Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Rotation is a thing everyone should be aware of, especially financiers. I’m here to lay out what I think financiers should be holding back, or looking to buy during the usual Standard dump selling.

There are deals to be had around these times, and while not everything will be worth holding on to, there are some things to stash away. This is a list I will be sharing (yes, another list!) with you all on what I think financiers should be looking to buy at discounted prices.

Fellow writer Brian DeMars outlined Theros block in his recent article as potential cards to keep an eye on. I wanted to write this as a complementary piece, covering not only Theros, but M15 as well. I'm also mention cards in KTK block that are starting to drop to all-time lows and are worth grabbing over the summer lull when THS block rotates. Though I will surely devote more time and articles on that front specifically in the future.

Here’s the list for everyone’s consideration: THS/M15 + Khans Rotation List

So, now that everyone has that information for their own keeping, I wanted to go into detail on a few of the cards I have added to the list. I’m not the most qualified to pick out “casual/EDH” cards, but I think the ones I’ve included have been worth noting on those fronts. My methodology on these lists as always (for cards being added):

- Add cards that are proven in a Constructed setting.

- Currently at an all time low.

- Low Spread

- Good in EDH/Casual setting.

The Constructed Contenders in Theros/M15

Proven Constructed

These are probably the best bet for seeing any continued play once they rotate out of Standard. Some of these cards are already at all-time lows. Specifically a card like Brimaz, King of Oreskos. I think these cards can continue to trend down further over the coming months, especially if they aren’t played in Standard currently. A card like Eidolon of the Great Revel probably won’t decrease much in value, even during rotation, although I’m certain most financiers knew that already.

Looking back through history, I wanted to highlight some trends of what prime Constructed-viable cards went through when they were no longer in Standard. Looking at these trends could shed some light on when would be the lowest possible point to invest back into some of these cards, if they do end up seeing an increased amount of play in Modern or Legacy.

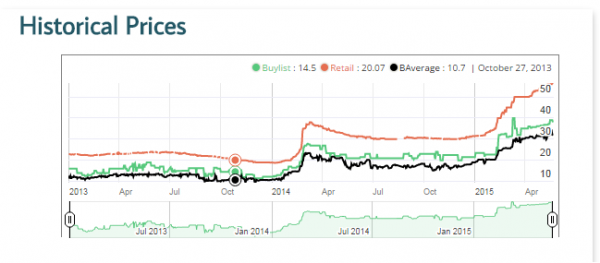

Looking back, Snapcaster Mage was averaging around 22$ during its tenure in Standard. The card rotated out of Standard in October 2013, and trended around the 18-19$ range until about February 2014.

After a high profile card like Snapcaster Mage (which was a rare) rotated, it only lost about 18% of its value. It maintained that price for little while before going through its first spike a mere few months later, gaining about 94%. After that point it just continued to go up after leveling off for quite some time.

Though you can see the trend, that with a card like Snapcaster Mage, (a multi-format staple) there was little decline after it rotated and it did not lose its value for that long. So generally with cards like these the “sit and wait” attitude may not be the wisest outlook in terms of investment.

That trend may not translate to many of the cards rotating in THS/M15, but it could apply to a couple specific cards. If I had to choose it would be Eidolon of the Great Revel and Thoughtseize.

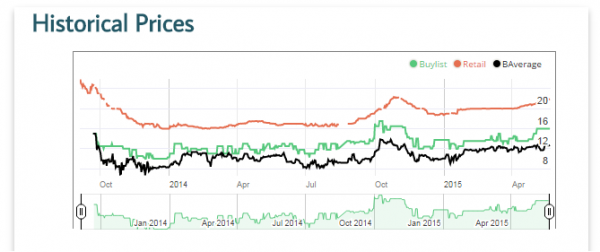

Now, there are more copies of Thoughtseize out there in the world than Snapcaster Mage, considering it was in two sets, and Theros block was a successful set in terms of how much product was opened. At the same time, Thoughtseize still has everything going for it, the exact same criteria as it always has had.

- Played in multiple formats.

- All time low.

Thoughtseize had its lowest point already during its tenure in Standard, but now that another prime reprint slot (in MM2015) has come and gone, the future is hazy on when it could return. It has maintained its price currently for quite some time, and I think drawing a parallel from Snapcaster’s history could be applied here.

