Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

This week I wanted to touch on two separate topics – a two-for-one of sorts. The reason itself is twofold. There are two ideas that simultaneously popped into my head when I sat down to write this article, yet neither really merited their own piece.

The fact of the matter is today is Halloween and I’ll be very busy throughout the day with family activities. Then tomorrow I board a plane to Brussels, Belgium for a business trip. I find myself sitting at a car dealership this morning, waiting for my car to be repaired – it’s the optimal time to write my weekly article.

Because I don’t have more results to tap into from this past weekend, as the tournaments have not yet occurred, these two topics will combine into a full article quite nicely.

Without further adieu, here we go.

Standard Trend Continuation?

Last week I went out on a limb and identified negative trends in many Standard staples. Despite fears of ridicule, I posted the data and my supporting theories for this observation. As it turns out, a number of Insiders also shared my concern. The comments in that article were surprisingly supportive, and for this I want to thank the community.

What I want to re-emphasize this week is that the trend, which could have been prematurely called a “trend” last week, is now solidifying. In other words, what started off as a small pullback after rapid over-extension appears to be a true downward trajectory. Take Courser of Kruphix as a prime example and note the continuation of last week’s decline into this week.

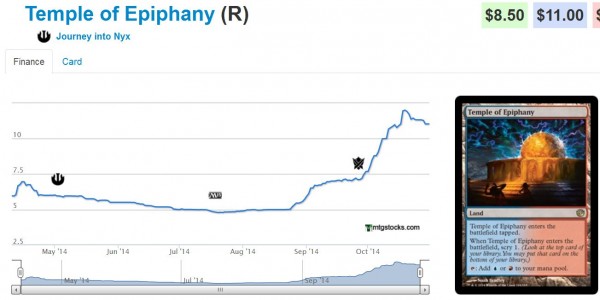

If anything, this chart indicates to me an acceleration of negative price momentum. You may argue that Courser-based decks aren’t the best metagame choice at the moment. My counter to that would be to examine an even more compelling example, Temple of Epiphany.

No one can argue the strength of Jeskai decks running Mantis Rider and the like. Yet even this crucial mana-fixing land from a small set has shown a breakdown in price over the last couple weeks.

This data is truly concerning to me because I did not expect support for Standard prices to deteriorate so soon after rotation. Yet one commenter called out a critical detail I had overlooked last week – the fact that we’re in the middle of a Sealed PTQ season.

Once we move into Standard PTQ season for Pro Tour Brussels (incidentally where I’m going tomorrow), demand for these staples should pick up, right? I’d have to imagine this is so, yet I never really identified Standard as a cyclical format reliant on seasons like Modern and the old Extended formats. Standard continues to be the most popular format, so shouldn’t demand for these cards – especially right after rotation – be sufficient to catalyze prices higher?

Apparently the answer is no. We had the initial spikes in many Standard cards as everyone flocked to their favorite decks and speculators bought in deeply. But now that the initial demand has been met, perhaps we are due for a quiet period heading into December. Perhaps this is the new reality – the more interconnected the MTG community is, the faster formats are “solved” and the faster card prices hit their new levels. It’s at least a theory I could believe.

One More Thing

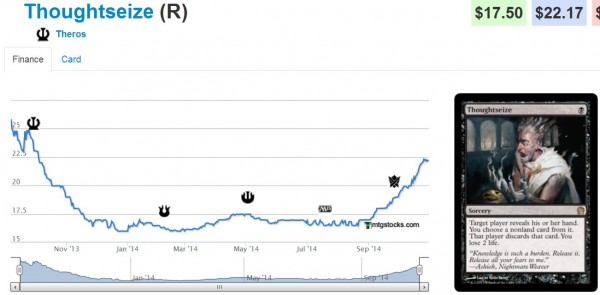

Theros Thoughtseize has barely budged over the past couple weeks. I thought perhaps it was just taking a brief breather before continuing its upward trend but the trajectory has truly leveled out.

