Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

I was never really the “doom and gloom” type. My faith in Magic has been continuously steadfast for numerous years---it’s why I always maintain a position in MTG cards. But I have to admit the recent overprinting of excessive sets has really shaken my fortitude. Just one look at the picture below, posted in the Facebook High End Group, gives me good cause for hesitation.

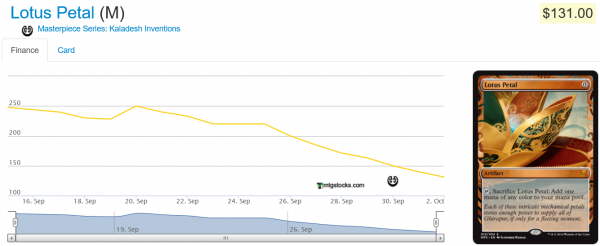

That’s a lot of high-dollar cards, and the supply of these is apparently huge. Since every one of these competes for our hard-earned cash, they all can’t maintain an elevated price. Hence, this happens:

It doesn’t matter how beautiful the artwork is on something like this. Nor can Cube, Vintage, and Legacy players generate enough demand for these. The supply far outweighs current demand for any individual Masterpiece. Thus, we witness severe declines.

These declines don’t stop at just the recently printed stuff. With the Masterpiece Series, we’re seeing formidable pricing pressure across all of Standard. Yet it is partially because all eyes are on the new Standard that we’re seeing rampant price declines on Modern and Legacy staples.

Net, it truly is a tumultuous time for MTG financiers. Most frighteningly of all: I’m not sure if it’s going to improve in the coming months.

Bull Markets

CNBC regular Jim Cramer states on his daily television show, Mad Money, “There’s always a bull market somewhere, and I promise to help you find it.” He’s inevitably correct about the stock market in saying this, and I believe there’s a similar mantra that can be applied to MTG finance. It’s not always doom and gloom everywhere. Some cards are climbing higher and will continue to do so.

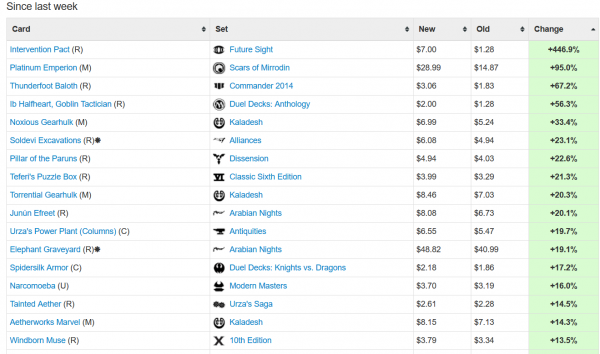

To find this bull market, I first stop by the MTG Stocks Interests list from the past seven days (not the daily list). Here’s what I’m seeing as of Sunday morning:

First, I’ll acknowledge there are three Kaladesh cards on the list: Noxious Gearhulk, Torrential Gearhulk, and Aetherworks Marvel. At this stage Aetherworks Marvel is highly speculative, so I would only acquire these if I believed in a breakout deck at the Pro Tour. Personally, I think there’s too much risk there.

The gearhulks are highly reminiscent of the old Core Set titans from years ago. When those were first printed, there were consistently two worth northward of $15: Primeval Titan was always number one and number two fluctuated between Frost Titan and Grave Titan depending on the Standard metagame of the month.

Even in an environment of Masterpieces dragging down Kaladesh prices, there still may be room for profit on a strategic gearhulk bet. The best gearhulk is green and unfortunately it’s already the most expensive. But if we look at history with the titans, the data suggest other gearhulks will have a shot at spiking above $10.

I’d recommend trading into the ones you think will make the most impact on Standard, but recognize you’re still gambling a bit. The upside is probably around 100% in gains on the non-green gearhulks, but you could end up paying $6 for a $1-$2 mythic. Thus, recognize you’re gambling in this endeavor.

The Best Way to Play

Outside of the three Kaladesh cards, the vast majority of last week’s movers are all casual and EDH cards. I look at stuff like Thunderfoot Baloth, Teferi's Puzzle Box, Pillar of the Paruns, and Windborn Muse and it all screams “Commander.” Each card has its own individual catalyst that is driving their prices higher. Those catalyst range from the printing of Leovold, Emissary of Trest to the anticipation of the upcoming four-color Commander decks.

If you’re looking for opportunities and would prefer not to gamble on Standard, this is the category that merits the most attention in my opinion. Leovold has rekindled interest in cards like Teferi's Puzzle Box, but foils are worth a closer look.

Other card-draw artifacts that become imbalanced with Leovold are also worth consideration, such as Howling Mine or even Temple Bell. Think the latter is a bulk rare thanks to its printing in Commander 2013? Think again.

Foils of both of these card-drawing engines are also attractive, especially since they help you dodge potential pressure of reprints in future Commander sets.

Want to know what else is Commander-driven but escaping bulk bins as we speak? Here’s a hint: they’re the only four-colored cards ever printed. If you guessed the nephilim, you’d be right!

These have all been climbing steadily since they bottomed in July 2015, and the announcement that our next Commander decks would be four colors has certainly helped catalyze demand further. If these can dodge reprint in the Commander set---a strong possibility in my opinion---then they're all destined to crack $2 by this time next year. While that doesn’t necessarily mean millions of dollars in profits, it certainly indicates these are all safe pickups with little downside risk.

Once again, foils are likely an even more attractive pickup if you want to go deep. But with the age of these cards and their singular printing, I believe nonfoils offer plenty of upside while requiring far less capital commitment.

