Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Hello and welcome, fellow financiers.

I’m Chaz, and I’m very humbled to be writing for Quiet Speculation and to have the chance to write for you all.

When I first started in the finance side of this game, I really never knew how it would end up. All I did know is that I’ve always tried to be a contributing member to our great community, no matter how small.

At the same time, I started delving into the financial side more as a way for the hobby to pay for itself. If anyone has not seen my prior works, feel free to poke around for my literature. I am ecstatic to write and discuss finance with you all.

My first article here on Quite Speculation will be somewhat of an “Finance 101” piece, ending with some talk about my recent findings, utilizing some of the research I have done, day in and day out.

I want to use this article as a way to give financers (new and experienced) an actual look into what I specifically do on a routine basis when it comes to MTG Finance--introducing myself and my methods.

First, we'll start with defining who I am as a financier and some of the habits I like to abide by.

My MTG Finance Guidelines:

- Don’t chase good money with bad. Since I started delving into the financial aspect of the game, I started removing myself from chasing the white rabbit down that dark hole. I found that chasing speculative cards almost always ends up with holes in my pockets--other than those extenuating circumstances where one can find a card “pre-spike”. On the contrary, I tend to now invest my money into “safe” and “proven” cards. I won’t lie to you all: it’s not flashy, it’s not that exciting. But, for me, it has paid off the most. I’m sure most of you who ended up stashing away copies of Snapcaster Mage agree.

- Keep emotions at the door. This is a big one for me. It’s very easy to get caught up in the hype, and frantically pushing the “purchase” button. Results are really the determining factor, time and again. When I say this, I’m not always talking about tournament results. Do a little more research before letting emotions guide your hand.

- Defining a research methodology. Defining a method for yourself can be an arduous task, but looking behind the numbers is invaluable information. While it looks fantastic to see a “+350%” on a certain card on the surface, underneath it could be leaving you stuck with a spiked card that won’t move from inventory. Analyze decklists, look at “top EDH cards” lists, and scour the internet to get a feel on supply. All of these could take some time, but it’s well worth the effort. Don’t blindly spend money on cards that aren’t worth your time or effort. Really evaluate the Opportunity Cost of every card that is purchased (or not.) For every failed “speculative” card, could that money be better spent elsewhere?

- Utilizing all resources. For a while I “didn’t do the Reddit thing.” Don’t “not do the Reddit thing”, utilizing every tool around you will keep you highly informed. Twitter, Reddit, Facebook, QS, Trader Tools. “With your powers combined, I am…” Well, maybe not Captian Planet, but you get the idea. I can’t count how many times picking the brains of other well versed financial minds have driven to or away from specific cards. In the end, we’re all students, always trying to learn. I don’t think anyone is above asking a question and learning.

- What is your goal? Funding school? Keeping your store going? Pocket money? All of these questions you should be asking yourself, letting it define the actions (and budget) you take within this market. This may also help calculate an ROI you’re willing to live with on a card by card basis.

An MTG Finance Day:

On an average day, I usually wake up anywhere between 7-8AM.

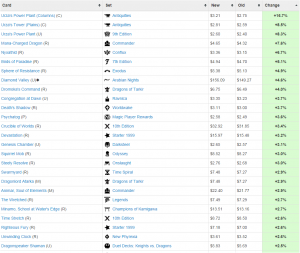

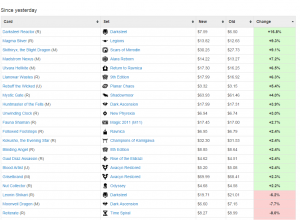

The very first thing I do, aside from heading to the bathroom, is check the daily stocks lists. They’re typically posted around 4-5AM. I check both the normal stocks and foils.

Let’s take a look shall we?

So, the way I start interpreting this information is that cards gaining the most percentage (and, in some cases, extreme percentages) up at the top are generally the cards that have spiked and/or in the process of a spike/buy-out.

