Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

I see many people tout the virtues of Reserved List (RL) cards. It always seems as if anything could spike next and with the limited supply of RL cards there is a lot of money to be made. Or is there? Today I want to look at the pros and cons of investing in RL cards---mostly, however, the cons, as I feel many people overlook or underestimate those.

Pros of Reserved List Investing

As many have spoken about this I will summarize the main points:

As many have spoken about this I will summarize the main points:

- There is a finite supply of RL cards; for some the numbers are known.

- Wizards has promised us that they will never reprint these cards in functionally identical form.

- The newest of these cards were printed in 1999.

- The playerbase was much smaller when these were printed.

- There has been plenty of time for these cards to get lost to natural causes.

- The top RL cards have shown consistent growth over many years.

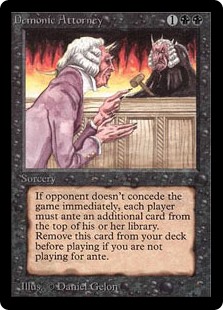

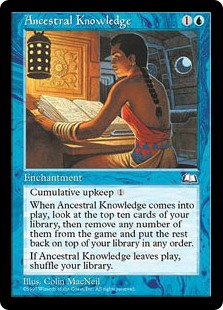

- Every now and then a new RL card makes it big.

These are good points and I am not going to tell you that there is absolutely no merit to investing in RL cards. I hold quite a few RL cards myself and I know they are a safe investment that I can hold for many years. However, that's largely the collector in me speaking, as to a trader there is no gain to just owning cards. As a trader I certainly appreciate these factors, but there are also other things to consider.

Cons of Reserved List Investing

Rarity vs. Demand

Obviously there are people who like these older cards. The question to ask is how common they are when compared to the number of copies printed.

Obviously there are people who like these older cards. The question to ask is how common they are when compared to the number of copies printed.

An Alpha rare? Sure, I believe there are probably enough people to create demand for all 1100 copies (even if everything has been reprinted). A Legends rare? Sure, 19,500 copies can probably find a home somewhere, though it may be hard for the weirder ones. A Revised rare? Hmm, now things start becoming more interesting. I can certainly see demand for 289,000 copies of a dual, but can we really find a place for just as many Veteran Bodyguards? As its price illustrates: no, we can't.

Lets try to get a feeling for the kind of demand needed for an equilibrium for the sets we know the numbers of. Be aware: Stephen D'Angelo, who originally put these numbers together on Crystal Keep, included a relevant disclaimer at the beginning of his post. These numbers may be the most reliable we have but they are not guaranteed to be accurate.

Based on these numbers, and Wizards' statement that there were around 20 million Magic players and fans in 2014, we can calculate how common or rare the person must be who wants a copy of a card. Demand significantly higher than available copies makes a card sellable, whereas significantly less demand likely mean you'll be stuck with a card for some time.

We'll compare these to that 20 million number as it's often quoted. I'll list a number for both playsets and singles, as different cards are likely to be demanded in different numbers.

| Set Name | Volume (Rares) |

Demand (Playset) |

Demand (Singles) |

| Alpha | 1100 | 1 in 72727 | 1 in 18182 |

| Beta | 3200 | 1 in 25000 | 1 in 6250 |

| Unlimited | 18500 | 1 in 4324 | 1 in 1081 |

| Revised | 289000 | 1 in 277 | 1 in 69 |

| Arabian Nights | 20500 | 1 in 3902 | 1 in 976 |

| Antiquities | 31000 | 1 in 2581 | 1 in 645 |

| Legends | 19500 | 1 in 4103 | 1 in 1026 |

| The Dark | 128000 | 1 in 625 | 1 in 156 |

| Fallen Empires | 744000 | 1 in 108 | 1 in 27 |

For an Alpha card, we can see that you need very few people to want it at a given price. On the other hand, you probably know at least 27 Magic players; what is the likelihood that at least one of them is interested in some random Fallen Empires card that's usually played as a single copy?

At the time these sets were printed there were actually very few players compared to today. We know that Fallen Empires was overprinted for its time, and was an unpopular set to boot, but I've never seen Revised referred to as such. (In fact, the destruction of Summer Edition is said to have led to a Revised shortage in '94).

Given playerbase growth I don't think it would be out of the question for later RL cards to have a print run closer to or beyond the Fallen Empires numbers in order to line up with the bigger playerbase of their time. I was able to find some numbers estimating the size of the playerbase by year here, though no references are given. Unfortunately it doesn't go back far enough for our needs, but my gut feeling would be that by the time Fallen Empires was printed it was still well under the 5 million suggested for 1997-1998.

