Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Hello everyone, welcome back!

As you have seen, Quiet Speculation has undergone a massive makeover. The website, the forums, and Trader Tools have all been revamped and updated, and I have to say it’s looking fantastic. Okay, so I kind of saw this all before you did, but that’s not the point!

Anyway, I had another segment I was going to write about, but I decided to save that for another time. I think with the Trader Tools improvements, it was better for me to actually focus on that, to show off how these new improvements can be an invaluable tool for Insiders and future investing. All my previous articles I have talked about the things I will be covering, but the new Trader Tools really makes it so much easier to track this data.

I have talked about my investment strategies, and my research methodology. So, let me take you through the new Trader Tools, and how I would use this to find an investment opportunity.

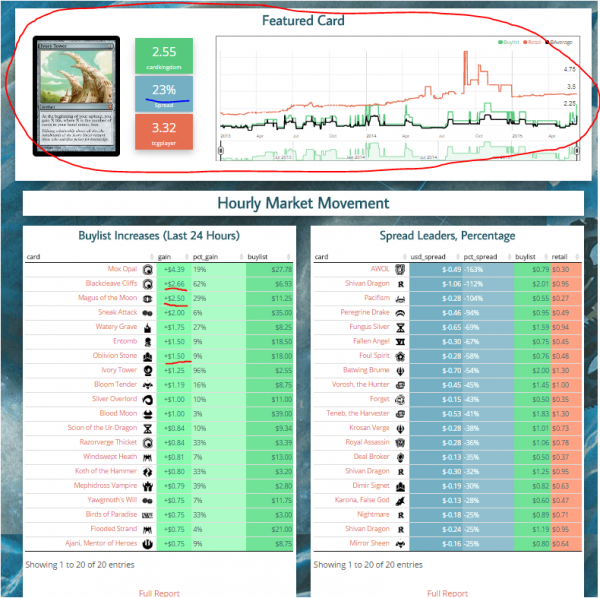

Firstly, we have the new Trader Tools page:

As you can all see, the pertinent information is now consolidated to this screen. Buylist updates, spreads, retail updates. The data is pulled hourly, and is updated the same way as other stock sites you’ve all grown accustomed to. So, really there’s no reason to have to use other sites since all the information is right in front of you. Which is great, because why have 3-4 tabs open when one will do? I agree!

I took the time to highlight some of the buylist increases because that’s where I normally look first. I do that because I want to know what the vendors are looking for. If the vendors are offering an attractive price, they are looking to acquire this card ASAP.

It also does something else for me--it validates if a spiking card will really end up holding a new price. If the vendors aren’t moving their buylist, you can be sure (more often than not) the new price won’t hold.

One of the cards I highlighted in that bunch was Oblivion Stone, and if you’ve all been paying attention to the recent price movements you will notice that the buylists have matched some of the cards that have increased recently. Like I pointed out earlier, this confirms that there was demand for these cards, and the original price was a bit low compared to the new ones they settled at.

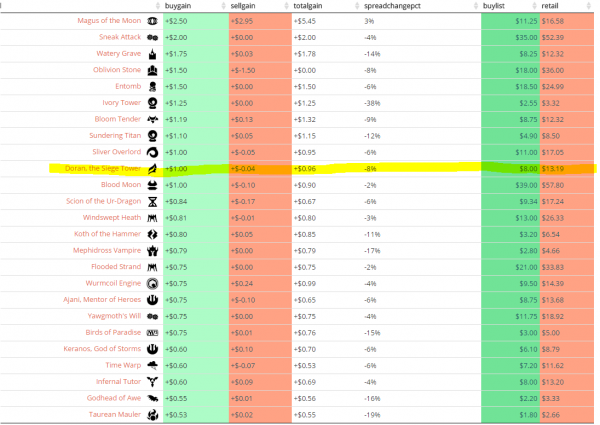

So, let’s go ahead and look at the “Full Report” on the buylist page. You’re usually going to get a couple pages highlighting the top buylist gains, and then down to the lowest. Most of the times when buylist prices increase dramatically (the cards at the top) the card in question has spiked (or is in the process of spiking) in value. Sometimes it’s not though, and that’s when we ultimately get a very attractive spread on a card currently.

Delving into Doran?

So admittedly it was hard to hone in on one card for this; I honestly didn’t see much on the buylist “leaderboard” to write home about. So, I ended up with Doran, the Siege Tower.

I know a while back this was starting to show some considerable gains. The hype certainly died out over that time, and now we’re basically at Doran’s pre-spike price. Why is the buylist price suddenly increasing by $1.00, up to $8.00 with a 39% spread? Semi-pedestrian numbers at the moment.

