Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Hello Insiders, and welcome back.

A while back I wrote an article called “Rotate Now, Not in October.” I feel the need to revisit this topic as we come up on an important rotation date for Standard.

In April, Khans of Tarkir (KTK) and Fate Reforged (FRF) will go away, leaving us with Dragons of Tarkir (DTK), Magic Origins (ORI), Battle for Zendikar block and Shadows Over Innistrad (SOI). As this will be the first Spring rotation ever, we don't know exactly how it will go, but we can assume it will largely resemble Fall rotations from past years.

We do know the departure of fetchlands will remove a major financial barrier that has been keeping people out of Standard. We discussed this on the latest QS Cast, and agreed that recent tournament results may indicate that finance is dictating deck choices. Expect Standard to attract more players after SOI debuts.

None of this is news to any of you, and by now I’m sure you've removed any and all rotting prospects from KTK and FRF from your inventory. If you haven’t, the time is past due and I advise acting as soon as possible.

I wrote about this in several articles during October. In the new landscape of Magic finance, there's a greater threat of reprints, which constitutes a major hurdle to the investor. Reprints were responsible for tanking some of our more promising prospects from last year. Notably, Warden of the First Tree never took off, despite seeing a considerable amount of play.

When I look back at my specs from this period, some were solid, some less so. My weaker selections included many of the penny stocks, as well as stuff like Narset Transcendent, which proved to be a mediocre card.

This time around we need to be smarter, and even when targeting penny stocks, not get cute. I'm going to refocus and look for the solid playables.

Those penny stock purchases didn't end up horribly, because I buylisted them after Pro Tour BFZ to more or less break even. Taking credit on trade-ins largely wiped out what would have been some undesirable losses.

Of course, that's not really where I want to be, and there's a better way---identifying the best candidates for continued success after rotation, even if they're boring, known quantities.

The Silkwrap Effect

There are always a few key uncommons that play a pivotal role in any format. For the last several months, Silkwrap has been occupying that spot, but there's no guarantee that continues.

Unlike something like Stoke the Flames, which was a format-defining powerhouse no matter how you slice it, Silkwrap is a product of a particular environment. It serves a specific purpose when the meta dictates its necessity, and in another context the chase uncommon may be different.

There are plenty of powerful uncommons worth looking at. Here are some uncommons I pulled up from Trader Tools that are posting the lowest spreads.

Low-Spread Uncommons

That’s already quite a large list. That’s not even accounting for cards like Silumgar's Scorn, which doesn’t have an attractive spread due to retail sales, but can be found for considerably less if one takes the extra time to look.

My vote is for cards that have already proven themselves, including Zulaport Cutthroat, Stasis Snare and the aforementioned Silumgar’s Scorn. With the meta shifting again in a drastic way, maybe Silkwrap will be rendered obsolete and replaced with other options.

Esper Dragons has almost leap-frogged over Dark Jeskai as the premier control strategy. After rotation the deck remains intact, and players will continue to play it.

I don't foresee a card like Dragonlord Ojutai going anywhere, but it's not that attractive due to a high buy-in. A complimentary card like Scorn, on the other hand, may end up being a fantastic buylist play.

I don't want to speculate too hard on these uncommons, but I think they're worth stocking up when the opportunity presents itself at a reasonable price.

Penny Stocks & Mythics

I do love penny stocks, and who doesn’t? Low entry, with a bare minimum buylist price of $0.10 per rare. There’s always opportunity to be had, but we have to be careful. It's easy to want to get cute (I'm guilty as well), which is a good way to end up overpaying on a pile of garbage.

The big issue here is the high volume of these cards in circulation. BFZ rares, and even mythics, have been opened en masse due to the ongoing Expedition craze (which I'll talk about later below). Add this to the general trend of each Standard set selling more than the year before.

No matter how much we wanted Mantis Rider to go over 1$, it just couldn’t sustain that price for more than brief periods. This led those of us with tons of copies to sheepishly buylist them back, breaking even or taking a loss.

So tread carefully.

I've split the possible specs into two categories. One is for pure penny stocks. The other is for mythics and rares I think merit a reconsideration, but whose prices are above bulk.

A few notes: lean on ORI over BFZ, and lean on mythics over rares, assuming you can find good prices.

Penny Stocks

Rares and Mythics

There’s obviously not much to draw from considering we’re working with only two sets. A few of these have dropped a lot since their release, but continue to be what I would call “quintessential Standard cards.”

A perfect example of this is Drana, Liberator of Malakir. It's an inherently powerful card, with tons of potential, that happens to be kept in check by Mantis Rider right now. Its fortune may change come April.

In his article from yesterday, Mike Lanigan also pointed out Kiora, Master of the Depths. Like Narset Transcendant, Kiora looks to have some interesting build-around potential, but unlike Narset she's already started to see play in successful lists.

If might be a good time to grab cheap copies of the merfolk planeswalker. If anything, ramp strategies are only going to become more abundant once Oath of the Gatewatch releases, and Kiora slots right into the archetype.

