Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

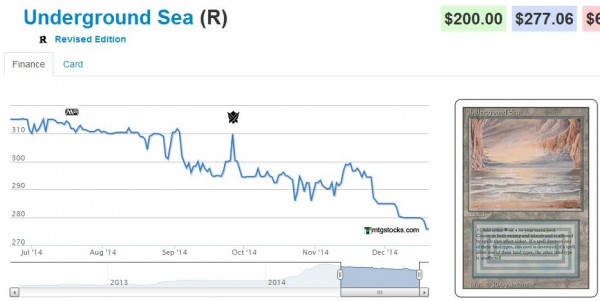

Over the last few months I’ve commented many times on the apparent decline in Legacy prices. All Dual Lands have taken their hits on the chin, and other staples like Wasteland, Lion's Eye Diamond and Sneak Attack have all fallen off their highs.

Now players are beginning to get concerned because their valuable collections are depreciating at a time when Legacy broadcasting (via SCG Opens) is getting cut drastically. In 2015, we’ll only be able to watch quality Legacy play a few times throughout the year, compared with almost weekly in the current Standard/Legacy Saturday/Sunday format.

One could make a case that Legacy is hurting. But it isn’t.

I firmly believe the format is healthy. Don’t get me wrong, I absolutely hate Treasure Cruise in Legacy as much as the next guy, but the format tends to evolve over time as new cards are printed, keeping it dynamic and “fresh” despite an aging card pool.

I used to complain that Legacy was no longer as enjoyable as it used to be after Wizards printed all these newfangled cards such as Jace, the Mind Sculptor and Stoneforge Mystic. Now, only a few years later, these cards are as familiar to me as Force of Will. And now I look at Young Pyromancer as the “uncool” new card people play.

This evolutionary nature makes Legacy an amazing format, and I don’t think a lack of spectator events on the internet is going to change players’ dedication to it.

An Alternate Thesis

“Alright”, you say, “If the format is healthy then why the heck are my cards dropping in price like this?”

There are a number of factors at play here. The metagame is evolving and U/R strategies happen to be “in” right now. We’re also seeing typical seasonal sell-offs characteristic of this time of year. The previous high on cards like Underground Sea may have also been driven a bit too artificially by sudden price changes at Star City Games. One could argue now that the Invisible Hand is now at work trying to find the right price.

I’ve got a different theory.

Silver and Gold

A couple weeks ago I made a comparison between silver prices and Legacy prices. Both had shown a downward trajectory, and I tried to use anecdotal experiences with purchasing silver to call where the bottom might occur on Legacy staples.

The problem with that article was that it wasn’t really data-based beyond some qualitative comparisons. There were many holes in the argument.

In reality, I firmly believe there is a correlation between precious metal prices and Legacy card prices. But the two don’t interact directly.

The REAL culprit responsible for this downward trend is the US Dollar.

Due to macroeconomic trends, the US Dollar is exceptionally strong right now. Each month we are hitting new highs against currencies like the Euro and the Yen.

What does this have to do with silver and Magic Card pricing? Everything.

Silver and Magic Cards alike are akin to commodities. Complain all you want about the cost of entry into Legacy, but, in reality, there are an abundance of cards available – enough that they are largely interchangeable. (Granted, condition is a factor so NM cards may not apply here, but for the sake of argument, let’s assume generally “played” cards are mostly interchangeable).

If we accept the assumption that Magic Cards, like silver, are commodities, then we must recognize their prices can be readily influenced by the power of the dollar. The stronger the demand for the US Dollar, the cheaper these cards can become.

Demand out of non-US countries will in turn decrease because players won’t want to pay the unfavorable exchange rate. We used to see Dual Lands and Power flow from west to east as players in Europe took advantage of a strong Euro. Now that trend is significantly reduced as the currency exchange rate no longer favors those overseas.

And it’s not just Magic Cards and silver taking a hit. We’re seeing overall deflationary trends across the board. Check out the most recent Consumer Price Index (CPI), a measure issued by the Bureau of Labor Statistics that quantifies how prices are shifting over a time period.

When you do not include seasonable changes, the CPI reading for November 2014 was -0.5%. Subtract food and energy and you get -0.1%. So while oil prices are the likely driver for lower consumer costs, there’s still an overall impact of the strengthening dollar.

