Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Although I have little time for them, I do actually have a few other hobbies outside of Magic: The Gathering.

Most know by now that I’m an avid trader on the stock market. I also enjoy reading fantasy and science fiction novels, along with the occasional book on finance. I even have a keen interest in the life of Marie Antoinette, of all people.

It turns out I also enjoy the financial aspect of another collectible: coins.

My interest in numismatics began over two decades ago when my father gifted me the penny collection from his childhood. While there wasn’t much value in the wheaties dating back to 1909, I still found fascination that older U.S. coinage could carry special value due to their rarity. The obsolete denominations such as the twenty cent piece and three cent nickel continue to spark my interest, although I’ve never owned either.

The twenty cent piece had another characteristic that caught my eye. It, along with many coins from the 1800’s and two-thirds of the 1900’s, is made up of 90% silver.

As you can imagine, the silver (and gold) markets can have a profound impact on old coin values. While many older and/or rarer coins can have special value due to their lower minting numbers or rarer mint marks, the majority in existence will rise and fall in value along with the price of silver.

As it turns out, this makes for a rather volatile market.

What Do Silver and MTG Finance Have In Common?

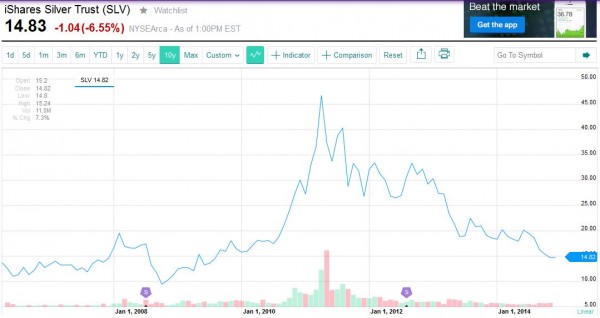

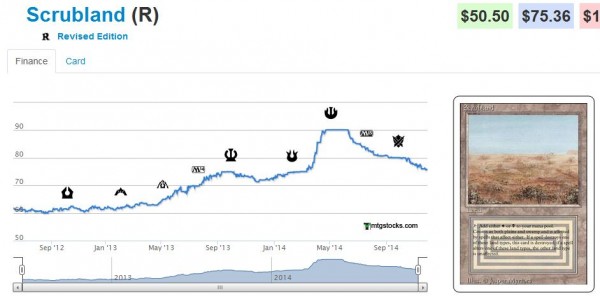

No, this isn’t the beginning of a riddle – it’s a legitimate question with an insightful answer. Allow me to reference a couple of price charts. After all, a picture speaks a thousand words.

I’ll admit these two charts don’t match up perfectly. On the Scrubland chart, x-axis is too narrow and the y-axis not steep enough to match the chart for silver (via the SLV externally traded fund) perfectly.

But the overall trend is very similar: gradual increase over time, followed by a sudden jump and ensuing drop-off. And while the Scrubland chart matched most closely to make my point, all of the dual lands and many other Legacy staples show similar behavior.

An Eerie Parallel

When I graduated high school and moved off to college, I was very light on funds. In a desperate attempt to raise cash, I made two very short-sighted decisions: I sold off my coin collection and almost every Magic card I owned worth over $3.

Yes, this meant my Force of Wills were shipped right along side my Flying Eagle Cent. The worst part of all was that I was so eager to make a buck that I sold these items very sub-optimally, leveraging garage sales and eBay auctions.

My stomach hurts even thinking about it.

Back in 2008, I had a lucky break--I regained interest in both MTG and coins. Fortunately for me, the Legacy boom was only starting and silver had plummeted to a major low.

My timing to get back into both of these hobbies could not have been much more perfect. But as dual land prices and silver prices started skyrocketing, I faced that same temptation all over again. It became difficult to justify holding so much money in cards and coins while pressures from raising a new child and buying a house loomed on the horizon.

Yet again I sold out. Only this time I did so in a much more informed way, leveraging multiple channels and doing thorough research to ensure I maxed out my value (while of course balancing the amount of time I would spend doing so).

Fast forward two years and we arrive in the present. Legacy prices have dropped and silver prices are approaching a five year low.

Here’s My Light Bulb

Over the past couple weeks I’ve bought a few incremental dual lands to increase my Legacy portfolio. I’ve illustrated my rationale in past articles, and the recent SCG announcement does not drastically impact my view. As duals drop in price, I am eager to acquire a few more to once again approach that lofty goal of owning the full set of 40.

This past Friday brought one of the largest single day drops in silver prices that I’ve seen in quite some time. It appears a pricing war between OPEC and US oil is underway, and this is applying tremendous pressure on commodities while buoying the strength of the US Dollar to new highs. On this news, I decided I’d once again dabble in the silver market by purchasing a few older silver coins. I love their historic look and feel, and with prices dropping so low, how could I resist?

When I got to the gold and coin shop I was disappointed to find that their stock in cull silver coins was near zero. In other words, their inventory was basically wiped out--either that or they aren’t interested in selling their inventory at such low prices.

In fact, this isn’t just an issue for local coin dealers. Even the U.S. Mint recently experienced a surge in demand for their Silver Eagles, causing temporary sell-outs: http://www.reuters.com/article/2014/11/05/usa-mint-silver-coins-idUSL1N0SV2RP20141105

The linked Reuters article is brief, but it highlights the main driver for this surge in demand: silver prices are tanking. In a standard supply and demand driven market, as prices drop, the supply also drops while demand rises.

