Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

In the past, writers have explored the impact of technology on MTG Finance. The old timers reminisce of times when buying, selling, and trading was based off of a magazine and a few friends. If you were lucky, the store owner at your local hobby shop would not be opposed to your calling once a week asking the price for a particular card.

The most recent technological advancements have also created efficiency when trading cards – one that did not exist eighteen years ago when I made my first trade.

In the past, you truly were responsible for knowing values of cards. Otherwise, the prevailing mindset was of a Wild West flavor: “Trade at your own risk”.

Nowadays, the approach is completely different. One can know the value of exactly zero of their cards, yet make a perfectly valued trade every single time. Of course I’m referring to the use of smart phones to facilitate fair trades.

But some players have questioned whether or not the influence of perfect information is a positive one. They cite instances of failed trades due to a trade imbalance totaling under a buck despite an overall trade value of hundreds of dollars. Veterans also dislike the time delay caused by looking up the value of every card, and they long for the times when two cards could be “close enough” in value to imply a snap judgment decision.

At the risk of inciting controversy, this week I want to share my perspective on the benefits of having perfect information, and why I would never leave home without it.

A Couple Metaphors

Picture this: you’re at the grocery store buying food for the week, and you notice at the end of the order that the bread you purchased rang up for $1.50 when you know it was on sale for $1.00. How do you react?

If it were me, I’d say something. Regardless of the total cost of my shopping trip, I have no desire to overpay on something. To me, it wouldn’t matter if I was already committing $100 on this particular shopping trip – fifty cents is fifty cents, and I sure know I’d rather have the money than give it to the greedy corporation that is the grocery store chain.

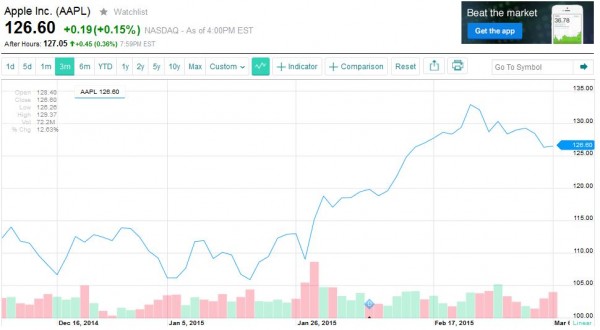

Here’s another scenario, which strikes a little closer to home. Let’s say you’re interested in buying ten shares of Apple stock. The stock closed at $126.60 last Friday.

Adding in a nominal brokerage fee (let’s assume $7) your total cost would be $1273.00 for those ten shares. You decide the stock is likely to go higher after completing your analysis so you pull the trigger. You place a limit order with your broker so you can dictate the price you pay, but since you’re eager to buy, you simply use the market price of $126.60.

Moments later the shares appear in your account. However, much to your dismay, you see that your broker charged you $126.65 per share instead of your requested price of $126.60. They took $0.50 from you which you did not authorize. How would you feel?

Moving Back To MTG Finance

Both of the scenarios above would really rub me the wrong way. In fact, I am never ashamed of calling a grocery store out on what I believe is a mispriced item… when it’s in my favor, of course. And if my broker charged me fifty cents more than I authorized for a given stock, you’d better believe I’d be on the phone within minutes demanding an explanation.

In both cases, I’m paying the grocery store and my broker more than enough to stay in business, so I don’t need to justify giving them even more money out of laziness. If they truly need to charge that extra fifty cents, they should advertise such.

For me, the same attitudes translate perfect to trading Magic cards. By looking up cards on the internet, we can compare current, accurate values for every card involved in a trade. Afraid something is in the middle of a buyout, such as Foil Teferi's Response? Don’t worry about it, TCG Mid valuations have you covered.

Unsure how much your Karn Liberated has already dropped in price after the MMA 2015 reprint announcement? No need to speculate, the live value is already available to you.

In short, there’s no reason to mis-value a card when trading.

A consequence of this perfect information is the motivation to ensure trades are valued precisely evenly. It is my nature to extract every bit of value I am entitled to, within reason. If my trade partner is rounding values to the nearest quarter, then I’ll make sure a $2.72 card is valued at $2.75 in our trade. If they are rounding to the nearest dollar, you better believe I’d make sure my cards aren’t being rounded down while theirs is being rounded up. All I ask for is equality and fair pricing.

