Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Hey. Spoilers for Aether Revolt are here. I don't want to talk about them in my article yet, because I'm not the person to ask if you want to preorder stuff. We all know what my niche is here, and we're going talk about some bulk today. Check out mythicspoiler.com, and then come back to grind some bulk.

Qualifying Past Promises

Okay, remember how last week I promised that I wouldn't do a "year in review" article? Well, that was going to be true, until MTGStocks posted this informative list including the top 250 cards of 2016 in terms of percentage gains from January 1 until Dec 31. If you're a fan of long-term specs, this is the kind of information you want to make a mental note of before picking up some cards during the last of the winter doldrums.

The top 20 cards in this list of 250 all had gains of over 500 percent during 2016, and those are the kind of margins I can get behind. By separating those cards into their respective formats, we can break down where the most money was to be made in long-term specs this year. (Hint: it wasn't Standard.)

Modern

Old School

Pauper

EDH

Legacy

Kitchen Table

Doubling Up x 2.5

All of the above cards (in multiple printings, for some of them) quintupled in price between the two data points of January 1 until December 31.

Interestingly enough, most of these prices are relatively close to the peak post-spike price. On a "normal" spike curve when demand has a sudden increase, you expect the card to trickle down and reach an equilibrium after the spike, where the supply curve and demand curve interact. While you had a few days to sell Greater Gargadon at $15, the majority of its post-spike life has been coasting along at slighly less than $10, and seeing incremental decreases as Dredge adapts to no longer need the card.

On the other hand, Squandered Resources is still $6 for several months after The Gitrog Monster was printed. It even continued to climb as Kaladesh released, and is sitting pretty at $6. Not bad for a card that's been an unplayable bulk rare for the past decade or two.

Of course, a 500-percent margin sounds great when you're talking actual cash. Turning a pile of $5 cards into $25 cards is the fairy-tale of all speculators looking to get started in Magic finance, but another cursory glance over Stock's top-20 list shows that we're talking about a much smaller individual card price on January 1, 2016. Barring weird Old School cards (Tetravus and Urza's Miter) and Ancestral Visions, basically every single card on that top 20 list (even going down to the top 30) was a bulk rare or dollar card that experienced a surge in demand.

Does it feel like I'm suggesting that you invest in bulk yet? Good. I am.

There's so much money to be made in the game through long-term specs, grounded safely in the fact that Wizards can't reprint everything that spikes. They're playing a game of whack-a-mole with Modern, EDH, Pauper, and Casual cards. Maybe they hit Brindle Shoat in a bridDuel Deck this coming year, but it's too late; I already made $20 picking a playset out of bulk and selling them to a Pauper completionist. Even if we ignore the existence of the Reserved List and formats like Old School as investment opportunities, it's clear that going wide on a bulk strategy is a power play that can't be burned out by an inconvenient move by Wizards.

My message to you is to pick up the cards that no one wants today, because the winds of change in Magic blow strong.

Do you want to know how many Dig Through Time I picked up at $.25 each immediately after rotation, because "that card will get banned in every format that matters?" Even if I only sell them on TCGplayer for $3.99, I'm raking in over $2.5 per copy for a 1000 percent gain.

Buy bulk rares. Be that person at the trade tables, and say, "I will take any rare that you want to give me at $.10-.11 a piece, as long as it is English, Near Mint, and gold symboled." Here's some of the cards I've picked up recently at $.10 a piece: Siege Rhino, Jeskai Ascendancy, High Market, Hallowed Burial, Hand of the Praetors, Kami of the Crescent Moon, and more.

Some people will say no. That's fine too. Some players would rather stockpile playsets of cards that they might consider playing in the future, and I don't blame them. But 90 percent of the time, there's some bulk that someone wants to get rid of, and dust into a couple of fetches from your binder. Most of the players who I pick up bulk rares from aren't unloading their collections to pay rent; they want space in their binder and Thoughtseizes in their decks. If you can be that person who's willing to soak up a large quantity of currently unwanted cards by unloading Standard/Modern staples, you're going to be light years ahead of those trying to figure out the next Smuggler's Copter or Torrential Gearhulk.

