Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the MTGO Market Report as compiled by Sylvain Lehoux and Matthew Lewis. The report is loosely broken down into two perspectives. A broader perspective will be written by Matthew and will focus on recent trends in set prices, taking into account how paper prices and MTGO prices interact. Sylvain will take a closer look at particular opportunities based on various factors such as (but not limited to) set releases, flashback drafts and banned/restricted announcements.

There will be some overlap between the two sections. As always, speculators should take into account their own budget, risk tolerance and current portfolio before taking on any recommended positions.

Redemption

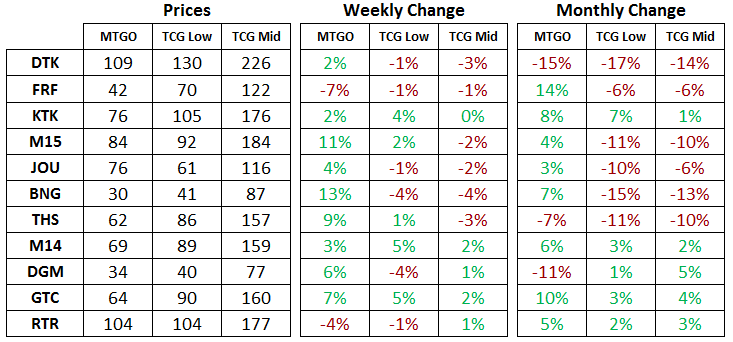

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of June 29th, 2015. The TCG Low and TCG Mid prices are the sum of each set’s individual card prices on TCG Player, either the low price or the mid-price respectively.

All MTGO set prices this week are taken from Goatbot’s website, and all weekly changes are now calculated relative to Goatbot’s ‘Full Set’ prices from the previous week. All monthly changes are also relative to the previous month prices, taken from Goatbot’s website at that time. Occasionally ‘Full Set’ prices are not available, and so estimated set prices are used instead.

Return to Ravnica Block & M14

The big news this week was the end of RTR set redemption. This will have a profound impact on the price of an MTGO set of RTR going forward. Without redemption providing an anchor to paper values, online prices will start to drift according to supply and demand.

This means that any junk mythic rare has very little value now, as the only practical demand for a card like Utvara Hellkite was from redeemers. Cards that are played in Modern, such as Steam Vents and Abrupt Decay, will see more stable prices as Modern grows as a format and the MTGO client slowly improves.

What this means for speculators is that any junk mythic rare should be sold immediately. When bot chains and players holding these cards realize that their assets have declined in value and that prices are sure to follow, they will be on the lookout for buyers. Smart operators will have already increased their spread by lowering their buy prices, and they will start marking down the sell price in order reduce stock and to ring out any value that they can.

Do not be fooled by any short-term bounces in these cards. MTGO can sometimes be a very inefficient market, particularly when you have to be paying attention to the right sources to find out that RTR set redemption has ended.

The three top mythic rares by price in RTR are all played in Modern, though they can hardly be called staples at the moment. If you are holding Sphinx's Revelation, Jace, Architect of Thought or Worldspine Wurm, then you should sell these cards now. Although Modern demand will support their prices now and in the future, the uncertainty produced by the end of redemption is very high. The MTGO Market Report already put a sell recommendation on Sphinx's Revelation, so for that card this is just reiterating that earlier call.

With the spoiling of Goblin Piledriver in Magic Origins (ORI), the value of M14's Mutavault has increased. After peaking in March, paper set prices have been drifting down but this trend is over. With the possibility of two tribal decks wanting this card for Modern play (Merfolk and now Goblins), M14 should see an uptick in demand from redeemers as they seek to capitalize on the presence of Mutavault and other Modern-playable cards from this set.