Now, don’t get me wrong – I know this value fluctuates a bit rapidly and one cannot always trust it blindly. Other than gas prices (and Magic Card prices), I’m not seeing a whole lot of price reductions, are you? Still, my point is that Magic Cards are not unique – they’re getting caught up in a macroeconomic trend that stretches far beyond a trading card game.

Standard Corollary and Vintage Exemption

Before I close, I want to address two other recent trends in MTG pricing.

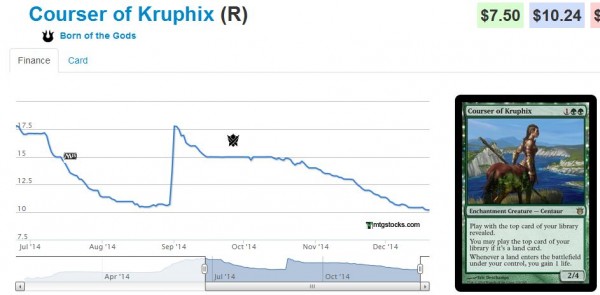

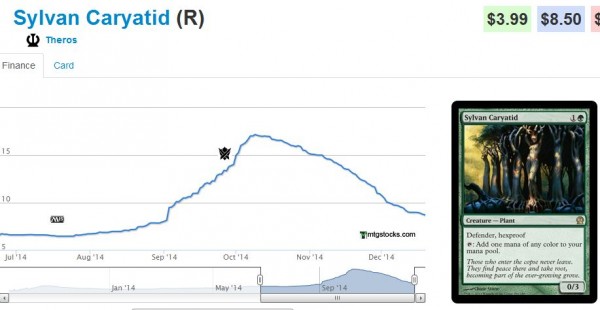

First, I want to demonstrate the consistency of my argument above with Standard Magic Card pricing trends. Notice how Standard cards have been on the receiving end of some of the worst price depreciation we’ve seen in a while now (outside of general format rotation trends).

We’re going to have cards like Courser of Kruphix in Standard for a while, so it’s not like it’s about to rotate out of relevance. Yet that price still drops.

If we’re truly seeing currency effects on Magic Card prices, then the more commoditized a given card is, the more impacted it will be.

Sure enough, that’s exactly what we’re observing. I would argue that Standard cards are the most commoditized because they’re even more interchangeable than Legacy cards. Since they’re so much newer, condition is usually not a concern and the price difference between SP copies and NM copies is virtually negligible to most players.

Therefore, one would expect Standard card prices to take the largest hit as the US Dollar increases in value. When you inspect charts like that of Sylvan Caryatid, you have all the data you need.

The second argument I want to make that further strengthens my thesis uses the recent price trends on Power. Recall that Star City Games recently jacked up their pricing on all Power.

If Magic Cards were truly influenced by currency effects, why are Moxen exempted? Shouldn’t there also be less demand out of Europe, driving prices lower?

Yes and no. You will probably see an emerging trend of European players selling Power more than buying Power. But the key factor at play with Power is the fact that they aren’t commoditized.

These cards are so rare that they will be less impacted by currency trends. If things get out of hand, surely even Black Lotus can’t stay immune forever. But because Power is more of a collectible item and less a commodity like silver, gold, or Standard cards, the end result is a more robustly stabilized market.

Because Power prices have gone up through the last few months, I’d argue that my thesis around currency effects is even stronger.

Next Steps

For those who follow economic trends, you are also likely aware that the current interest rate environment is a bit extreme. Rates are currently very low – this usually leads to a risk of rapid inflation or a decline in the US Dollar’s value. But with the economic struggles in foreign countries, combined with the sudden decline in oil prices, we are not seeing the inflationary trend many predicted… yet.

Things can’t stay like this forever. Interest rates are so close to zero that, unless they go negative, they really can’t get much lower. Eventually the feds will print so much currency that inflation will become inevitable. When that happens, we’ll see the value of our collections bounce back again.

For this reason, I’m still bullish on Legacy and Dual Land prices.

These cards can and will go higher in price over time. When the economic picture shifts, we’ll see that rebound. As long as Legacy remains a desirable format and Magic as a whole grows in popularity, the previous upward trend will return. It may take months or even more than a year, but I’m confident these investments are safe.