Since last week, I have buy listed my copies to Star City Games for $17.50 each and proceeded to re-purchase six copies back for an average of roughly $16.50 each. If there’s one positive observation I’ve made on Thoughtseize, it’s this: buy it now listings for playsets on eBay have drifted slightly higher.

Perhaps my assessment last week was too bearish. I’m not going to call an all-out sell on Thoughtseize based on the data I’ve been gathering. What I will say is that Star City Games is providing you with an easy out on your copies, and you may get more from them than you would from eBay or TCG Player after fees.

While these could move higher, I don’t expect a significant jump in the next couple months. I’ll maintain a “neutral” rating, but encourage you to try and find copies for under $17.50 yourself so you can take advantage of SCG’s aggressive buy price. They now have about 50 copies in stock between NM and SP copies and there may come a time when they have “enough” copies and drop their buy price down. With all these copies in stock, it certainly feels more likely that they will drop their buy list price than raise it.

Speaking of Thoughtseize…

A little while back I was having a regular debate with Nick Becvar about Thoughtseize and the stock market. At one point he sent me a thought-provoking message that I have since dwelt upon extensively:

Seize [SIC] isn’t like a stock where it can suddenly just drop with bad earnings. Unless it’s reprinted (which is 99.9% unlikely) it won’t go down.

After pondering this statement for a bit, I’ve come to the conclusion that Nick is only partially correct. Thoughtseize isn’t like a stock in that it won’t suddenly drop with bad earnings. The discard spell is especially immune to variability because of its robustness in multiple formats. Essentially, Thoughtseize is your standard blue chip Magic Card. While it may have a relatively bad quarter, it doesn’t really disappoint to the magnitude where it would drop suddenly and drastically.

But metagame shifts aren’t so kind to more speculative cards. I remember a few years ago when the Titans were first introduced to Standard and the best performing Titan seemed to change weekly. At one point Frost Titan was all the rage and it traded for $20. Less than a month later people realized Grave Titan was the real “growth stock” and old Frosty dropped to single digits.

And if you think a reprint is needed in order to spark a sudden drop in price, you should really look at the price trends on stuff like Pearl Lake Ancient, Dig Through Time, and Aluren. Just like with stocks, people tend to get overly emotional about their buying and cause a card’s price to overshoot reality. It doesn’t take long for supply to catch up, driving the price down almost as rapidly as it went up.

Turning back to the card in question, I do believe Thoughtseize is fairly immune to sudden price fluctuations. But stating the card is not like a stock is perhaps only partially true. There are many similarities between the two if you look at the right comparison stock.

Consider a comparison between Thoughtseize and a blue chip company like Coca-Cola. Thoughtseize is performing exactly like a stalwart blue chip stock, churning out solid earnings quarter after quarter simply because it is popular in a diverse group of formats. Even reprinting has a parallel in the stock market – it’s an issue of new shares to raise additional capital!

Stalwarts definitely have a place in anyone’s diverse portfolio. Dual Lands are another prime example. But they’re not always going to provide explosive growth without major shifts in Magic’s structure (e.g. creation of a new format like Modern). Therefore they shouldn’t make up your entire portfolio because you’ll not really outperform the “market”.

That’s why I’m treating them like I’d treat any blue chip stock. I don’t expect a ton of growth, but when they do appreciate nicely I will trim back the position. It’s time to take some profits off the table and rotate them into other stalwarts which haven’t run up lately. In fact, Dual Lands are a perfect example right now, as they have pulled back from their highs quite a bit.

Rotating funds from one stalwart position to another is a common strategy of stock expert Peter Lynch. He describes this strategy in his book One Up On Wall Street. I’d highly recommend the book to any who have an interest in stock investing (just be aware that his examples can be a bit outdated).

