Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the MTGO Market Report as compiled by Matthew Lewis. The report will cover a range of topics, including a summary of set prices and price changes for redeemable sets, a look at the major trends in various Constructed formats and a "Trade of the Week" section that highlights a particular speculative strategy with an example and accompanying explanation.

As always, speculators should take into account their own budgets, risk tolerance and current portfolios before buying or selling any digital objects. Please send questions via private message or post below in the article comments.

Redemption

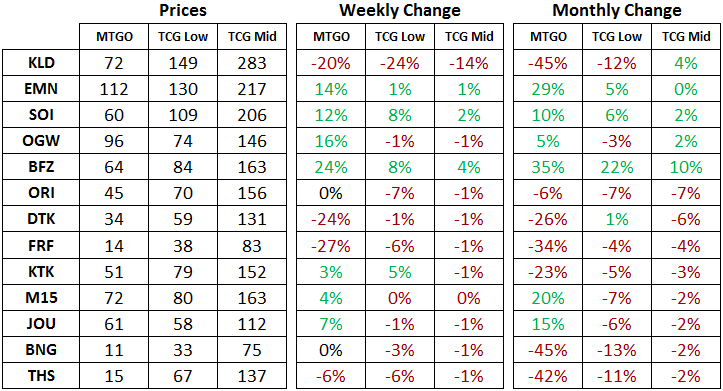

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of October 24, 2016. The TCGplayer low and TCGplayer mid prices are the sum of each set's individual card prices on TCGplayer, either the low price or the mid price respectively. Note that sets of Theros (THS) are out of stock in the Magic Online store, so this set is no longer redeemable.

All MTGO set prices this week are taken from GoatBot's website, and all weekly changes are now calculated relative to GoatBot's "full set" prices from the previous week. All monthly changes are also relative to the previous month's prices, taken from GoatBot's website at that time. Occasionally, full set prices are not available, and so estimated set prices are used instead.

Flashback Draft of the Week

Triple Innistrad (ISD) drafts start this week just in time for Halloween! This is a beloved draft format, sometimes described as the best draft format of all time. If you are looking to try this format out for the first time, be sure to read up on some of the draft strategies that you can employ. Limited Resources is a podcast focused on improving at draft formats, and so starting with their work is a great first step in boning up on triple ISD. Here's a link to the Innistrad Sunset Show where Marshall Sutcliffe and Jon Loucks discussed the format after playing it for a number of weeks.

On the value front, keep your eyes out for one of the flagship cards of Magic in Liliana of the Veil. This is routinely among the most expensive cards in Modern, and everyone is hoping to crack this in their boosters. Snapcaster Mage is a nice rare to open and it's coming in at around 10 tix at the moment. There aren't any commons or uncommons with much value, so there won't be much chance to make up for a bad draft with valuable pulls.

Standard

The big news in Standard this week is the return to a single rotation in the fall. The immediate impact of this move is to increase the longevity of Battle for Zendikar (BFZ) and Oath of the Gatewatch (OGW) in Standard. Note that there is no change to the amount of time that Shadows over Innistrad (SOI) and Eldritch Moon (EMN) will be in Standard. Gideon, Ally of Zendikar appears to be the prime beneficiary of this change, as the usual slide in price prior to rotation gets delayed into the summer. An extra six months of Standard playability goes a long way to supporting the price increase of the last week.

This does mean there is some opportunity on out-of-favor cards from BFZ block. I would look towards cards that have seen play in Standard already and also keep an eye out for mechanics and themes from Amonkhet (AKH), the spring 2017 large set. It's possible that some powerful interaction between cards from BFZ or OGW and cards from AKH will slip through the cracks. Stay tuned for any leaks or spoilers from AKH; savvy speculators will have the chance to get their copies of relevant cards before the masses and make a nice profit, regardless of whether or not the interaction is Standard playable.