After the dust settles and all involved cards are pulled out of binders, the tallying begins. If my trade partner’s pile comes up fifty cents short and we’d been rounding to the nearest quarter the entire time, I will feel entitled to finding that extra fifty cents. Now if my opponent’s trade binder only contained $20+ cards, this wouldn’t be possible and I’d likely move on. But chances are the guy’s got at least some random cards thrown into the binder for just such occasions – I know I do!

So what if I ask for that extra $0.50? After looking up every single card, we would know for a fact that I’d be entitled to this remaining credit. I would never have a qualm about my trade partner asking for his $0.50 should my pile be the short one. Just like at the grocery store or with my stock broker, I am not okay with giving away free money when it takes just thirty seconds longer to find a Curse of the Swine to bring a trade closer to even.

I don’t fight over pennies, of course. But if my trade partner’s been rounding to a quarter the entire time, I’m going to ensure the quarters balance out. If they’ve been rounding to the nearest buck, I’ll make sure I get that last buck I’m entitled to. If my trade partner is frustrated by this tedium, then I’m fine letting them sacrifice the fifty cents to get a trade over with. Personally, I think trading is fun and I enjoy getting to know other players. So dragging the trade out an extra minute to match up values perfectly is something I’d enjoy.

Perhaps the biggest benefit is the chance to get those speculative throw-ins you’re on the hunt for without having to spend cash and pay for shipping. It’s annoying to have to purchase a couple copies of a $0.25 card for speculation – you need to make sure you can justify paying shipping, you need to make sure your purchase price is at least $1 (on TCG Player), etc. etc. It’s a nuisance to try and optimize these tiny purchases.

Getting the chance to grab an extra Swan Song or Merieke Ri Berit as throw-in is well worth the extra minute of trading, though. And, again, I am perfectly understanding when the shoes are reversed.

Wrapping It Up

The intent of this article is neither to be preachy nor to come off overly defensive. Though, now that it’s finished, I realize I feel a bit more strongly about the issue than I initially thought. I merely believe in paying market prices for cards and not overpaying unnecessarily.

Of course, there are exceptions to everything and I don’t view this issue as black and white as this article reads. If I’m trading with friends, or I really need to push a trade through quickly, or the imbalance in trade value is less than 1% of the total trade value, I’m more inclined to just let it go.

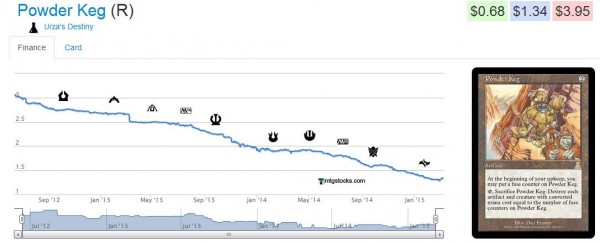

But there are two reasons I try to avoid this when possible. First, I see no reason to give another player free money. My goal is to save for my son’s college education here, and I won’t get there faster by giving $0.50 to every trade partner. And second, I often enjoy trading the small cards as a way to speculate on those lottery tickets without committing cash. What better way to grab extra Tiny Leaders speculation like Powder Keg or pick up terrific buy-list fodder such as Daghatar the Adamant, or even just getting more bulk rares to use in a casual bulk rare draft?

Whatever your motivation is, all I ask is that you have patience with traders like me who are trying not to lose value.

Even a small hit, added up over many occurrences, can lead to significant losses. Losing $0.50 when buying a stock once could be excusable, but doing so a dozen times really becomes prohibitive in my book. And a grocery store that repeatedly overcharges me incorrectly would rapidly become my ex-grocery store.

Naturally, I treat my MTG investments the same way - we're dealing with money, after all, and with perfect information gifted to us by technology I see no reason to give handouts on a frequent basis. There are always exceptions, and I'm not opposed to helping people out here and there - especially new players and friends. But experienced sharks with binders full of Duals and Goyfs won't get freebies from me if I can help it.