Theros Block & M15

Brewers are getting excited about Standard again, with the splashy nature of preview cards such as Day's Undoing and Goblin Piledriver, not to mention the flip planeswalkers, driving the interest. This has resulted in the prices on all of THS block and M15 set prices seeing a bump this week on MTGO. Selling into this surge demand is the correct move for any speculator still holding cards from these sets, or for players who aren't interested in playing over the summer.

Temple of Malady is an intriguing speculative target that bucks this perspective though. It has peaked twice at around 20 tix, and is down below 9 tix as of today.

The printing of Languish seems perfectly designed to complement the five-toughness bruisers available to Abzan colours in Standard at the moment. Starfield of Nyx is a card that could power up enchantment matters decks, which generate advantage with Doomwake Giant and Eidolon of Blossoms, another Abzan shell that could pump up demand for the black-green scry land.

With the historical price pattern well established, another peak of 20 tix is a possibility depending on how the Standard metagame unfolds after the release of ORI.

Tarkir Block

These three sets have been mostly stable this week on MTGO, with KTK and DTK ticking upwards and FRF falling a little. At its current price, the small set of Tarkir block represents the cheapest set available for redemption relative to paper prices, both TCG Low and TCG Mid.

This is a signal that buying mythic rares from FRF is still a good long-term strategy, as redemption can lift the price of MTGO sets to be closer to paper. Elsewhere, KTK appears to have bottomed in paper, with prices stable or positive in the past week and over the past month.

Targeted Recommendations Summary

In today’s report we take a look back at the first six months of the MTGO Market Report and perform an analysis of the buy and sell recommendations.

Each closed call (i.e. the card was bought and sold) can be evaluated and judged a success or failure by looking at percentage gains or losses. We’ll also construct a mock portfolio to estimate what the net gains or losses could be for a speculator following the recommendations. Lastly, we’ll make comments on any outstanding buy calls and discuss their future.

Evaluation Method

There is no absolute and unique method to evaluate the performance of our recommendations, but we’ve come up with what we think is an objective approach to estimate gains and losses. Gains and losses presented here may also be different from a given person’s portfolio, even if they strictly followed our recommendations.

Buy Prices

For every recommendation, the buy price we used is the price as recorded by mtggoldfish.com on the day of the recommendation. The bias here is that it’s possible to buy cards at a lower price than the listed mtggoldfish price. Mtggoldfish uses mtgotraders prices which are frequently not the cheapest (they focus on stocking every card, not the lowest price). Also, acting on the recommendation on a different day might yield different results as prices might have fluctuated in the interim period.

Sell Prices

The sell price we used is the price as recorded by mtggoldfish.com on the day of recommendation, with the following adjustments. For every card price below 2 Tix, 80% of the listed sell price was assumed to be retained. This accounts for the buy and sell spread of most bots on low-priced cards, which tend to have higher margins. For cards above 2 tix, 90% of the listed sell price was assumed to be retained.

Again, the exact price which a given speculator gets will probably not correspond perfectly to the sell price either. The purpose is to illustrate what is possible, given a reasonable set of assumptions and the actual buy and sell recommendations given in the report.

Prices used for recommendations still open are current as of Thursday, the 25th of June. The same 80% and 90% price adjustments have been taken into consideration for cards less than 2 tix and cards greater than 2 tix, respectively.

The Mock Portfolio

A mock portfolio based on these recommendations was built in order to put the recommendations into a different, more tangible context. The rules of this simulated portfolio are as follows. A maximum of 50 Tix was dedicated to each recommendation, and an upper limit on the number of copies was set to 40. Based on our experience, buying or selling up to 40 copies of a given card, without significantly affecting prices, is possible if a number of different bot chains are used.

This time around, we also took into account the fact that Tix generated by selling positions can be re-invested into new positions. Basically, we added the dimension of compound interest to our mock portfolio.

