Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the MTGO Market Report as compiled by Matthew Lewis. The report will cover a range of topics, including a summary of set prices and price changes for redeemable sets, a look at the major trends in various Constructed formats and a "Trade of the Week" section that highlights a particular speculative strategy with an example and accompanying explanation.

As always, speculators should take into account their own budgets, risk tolerance and current portfolios before buying or selling any digital objects. Please send questions via private message or post below in the article comments.

Redemption

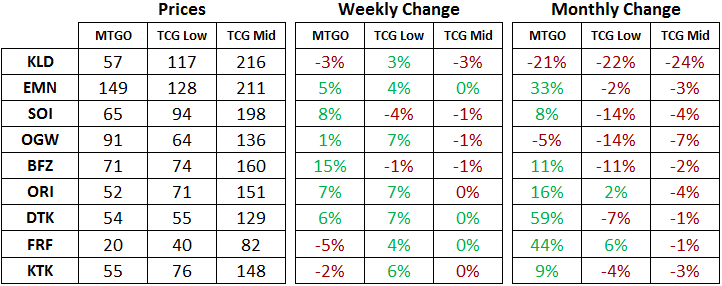

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of November 28, 2016. The TCGplayer low and TCGplayer mid prices are the sum of each set's individual card prices on TCGplayer, either the low price or the mid price respectively.

All MTGO set prices this week are taken from GoatBot's website, and all weekly changes are now calculated relative to GoatBot's "full set" prices from the previous week. All monthly changes are also relative to the previous month's prices, taken from GoatBot's website at that time. Occasionally, full set prices are not available, and so estimated set prices are used instead.

Outside of Kaladesh (KLD), prices continue to rise on MTGO this week, with Eldritch Moon (EMN) leading the way as the most expensive set in Standard. It's now up 80 percent from its low of 83 tix in September. Shadows over Innistrad (SOI) is also finally getting in on the act with an 8-percent increase this week. SOI is still cheap relative to its paper price, and it compares well with other redeemable large sets, so I am anticipating further price gains over the next month.

Battle for Zendikar (BFZ) jumped 15 percent largely on the back of Gideon, Ally of Zendikar, which set a new all-time high of close to 37 tix. Oath of the Gatewatch (OGW) has languished in comparison, with that set's top card, Kalitas, Traitor of Ghet, dropping below the 20-tix mark for the first time in two months.

For the recently rotated sets, both Magic Origins (ORI) and Dragons of Tarkir (DTK) rose this week on MTGO. It looks like interest in Modern and the relative price differential with paper is driving their digital prices higher. Paper prices on these two sets are stabilizing and this will be constructive for digital prices going forward.

Flashback Draft of the Week

The second visit to the plane of Ravnica is the setting for this week's flashback draft. Triple Return to Ravnica (RTR) draft features the reprinted shocklands and the old Standard powerhouse Sphinx's Revelation. There is also Rest in Peace in the rare slot, a powerful sideboard card in Modern and the highest priced rare in the set at 6 tix. Another card to watch out for is Jace, Architect of Thought. It hasn't shown any utility in the current Modern format, but it has popped up in the past and has been as high as 10 tix in the past twelve months.

The draft format focuses on five of the ten guilds, with the other five guilds covered next week with triple Gatecrash (GTC) draft. If you are into podcasts, Limited Resources is excellent and does an overview of each of the guilds and how to draft them in this episode. Trying to figure out which cards are important for a particular guild and which guild is open in the draft will carry you to success for triple RTR draft.

The Future of Standard Speculation on MTGO

With the shortening of the redemption window for Kaladesh (KLD) and all future sets on MTGO, speculators will have to make adjustments to their strategies. No longer will redemption provide a price floor on Standard sets; the price of KLD cards will fluctuate with the vagaries of supply and demand. As a result, we'll have to put aside all strategies related to redemption. This means that buying full sets at the end of a set's draft period will no longer work, nor will targeting full sets as they rotate out of Standard. Junk mythic rares will end up being pure junk as soon as redemption closes.