Call me crazy, but I do treat my Magic Card positions as stocks and “trade” them accordingly. A card like Thoughtseize may not behave like some stocks, but I’d wager there’s a stock parallel for almost any Magic Card. And with this parallel in mind, I’d say it’s time to trim back on the Thoughtseize position in order to move into a different blue chip card with more room to run.

How’s that for overthinking an innocent text? I’m really curious to hear what the QS community thinks of this parallel. Please share your thoughts, positive or negative – especially if you do have exposure to both the MTG market and the stock market!

…

Sigbits

This week I want to highlight a few cards which are quite costly considering the amount of play they see, and which could be prone to severe price drops should they be reprinted. Holding copies of these cards may be unwise because upside may be limited while downside risk is quite significant.

- Star City Games has plenty of Damnation in stock, with NM pricing at $44.99. While we won’t see more textless promos get printed (these retail for $49.99), I wouldn’t be surprised to see the black Wrath of God reprinted eventually. I wouldn’t be looking to acquire more of these, let’s put it that way.

- I’ve talked multiple times in the past about Linvala, Keeper of Silence and she is bafflingly expensive. Angel collectors (such as myself) go ga-ga over the beautiful artwork. That, combined with her mythic rarity from Rise of the Eldrazi, drives her retail price up to $49.99. Once again, any sort of reprint and her price tanks. But as long as that doesn’t happen, this is casual gold (although not likely to rise higher in price…at least, not at an appreciable rate).

- A few months ago I eagerly buy listed my single copy of Fulminator Mage for $20. After acquiring the card for around a buck not too long ago, I was delighted to cash in. Now the card retails for $44.99 and I’m sure buy lists are higher than $20. Rares from Shadowmoor are quite difficult to track down, it turns out. But one reprint would surely take this Modern-only card down to earth in no time.

Maybe all the Standard cards just have Ebola …

LOL I just saw your article title. Look forward to reading it. I get the sense it will not differ in opinion based on the title.

I get the sense it will not differ in opinion based on the title.

Interesting article. It’s true that Standard prices are tanking seemingly quickly, making speccing on current standard cards much less reliant. Your thoughtseize example is a good reminder to keep some “old faithfulls” in our portfolios.

Hi Colt,

Thanks for the kind words! I know I kind of deviated a bit from my traditional article formulas, but I truly feel the way I indicated. To me, Magic Cards are like investments and they compete with real life stocks for my cash. Therefore it is perfectly reasonable for me to treat them as such. And when I have a blue chip stock rise rapidly, I know it’s time to trim back the position because upside in the short term is limited from here!

Old faithfuls of sorts should definitely be a part of anyone’s portfolio if they are looking to invest in Magic.

Based on the 5CC black wrath spoiled from Fate Reforged, I think it’s safe to say that we won’t see Damnation in the next set (and probably not the entire block). My guess is MM2 at the earliest, unless WotC decides to head back to 4CC wraths before then.

Justin,

It would appear you are correct. There was no Damnation in the new Commander deck (which was to my surprise) and I don’t see it in Standard for a while. So if you’re sitting on some copies, it won’t hurt you to hold. I just don’t know what upside remains in the near term at these price levels, you know? I think the money could give you better returns elsewhere, but if Damnation is your choice for a steady stalwart card, I don’t think you’ll lose out for a while.

The only problem I see there…is that what decks are playing Damnation in modern now? The only one I can think of is Gifts control and even then it’s a 1 of. If U/R Delver continues to increase as an overall % of the modern metagame I’d question how much damnation will really see play…I know they don’t play any truly hard counters currently…but just spell pierce and remand can slow your wrath effect down long enough to kill you….I actually think Damnation is an easy sell right now.

What’s your thoughts on portfolio and risk management techniques as a logical next step to MTG analysis? For example since there are already Indices that exist for Standard, Modern and Legacy staples, perhaps it could be possible to quantitatively evaluate cards in terms of their alphas, betas and correlations? It would probably suit more of a long term holding strategy for eternal staples.