Evaluating the Recommendations

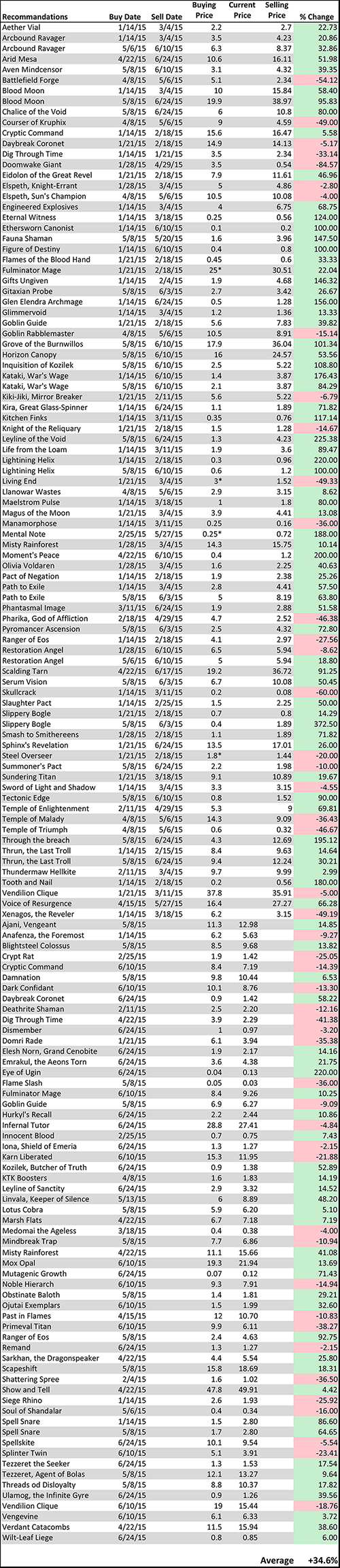

The table below presents the percentage change in each recommendation as per the above assumptions.

* indicates the maximum buying price we recommended for this card, although the price on Mtggoldfish was higher on the day we recommended the position.

Considering all recommendations, both closed and open, the average gain is +34.6%. If only closed positions are considered, the average gain is +50.4%.

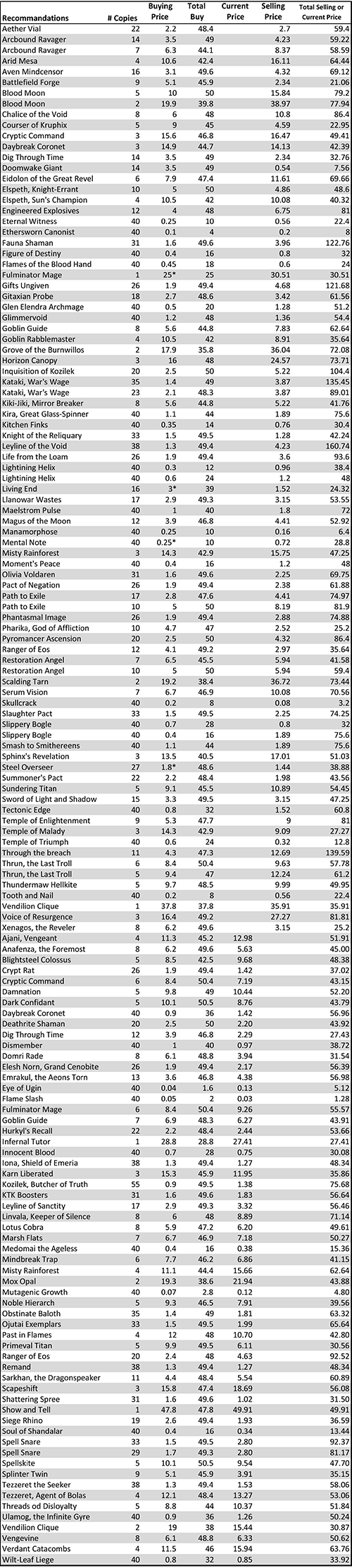

Now let’s take a look at our mock portfolio:

The mock portfolio shows you how much of each position it would have. After six months now, this mock portfolio would have bought and sold 85 positions, while 59 still remain open. With the profit of 85 closed positions that would have been re-invested (as any speculator would proceed with his/her own portfolio) it would not make sense to compare the total buying price of all the positions to the total selling price to estimate the overall profit generated.

