Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the first MTGO Market Report as compiled by Sylvain Lehoux and Matthew Lewis.

The report is loosely broken down into two perspectives. A broader perspective will be written by Matthew and will focus on recent trends in set prices, taking into account how paper prices and MTGO prices interact. Sylvain will take a closer look at particular opportunities based on various factors such as (but not limited to) set releases, flashback drafts and banned/restricted announcements. There will be some overlap between the two sections.

As always, speculators should take into account their own budget, risk tolerance and current portfolio before taking on any recommended positions.

Redemption

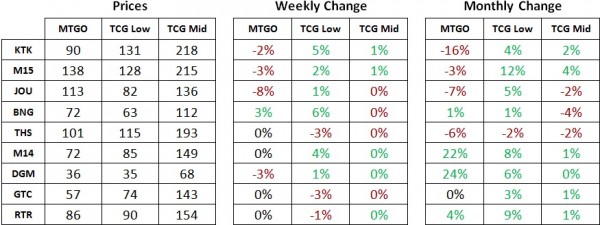

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of January 12th, 2015. The MTGO prices reflect the set sell price scraped from the Supernova Bots website, while the TCG Low and TCG Mid prices are the sum of each set’s individual card prices on TCG Player, either the low price or the mid-price respectively.

Return to Ravnica Block and M14

Starting from the recently rotated sets, TCG prices have bottomed in the last month and have turned upwards. This shift will provide price support for MTGO sets as price increases feedback through redemption to the online market. RTR, GTC, and M14 remain the picks to consider, with DGM continuing to be one of the least redeemable sets ever.

RTR and GTC both have the shock lands in the rare slot supporting set prices. With the recent announcement of Modern Masters 2015, interest in the Modern format is going to get a boost in the spring. The shock lands are safe from reprint this time around, so expect TCG prices to continue to climb in the next six months for these sets. This will support further price increases on the mythic rares from RTR and GTC.

Although the best buying opportunity on these sets has past, buying the bottom end of the market is a low-risk bet while they are still redeemable. More specifically, keep your eyes on Enter the Infinite from GTC. This card is one Travis Woo deck away from heading back to 6+ tix, as the recent attention he gave to Jace, Architect of Thought has shown.

Domri Rade is also one to consider as an out-of-favor, but Modern-playable, card. With the upcoming banned and restricted list announcement, the possibility of a format shake up is imminent. In this light, also consider Sphinx's Revelation from RTR. A Treasure Cruise ban in Modern would promote this gold instant as an option for card draw in the format. It’s probably been under-utilized since KTK was released, so it will be a card to keep an eye on in Modern.

Lastly, Deathpact Angel is the cheapest of the GTC mythic rares and is underpriced relative to other junk mythic rares from GTC and RTR. If you are looking to get your feet wet with speculating on redeemable mythic rares, this is a fine card to start with at under 0.90 tix.

DGM and M14 are sets to avoid buying. Small sets with very few playable rares get no price support from redemption, so that’s a big strike against DGM. As for M14, it’s already risen substantially in the past few months and further upside is difficult to see at this point. Both sets would suffer if Birthing Pod is banned in Modern, so consider selling Voice of Resurgence and Archangel of Thune in the next few days if you are holding any copies.

Theros Block and M15

As for Standard-legal sets, M15, JOU and BNG are all priced at a premium compared to TCG Low. This means there will be no price support from redemption for these sets and that they are probably near their price peak.

THS has some value as a larger set, but is also the most plentiful in terms of supply on MTGO. Generally, the time to speculate on these sets is past, though something like Xenagos, the Reveler could see a metagame shift price increase after Fate Reforged is released.

Khans of Tarkir

KTK is one of the most redeemable sets in memory, with the allied fetch lands providing a ton of value. The time to buy mythic rares from this set will be during online release events for Fate Reforged. Make sure you have some tix set aside to stock up on this set.

In particular, a card like Siege Rhino should continue to be Standard-playable for the next year, and has shown itself to be Modern-playable as well. Going deep on this card as a long-term hold is a very defensible strategy.

Targeted Speculative Buying Opportunities

Standard

As suggested above, few Standard cards have a speculative interest right now. Here are the targets for this week.

Xenagos, the Reveler

Anafenza, the Foremost

Siege Rhino

Dig Through Time

With anything in Standard you should be happy with a 50% profit, 100% being a great result with cards already priced over 2 Tix for rares and over 6 Tix for mythics. These investments can pay off quickly, if you are not too greedy.

