Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the MTGO Market Report as compiled by Sylvain Lehoux and Matthew Lewis. The report is loosely broken down into two perspectives. A broader perspective will be written by Matthew and will focus on recent trends in set prices, taking into account how paper prices and MTGO prices interact. Sylvain will take a closer look at particular opportunities based on various factors such as (but not limited to) set releases, flashback drafts and banned/restricted announcements.

There will be some overlap between the two sections. As always, speculators should take into account their own budget, risk tolerance and current portfolio before taking on any recommended positions.

Redemption

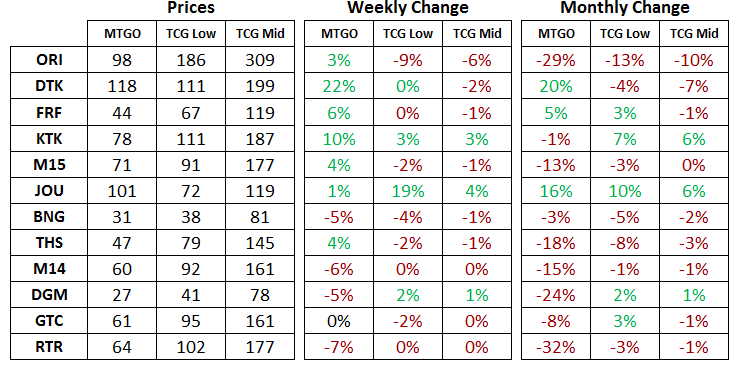

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of August 17th, 2015. The TCG Low and TCG Mid prices are the sum of each set’s individual card prices on TCG Player, either the low price or the mid-price respectively.

All MTGO set prices this week are taken from Goatbot’s website, and all weekly changes are now calculated relative to Goatbot’s ‘Full Set’ prices from the previous week. All monthly changes are also relative to the previous month prices, taken from Goatbot’s website at that time. Occasionally ‘Full Set’ prices are not available, and so estimated set prices are used instead.

Return to Ravnica Block & M14

With RTR continuing to fall in price, it won't be long before a set of GTC is worth more than a set of RTR. This is a perfect example of how much redemption matters to the price of a digital set. Without the ability to redeem a set of RTR, the price has been falling steadily. After redemption went offline, everyone who sold their RTR cards immediately fared well compared to those who held onto their cards.

Even those just holding a playset could have benefited by selling their Modern-playable cards (like Jace, Architect of Thought) with an eye to buying them back after the price had come down. If you are not currently using a card, and it's going to drop in price, take the prudent course of action and sell the card. The drop in price for the cards from RTR was predictable as soon as it became clear that redemption had closed.

Voice of Resurgence has fallen back below 20 tix on Goatbot, which is very near the previous price floor of 17 tix. This is a good price for players to grab a playset, but speculators will want to wait until BFZ release events fire up and start draining tix from the MTGO economy. Although it's a playable card in Modern, there's not much time between now and the release of BFZ. When the window to see gains is short, only speculate on format staples that have a good chance of going higher. At current prices and at its current level of play in Modern, this mythic two-drop is risky.

Theros Block & M15

Summer Standard keeps throwing out surprises that interrupt the downtrends in these sets. However, once the official spoiler season for BFZ begins in September, Standard will be very much a lame duck format. It's just time to watch out for cheap junk mythic rares and to keep tabs on the Modern-playable cards from these sets that are getting cheap.

Both THS and BNG are dropping rapidly in paper and so redemption can provide no support to the digital prices of these sets. Look for paper prices to stabilize before any support from redemption can reassert itself.

From JOU, Keranos, God of Storms and Eidolon of the Great Revel have both fallen below 20 tix. It's not time to buy these yet, but they are on the list of targets. JOU is not a candidate for redemption, but both of these cards see play in Modern.

Jace, the Living Guildpact from M15 is approaching a level that is rarely breached by Standard-legal planeswalkers. If this card falls below that threshold of 1 tix, don't hesitate to start buying. M15 will be redeemed at average numbers for a core set so there will be price support down the road for all mythic rares from this set.

Tarkir Block & Magic Origins

Dragonlord Ojutai went back up to 14 tix and Den Protector is getting closer to 10 tix, a high but attainable price for a non-mythic rare. These two cards contributed to DTK seeing a whopping 22% increase over last week. With the end of heavy drafting of this set, the supply of new cards has slowed to a trickle and we are seeing prices find a new equilibrium.

DTK is quite an interesting case as it was only opened heavily for a couple of months, and unlike a normal large set it was only opened two boosters per drafter. Combined with the extended release of MM2, there is the potential for this set to power much higher in the coming months. At current prices, redeemers will not be clamoring to convert digital DTK to paper, but we only have to look at JOU to see how the MTGO price of a lightly opened third set can diverge wildly from the paper price.