Instead, and in order to more accurately reflect the accumulated value of a real portfolio, we build a cumulative table to account for the Tix balance of the mock portfolio at any time during these first six months. Every time a card is bought, an amount of Tix (corresponding to the number of copies times buying price) is debited; every time a card is sold, an amount of Tix (corresponding to the number of copies times selling price) is credited.

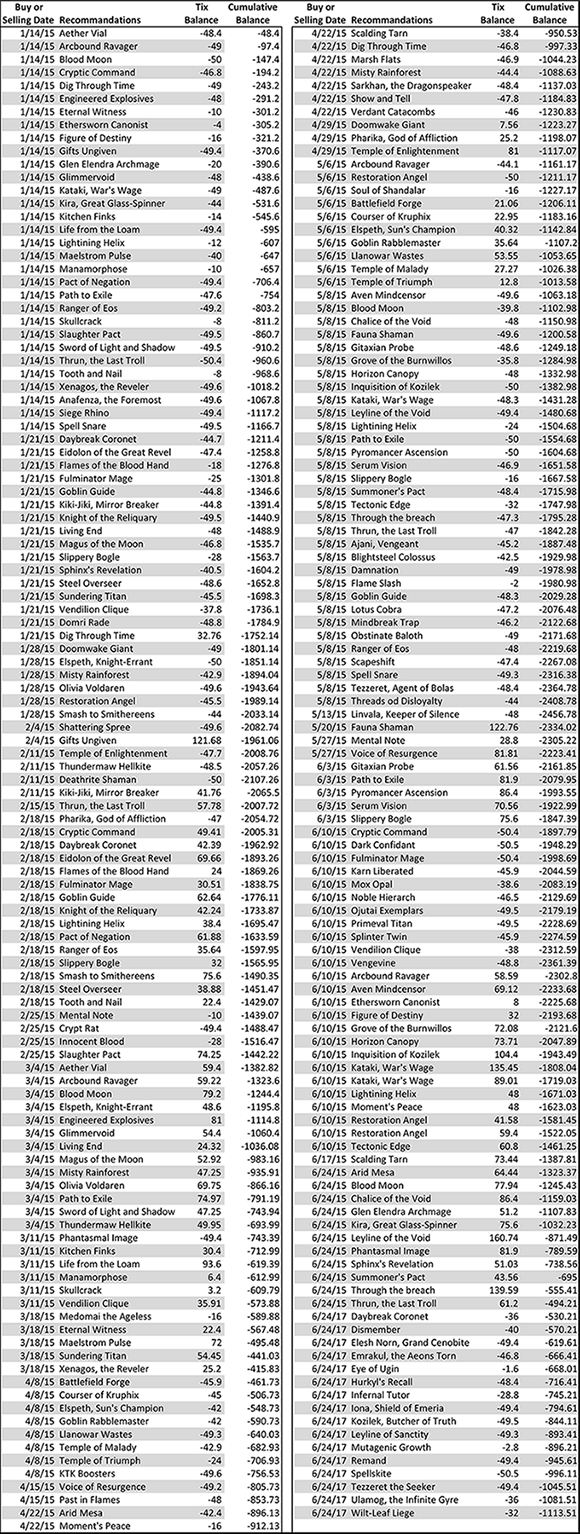

Here is the cumulative table:

With this cumulative mock portfolio, no more than 2456 Tix were ever required to cover all of the MTGO Market Report buying recommendations, according to the above buying assumptions.