I'm rambling at this point, but I'm glad that Peter over at MTGStocks released this data as an overview of 2016. It got me thinking as to what kinds of cards we'll see on next year's "250 top risers of 2017" list. Maybe we see some ridiculous enter-the-battlefield triggers printed this year and Torpor Orb goes to $10. Maybe the aforementioned Jeskai Ascendancy combines with something that slips past the Development team at WotC, and we see it hit $4 again. Even if it only goes to $4 and we buylist for $2.50, that's the 1000-percent multiplier we're looking for. Based on the Expertise cycle we're getting in Aether Revolt, I wouldn't be surprised to see Beck // Call on that list already, considering it started the year at dime status...

End Step

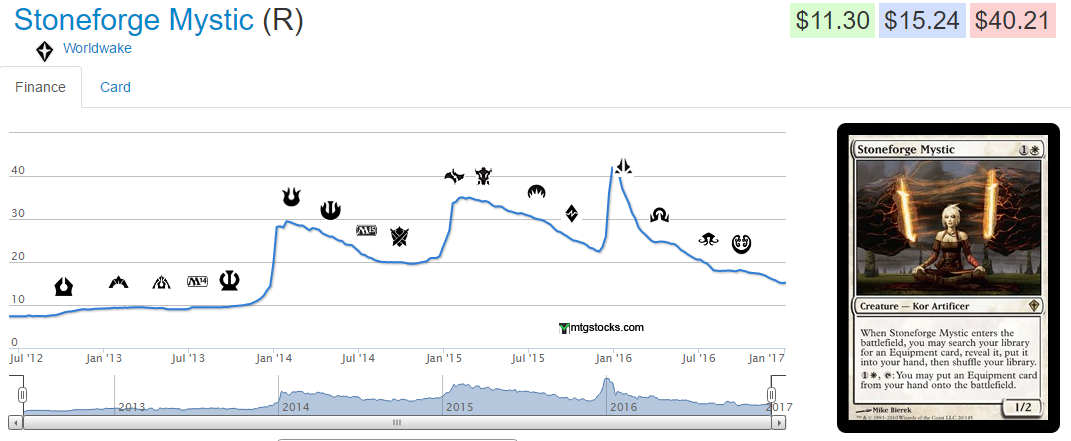

January means a lot of things: cold weather, writing the wrong dates on stuff, and the inexorable roller coaster that is Stoneforge Mystics price graph.

Every January for the past three years, it's jumped up and down like clockwork because of the speculation for its potential release from prison. This year is different, though, and the graph suggests that without any other information.

While the card has previously bottomed out at $20 before climbing, it's dropped to a paltry $15 this year, and that's only TCG mid. The culprit is of course the Grand Prix promo distributed en masse and swamping the market with Stoneforges, and you can find them for as low as $10 on TCGplayer nowadays.

So here's my question to you: what do you think is going to happen with Stoneforge? There's only a couple of possibilities here; it either gets crushed under the weight of its huge supply to the point where it doesn't jump in January, or the unban hype and low buy-in are strong enough to push it back into the $20s. What do you think? I mean, we all know you'd rather buy 100 bulk rares for $10, but if you had to buy a Stoneforge or nothing... what's your pick? I'm personally staying away, but maybe WotC thinks Modern needs another shake-up. Thoughts?

It was not Peter who posted that, it was Arjen, the site’s creator.

This is exactly why I like bulk and collections so much. Pull out anything that seems remotely playable that’s currently bulk, hold as long as you want (you can always move it as bulk later) and every now and then one of those cards goes up significantly. I just pulled out 16 Beck / Calls from those cards and I know I have a bunch of Strionic Resonators and Illusionist’s Bracers in there too that have also made some nice gains versus the $0.1 I traded them in at.

I like to hold any card that was only printed in Commander X or Conspiracy. Many may never jump, but when they do they are fairly rare.

thanks for sharing. mine are in a box collecting dust.