…

Sigbits

- Is it just me, or is Engineered Explosives really good in Tiny Leaders? I grabbed a couple to use, and I just noticed SCG is completely sold out of nonfoil copies. Fifth Dawn is out of stock at $8.39 and Modern Masters is out at $8.45.

- Star City Games is also out of a few of the unique Tiny Leader generals, and if this format continues to gain traction, we can expect big price bumps. My two favorite targets are Sygg, River Cutthroat, sold out at $5.79, and Tetsuo Umezawa, SP copies at $44.99. While it’s worth noting that SCG hasn’t moved a copy of Tetsuo at the higher price yet, the fact that he’s on the Reserved List makes me confident that price isn’t dropping as long as Tiny Leaders remains a “thing”.

- Here’s a random one for you. Did you know Scroll Rack is a $20 card now? This, despite being reprinted in Commander’s Arsenal. Star City Games is sold out of the original printing at $21.19. Wow!

You sound like a lovely person to trade with

Hahahahahaha. I’ve always been difficult to trade with I’ll admit. Though I’ve come a long way believe it or not.

It’s funny because I love the concept but often lack confidence to make good trades. But now with smart phones and instant price lookups, I’ve become more mechanical about the process. If values match up, the trade is good with me. And I always let my partner dictate how pricing is looked up – they can choose whatever resource they’d like as long as it’s consistent.

You do realize they can abuse that when they know you’ll let them choose the price source?

Let’s say I would have wanted to abuse this for our Mox deal:

– Hey, the cheapest HP Jet on TCG Player is being offered by Channel Fireball.

– Is CFB likely to be the cheapest on many things?

– Would you mind if we used CFB as our source for all prices?

– Profit.

The cheapest Jet was in fact CFB’s, I could’ve certainly made use of this had I wanted to. You also were not watching along on the laptop, so I could’ve easily valued my cards a bit higher than they were. Now I would do neither and I believe I treated you quite fairly on that deal, as I think you would agree.

… but you do give people the opportunity to set things up this way.

(I should have finished that last sentence, lol).

The one time I let someone use a price source I was not very familiar with I got taken in the way described.

You know I would have rolled my eyes at you at this point. I definitely would WANT to know how my trade partner is valuing cards up front. If they say SCG, then I would look for cards I believe SCG had priced fairly (or for cards they were sold out of, with possibility of a price bump). No matter the price source, I’d make sure the numbers sounded reasonable in my head. I wouldn’t trust things blindly, and sometimes a price surprises me and I just put the card back. I believe I did that to you a couple times. No harm in it. Some things are just not worth as much to me as they are to others.

It remains something that could be abused even if you might notice more quickly than most.

I agree with every statement in your article by themselves, but I think the premise is wrong. You assume there is a price source that will let you avoid all mis-valuation and based on this you recommend an approach to trading. Unfortunately there are hundreds of different price sources you could be using and quite a few that are commonly used (SCG, BLP, Ebay, MCM, TCG Player, etc.). Each price source has its disadvantages, for example for each one just mentioned:

– SCG: cheap cards are valued relatively high, high prices in general

– BLP: no idea what the card looked like or whether there was an outlier

– Ebay: hgher / lower rating, are they getting what they are asking? If looking at completed listings: see BLP, but with less history and a better idea of condition. Many factors could influence a card ending higher or lower than normal and some cards will only rarely be offered.

– MCM: race to the bottom: cheap cards are valued very low, this leads to an imbalance in values when trading up or down. Cheap sellers often offer poor service/grading so in reality people don’t buy from them unless they don’t care for that.

– TCG Player: race to the bottom, leading to the same imbalance, sometimes poor grading

I prefer to look at TCG Player (low) out of these, with my location enabled, which weeds out the absolute cheapest sellers in most cases. I certainly will look at the actual data before deciding to use a price: if few copies are available the price might not be reliable. If the price source only shows asking prices they may not sell at that price. One source’s NM is not the same as another source’s NM. There may be outliers (everybody knows about crazy high asking prices pushing up the TCG Player average). There are way too many variables so even when consistently using 1 source you might end up with a very skewed deal.