This means that with a starting bankroll of 2500 Tix, the mock portfolio would currently be valued at 4128.6 Tix. The current open positions accumulate a total value of 2742.1 Tix and the mock portfolio would also have 1386.49 free Tix (2500-1113.51). 4128.6 represents a 65.1% increase in bankroll value since January.

Outlook for Currently Open Recommendations

Standard Positions

The Standard recommendations should look better and better as we approach rotation. With Magic Origins in a few weeks and Battle for Zendikar (BFZ) in the fall, Tarkir block cards are expected to gain value as supply diminishes and demand increases with the need to brew new Standard decks.

Waiting for ORI to be released and staying liquid in Tix is what speculators should be doing. During the next round of release events, the time will come to accumulate promising Tarkir block and ORI positions.

Modern

Modern Masters 2015 represent most of our current open positions in Modern. This massive reprint devalued a lot of Modern staples and created several great buying opportunities. According to Modern price cycles and swings, they should all rise sooner or later.

A first stop to watch will occur during BFZ release. As players will shift their attention to a new Standard environment, Modern prices that would have risen until September may drop a little bit. It might then be a good period to sell some MM2 Modern positions acquired these past weeks.

Others Modern positions we are still holding are non-reprinted cards that haven't moved much since May. They probably won't be significantly affected by the release of BFZ. These cards need a metagame change to be favored again and thus rise in price.

Vintage and Legacy

Not much has disrupted the slow and flat price fluctuations of these two formats. Tempest Remastered dragged down some prices, most notably City of Traitors, Intuition and Mox Diamond, but it failed to bring a playset of Wasteland down to a more affordable price. For speculators holding positions related to these two formats, the Legacy MOCS in November is the time to consider selling any speculative investments.

Pauper

Pauper is not nearly as popular as Modern and price variations not as strong. However cards in this format have clearly shown cyclical trends over the past few months. These price swings should certainly repeat in the coming months. As spreads are usually bigger than with Modern, following price fluctuations regularly is key for Pauper speculators to maximize profits here.

Targeted Speculative Buying Opportunities

None

Targeted Speculative Selling Opportunities

Modern

Ranger of Eos

Misty Rainforest

I have said it before, this is the best article series anywhere in mtgfinance. Well done, lads. Thanks for your ‘just the facts’ style and for presenting a varied array of strategies. You manage to cast a wide net while staying concise, and you do a great job of pointing out opportunities without spoonfeeding. This column alone is well worth the price of QS Insider.

I’ll take the liberty of speaking for Sylvain here, but it’s our pleasure to bring our understanding of the MTGO economy to QS readers. Getting feedback like this is meaningful and always appreciated.

Thank you for the very kind words.

Matt

Don’t think i’ve commented more than once here..

But this is the only article i read on QS each week. No sleight to any other authors, I just think you guys really hit it out of the park with this series in terms of raw data and actionable information.

Thanks Cooper!

How did you find out about the end of RTR redemption? Just from checking the store? Can’t find any announcement…

Someone on twitter noticed the store was empty, and then posted the question whether they ever refill after the guarantee date passes. Eventually Mike Turian confirmed via twitter that RTR sets were sold out and not going to be refilled.

There has been no official announcement of these events when they occur but there usually will be confirmation by official parties on twitter or on the WoTC forums. Also, maybe this week there will be something in the weekly MTGO update on the mothership. TBD.

So up top you say temple of Malady is a good prospect…but then dont put it in your buying opportunities area…..should i be buying these at 7 tiks?

This is a good question. I think Temple of Malady is something to watch, but it’s no slam dunk. This could keep going down and might never recover. Speculating on rares in their last few months in Standard is very very risky.

They only buy and sell recommendations that we make are when we both agree that it is worth it, or the timing is correct. Usually these are low risk specs that readers can expect to eventually sell for a profit.

In this case, Temple of Malady was just my own thought, and I didn’t put it forward to Sylvain as a buy recommendation. If it continues to fall in price, then it will get more and more interesting. But for now, just keep an eye on it.