If you've been paying attention, the end of September and heading into the release of Kaladesh (KLD) was an excellent time to be picking up cards from Eldritch Moon (EMN) and Shadows over Innistrad (SOI). Both sets have shown strong price gains in the past week, with each rising by over 10 percent as the new Standard format shakes out and players seek to try out the new strategies.

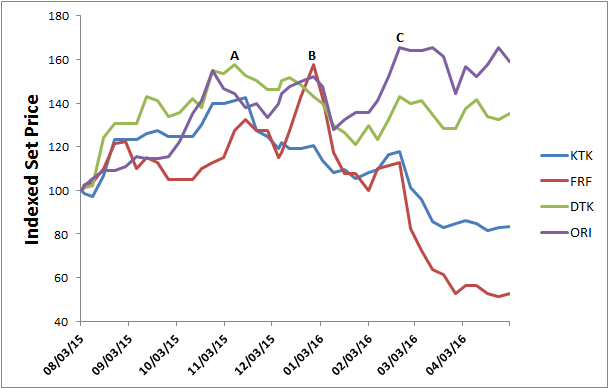

In light of these recent price gains, speculators should be thinking about the best time to sell. Although there is lots of room for individual cards to move up and down in price, price trends from recent Standard sets heading into the winter do give some guidance on what to expect. Below is a chart of indexed set prices for Khans of Tarkir (KTK), Fate Reforged (FRF), Dragons of Tarkir (DTK), and Magic Origins (ORI). The index begins on August 3, 2015, with each set at 100 and it runs until the end of April, 2016. Each data point is the the price of the set on that day, divided by the price of the set on August 3, 2015, multiplied by 100.

Three key time periods are marked A, B and C. Point A occurs at the end of October and into early November of 2015. In this time period, all four sets found at least a near-term price peak. For DTK, it is the highest price for the whole time period, peaking on November 9 at 150 tix with an indexed value of 158. KTK saw its highest price a week later at 104 tix, with an indexed value of 142. ORI found a near-term price peak on October 26 at 140 tix and an indexed value of 155. The smallest gain around that time was for FRF, which also saw a near term price peak at 53 tix on November 16, with an indexed value of 133. All of these price gains can generally be seen tracking interest in Magic ramping up from the end of summer and into the new fall Standard.

The next important time period is around point B, right at the beginning of 2016. FRF reached its all-time high on December 29 at 63 tix and an indexed value of 158, largely on the back of Monastery Mentor. ORI was on the upswing again, as well, cresting near its past peak on the same day at an indexed value of 152. Both DTK and KTK were in the middle of a downtrend, though that continued into January of 2016 when all set prices came down rapidly around the release of Oath of the Gatewatch (OGW).

Point C is the all-time peak for ORI and the post-OGW peak for DTK. ORI hit a price of 149 tix on February 22, an indexed value of 166. KTK and FRF rose briefly at the time, too, though both of these sets were staring down the first and only spring Standard rotation, so their values were in terminal decline at that point.

With all of this evidence in mind, it's clear to me that the next four weeks represent the best selling opportunities for SOI and EMN. Selling sooner rather than later will also generate liquidity in your portfolio, which can be put to good use around the release of Aether Revolt at the end of January 2017.

There is a chance for higher prices later into the winter, but there is no certainty of this. If you managed to sell out of ORI at the peak around point A, you would have had almost four months to make use of your tix before ORI exceeded that early price peak. If you sold out of DTK at that time, you would be sitting pretty looking at the declining set price for most of the that winter. Obviously the trends for KTK and FRF are not going to befall SOI or EMN, but the point should be clear that the bulk of the gains for these sets will have already occurred before December.

With the recent reversion to only rotating Standard in the fall, it also turned out that buying sets of Battle for Zendikar (BFZ) and Oath of the Gatewatch (OGW) in September would have yielded good results. Previously the expectation for these sets would have been to follow the path of KTK and FRF, but with an extra six months in Standard, these two sets have a chance to see a new price peak this winter.