It may lose a similar percent once it rotates, and while it may not be a mere few months before it starts to appreciate again, the gains will end up happening. If we were to just plug in the same numbers from Snapcaster Mage, the numbers on Thoughtseize *could* look like this:

October 2 2015: -18% New Retail price- $18

February 25th 2015 +94% New Retail price-$34.92

Again, there are more copies of Thoughtseize out there, but the graphs and charts for both cards look almost identical at this point in time. Could there be a drastic increase in Thoughtseize similar to Snapcaster Mage? A technical analysis would indicate that there could be a trend, but it may not happen in the exact same way. Without reprints there will most likely be steady increases on such a high profile card as this. With an increased supply I lean to a more steady increase, but stranger things have happened in MTGFinance.

Casual Stash Away?

Casual/EDH!

Like I mentioned previously, I’m not some EDH/Casual aficionado, but I do know a few of these cards are already on the radar and have been mentioned in recent articles here on QS. I have touched on these before in another of my articles, so take it for what its worth.

I don’t normally like speculation, especially on something as fickle as EDH/Casual, but I do like the prospect of Dictate of Erebos the best. It already represents a low spread, and comparing it to its predecessor Grave Pact, it just seems like a good penny stock at this point.

As many have stated, and even here on the QS forums, the god cycle could also be a slam-dunk investment as time goes on. They speak to that type of crowd, and a few of the pantheon have been listed in “Top EDH lists” already. They’re unique cards and most likely will only show up in a Commander product.

I wouldn’t be the person to evaluate every single one of them, so I ended up adding all of them to my list. The foil multiplier on them alone could pull a few of these up from some very alarming low points right now, with a few only commanding a couple of dollars.

Just a note here: I can’t remember where I read this (I think it’s our QS Forums) where a vendor was having a hard time keeping Ajani Steadfast, Jace, the Living Guildpact and Godsend in their inventory.

Uncommons of the Future?

Uncommons to watch

They may not be that attractive right now, but staple uncommons of the past like Inquisition of Kozilek and Lightning Helix didn't always command the prices they do today. It may take quite a bit of time before there are any considerable gains on these cards, but I do like me some Ensoul Artifact.

I would target the under-opened M15 uncommons before any of the others first. Especially some of the uncommon Slivers; those always seem to maintain some semblance of a price. Chalk it up to people just loving their Sliver tribes I suppose.

The Khans of October

Khans on a Downtrend

So I leave you all on this note, and I will fully commit to covering more Khans block cards as the summer lull kicks in, but with some of these cards already hitting all-time lows as previously mentioned, it could be a great opportunity to analyze these and stash a few under-priced staples in anticipation for this coming October rotation.

These debates always come up, and while these cards may seem like a 100% lock for “amazing come rotation,” we don’t actually know what is going to be released. New cards could completely change the landscape and eclipse what is currently in the card pool. I just want people to take caution before they suddenly end up with a stack of Underworld Cerberus thinking there’s going to be a solid chance a card shines after rotation.

The best thing to do is to just avoid “what could be good” and focus on what’s already good in various formats, in this case cards like Tasigur, the Golden Fang or Monastery Mentor. The cards that have already shown prowess (pun!) not only in Standard, but Modern and Legacy as well.

It’s still good to note that cards like Wingmate Roc are at their low points, but to go ahead and pick up copies is operating under the assumption on no other good 5cc drops coming down the pipeline. The same holds true for any card, so why not just focus on specific cards that have proven themselves.

I understand it's not flashy or exciting, but they're going to end up being the next Abrupt Decay, Snapcaster Mage or Voice of Resurgence this time around. Utilizing good card evaluation isn't something that hasn't been said before, but it's always going to be important when financing with Magic cards.

So, until next time everyone! Keep that inventory turning and document some of these cards going forward.

-Chaz

Keep up the great work great read!

Thanks so much Andrew!

Great article! Would you pick all of these up as non-foil or are there any on the list which you think have better prospects as foil? I’m personally looking at Grave Pact, Anax & Cymede, Ashen Rider, Monastery Mentor and Tasigur as some of the cards where the foil potentially commands more upside than the nonfoil.

I think foils on the cards you mentioned are good prospects. I really wouldn’t know how Tiny Leaders ultimately ends up, so I guess the only one i’d take caution on is Anax & Cymede.

I really couldn’t say on the foils on EDH stuff, it’s really a fickle market and there are still some cards out there one would “think” is a slam-dunk (even based on foil multiplier), but the numbers usually reflect that people just don’t want them.

Tasigur/Mentor should be the *most* safe and best investment out of those. I would say Dictate second (assuming you meant Dictate instead of Grave Pact?).