Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome back, readers!

Today's article will focus on a fundamental aspect of buying/selling items. You don't make a profit when a card's value goes up—you make a profit when you sell or trade the card at its new value. And the actual money you receive in these transactions can differ markedly from the numbers you see in price charts.

A Concrete Example

Superfriends decks built around planeswalkers have been a popular option in Commander for some time. The printing of Atraxa, Praetors' Voice has renewed interest in these archetypes, which can make especially good use of a repeated proliferate effect. As a result, several cards that interact directly with planeswalkers have seen gains, including The Chain Veil, Teferi, Temporal Archmage and Ajani Steadfast.

Let's take a look at two of these recently spiked cards.

The Chain Veil

I myself didn't stock up on The Chain Veil, though I did purchase two foils for $8 each back in November 2014. I did think the card had strong Commander potential (hence why I went with foil versions).

You could buy this card for around $2 for months. Then all of a sudden we see a nice price spike. The card hits $6 before dropping back down to the $5 mark. So if you had been buying up copies at the $2 mark you may look at your stack and think, "Wow, I just made 250% in profit!" But have you?

You can't go into Target and trade in four copies to buy the latest blu-ray movie you wanted, nor can you hand one to the cashier at McDonald's to cover your lunch. I realize that sounds a bit facetious but it's common knowledge that (outside of major Magic events or your local game store) Magic cards don't act like regular currency. They have to be converted into regular currency via transactions.

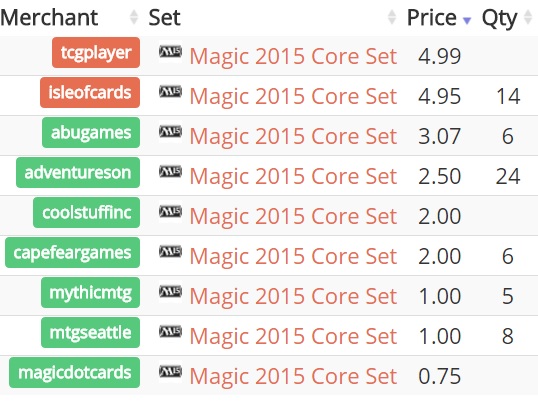

So let's see the actual buylist prices for The Chain Veil.

Looking to vendors outside of Trader Tools, we also know:

- Star City Games is paying $2 for NM copies.

- Channel Fireball is paying $2.50 (for up to 50 copies).

So let's run the numbers. Say you bought 100 copies of The Chain Veil. You could sell:

- 6 copies to ABU Games for $18.42

- 50 copies to Channel Fireball for $125

- 24 copies to Adventures On for $60

And your remaining 20 copies you could cash out at a break-even(ish) price. So all in all you would have invested $200 and made at most $43.42, not including the cost of shipping the cards to said dealers (we're also assuming all copies are actually NM). If we include just the shipping cost we're likely looking at more like $30 in profit.

To be fair, this is a 15% profit margin, which is actually pretty healthy in the business world. But it's a far cry from that 250% figure we initially thought of.

This is also the minimum profit you could expect to make on this spec, because you could throw a bunch of copies up on TCG Player (even at, say, $3.50) which would put you ahead of the buylist prices. But isn't it crazy how a card can jump up 250% in a week and even if we'd stockpiled them we might only make 15% profit?

Another caveat to this is that buylists shift slower than selling prices (for the most part). The major stores don't want to get caught up in a hype-based jump and then lose out when the hype stalls and the card plummets. They tend to simply wait for the market price to reach a steadier state before raising prices. So it is entirely possible that we'll see other buylists start to move upward, which would allow for additional guaranteed minimum profit.

Ajani Steadfast

Here's another card that benefited (most likely) from the printing of Atraxa. Along with Teferi, Temporal Archmage, Ajani Steadfast has seen strong growth in the past month or so.

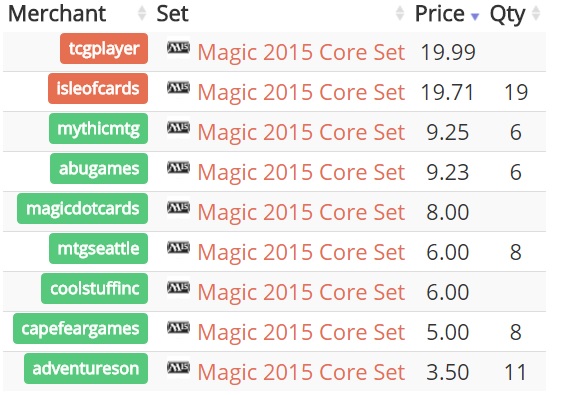

For almost two years, Ajani buylisted in the $4-$5 range and retailed in the $6-$8 range. With the recent spike in Ajani we now have a retail price of almost $20 and buylist prices ranging from $5-$9.25. If we had spent the same $200 as above on Ajani Steadfast, we could have purchased 29 copies (assuming we bought them for an average of around $7 each).

- SCG is paying $6 per copy.

- Channel Fireball is paying $6 per copy.

So again we would sell:

- 6 copies to MythicMTG for $55.5.

- 6 copies to ABU Games for $55.38.

- Finally, if we review MagicDotCards we see that the NM buylist is actually $6.40 ($8 is only for Gem Mint). This is less than what we paid and we'd be losing $0.6 per copy if we sold out. Meaning we will hold all additional copies in the hopes that other buylists go up.

So this time our total minimal profit (again, barring shipping costs and condition downgrades) is $26.88. With shipping to three separate vendors it's likely closer to $20, giving us a decent profit margin of 32%. Again it's important to keep in mind that this is the minimum profit assuming we couldn't out any copies at prices closer to retail via regular sales.

But even then we had a card go from $7 to $20 (a 285% gain) and we're still only making around 32% profit.

The Takeaway

The reason I wanted to emphasize these two examples is because when you first start out speculating it's very easy to get carried away when one of your spec targets jumps in value. The rush you get from a called spec (especially one a lot of people disagreed with you on) is a pretty powerful high, and it's easy to just keep buying into more and more specs, assuming the tide will always keep rising.

Thus it's absolutely critical to understand that just because the retail price on a card jumps, that doesn't mean you've actually made a profit. Profits occur only after you've converted those cards into cold hard cash.

Now, obviously the profit margin is heavily dependent on your initial investment. For this exercise I assumed you purchased the cards at retail prices; you could also set up your own buylist, either as a store or locally. If you can acquire your spec targets for less than retail, then your profit margin will go up (potentially by a considerable amount), but you may have more difficulty acquiring copies as well.

Remembering Risk

One other factor that isn't calculated in these profits is the risk associated with the investment. I realize this is a very amorphous (and exceedingly difficult) factor to include in any type of calculations, but it is one we need to at least keep in mind.

After all, if we had been stocking up on Master Biomancer (which was a solid spec target) then the Commander 2016 reprinting would have shown us a 14% retail price drop and a full 25% buylist price drop.

You can look up numerous ways to calculate certain forms of risk, but currently I don't have a great method to apply to Magic cards. I imagine that if someone had a concrete method to calculate risk for Magic specs, they could make a good bit of money selling it to the major stores.

Conclusion

My final thoughts on this matter are simply that we need to understand the true profit we generate from speculating. This means setting realistic expectations, remembering hidden costs like shipping, and understanding that there's always a risk (even if it's extremely difficult to calculate).

If any of my readers do have a good idea of how to approach systematic risk calculation on Magic specs, I'd love to open a discussion, whether on the forums or in the comments below.