Another way to look at it is to compare the playerbase numbers as print runs should roughly align with the number of players. 5 million players suggests that rares back then were printed for a playerbase 25% the size of the current playerbase, and thus are about four times as rare as they should be if they were printed now. Of course Wizards changed the rarities, but as a rough estimate this should still work.

Finding a Target Audience

I'm sure that if you ask the regulars at your local game store about duals or Power 9, quite a few will know what they are. How many of them do you think could tell you what a Damping Field, Frankenstein's Monster or Kudzu does?

I'm sure that if you ask the regulars at your local game store about duals or Power 9, quite a few will know what they are. How many of them do you think could tell you what a Damping Field, Frankenstein's Monster or Kudzu does?

Unfortunately there are far more unexciting RL cards than there are gems---the same is true for the sets these cards are from in general. As such, very few players who started well after Urza's Destiny (the cutoff for the RL list) ever looked into these cards.

I see many players these days just skip over anything in trade binders with old borders. To move this stuff you need people who were around at this time, or who have extensively researched older cards, because people just aren't going to read every card they see in a binder.

This would likely include other traders, who go after these cards for the same reasons you do. Otherwise you need people who have been around for some time, or who have tried hard at catching up. Other traders will be looking for a deal, and the old-timers have had many years to pick up the cards they want. So your audience is comprised mostly of the third group, the players trying to catch up. How many of these do you think are around?

As a card's price grows, fewer people will want it at that price. On the other hand, if its playability has increased that may push up demand even at the higher price. The rarity of the cards helps, but, as illustrated, probably not all that much unless you're considering really old cards. It may be very hard to find that person who would buy it at the new price, even if on paper you have made pretty significant gains.

You may of course trade to other traders, which is basically applying the "greater fool theory," but in that case you're playing a game of hot potato and the prices lose touch with reality altogether. You could count on selling to a shop and make it their problem, but you usually need a very big price jump for their buylist price to get above what you bought in for.

Patience Required

The RL covers the entire range of Magic card quality, from utter crap to the most precious gems. As so many years have passed already, most gems have been found by now, barring an RL card that becomes better with a newly printed combo. The latter is a crap-shoot at best---you could buy a whole lot of different cards and hope something happens, but you're still out for the cost of everything that doesn't spike. The former cards already see heavy trade and high prices. They could indeed go higher, and likely will over time, but do you have the patience to wait for that?

The RL covers the entire range of Magic card quality, from utter crap to the most precious gems. As so many years have passed already, most gems have been found by now, barring an RL card that becomes better with a newly printed combo. The latter is a crap-shoot at best---you could buy a whole lot of different cards and hope something happens, but you're still out for the cost of everything that doesn't spike. The former cards already see heavy trade and high prices. They could indeed go higher, and likely will over time, but do you have the patience to wait for that?

Ideally, you would be able to predict the sort of card Wizards might print that breaks something, and estimate the likelihood of that happening. Unfortunately, you're not alone, so even cards with potential already have an above-average price due to other people figuring out their potential too. At this point we're basically left with the dregs or with already-expensive cards that may not see the percentage gains of your dreams.

There is still money to be made, but realize that few cards are left that could make the amazing jumps we have seen in the past. Put differently: if it was going to jump it likely already would have.

You can go two ways. If you invest in dregs you hope that the few that jump pay for the rest. If you invest in gems you count on them rising further, either steadily or through a spike if something new makes them even better. Neither is ideal as the jump of the dregs may never come or it may be too small, while the gems require a much more substantial investment and the average gains per period are probably not too exciting.

If you tend to do long-term investing (on the order of years), both could work as they are low-maintenance and you just wait until whenever they reach your target. But if you like to work on a shorter time frame (weeks to months) you probably only want to look for spike situations when shops are lagging behind, and then flip immediately.

Final Words

Personally, I like long-term investing; I am happy to accept that it may take years before an investment pays out. I just don't have the time to keep up with the volatility of newer cards.

Personally, I like long-term investing; I am happy to accept that it may take years before an investment pays out. I just don't have the time to keep up with the volatility of newer cards.

I know that I may have a hard time finding someone to sell to, but I have the patience to wait for them to show up. I also tend to get most cards like this by buying collections---those deals tend to be good enough to get my money out of other cards, while I hold the RL cards for future gains.

So the Reserved List can still present value to speculators, but it's not for everyone. Depending on your goals with Magic finance and your resources, both in time and money, it may be a more or less promising venture.

Well written article Niels. I really appreciate the table as it’s an easy to understand comparison between the early sets and demand potential.

Thanks David! I thought that might be an interesting way to look at the data. Wish we had confirmed numbers.