Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Last February I discussed the option of investing in full sets. With less available time to dedicate to speculation, and a decent number of Tix still on my account, I was considering moving into full sets, specifically of Khans of Tarkir (KTK).

The initial plan was to buy multiple sets of KTK around the release of Dragons of Tarkir (DTK), and sell them later in the Fall. I expected returns of 30% to 50%.

I did execute that plan and it's clearly paying off now. What I didn't expect was that sitting on large stacks of cards, including many I never would have picked individually, would enable other opportunities--among them short selling.

Today I want to explain why speculating on full sets is not only one of the best investments you can make on MTGO, but also the perfect setup for short selling.

The Best Investment on MTGO

Some people claim that MTGO speculation, and Magic finance more broadly, has more to do with gambling and luck than with careful, calculated investment. We, as speculators, have supposedly been lucky once or twice, but nothing is really predictable and there are no sure bets.

We in the finance community know this isn't the case. Buying a basket of Modern staples when prices are low, as they are right now, is pretty close to a "sure bet," especially when you know how and why Modern prices fluctuate. Likewise, betting on every mythic from M14 or M15 was definitely as close to a sure bet as possible.

In terms of predictability and stability, those specs don't come close to full sets on MTGO.

I'm fairly certain that any financial adviser who looked at the different charts on MtgGoldfish would quickly conclude that full sets are the safest, most predictable and most profitable instrument you can find. (And that they are probably outperforming any financial product you can find out there.)

Consequently, I would expect them to recommend new speculators focus on full sets before moving on to riskier, higher-potential specs such as Modern staples.

Of the nineteen sets whose prices are recorded on MtgGoldfish (Scars of Mirrodin to Dragons of Tarkir, including the four core sets), all of them followed the exact same pattern--an increase in price toward the end of the Summer, when Standard was rotating. The price increase is certainly not always by 80%, but it holds for every set without exception.

Speculating on full sets should be the first task for any new MTGO speculator, and should form part of the portfolio of any serious long-term speculators, regardless of bankroll size. Full sets offer great stability and totally nullify the effects of metagame changes, bans/unbans and new set releases.

Every set will have some valuable cards. If you hold them all you don't have to guess winners and losers, or even pay attention to any sort of hype.

All But a Straight Line

Based on previous trends, buying fall sets during the summer to sell during the following fall seems to be one of the easiest specs available on MTGO.

With Khans of Tarkir I decided to buy my sets during Dragons of Tarkir release events, when I anticipated KTK prices would start rising. At first, the original speculative move was very simple: buy in April, wait about six months and sell in October.

Right there we have one component needed for short selling--holding a bunch of cards for a long period of time, without caring about individual variations.

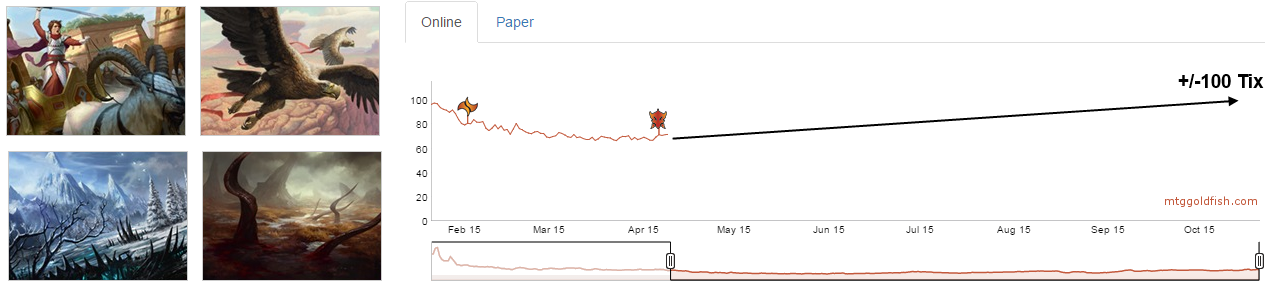

So if the trend is certain to be up, what kind of trend are we really talking about? After all, short selling requires prices to be high at some point but lower sometime later. Let see what the price variations looked like with KTK.

Assuming the price in October is about 100 Tix, how straight and even would you expect the intervening curve to be?

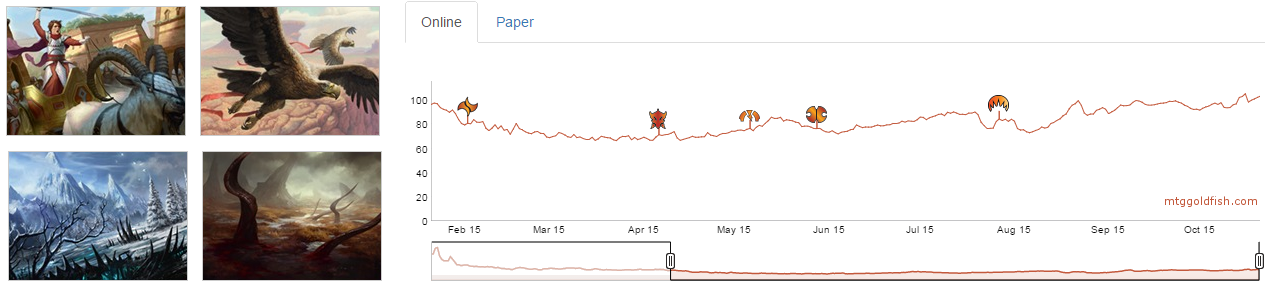

Between April and October, several significant events occurred that were capable of affecting the price of KTK full sets. These were the release of five new sets, three Standard Pro Tours, and the summer season known to be a lull in Magic activity in general.