So, I then navigate through Trader Tools and look at the Historical Prices, finding that the buylist price and the retail price acted fairly stagnant for quite some time after it increased months ago. This is really the tool you want to look at to get an idea of what the card could do in the future.

I always say that “technical” finance isn't really the direction I would take in this market, but price graphs could be useful in the sense of the card’s demand in the past. What that means is, Doran is a viable card; and we know this because it’s been a tournament staple before and could certainly command a premium price tag.

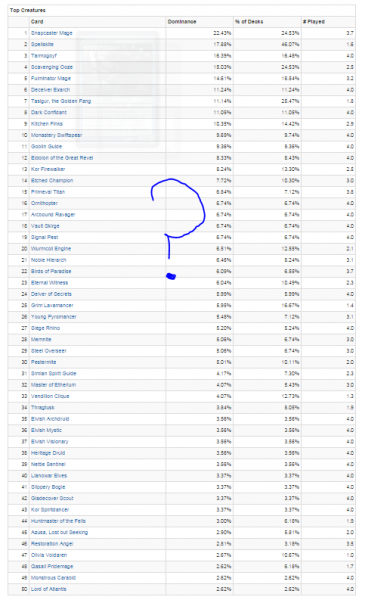

Here is where some fundamentals come in looking at this number. We know that Doran doesn't command that premium price, and we know that because it’s just not popular in Constructed right now. Looking a little further we can even bring up past results of the card:

Doran Junk - #1 in MTGO Modern MOCS

...That being the only recent event I could find that’s pertinent. It also doesn’t show up on the Top 50 creatures list in Modern, seen here:

So what does this mean for our large Treefolk friend? Well, it means that I really wouldn’t be investing in this card. Currently there’s just no demand for it, and it doesn’t even seem like it’s being included in Collected Company decklists currently.

Could this all change? Certainly--but as of right now, I chalk this up to a store that just wanted to stock up on some copies and offered a high buylist price for them. At the same time, it’s still worth documenting because of the current spread and retail price. So while it’s not something that I’m super excited about right now, there’s a lot of fundamental variables in its favor when analyzing its stock. Including:

- Only one printing. (Only other printing is an FTV promo from 2011)

- 3CMC. (Could somehow fight for a spot in “CoCompany” decks)

- Former Constructed staple. (Has the power to become viable at some point)

- Casual demand. (It’s a beast in Duel Commander)

Like I said, it has a lot going for it, but currently it’s not raising any red flags for me. Maybe you all would disagree with me, but I would like to observe its graph a little more before I would personally invest in the card. If this card were to somehow show up on the buylist charts consecutively then I would have some different dialogue about it.

So Chaz, what about finding some actual viable investments? I know you’re all asking the question. My answer is that with Trader Tools, you have an immense amount of information at your disposal. I encourage you to survey the numbers and do a little bit of back-end research.

So while Doran didn’t pan out on the first try, there is one other card I have seen pop up here and there on buylist charts in TT. It also occurred to me when Oblivion Stone spiked recently.

Opportunity in Groves?

I found it odd that a card like Oblivion Stone spiked so dramatically, and ultimately held a new price far higher than its previous one. Grove of the Burnwillows has the exact same set of circumstances as a card in the same deck. It has been hovering around a 20% spread for quite some time, and Trader Tools even shows us the buylist price has been increasing since May.

Now, I understand the capital cost is high, so I wouldn't recommend this to everyone. I just think it’s important to document and understand why a card could increase in value before it actually does. Oblivion Stone had a Commander printing and its first printing in 2003. There just wasn't that many copies out there. Well, we all know Grove commands a premium price, and it’s for those exact reasons. It’s a tournament-viable card, with it’s first printing in 2007.

The FTV printing has undoubtedly held this in check for a while, but it’s coming up on three years since the box set has been release. We all know that those FTV sets are limited, and it’s only a matter of time, barring an “actual” reprinting, that this card potentially takes off. Maybe this card goes nowhere, and I understand it has a high initial investment. At the same time with buylists at 30$ already, picking these up at say 35$ really minimizes risk. Which it seems feasible right now with the copies out there.

So there you all have it. The new Trader Tools is really awesome, and I’m glad it got the updates it did. It really does track everything you need to know right in one spot, and it’s now much faster than it used to be. A tool we should all be using as financiers.

I was happy to showcase how I use this tool to find investment opportunities. While Doran may not have been the best choice, there aren't always cards jumping out all the time. That’s just the nature of this business. What I do know is that cards I have mentioned in previous articles are showing some considerable buylist prices.

Recent Buylist Gainers

That’s all for today folks, and enjoy the new and improved Quiet Speculation, and its Trader Tools!

Feel free to discuss anything I cover in my articles in the comments below!

-Chaz

I really think the increase in this cards comes from its utilization in tiny leaders.