Mike mentioned the G/u Eldrazi Ramp deck from GP Kobe in his article, and we talked about it on QS Cast as well. If you haven't seen it yet, take a look:

G/u Eldrazi Ramp (6th place at GP Kobe)

Part the Waterveil is certainly interesting to see in a ramp deck. The deck obviously did well last weekend, and it looks to be a contender. Alongside the renewed interest in (Dark) Temur, Kiroa 2.0 suddenly looks a lot better than initially evaluated.

People didn't think Kiora was terrible, of course, just overvalued. That was certainly true at the time, but with BFZ prices suppressed right now, it wouldn't be out of the ordinary to see some cards rebound. Remember, Expeditions aren't nearly as common as the fetchlands from Khans, so they can only soak up so much of the total set value.

What About Expeditions?

Speaking of Expeditions, let's talk about a few of them I think are well positioned before I go.

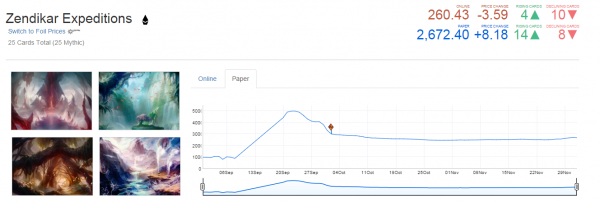

By now everyone knows these cards can hold their value. They have proven quite popular, which is clearly reflected in the price.

While the graph shows a decline, you can see it starting to trend upward at the tail end. Some of the less in-demand Expeditions, like Smoldering Marsh, are still dropping though, which has kept the average down and belied the movement exhibited by other Expeditions. Scalding Tarn, for example, has seen considerable gains since BFZ was released.

BFZ packs have been opened week in and week out for drafts and such, and there’s still a while to go. But if everyone has been waiting to pick up their Expeditions until the price drops more, the demand might be catching up or exceeding supply soon.

There may be a reprieve once Oath of the Gatewatch is released and a brand new set of Expeditions diverts people’s attention. At the same time, if they’re not as desirable as Battle for Zendikar Expeditions, there will likely be a renewed interest to purchase the latter.

If you're looking to invest in the Expeditions, sooner rather than later is the mantra. Some are obviously more appealing than others---here's what I would target:

Value-Priced Expeditions

The blue fetches are obviously great, and probably the Expeditions with the most robust future. I don't think it's crazy to take that direction, but I'm focusing on the ones with a lower entry point.

Flooded Strand and Polluted Delta are great and all, but I don't know how much upside they provide, especially in the short term. Scalding Tarn has posted some drastic gains, so there's definitely profit to be had---but at a steeper buy-in.

I'm looking to get the highest return for my investment, which leads me to the Expeditions listed above. They're available for a considerably lower price, and largely see the same amount of play in both Modern and Legacy.

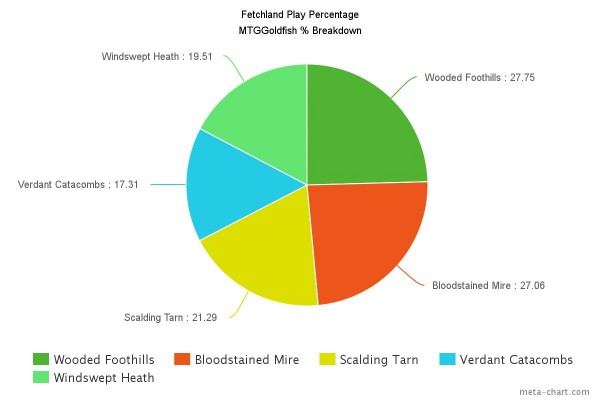

In Modern, red and green lands actually look to be supplanting blue lands as the most played ones. Here's a chart of the top five lands played in Modern right now, according to MTGGoldfish:

In Legacy blue is still king, but Verdant Catacombs sees lots of play there too. I think that Expedition specifically is one of the most promising---it has a considerable play percentage, and a drastically lower price entry in comparison.

I may be a bit biased when it comes to Cinder Glade, but it is the only Battle land seeing play in eternal formats, due to Scapeshift.

In any case, I'll be monitoring the price of Expeditions as we move forward, and I'll be sure to share my thoughts with you as they develop.

As always, if you're looking for future targets, there's some fantastic discussion taking place on the Insider forums and on QS Cast, as well as insights offered by other writers here at QS. Consider taking a look at Mike Lanigan's article about recent tournaments for some more ideas.

Until next time everyone

-Chaz @ChazVMTG

Nice article , speaking of expeditions i managed to get two scalding tarns on my last draft for around 200 euro each wich om super happy about (and so was he) . Loving them for long term value but as u said its a steep buyin!

Awesome, good haul. Should already see some modest gains on those Tarns.

Yeah, like I said the profits are there – but the buy-in is extremely steep. I know Tarn has trended upward in a big way, don’t know how much it can grow now. I was providing options to look elsewhere.

Great article!

Thanks! Glad you liked it Edward.