Modern

This week, most of the buying opportunities are related to Modern. This format is traditionally the place to find profitable cyclical investments; prices tend to fluctuate with the ebb and flow of interest in the format. This week also marks the end of a second wave of MMA flashback drafts since the start of December. As a result, almost all MMA Modern staples are at their lowest price for the past eight to twelve months.

The current opportunity on these cards is big. It’s not just one or two cards we are talking about, but dozens and dozens of cards that are worth investing in now. With such a variety of cards to speculate on, it makes it easy to build a diversified basket of positions for all sizes of bankroll.

Finally, the upcoming Modern Pro Tour in February could be the ideal occasion to sell many of these cards for a fast profit. Pro Tours often trigger strong interest in the featured constructed format, so it’s the perfect time to build a portfolio with a chance at short-term profits.

If pretty much all MMA Modern-playable cards are expected to rise, some have more speculative potential than others. Recent metagame shifts made some positions riskier despite a very attractive price considering their price history. Cards such as Dark Confidant, Vendilion Clique and Kiki-Jiki, Mirror Breaker are among them.

Here is our selection of MMA and other Modern positions to consider. Make sure to invest in those making sense for your bankroll and portfolio strategy.

Cryptic Command

Blood Moon

Thrun, the Last Troll

Engineered Explosives

Sword of Light and Shadow

Pact of Negation

Arcbound Ravager

Ranger of Eos

Life from the Loam

Path to Exile

Aether Vial

Gifts Ungiven

Slaughter Pact

Summoner's Pact

Glimmervoid

Kataki, War's Wage

Kira, Great Glass-Spinner

Maelstrom Pulse

Glen Elendra Archmage

Kitchen Finks

Lightning Helix

Skullcrack

Spell Snare

Manamorphose

Tooth and Nail

Figure of Destiny

Eternal Witness

Ethersworn Canonist

The time frame for these specs is in the matter of weeks or a couple of months, with a 50% to 200% target profit depending on the position. As further information on MMA 2015 is revealed, you will want to regularly review your Modern portfolio due to reprint risk.

I like this kind of articles. They are worth the money!

Good job, and great insights!

Thank you! We are going to be rolling these out on a weekly basis. I feel there’s always something to talk about in the market, but their might not be great opportunities every week. I think it will be a good guide for any QS member who is interested in speculating on mtgo.

Great read, as usual. Do these and MTGO investments in general translate well to “real” cards?

There’s very little correlation between investments you can made on MTGO and on Mtg paper.

Market dynamics, events, and prices are mostly different between the two worlds.

I can’t believe you still use supernova to calculate mtgo prices… Supernova was a topplayer several years ago, but now they are lightyears behind.

For m15 for example they have 10 cards out of stock. Their buyprice for perilous vault is 11.5 ! How can you use numbers like this and get a decent result ?

Using supernova only because they have those easy lists to get into your sheets is making your numbers unthrustworthy in my opinion. Of course it’s more work to get them elsewhere, but at least you will have the correct numbers.

Besides from that, great article ! Don’t take this as I’m not happy with it, just not with that part.

Out of comparison, here are goat’s total set prices vs nova’s vs mtgotraders from today, note, goat and nova don’t include commons and uncommons for some of the older sets, while I’m assuming mtgotraders does.

KTK: 88 vs 91 vs 95

M15: 130 vs 138 vs 157

JOU: 102 vs 109 vs 134

BNG: 67 vs 69 vs 78

THS: 101 vs 103 vs 112

M14: 70.5 vs 73 vs 85

DGM: 38 vs 35 vs 40

GTC: 57 vs 58 vs 64

RTR: 94 vs 87 vs 90

Which of these is the ‘correct’ price? I think it’s debatable and each has their own bias. I think it’s ‘ok’ to use biased data, as long as the bias is understood. The bias for supernova is that they are slow to update prices on individual cards, which means that on individual cards their prices are lagged relative to the market. But it still seems their set prices are ‘reasonable’. I’m going to continue to use supernova prices as long as they are available.

Thanks for reading and commenting, I appreciate the constructive criticism. If I can figure out a way to scrape set prices from goat, mtgolibrary or mtgotraders, it’s never a bad idea to have more data at your finger tips, but I won’t be doing it manually, which I what did today for the above numbers.

I understand you, my concern is this : with goatbots you can be fairly sure that the cards they are out of stock for still have the ‘correct’ buyprice; with supernova, most of the times that is not true.

Thanks for answering.

one of the best article ever!!

no brainer for me to follow these suggestions

I love this Market Watch report you and Matt are offering, but missed the last one. Is there anyone to sign up for an e-mail or is there a schedule when these are released?