good (or my son goes to college, whichever happens first). But because there’s sufficient value in them, I make sure to include them in my portfolio assessment.

I’ll likely continue to add to this collection over time as I find more flavorful cards I enjoy enough to buy. I’ll also continue to dabble in cheaper casual staples that Wizards prints because of their slow-and-steady trends upward. But because casual formats are not my expertise, my focus on EDH and Cube staples will remain small.

That being said, I can think of little that would be safer to invest in than stuff like foil Little Girl, All Hallow's Eve and Gifts Given.

Vintage – 12%

This bucket fluctuates the most drastically simply because the cards I include in the category are worth so much. I may pick up two pieces of Power only to immediately flip them for a modest profit. My intent is always to hold onto a Mox or two alongside a few Mana Drains, but these are so easy to move right now that I can’t resist taking the guaranteed profit.

Italian Mana Drains are now selling for $100+ on eBay. A couple months ago you could buy a played English copy for a similar price. Star City Games has been sold out of Mana Drains for an eternity now and a price increase is inevitable.

I don’t necessarily want to bet the farm on these simply because they’re not on the Reserved List. Upside is much reduced at these new prices as well. But buying these at their old prices (still possible, I find) or trading into them can yield nice returns.

And, of course, Power is Power. It’s been on a tear over the last few months much like other Vintage staples. People want these for their cubes as well. When the dust settles at the end of this year, I hope to have at least two Moxen in my portfolio for a mid-term investment. But as long as I can virtually sell them for profit before I even receive the cards in the mail, I’ll continue to play the quick flip game for the easy buck.

Standard – 3%

“Wait a second, Sig. You’ve been pushing Temples and Thoughtseizes so hard these last couple months and your Standard portfolio is only 3% of your total MTG investment?!”

Yup.

The reason – Standard cards are just so cheap! I can buy thirty Temples for less than $100. I can grab a couple playsets of Thoughtseize for under $100 as well. And my other Standard bets are tiny and unfocused. My strategy with Standard has always been to acquire staples after they’ve proven themselves in a new format. I miss out on the maximum potential profit, but I find there’s still plenty of opportunity to buy Standard cards on the way up.

So when Khans of Tarkir is released in the fall, I will monitor tournament results VERY closely. I will actively buy cards that make a strong showing with the intent of selling them just a few weeks later after they finish their run. I find this strategy yields decent profits with very little risk – a risk/reward balance that fits my appetite perfectly. So while my Standard holdings seem very tiny right now, they should spike for about a month come this fall.

Still, despite all of this, my attention on Standard is always limited. For one, it takes massive buying of Standard cards to equal one Mox or a couple Dual Lands. And it’s much easier for me to move a Mox Ruby than it is moving 100 Temples. With this in mind, I’ll always put more emphasis on eternal staples.

Summing it Up

That about sums it up! Now you have a good idea of where my money is currently parked.

Are you surprised with any components of the breakdown? I know I was! I had no clue I still had so much emphasis on Modern. The more I think about it, the more I hope my Shock Lands option is called away so that I can reduce my exposure to the format in the short term. I’d much rather have the cash right now so I could buy a few foil Shocks, a couple more Dual Lands, and have the rest available for some quick buying come Standard rotation.

My top focus areas right now remain well-priced Mana Drains, Tropical Islands and Tundras, with a few Temples thrown into the mix for good measure. I’m sure this will shift some come the fall when prices move around again. But for now, I like where I’m at and, other than my undesirably large Modern position, I am quite pleased with my shift in focus. Hopefully the moves pay out as we close out 2014!

…

Sigbits

- In case you missed it, Maralen of the Mornsong was bought out on TCG Player. The card was priced at $1.99 at Star City Games. Of course they’re sold out now and the restocked price will surely be higher. But keep your eye out for these in trade binders – especially foils, which are also sold out at $19.99!

- A sudden interest in Goblin Guide has driven the price of the one-drop creature much higher. He’s now sold out at Star City Games with a price tag of $19.99, with a price bump very likely in the short term.

- The recent reappearance of Slivers in Magic 2015 has sent many Sliver prices much higher. Foil Magma Sliver: sold out at $11.99. Foil Pulmonic Sliver: sold out at $6.99. And Horned Sliver: sold out at $3.99. Just as a few examples. If you have any old Slivers lying around, I’d make sure you centralize them in your trade binders. You never know when you’ll come across that crazed Sliver fan who wants all the Slivers and will give you a premium in trade for having many available.

Appreciate the insight into the dual lands. I’ve started picking some up since I’m trying to get into legacy. If the consensus is that they will pick back up eventually I don’t feel as bad that I may be jumping the gun on getting them as they bottom out.

I’m not sure if everyone agrees that Duals will pick back up eventually, but I would put money on it (well, I am putting money on it!). Duals tend to go through these up and down cycles, and each peak is higher than the last. I’m trusting this is just another summer lull and prices pick up again in the fall. Would love to hear others’ thoughts on this as well!