Modern

Last week, I was looking at a probable bottom for DTK and ORI, but DTK found a new lower price this week, dropping 24 percent to 34 tix for a complete set. This price has to be considered "good value." With Collected Company, Atarka's Command and Kolaghan's Command all being Modern staples, speculators and players alike should be confident in picking up sets of DTK at current prices. A price of 34 tix is the lowest set price for a redeemable large set since the redemption fee was raised to $25.

Here's another reminder that Born of the Gods (BNG), Journey Into Nyx (JOU) and Magic 2015 (M15) will all go offline for redemption in November. This means that there will be some price adjustments on cards from these sets as the price floor provided by redemption disappears. If you are holding any mythic rares from these sets, particularly cards that are not Modern playable, be sure to sell these soon. For example, Nissa, Worldwaker is a 7-tix card right now, and this value is coming mostly from redemption since this card is not Modern playable.

On the singles front, Cavern of Souls has rebounded very nicely in the last few weeks after hitting a low of around 21 tix with the release of KLD. Its current price of 36 tix is in the middle to top end of its range from the past year. If you were lucky enough to pick up a playset or two of these, don't be afraid to sell them if you are not using them at the moment. Triple Avacyn Restored (AVR) draft is going to enter the flashback draft queue in two weeks. Although not a beloved draft format like triple ISD, there will still be a few plucky drafters lining up to relive this format. That means we can expect a price dip on cards from this set.

Trade of the Week

As usual, the portfolio is available at this link. With the advent of Black-Green Delirium strategies this week at Grand Prix Providence, I felt it was time to start paring down the number of Grim Flayers in my portfolio. It's had a nice run from 7 tix to 20 tix, so there's no shame in taking a little profit off the table at this price. In light of my above analysis regarding the best time to sell, it's prudent to be a seller of cards from EMN and SOI over the next month, and I like to take my own advice when I can.

So maybe I’m reading this wrong, but by the table, KLD sets are $72 on MODO and $149 for TCG Low – Is there money to be made right now in investing in these sets to redeem and sell?

There is money to be made, but you have to be able to control costs on purchasing the cards on MTGO, and then you have to be able to move the sets profitably in paper.

Once redemption opens for KLD (early November I believe), then the price difference between MTGO and paper will start narrowing. There will be many operators trying to squeeze profit out of the exact thing you have observed here.

I tried redeeming sets a few years ago. I found out that shipping costs to Canada are an extra charge as well as paying duties. Next, I found I couldn’t get top dollar for my paper sets because I was not an established seller. All in all, it was not a profitable enterprise, but I certainly learned a lot in the process.

If you are keen to try it out, I would pay attention to what David will write, and start small to see if it works for you.

Not to Hijack this from Matt but I wrote an article covering just this question that should hopefully come out later this week.

I’ll look forward to it!

Did I miss this one?

I don’t understand the different forecasts for BFZ OGW block and SOI EMN.

‘With all of this evidence in mind, it’s clear to me that the next four weeks represent the best selling opportunities for SOI and EMN.’

and

‘(BFZ and OGW)… these two sets have a chance to see a new price peak this winter.’

Or maybe I’m misreading, ‘a chance to see a price peak’ doesn’t necessarily mean ‘I think these will see a new price peak this winter’.

I wrote most of the Standard section just thinking about EMN and SOI, and then I tacked on some comments regarding BFZ and OGW due to the change in rotation. I think that’s why there is some dissonance. I will clarify here.

I think all four sets are going to peak at some point over the next 4 to 6 months. I also think the best selling period for all four sets, due to a combination of recent price gains, risk, and opportunity cost, is the next 4 weeks.

Thanks for commenting!

“Although not a beloved draft format like triple ISD”

Possibly the greatest understatement of all time. AVR is widely considered the worse draft format of all time, if the view is widely spoken of over the coming weeks cavern might not take much of a hit from this.

Well that’s true! I like aggressive formats and I enjoyed AVR limited, even though I acknowledge the criticism. I made my best high level finish at GP Vancouver, which featured AVR sealed and draft.

https://www.youtube.com/watch?v=Dzz1aRYXtwU