Fortunately, we already have ample evidence there there are successful speculative strategies for non-redeemable objects. Most Modern-legal cards are digital objects that cannot be translated into paper. Take for instance, Blood Moon. The last time this card was redeemable was about ten years ago, since Modern Masters (MMA) was not redeemable. It has regularly fluctuated between 20 and 40 tix in the last two years and is now at an all-time high of almost 50 tix. Buying this card when interest in Modern is on a downswing and then patiently holding for a number of months has proven to be a profitable strategy. And Blood Moon is not an exceptional card. There are many Modern staples that regularly cycle up and down in an almost predictable way.

Having such a clear example to guide us, it's safe to say that cards from KLD and Aether Revolt (AER) will also experience their own price swings up and down, depending on rising and falling interest in Standard and Modern. Once redemption on these two sets ends in May, supply and demand from within the MTGO economy alone will dictate the price of cards like Smuggler's Copter and Chandra, Torch of Defiance.

Previously the prices of cards being drafted would generally bottom out just prior to the release of the newest set and draft format. The two lowest-risk moves you could have made in the last year would have been to buy OGW sets in April and EMN sets in September. These two expansions both saw price increases of 50 percent or more in the weeks after they stopped being heavily drafted. Redemption provided the trust that that total set price would be relatively stable, so there was no need to try and pick out which cards would be the most valuable. Just buy them all!

If KLD and AER would have been redeemable like every other past set, then buying complete sets sets in April would have been a fine strategy. As it stands, though, the end of redemption means that the price of these sets could bottom after the close of redemption. Redemption will be closing in the month after the introduction of Amonkhet into Standard, so there will be competing forces acting on prices. Demand could be up due to renewed interest in Standard, while supply could be high due to redemption closing. Speculators will have to be more cautious on timing their buys as a result.

I suspect there will be a spike in demand just prior to the end of redemption. Anyone who had been thinking about redeeming a set will have to complete their sets by the redemption deadline. The marginal cost of completing the set will be small relative to the sunk cost of the rest of the set already in their collections, so they will be looking to complete their sets and they won't be as picky in terms of price.

Once the window to redeem these sets closes, then any bag holders will be looking to sell their cards. As a result, prices will decline as these stranded assets hit the market. Junk mythic rares in particular will find new all-time lows; I would expect some KLD mythic rares to sell for less than 0.01 tix by June.

Part of the challenge for speculators will be to avoid buying the cards that are pure junk since these will no longer have a price floor provided by redemption. This is the easy part, as most rares priced in the 0.05 to 0.50 tix range are closer to junk than not. Mythic rares in the 0.2 to 1.00 tix range are the same. If you are buying cards in these price ranges, then you are targeting very marginal cards that will lose almost certainly lose value after redemption closes.

If you are buying rares for 0.01 tix or mythic rares for 0.05 tix or less, then you are in the pure junk category already and the loss of value from redemption closing will be small. Buying cards at these prices will be a gamble based on their take up in Standard or Modern. Essentially you would be betting that these cards are not, in fact, pure junk and that they will be played at some point. I think it's a fine gamble if you have a knack for identifying cards that are underappreciated.

The rest of the challenge will be for speculators to be brave and to buy cards that are no longer tied to anything with physical value. If you are comfortable doing that, then buying Standard and Modern staples and playables from KLD and AER in the late spring will be a profitable strategy. Patience will be required as usual, but I have no doubt that the changes to redemption will not impact the speculative potential for these sets. The end of redemption means that speculators will have to be more careful about managing their downside risk, but the upside will still be dictated by supply and demand in the MTGO market, which is still dominated by players and the in-game value of the cards.

Trade of the Week

As usual, the portfolio is available at this link. This week I bought a few copies of Cavern of Souls at the conclusion of the triple Avacyn Restored flashback draft queue. An all-format staple in multiple archetypes is about as much of a no-brainer speculation target as you can get. All you have to do is poke around for the lowest priced playsets near the end of the flashback queue and throw them into your portfolio. Typically the prices rebound in the following month to a break-even level, with further gains entirely possible. This one is no different and it is already at a price where I could sell my copies at no loss, if I had to get liquid for some reason.

Modern prices are currently in an uptrend and I will look to sell this position before the end of February. I'm not too concerned about what price it reaches, but if it gets into the 35 to 40 tix range, I would consider that a good selling price. The bigger concern is the threat of this card being reprinted. Holding Modern staples into the late winter will have rising reprint risk as we get closer to the release of Modern Masters 2017 (MM3) and its attendant spoiler season. The release date for MM3 is set for March 17, 2017.