The other two Tarkir block sets also saw price increases this week. With KTK still being priced at a discount to paper, and paper prices showing strength heading into September, it's expected that KTK will continue to appreciate in price. The market is adjusting to the reality of there being no imminent reprint of the Zendikar fetchlands and the price of a set of KTK is getting the benefit as a result.

The middle set of the block has a slightly worse outlook than the other two sets at the moment, despite the price rebound coming out of ORI release events. Much less redemption occurs for small sets due to having to spread the costs of redemption over a smaller card pool. Until paper prices completely stabilize, gains for FRF are expected to be muted.

The spoiling of the colourless Eldrazi mechanic this week, the keyword devoid, makes Ghostfire Blade and Ugin, the Spirit Dragon look like Tarkir block plants for BFZ. This piece of equipment has been seeing recent success in Standard so it's not a buy low candidate. Just one to hold onto in the Fall if you've already got a stash of them. Ugin has been very stable in the 8 to 9 tix range and so buying at current prices won't incur much risk.

The two set prices for ORI are converging, but it's the paper prices coming down to meet the digital. This is a normal progression but it will end soon with the release of BFZ. With a short drafting window, a number of novel cards and the opposing-colour pain lands, ORI is a set you can sink tix into.

Modern

This week was the tipping point for Modern positions. As underlined by the three majors Modern indices (Total Modern Format, MMA and MM2) and after bottoming this past week, prices rebounded this past weekend and earlier this week. Some positions rebounded moderately but others doubled in less than a week.

The MM2 full set value increased by about 10% since last Friday and, as of Monday, less than fifteen MM2 cards were losing value compared to the previous week--a clear indicator of the new trend. On average, the trend should be upward until the end of September. Among the rare MM2 Modern staples that haven’t really recovered from this month-long price drop are Spellskite, Splinter Twin, Karn Liberated, Noble Hierarch and Primeval Titan. Speculators who hadn’t bought these positions earlier in July or more recently in August may want to acquire some of these Modern staples now.

Other Modern staples, including Snapcaster Mage, Stony Silence, Aether Vial, Rest in Peace and Slippery Bogle, have also seen a nice price hike over the past few days. Attentive speculators who bought some of these positions during the big price drop recorded late July/early August may have already doubled their investment here.

Buying prices should soon follow this rise and generate comfortable profit by the end of the month or early this September. At this point, it will be up to each speculator to decide to hold for potential higher profit or to sell, perhaps redirecting the Tix generated to other speculations such as ORI rares.

Following the initial spike that occurred two weeks ago, the five ZEN fetchlands, with the exception of Marsh Flats, are keeping the trend up. Expect these lands to follow the general Modern price trend for the next four to six weeks too.

Legacy & Vintage

Legacy prices were mostly unaffected by the release of Magic Origins and they didn’t react much to the termination of ORI release events. A noticeable price rebound can be observed only for the Total VMA set price and the P9 index. If historically prices across all formats have always increased in between the release of the core set and the following Fall set, speculators should not expect all Legacy and Vintage positions to be as dynamic as Modern ones.

Of note this week, despite seeing play in several deck archetypes in Legacy, Deathrite Shaman has slipped under 1.3 Tix, its all-time lowest price on MTGO. Three months before the Legacy MOCS the black-green elf looks like a solid speculative target.

Pauper

One week after the introduction of Play Points, Pauper seems rather unaffected by the change and price fluctuations remain normal. Snap hit a one-year high, Sunscape Familiar keeps cruising to higher prices and Innocent Blood, Lava Spike and Chittering Rats have all rebounded from their low point, hit around the release of ORI.

Pauper staples are unlikely to keep rising until the end of September though. Instead, they're most likely to follow their own up and down cycles and Pauper speculators should consider selling their positions when they double in price, whether it took two days or two weeks to meet this profit.

Mono-Green Stompy is one of the cheapest Pauper decks. With Nettle Sentinel as the most valuable card and a lot of bulk commons in the deck, Stompy put itself as the second most represented deck in the Pauper metagame these days. If the popularity of Stompy sustains, cards to watch include Mutagenic Growth, Rancor and Quirion Ranger, the three other cards in addition to Nettle Sentinel that hold significant value above bulk.

Targeted Speculative Buying Opportunities

Legacy

Deathrite Shaman

We have recommended buying this card some time ago and after the dip experienced these past weeks we strongly feel this is a good buying opportunity at this point again with the Legacy MOCS three months ahead.