Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the MTGO Market Report as compiled by Matthew Lewis. The report will cover a range of topics, including a summary of set prices and price changes for redeemable sets, a look at the major trends in various Constructed formats and a "Trade of the Week" section that highlights a particular speculative strategy with an example and accompanying explanation.

As always, speculators should take into account their own budgets, risk tolerance and current portfolios before buying or selling any digital objects. Please send questions via private message or post below in the article comments.

Redemption

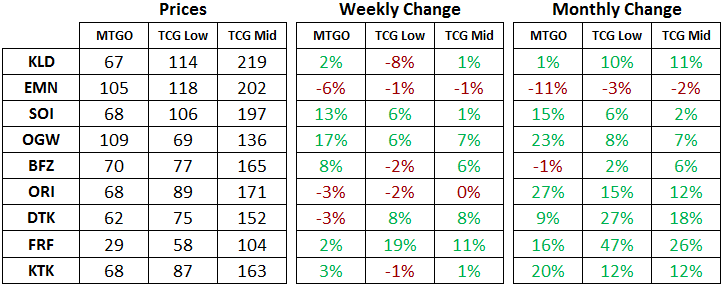

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of January 16 2017. The TCGplayer low and TCGplayer mid prices are the sum of each set's individual card prices on TCGplayer, either the low price or the mid price respectively.

All MTGO set prices this week are taken from GoatBot's website, and all weekly changes are now calculated relative to GoatBot's "full set" prices from the previous week. All monthly changes are also relative to the previous month's prices, taken from GoatBot's website at that time. Occasionally, full set prices are not available, and so estimated set prices are used instead.

Changes to the MTGO Economy

Lee Sharpe has announced some changes to the MTGO economy that all speculators and players should pay attention to. See the full announcement here. Every time prize structures and entry fees change, it's important to take a step back and see which direction the economy is going to take. In this case, there is one substantial change that has some important ramifications that I want to highlight.

Foil Mythic Rares

The end of prerelease events means that the foil mythic rare trade is back on for players. If you have not read my three-part series on this subject from 2015, I suggest starting there. This analysis was completed before the inclusion of foil rares and foil mythic rares in prerelease card pools. This change completely torpedoed the strategy by printing way more foil rares than previously, the impact you could see in the price of foil uncommons from all sets starting with Shadows over Innistrad (SOI). The removal of prerelease events means the skewed distribution of foils will be over and foil mythic rares will go back to being a store of value.

Unfortunately, the long term outlook for foil mythic rares is not good for speculators, since they have historically seen gains after the set is no longer being drafted, but while the set is still redeemable. The shortening of the redemption window means that buying foil mythic rares is not a safe long-term strategy for speculators.

On the other hand, players should feel free to purchase their playsets of foil mythic rares with confidence in the first two weeks of Aether Revolt's (AER) release. Buying a playset of each of the foil mythic rares will ensure a diversified basket that will hold its value until the end of AER redemption in May. Parts of the basket will rise and fall in price due to how the Standard metagame develops, but as a whole it will maintain its value.

If you want to play with the new cards, buying foil mythic rares ensures you'll get your tix out of these cards when you go to sell them in April or May. If you buy regular mythic rares, the prices are going to be falling as more and more cards are opened. It's the difference between buying a store of value versus buying a depreciating asset. Foil mythic rares will have a much higher upfront cost, but they will hold their value. In April or May, you can feel free to sell your foils and purchase regular ones instead at the tail end of Kaladesh (KLD) block draft.

Standard Boosters

With the end of prerelease events, tix-only entry fees are gone too. This has a couple of important ramifications. The first is that AER boosters will be in high demand as players will be able to use them to enter draft queues and leagues right away. AER boosters will go on sale in the store on January 30, so between January 25 (the day AER goes live on MTGO) and January 30, AER boosters will be very valuable and will probably be priced over 4 tix.

Previously there was a trade where you could buy the new set boosters that players had won from the tix-only events. You would hold them until they could be used as entry, and then resell them for a higher price. This trade is over with the end of tix-only entry fees.

Liquidity Crunch

For speculators, the good news is the liquidity crunch is still on when a new set is released. Players and bots alike will still need tix to buy the new cards and to enter the events, as most players will not have the new boosters yet. The end of tix-only events does mean the edge will be taken off of the liquidity crunch, but it will still exist due to the short-term wants and needs of the average player.