If you’d prefer to play the new Commander set angle without looking at nephilim (they’re fairly mediocre creatures, admittedly) then you could consider lands and artifacts that produce all five colors of mana. This is probably the driver for Pillar of the Paruns’s recent move higher. Look to Reflecting Pool or Mana Confluence to start, but I’m sure there are many others.

Looking at Mana Confluence’s chart, it appears the card is just now bottoming out. If it dodges reprint, it should offer steady upward movement due to gradual Commander demand. Once again, if you want to guarantee avoidance of reprint risk you should consider picking up foils.

Another Consideration: The Counter-Trend Buy

Buying into these Commander cards would have been a profitable proposition thus far. In an environment where there’s a lot of downward pressure in other segments of the market, I’d prefer to stick with what’s working. Especially if there are future catalysts on the short-term horizon, such as the four-colored Commander decks.

But there’s something to be said about the counter-trend. That is, are there solid pickups that are currently being “hated” yet still offer excellent long-term potential? Perhaps. To me the best segment worth exploring in this space would be Modern, yet the looming threat of a Modern Masters 2017 reprint gives me reason to pause. Snapcaster Mage and Tarmogoyf have gotten awfully cheap relative to their all-time highs, yet I wouldn’t want to buy into these dips given the possibility of reprint in less than a year.

Legacy also provides counter-trend opportunities. The Craig Berry spike on Lion's Eye Diamond has been mostly erased over the past couple months. Perhaps there’s opportunity there? Better yet, what about picking up the fifth most played card in Legacy: Polluted Delta. This card has been dropping steadily over the past 12 months and it is approaching all-time lows. Could this be a counter-trend pickup opportunity?

Personally, I’m still a bit intimidated by fetchlands since shocklands performed so poorly for me a couple years ago. But fetches are always in greater demand and their last printing will get older and older over time. Then again, the constant threat of Zendikar fetchland reprint is quite the rain cloud on the fetchland investment, so maybe this too is a poor idea.

You know what? I say avoid the counter-trend buys for now. They’re performing poorly for a good reason. My advice: stick with what’s working and wait for some of this reprint risk to pass before buying aggressively into Modern and Legacy.

Wrapping It Up

There’s always a bull market somewhere. Even in somber times such as these, when Wizards of the Coast is printing so much product that players can’t even keep up with their wallets. The constant bombardment of new sets will certainly damage some card prices, but that doesn’t mean everything should be avoided.

Clearly Commander cards have been working, especially when selected carefully based on recent or upcoming catalysts. To me, these are some of the best opportunities for the next six to twelve months. While Modern and Legacy are pushed aside in favor of Standard, it’s difficult to get excited about most other possible investments. And with Wizards’ clear goal of keeping Standard prices lower, it’s especially difficult for me to get excited about Standard speculation---you basically have to buy into the right cards before the Pro Tour to have a shot at appreciable profit.

Therefore, I leave you with this recommendation: pick up Commander staples that will perform well in four-colored decks. While you’re at it, don’t forget about the revived strategies the latest Conspiracy 2 legends offer, such as Leovold, Emissary of Trest. These cards have been some of the best performers in the past month and I don’t see the momentum slowing yet. Foils likely offer the best upside with the lowest downside risk from reprinting. I’d start there.

In the meantime, invest cautiously as we navigate a very trying time for MTG finance. That’s the best advice I can offer.

…

Sig’s Quick Hits

- It seems All Hallow's Eve has recently gotten a bump higher in price. This is likely just gradual decline in supply as the card ages more and more. It’s always been a favorite of mine, especially this time of year. I wouldn’t panic and buy out the market, but if you want a copy why not get one sooner rather than later? Star City Games has just one copy in stock and it’s MP, $49.99. Even Italian copies have gotten expensive (although they’re more plentiful), with Near Mint selling at $44.99.

- Star City Games is completely sold out of Temple Bells, apparently. Perhaps they see the recent price jump and are holding off to see where the dust settles. Either way, their $0.59 price for non-foils from Commander 2013 is likely to increase upon restocking. They’re already a little above market price for foils, at $4.99, but I suspect that price will also rise before the end of the year.

- Chaos Orb is still extremely low in stock thanks to Old School MTG. Star City Games has zero Alpha and Beta copies for sale. They only have one Unlimited copy in stock: it’s MP and $174.99! These have really jumped thanks to the Old School format. But I’ll admit I think the momentum has finally slowed, so I don’t expect this to climb much higher for a bit. I expect we’ll need to wait for Standard hype to die down before this and other Old School cards can gain traction for another leg higher.

Sig – really enjoyed this. Wonder how well set foil Mana Confluence will grow with it having a pretty expedition version

Thanks for the feedback! The week away helped erase some writer’s block :-).

Set foil Mana Confluence should gain some traction eventually. The most exciting version is of course the Expedition, but I suspect set foils will catch a bid sooner or later. I think you’ll have to be patient with this one though since the card was printed recently. Still, I almost wonder if it’s a better grab than something like Polluted Delta which people are already sitting on loads of copies of (plus Khans was a large set vs. Journey into Nyx).

Yeh maybe always had it pegged as a good foil to have but the expedition I think has pushed timelines out on the gain I wanted. No I think Modern staples at rare rarity I am clean staying off now. The non foil confluence I wouldn’t touch could easily be in every 4 colour commander deck they print for example……

Snapcaster Mage you mentioned, I think if its printed at Mythic its a good buy but if its a rare….

If it’s rare, that’s quite the dagger to Snapcaster’s price. Noble Hierarch survived reprinting at rare though…