Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

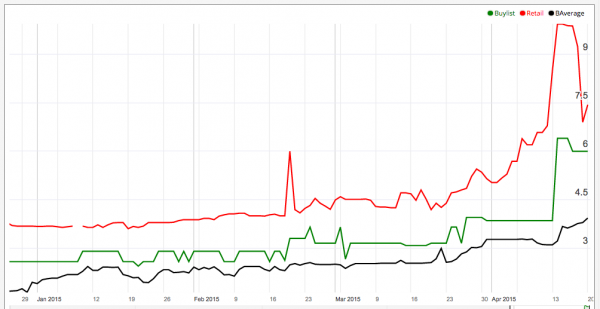

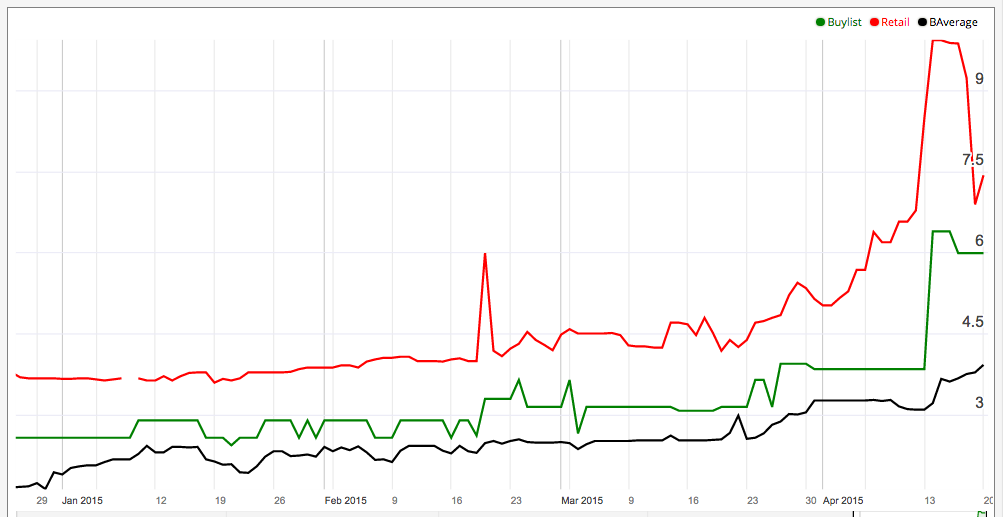

Last week, we saw a giant sell-side spike on Sphere of Resistance. We all kind of knew that the $10 price it hit wasn't "real", but we also knew that it was unlikely to return to its previous $4 level.

With these kinds of sell-side spikes, there has been a consistent trend of equilibrium; the sell price tends to settle at the approximate mean between the pre-spike price and the spike maximum. As you can see on today's chart, that is almost precisely what happened: (5.03+9.94) / 2 = 7.49, while today's price is 7.44. This rough formula for predicting how spikes will settle managed to indicate the price within 5 cents. Not bad for a rule of thumb!

The kicker is that the buy price has rocketed up to meet the sell price, with a spread of 19% at time of publishing. If you're new to QS, MTG Finance, or the idea of "spread", here's why this matters: the spread represents how much less money you'll make when you sell to a buy list, versus selling at retail. Generally speaking, spreads less than 30% are worth paying attention to. Spreads less than 20% are probably worth acting on, and spreads less than 10% are very rare indeed. So, a 20% spread on a card that many think is just baseless hype is probably worth considering.

The merchant who's willing to pay this premium is likely to get a lot of orders filled due to this narrow spread. It's a great decision, because those who bought their spheres at the old retail price of $5 or less will now be eager to cash out. It's a perfect time to bolster stock of an old, powerful card that might have a long-term future.

Why do you keep insisting this card is on the reserved list?

It is NOT on the reserved list.

I’m actually not sure where I got that idea. I’ve been corrected multiple times yet it STILL remains in my head.

sorry fixed.

fixed.