At this point, it’s usually not a good idea to purchase unless you can somehow get in before the pre-spike prices. For me, I tend to notice the smaller gains on cards, because you will, more likely than not, find a card gaining slowly before finally ending up in the top percentage change. Should these cards show up multiple times over the course of days (or weeks), that’s when flags should start going up.

Blood Artist foils, for example. The card has been steadily moving from $4.51 on March 25 to $5.20 as of April 6th. A 15% increase in that time period--that’s already a solid increase. These increases aren’t the most flashy, but they are happening before they finally spike to the top of the charts.

Unless there was a coordinated buy-out, it’s impossible to have seen the card on charts, and you can verify this by cross-checking with the graph and you will notice the direct vertical spike.

There are other factors that coincide with these trends, but I would classify these as either a “buy-out” or buying a card that already had severely low supply. While it isn’t the best feeling in the world to be left on the sidelines and miss potential profits, it’s always better to show restraint. Again, one has to leave the emotion out of these manufactured price spikes.

What do we do now?

Well, this is how I analyze these lists--a step by step process coming after looking through the numbers.

- I refer to some daily notes. Has there been a card I have been watching? I will check to see if said card has shown up before this morning. Exactly how many times did it show up, and what was the percentages during those times? After looking through my notes, I decide to see if a card is worth purchasing, since it has been showing up multiple days. Before waiting until it shows up at the top of the charts (which is usually too late to invest), I want to get in as close to the floor as possible.

- Was there a recent decklist with this card? How successful is the deck with said card in it? I check through various results on different websites to cross reference.

- Our last stop are the Quiet Speculation forums. What are other financiers saying about a specific card? Is there a forum post about it already? If not, start a new one. Outline the various research that’s been done on the specific card you’ve chosen to try and purchase.

- If, for whatever reason, I feel I need more information about a specific card, I would just ask the financiers I know. It’s an invaluable way to learn every scrap of information possible about what’s going on in the market. I’ve met and befriended some remarkable people with brilliant minds and value their opinion. All you have to do is ask!

After that’s all done, I tend to do the following:

- Sort any incoming cards that have arrived.

- Begin listing outgoing cards. Setting price points I feel comfortable with, which will be different for everyone, and leaving the emotion at the door. I calculate the ROI I’m fine with and let the card get listed. I don’t get caught up in getting every last penny of profit. I take what is fine for me and move on to the next card. I always say “there’s always another card just around the corner.” Unless this great game of Magic: The Gathering dies tomorrow, you’d be hard pressed to prove me wrong.

- Writing personal notes to be shipped with cards, for networking reasons.

- Ask local gaming store owner about updated buylists (if needed).

- Check Trader Tools on price fluctuations in the cards I have listed there. The Tool is just invaluable in showing me the bare-minimum out to any card. If you’re ever purchasing a card, you really need to be checking how the buylist prices fluctuate on said card. They set the bottom.

Utilizing Every Resource - Not Just Online Vendors

I can’t truly convey enough how important networking in any industry is.

Knowing people and creating beneficial connections is how one can really succeed, and not only in MTG Finance.

Establishing a good relationship with local gaming stores and store owners is really key. We all know shipping time could very well ruin a large margin of profits, which could be minimized by taking a drive to a local store and purchasing copies of a card that is about to be or is spiking.

Watching coverage at a high EV event? Instead of clamoring to grab copies online, one could easily find a deal just by having a great connection to a local store--saving valuable time waiting for the cards to be shipped, or worse, canceled.

I’m not saying purchasing online is wrong, by any means. It is usually the best way to go about things. I’m merely making the point that sometimes it’s best to utilize all the tools around you, and that’s amplified by establishing connections in the industry.

Putting it All Together: So, How About Some Sweet Tips?

Recently, when I analyze these stocks, I have noticed some very interesting trends.