If you are holding onto marginal positions heading into the release of AER on MTGO, you are better off selling now in order to build up your tix and to get liquid. There will be opportunities in cards and boosters at the end of January that players are looking to sell for tix. You should be the buyer at that time and you should not be trying to sell your own stuff. I anticipate KLD boosters will see a substantial drop in price in the last week of January. At the right price, KLD boosters will be a good target for speculators.

Treasure Chests

Lastly, Treasure Chests are changing again, this time awarding play points instead of boosters. This will be very interesting as there was previously no way to assign a price to play points. They are essentially equivalent to tix since they are just as useful for entering events, but since the only way you could get them was through playing and they are untradeable, there was never a market price for them.

Now that they are going to appear in Treasure Chests in a predictable fashion there will be an imputed market price. It's a little messy since the price of chests is higher than their expected value, but it's still possible we'll have a good price for play points at the end of the month. I expect the change from KLD boosters to play points will result in chests becoming more valuable.

There are other changes coming to the curated card list, on top of a reduced chance of opening Commander 2016 cards. All of these changes suggest a short-term bump in the market price of Treasure Chests after January 25. I'll be looking for a good price on these over the next week with an eye to reselling them at the end of the month.

Trade of the Week

With all the turmoil in Modern and Standard prices as a result of the recent bans, I've moved to being an aggressive buyer of cards with value in the new metagames. For a complete look at all of my recent purchases, please check out the portfolio, which is available at this link. Today I will hone in on one card that I have been buying and the technique I used to build my position.

Gideon, Ally of Zendikar has been a pillar of Standard and it reached a peak of 38 tix in early December, but it stayed mostly in the 27 to 33 tix range since the release of KLD. After the recent bans it dropped to 23 tix and this decline piqued my interest in the card. Although I can't predict what Standard will look like after AER enters the mix, Gideon, Ally of Zendikar has been one of the best things you can do in Standard. I expect this will continue in some fashion, so when a card of this power drops in price so quickly, it definitely gets my attention.

On Saturday, I decided to start accumulating copies of this card. Although I couldn't be certain where the descent would end, 23 tix seemed a very reasonable price relative to recent prices. My strategy when I opened this position was to buy the cheapest playset I could find as a test purchase and then wait to see what would happen the following day. I would continue to monitor prices and available supply and then respond accordingly. Further price declines would throw up a caution flag, while a stable or rising price would encourage more buying.

Sunday morning rolled around and prices had continued to soften. There were copies available for closer to 22 tix. This gave me some pause but I still felt like the price was an excellent one, so I bought two more copies, half of what I had bought the previous day. This was another test purchase and I resolved to continue to monitor prices and supply.

On Monday morning things had changed. Prices had firmed up and were now sitting closer to 24 tix. Although GoatBots and MTGOTraders were well stocked at this price, a quick scan of the MTGOLibrary bots revealed no copies for sale at 24 tix but some for sale at 25 tix and higher. The MTGOLibrary bots are typically competing at the bottom end of the market, so when there are no copies for sale at prices below the major bot chains, it's a strong signal that the market price for Gideon, Ally of Zendikar had turned higher. This meant my test purchases were at an end and it was time to buy up my full position.

In this case, I would buy a playset each from the major bot chains I use and then I would scour the classifieds for any stragglers that hadn't updated their prices. I think this is an excellent way to probe the market if there is a card that you believe in but are unsure of the price. At the moment, this trade appears to have worked out very well, as the price is back to over 27 tix.

If Gideon remains a pillar of Standard, I expect the price to crest 30 tix again, and at that point I will be a seller. If his role is diminished, then the price will begin drifting down again, at which time I will also be a seller. Once the metagame establishes itself, Gideon's roll in it will be clear and the price will follow. Buying into a selloff gave me a nice margin of safety with some upside if the card continues to be a pillar of Standard.

Hey Matt, great job breaking down this new information. I have a question though, what would you consider to be a good price for Treasure Chests?

I think if they get into the 2.5 to 2.7 tix range, this should be a good price for a test buy. It’s highly speculative right now, but they seem to have been in the 2.8 to 3.1 tix range on a regular basis. With the buy/sell spread typically less than 0.1 tix, less than 2.7 tix should be very safe in anticipation of the changes.

We don’t know for sure how the market will react to the changes to play points, but I think the market will like it. They have value as a replacement for draft entry fees, and they don’t fluctuate like booster prices, so the switch of KLD boosters to play points should be a boost.