Of course, it’s your money and your risk to take. But I’m content to sit on my modest collection of Dual Lands (well short of a full set of 40) and wait this trend out. I may even diversify by picking up some more silver along the way.

…

Sigbits

Usually I identify cards that are out of stock and going higher, but, in theme with this weeks’ article, I thought I’d point out some cards facing significant headwinds of late.

- I’ve mentioned Wasteland in the past for it’s excess supply at Star City Games. This week is no exception. In fact, the picture for the Nonbasic land looks even worse when you consider it’s currently marked down to $89.99-$71.99 for NM and MP copies respectively, yet there are 174 normal copies in stock!

- Sneak Attack and Show and Tell strategies have really fallen out of favor lately. The result: even more downward pressure on these cards’ values. Now Star City Games has 79 regular copies of Show and Tell in stock, with NM copies priced at $64.55. I don’t expect these to recover in the near term, and I would discourage any contrarianism on these cards.

- I LOOOOOOVE this one: remember those Thoughtseize I told everyone to get rid of by selling to Star City Games for $17.50 a couple weeks ago? Well, looks like they’re taking a bit of a loss on them. They still have 23 copies in stock despite marking them down to $16.82 during their December sale! I’ve made plenty of erroneous speculative calls (Scavenging Ooze, some of these Theros Temples), but this correct call is one I am very proud of.

Amazing and insane article. Loved this one!

Thanks, Doug! I REALLY enjoyed writing this one, and I actually think I’m onto something here. This isn’t just filler, either. I honestly think there is a legitimate correlation here. And I love incorporating “RL Finance” into my articles when I can!

Legacy always depreciates in November and December. I remember this happening last year and the year before as well. I believe it happens with standard cards as well around the holidays.

Yeah, true. But if you look, a lot of cards began their decline a bit earlier this year. Underground Sea appears to have peaked in August, and drifted downward throughout all of the fall. What really surprised me was the Standard charts. I know the PTQ season wasn’t Standard, but I was shocked to see Standard all-stars plummet in price despite being very strong post-rotation. Sylvan Caryatid is everywhere in Standard, yet the price has done nothing but drop since late October.

You’re absolutely right in pointing out the seasonality – I’m merely presenting another possible factor. 🙂

Europe is not the only place you need to look for the trends, Asia is a HUGE player in the market, particularly when it comes to Legacy/Vintage

Great build! Appreciate the comment – I want to say the USD is very strong vs. the Yen historically speaking as well. Japan has been struggling a bit lately. So this could compound the effect.

While I agree that magic cards are very much like commodities, it seems like a very large leap to attribute much of this year’s price movements to currency market movements. Magic card demand is more than fairly independent of FX change, not least because the vast majority of magic card demand is domestic.

Moreover it is not at all clear that global gold and silver price movements have a causal relationship to dollar strength, but that’s more of an ideological debate.

Following your commodity point, commodities often become very much dislocated from currency valuation movements due to “real market” factors. Correlation coefficients to the dollar vary and can seem ludicrously unimportant when, say, drought strikes grain or Saudi Arabia decides to stop defending $100/bbl crude. While it’s certainly worthwhile to be aware of the currency markets I’d say the fundamental drivers of a given magic card’s value are found far from the FX desks in New York and reside in Renton.

Charles,

I really appreciate your thoughtful rebuttal. By no means do I think I’ve solved the equation. The relationship just seemed a bit coincidental to me is all. With the Magic Card market there are so many factors: metagame shifts, tournament support, new set success, etc. etc. To think that currency FX could be a large factor would be way too short-sighted.

I hear a lot about how strong the Vintage scene is in Europe. Part of the reason Vintage was so popular in Europe could be related to the strength in the Euro. As you pointed out, the domestic market is fairly large. Perhaps players overseas took advantage of their stronger currencies to acquire Power and Duals at a cheaper price. I’d be curious to learn if there’s been a reversal in this trend, where cards like Moxen and Duals are more likely to go in the opposite direction. Even a small increase in supply from Europe could be enough to move prices measurably.

Alas, there are too many interfering factors to say for certain. I merely noticed the correlation and wondered if there was something to it via this article. Naturally there is no 100% right or wrong answer, and I always encourage dialogue in the comments section of my articles :).

Thanks again!