If people want to look up card prices they are free to do so, I do too when I am uncertain, but if they believe in the fable of the perfect price source I will be happy to explain why I feel their source is less than perfect and why I do not really care for trying to line everything up perfectly according to that source. If they feel they must they can put in all the effort and if it doesn’t look right to me I will have no problem with rejecting it. If they are reasonable and just want to check a few things to get a feeling of how things balance out I am perfectly fine with that.

I did not think Sigmund was difficult to trade with the few times we traded so far. The last time we did end up checking everything against TCG Player low for convenience sake, but as I was trading up I was happy to give up some extra value anyway.

Addition: even if you have a perfect price source the prices may still change quickly and your perfectly lined up deal may look very skewed tomorrow.

pi,

Thanks for your comment, and for the kind words regarding our last trade. The way we traded was exactly how I like to conduct trades. Look up everything (easy enough to do these days) and make sure values line up. It’s true that I took a little extra value since I traded down a Mox…but hey, that worked out in your favor anyway didn’t it? :).

Glad you agree with my individual statements. Regarding the pricing strategy – you are correct that there’s no perfect source. You’re also correct that one site may favor certain cards while other sites may favor other approaches. Guess what? I largely don’t care all that much. It’s true I don’t like using SCG pricing because that’s just one retailer’s opinion, and they have so many cards OOS at a given time that it’s hard to find the most up-to-date pricing there. They do a better job than most, but they’re still plenty behind on certain buyouts.

TCG Player pricing can also be manipulated, but it’s often the most reliable way to get up-to-the-minute pricing. Though eBay completed listings work for me too. I really don’t mind either way, as long as things are consistent.

In fact I often think in cash prices (eBay completed listings) because I live in a buy/sell world. I trade rarely these days as I don’t often get to the LGS and when I do, many people there don’t even bother trading. It’s kind of sad really. I love trading to diversify and turn over my inventory, but people are often just hesitant to do so in general.

In any event, hopefully my laid back attitude towards pricing source helps people feel more accepting to my trading principles. I will want that last $0.50 if your pile is short, but you can choose the pricing mechanism you’d like and you can look up every card. So there’s no room for debate at that point.

Thanks again for your thoughts!

Sig

(Glad to see you’re paying attention to the way I write my nick now ;))

That was the sort of high value deal where I do want to check cards as mistakes cost so much and yeah, I believe all our deals so far did work out in my favor over time ;-). As you may remember the bulk part I was actually fine with, but then you proposed to check and it turned out the Jitte was more valuable than we thought, so it ended up costing you there.

How would you feel about someone not wanting to use a price source? My preferred approach is usually to just put a proposal down on the table of these cards against those, making roughly matching stacks when there are more than a few cards. Then I’ll explain how I feel the stacks work out (this one is a little over in my favor, that one compensates for that, this one is in my favor but I expect card X to drop a bit from its current price, etc.). I aim for a little in my favor on the whole deal, but I’ll make the deal as long as I feel it’s fair for me. In the long run I reckon I come out ahead even if I do sometimes miss (I do tend to check deals afterwards for learning purposes).

I guess what I perhaps miss as a statement in the article:

“Apply common sense!”

Yes, that was implied in my mind but was not overtly stated.

When I trade face-to-face, I have a really hard time with trades that take longer than just a few minutes – I just really don’t enjoy it. On top of that, arguing about anything under a dollar appears kind of silly if the trade is over $10 (that’s my arbitrary limit), when my time is worth more than a dollar a minute.

On the other hand, I’m more than willing to balance things out to within 25-50 cents on deckbox, so I really don’t have any solid ground to stand upon.

Erik,

Thanks for sharing your thoughts. Why is it that you don’t enjoy training? Is it the stress, or the confrontation? I used to get really anxious about trading out of fear of losing on the deal (trading is a zero sum game when you look at it from a strictly financial standpoint). But by looking up everything, I’ve become much more laid back about it.

Some would say I’m more uptight about it BECAUSE I look cards up. But it eliminates all the guess work and therefore all the anxiety that I may get ripped off.

Thanks again,

Sig