It seems these disparate events didn't affect prices evenly or equally. The price increase between April and now is hardly linear.

The release of Modern Masters 2015 (MM2) in June and Magic Origins (ORI) in August clearly affected the price of KTK sets. In both cases, a loss of about 15% occurred within the two weeks surrounding the release of these sets.

Nevertheless, prices rebounded fairly soon after, and despite these dips the upward trend continued through these six months. In the end, Khans of Tarkir full sets increased by about 50% between April and October.

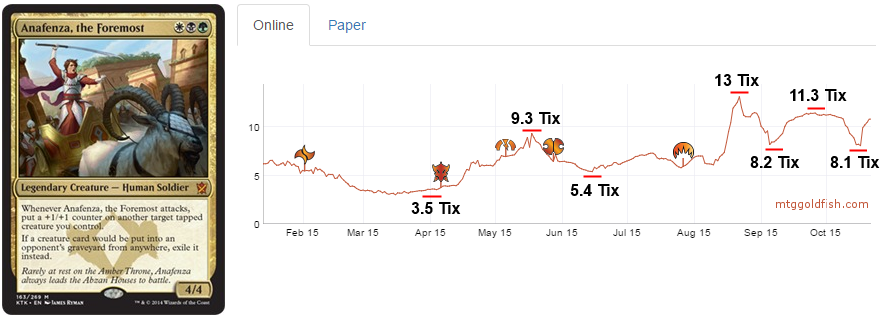

If you're thinking these fluctuations of +/-15% are too little to be exploited, take a closer look at the price variations of some individual KTK cards. Anafenza, the Foremost is a good example.

Anafenza was around 4 Tix when DTK was released, and is now around 10 Tix, a 150% price increase. But the trend is more akin to a roller coaster than a straight line. The price fluctuated half a dozen times, with 100% increases and 50% decreases.

A traditional speculative approach could take advantage of these price spikes. A short selling approach would aim to generate profits off the price drops.

Anafenza is one example among many that open the door to short sale opportunities. The context of full set speculation is simply what enables it.

The Perfect Setup for Short Selling

Back on April 4th I bought 50 full sets of Khans of Tarkir. Thanks to Goatbots it was the easiest transaction I ever made, especially considering the amount of Tix and cards involved. The only action required on my end was to transfer 3,250 Tix to Goatbots, and that's it.

Since we agreed in advance on the price and the number of sets to be delivered, Goatbots themselves loaded the 50 sets on my account. Three minutes is all it took to buy 3,250 Tix worth of cards.

I had acquired 50 copies of 269 cards, with the only objective to wait six months or so before cashing in. I had no intention of selling any of these cards individually and I didn't care about their individual price fluctuations.

Among these 269 cards was Anafenza, the Foremost, which underwent the price variations discussed above. Had I been inclined, I could have sold it sometime in June and rebought it in July. In the end I still need my Anafenzas for my sets, but it would have been possible to make 200 extra Tix in the process--50 times 4 Tix, the difference between the high and low points.

So we see how investing in full sets enables short selling. This is an excellent way to leverage your full set investment. If you thought a 50% profit was decent after six months, how about another 50% thanks to well-timed short sales?

In the context of full set speculation, short selling becomes an incredible viable option. It might not lead to short selling cards every week, but it does open a new avenue for speculation on MTGO.

Short selling your own cards, as I have described in this article, is one possibility. Another is to borrow cards from somebody else who's speculating on full sets. At this time, this method comes as close as possible to short selling on the stock market.

Next time I'll elaborate on the different possibilities and illustrate them with concrete examples.

Thank you for reading,

Sylvain Lehoux

What price entry point do you think is good for BFZ sets? BTW, congrats on getting 50 sets at 65, that was an amazing buy.

Timing will dictate the good price for BFZ. The release of the April set (SOI) will probably be the right time, but I would not venture into trying to predict the bottom of BFZ.

KTK sets certainly were a great spec but DTK set were even better (by a little bit)! FRF didn’t do much on the other hand (at least with my buying price).

Great Article. Do you have any reference for Nubes about navigating MTGO Trade, Third party bots, or even managing your own collection. I’ve found the whole process quite cumbersome. Thanks in advance

Drew

Hi Drew,

If you want you can shoot me a PM (via the forum) with your questions, and with more details if you want. I’ll answer them as much as I can.

Sylvain

great article as always.

You and Matt and the only reason I pay for the yearly fee

I followed this strategy but started with only FTF, bought approx around 35-36tix and now could sell to 44.

Do you think I should wait another 1-2 month or I should sell now?

Thanks!

Hi Jerry,

That’s the question I’m asking myself about FRF. Although my average buying price was much higher (~41). From 36 to 44 that’s still a decent 22% but nothing except Ugin has yet really emerged from FRF. Warden of the FT is rebounding as it seems and Mentor and Soulfire may bounce back too.

Unless you really need Tix I would suggest to wait one more month amd/or being able to sell ~50 Tix.