Eventually stores will refuse to sell their inventory or they will sell out because prices will drop too low. The end result will see the “Invisible Hand” move the price to where it belongs, balancing out both supply and demand.

The sudden disappearance of silver coins from the market tells me we may be searching for a bottom. This is especially true for the coin market, where the currency carries slight premiums over their melt value simply due to their beauty and numismatic value.

The price of raw silver may drop further because of market shenanigans and hype, but I suspect that if the price goes down too much further, there will just be no one willing to sell their silver coins. To me, this is a sign that we are almost at the perfect time to start buying.

But in the case of dual lands and other Legacy staples, we simply aren’t there yet. Despite the lower prices, inventory of duals have soared. Star City Games, the world’s largest MTG retailer, has recently dropped their prices on duals., yet they have 77 Revised Scrublands in stock at the time of this writing. There are over 100 Tropical Islands! Even the most popular dual Land, Volcanic Island, is still plentiful (although still $299.99 for NM).

Conclusions

It may be a stretch, but I think this divergence between silver coin and dual land inventory suggests the former is seeking a bottom while the latter is still facing significant headwinds. As a result, I think I’m going to hold off on acquiring more duals and other Legacy staples at this time. I have no regrets picking up what I’ve got right now--I just don’t want to add exposure here.

Here’s the good news: remember one of the largest differences between the two price charts I linked earlier? The timeline on the x-axis of the silver chart was much longer than on the Scrubland chart. So while silver may be closer to bottoming in comparison to Legacy staples, it also may move on a much slower time scale.

This could mean another year of downward movement on silver before we truly hit bottom. Meanwhile, one piece of news or move by Star City Games and the dual land market could rebound in a matter of days. In fact, I still fully expect we’ll see another bump in dual land prices next spring.

This faster timeline gives me hope, but it’s also a wake-up call to speculators. Be ready for any sudden market movements. I think we’ll see a continued drift downward in dual land prices until we start to see retailers “sold out” of them.

But on a moment’s notice we could see the turnaround. When that happens, it’s best if you’ve already got a small holding on hand to take advantage of the inevitable hype that will follow.

...

Sigbits

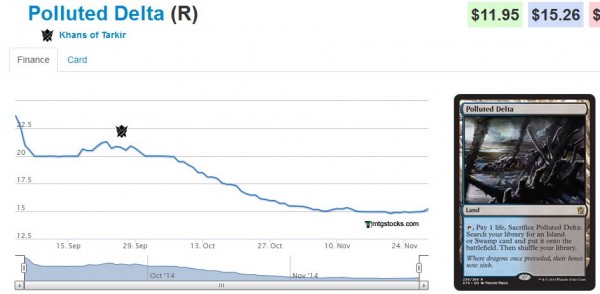

- Looking at their charts on mtgstocks.com, I believe Khans fetches are finally stabilizing. They seem to be moving more rapidly on Star City Games, and foil copies sell out often. Currently SCG is sold out of foil Polluted Delta with a price tag of $99.99.

- New Phyrexia common Gitaxian Probe is more popular than ever before thanks to synergies with Young Pyromancer and Monastery Swiftspear. As a result, SCG is sold out of nonfoil copies at $3.19. If you own many copies though, be careful. This is a prime prospect for reprint in Modern Masters 2.

- Did anybody else notice that SCG is sold out of regular Force of Wills at $109.99? When did that happen? I guess not all Legacy staples are behaving like silver prices right now. Could this be a foreshadowing of a pending recovery in the Legacy market? If so, then Wasteland didn’t get the memo: SCG has well over 200 total copies in stock across its various printings.

Very interesting comparison. I wish I could say I made as much money on the legacy boom as I did on the Silver boom in 2011-2012, but I hadn’t started playing magic at that point. As always Sig, great info. I may just have to go grab some silver bullion now.

Thanks for the kind words, desymond! I got very lucky with my timing. It was actually Ad Nauseum that sparked my interest in Legacy. When I read that card for the first time, I was so excited to try a deck running rituals, Chrome Mox, Mox Diamond, and then Tendrils for the win. I think my first build didn’t even run LED/Infernal Tutor. I read about those after I already built my version.

Of course, my version also had 4 Mystical Tutor. Then WOTC had to go and ban it. That was a sad day.

As for silver, I’m looking at prices rebound 5% today and am really mad at myself for not buying more!!! But today is an emotional type of day in markets. Let’s wait for some dust to settle before buying deeply.

As someone who doesn’t know much about the coin market what should I ask when I go into a coin shop? ‘I would like to see your 90% or better silver coins.’ ?

I usually ask – “Do you have any silver bullion or cull silver coins”. Bullion will be stuff like silver bars and silver coins made by 3rd party companies and they’re usually 99+% silver in content. Silver coins will be the 90% stuff – quarters, dimes, and half dollars from 1964 and earlier. Peace and Morgan Dollars. I like to get a little of both. The bullion will be the cheapest (in terms of how much premium you pay vs. the spot price of silver). The cull coins will carry small numismatic value, which means you pay more up front but should the silver market completely collapse, they’ll still have some value to collectors as coins. 🙂

Hope this helps! Thanks for reading!