Thanks for the kind comment

I really enjoy Sigbits. Keep up the good work!

Keep up the good work!

Bought 6 GP foil Goblin Guides last week for $15-18/ea, 6 set foils for $18/ea, and a handful of regular copies for less than $10/ea. Already seeing lots of movement on all of them, and I get a ton of trade requests for them everyday.

Also – whoever it was that told me to buy foil Stoke the Flames and set foil Flames of the Blood Hand a few weeks ago… THANK YOU! I got a dozen copies of each (Stoke for $4/ea, Blood Hand for $8/ea) and they have both more than doubled.

Hi Dawson,

Thanks for the kind words! I get a lot of positive feedback on Sigbits so they are definitely here to stay.

I am really excited to hear you are having positive experiences. Sounds like you made a killing on Goblin Guide! I myself missed the boat on that guy completely. But it’s OK, there are always opportunities somewhere, and I think the day is near when Theros Temples all increase and make me some nice profit.

I did mention Flames of the Blood Hand a little while ago – perhaps that’s where you heard of it? My advice on that one though is to sell sell sell! The card jumped due to hype and from having a lower supply, but there’s no real demand that is causing it to be so expensive in my opinion. Take some profits here. May be wise to move a few Goblin Guides soon too. They would look great in a Modern Masters II or Modern Event Deck.

Keep grinding out the profits!

Sig

A minor comment and question:

It would be helpful in these sorts of serial articles to include a link to the prior article in the series (i.e., your most recent portfolio breakdown). If it is included and I missed, my apologies (in which case it should be more prominent!).

The reason I was looking for it is that I’m curious how you categorize specs, which you may have explained in a prior article. I have about 80 copies of Anger of the Gods, which is standard legal but one of the top sideboard cards in modern. I have a few copies of Ashiok, which is standard legal but should also have a strong future as a casual card. Would you count these in both categories? The double counting seems fine as long as you are calculating percentages rather than dollar totals.

Thanks for the constructive feedback! In the future I will try to reference past articles summarizing my portfolio. For now, let’s establish the baseline with this article and reference this going forward.

As for specs, I mainly use my exit strategy to dictate what category a call falls under. So if we use Ashiok for an example, if you intend to sell him during Standard season because you expect the price to go up in the next year, then I’d count him as a Standard holding. If you are investing in Ashiok because you expect casual demand to boost the card’s price over the course of a couple years, then it would be more of a Casual holding.

In a similar way, I counted Thoughtseize as a Standard holding because I hope the card gets a bump once Standard rotates. On the other hand I counted Foil Thoughtseize as more of a Modern holding because I expect Modern (or Legacy) demand to drive price movement on the foil version. So really I base it all on my thesis.

Hope this helps, thanks for the comment!

Sig

Hello Sigmund!

I have been reading QS articles for two months or so now, and I have made my first sale. I love all that I am learning, but I was wondering if you could share how you sell your cards? I’ve been listing mine on MTG Salvation and was wondering if there are better sites to sell physical cards on. I am considering TCG player, but they take a hefty cut of the profit.

Is TCG player great and I am just dumb? Or is there another better place?

Thank you!

Chason,

This is a very tough question!!! I’m not sure if there is one solid way to sell cards. I’ve sold cards through eBay, Twitter, MOTL, Facebook, buy lists, events, word of mouth, and probably more. Really, it’s about getting the most you can out of your cards. Different cards may get better prices in one venue than another. I know I have sold cards on eBay before for more than I could buy them on Facebook (most recently with Mana Drain). So I try to maximize value wherever I can. eBay is usually the catch-all – I hate the fees, but sometimes it’s the only way to get a good price because that draws a LOT of buyers.

Personally I don’t use TCG Player. Nothing against the site, I just don’t feel like dealing with another selling platform. eBay works well for me and I LOVE being paid before I ship. Plus I can sell foreign cards, like the aforementioned Italian Mana Drains

Hope this helps! If you want more opinions, feel free to ask questions in the forums. I guaranteed you’ll hear 101 different selling strategies from our community! It really is a matter of what works best for you.

Sig

I’m surprised you count your personal collection as part of your portfolio. I don’t. Means I’m playing with ‘house money’.

My end goal is to pay for my son’s college education. I’ll always have Magic Cards, but nothing of value is sacred forever. I like to joke that if Jaya Ballard ever reaches like $2 or $3 on buy lists I’m shipping all of mine and buying a Mox. I get enjoyment out of certain cards, but often times I would just rather have the cash if it will help me get to my final goals.

Fortunately, foil Little Girl, Eureka, Shahrazad, City in a Bottle, etc. won’t be going down in price any time soon. So I can enjoy these for as long as I’d like. My son is only 2 1/2, after all :).