They tend to happen in the foil section and I have been cluing into (and sometimes investing in) some of these foils. They pop up on stocks infrequently, and when they do, I cross check them and figure out why. The supply is so low on some of these in online vendors that, when copies are purchased, it’s effectively wiping out a large percentage of the total supply.

Here are a few cards I have noticed lately. They have very attractive foil multipliers, and the non-foil versions have been steadily increasing these past few months. As always, I like to include full disclosure.

I have purchased: Foil Rune-Scarred Demon, Foil Dragonmaster Outcast, Foil Scrying Sheets.

I’m not going to try and give a full explanation as to why these multipliers are so very odd, though Eye of Ugin non-foils have been increasing quite a bit over the past few months, while the foil version has remained the same.

Between the dates of March 24th and March 30th, the card increased 7$. While it settled down a bit to 15$, the foil graph remains mostly unchanged, with most copies sitting in the 25$ range. The card is played in Modern Tron lists and has high appeal to the upcoming Battle for Zendikar block. This has shown up a few times in the stocks in the past weeks. It’s still sitting under a "normal" 2-4x multiplier. The only hesitation is a possible reprint in Modern Masters 2015.

This card is in short supply--for foils, that is.

Most online vendors don't even have them in stock. I have recently been seeing this in Modern MODO Dailies and in versions of the deck “Skred Red”. You could find these results on various sites.

I know a few financiers who have liked non-foils of this card for EDH purposes, and for other formats such as Tiny Leaders. With such scarcity in supply, and with the increasing value of non-foils, the foil multiplier is not what it normally should be. Normal copies sitting in the 5-6$ range, and the foil version sitting at 12$.

Another foil the keep an eye out for would be Blood Artist. It has been steadily increasing on the stock pages, and, without a foil reprint in sight, these could suddenly become very scarce and generate quite the demand. As I mentioned, it’s been up 15% and could end up being incorporated into these Collected Company decklists. A casual favorite, as well.

~

I’m happy to discuss anything in the article and I’m very interested in what you have to say about this weird phenomenon of such low foil multipliers, so please leave a comment.

Have you all found similar findings? Why would normal copies increase so much but the foil copies stay the same? Some interesting trends indeed.

That’s all for this time! I am looking forward to things to come here on QS.

Enjoy!

-Chaz

Like your articles Chaz. Looking forward to reading them here now. Was actually going to stop my subscription but looks like I have a reason to renew other than trader tools now.

Thanks so much Hayden. I really appreciate that. Good to see you here in the QS community.

Hey thanks! Trader Tools is also about to get a lot better, btw

Great article…as an FYI, one possible reason for the discrepancy in foil vs non-foil of Rune-Scarred demon..was that it was an M12 theme deck foil rare…so there are a LOT more of them out there than regular M12 foil rares….now even knowing that…having a multiplier of 1.4 still seems wrong (especially since it’s an auto-include in EDH and has shown seen some play in Vintage).

David! Thanks for the reply, always glad to have a fellow writer here at QS reply. Read your work lately, keep it up!

Rune-Scarred Demon certainly is in one of the event decks. I did take that into consideration. They add a lot more into circulation like you mentioned. So, I delved a little deeper before buying into them. I wondered what the actual intro-pack “Grab for Power” was selling for these days (since it’s OOP):

http://www.amazon.com/Magic-Gathering-Intro-POWER…

http://www.ebay.com/sch/i.html?_odkw=grab+for+pow…

Those were just the ones I found. I really didn’t find copies online to purchase. So, they’re scarce as it is.

Also, looking at it’s price graph, the foils have been steadily increasing as the normal version has been. I agree with you 1.4 multiplier seems wrong for a card that’s’ been consistently in the “top 50” list in Black on EDH lists.

Did not know it was played in Vintage though!

Ya..it occasionally finds it’s way into some Oath builds. I was a bit surprised at first too…but given how prevalent Demonic Tutor is I guess it isn’t that surprising.