Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

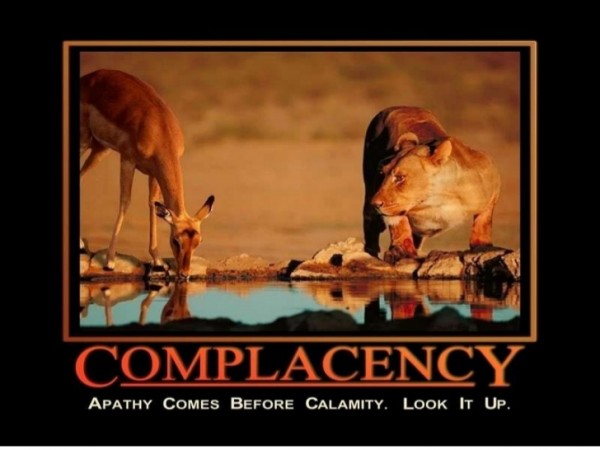

Welcome back, readers! Today's article is on a subject that extends far beyond just Magic speculation, but is certainly something that we need to watch out for. In the interest of making sure everyone is one the same page, we'll start the article with the cliche definition of a key word.

Complacency: a feeling of quiet pleasure or security, often while unaware of some potential danger, defect, or the like.

I found several definitions for complacency, but the one above sets the tone for this article best. The reason I'm writing this article is because I believe many of us (myself included) have become complacent when it comes to certain areas of Magic finance.

The day before Smuggler's Copter was banned, its buy price was $7.75. And why wouldn't it be? Wizards hadn't banned anything in Standard since Jace, the Mind Sculptor and Stoneforge Mystic more than five years ago, and both of those were already near rotation when they got banned. People got complacent. Many of us neglected the danger of a banning because it hadn't happened in a while. I imagine the people of Pompeii thought the same thing regarding their volcano.

There is a lot more risk with Magic finance then many of us would like to admit. The cards we invest in are made of cardboard, the ability to counterfeit them is getting better and better, and their true value stems only from people's desires to collect and play with them. They don't represent ownership in anything (like a stock) nor do they have guaranteed rates of return (like a bond). Worse yet, the entire supply is controlled by one entity, Wizards of the Coast, so decisions they make can drastically affect the value of the cards. That is a whole lot of risk.

Many people (including myself) often advocate for focusing on Reserved List cards as supposedly stable investments that mitigate risk. But even that position still shows complacency. Wizards isn't legally bound to the Reserved List. Sure, if they abolished it and began reprinting cards currently on it they could very well face a lawsuit, but it's unknown how that would transpire in court. They could also conclude that the profits generated from sales would overcome any litigation losses and move forward with it anyways.

I realize that's a whole lot of "doom and gloom" right there. But before you run to your local game store to dump your whole collection, remember that every type of investment carries risk.

Do you think all the people who were seeing their investment portfolios "rise" under Bernie Madoff expected to see him escorted out of his home in handcuffs? Or the people who bought a second home back in 2003 because real estate was such a "sure thing" anticipated the 2008 housing crash? All investment carries risk, but the biggest dangers come when we forget or ignore that fact.

Fighting Complacency

How do we shake off that complacency that has set in? I have two suggestions for practical steps to take in your Magic speculating activity towards this end.

Inventory Your Speculations

Do you know everything you're speculated on that's currently in your possession? How many have bought cards they thought were good speculation targets and then just thrown them into a box/binder and forgotten about them? I'll raise my hand on that last one.

When I first started out speculating, I was big into buying cards at retail prices if I thought they would go up. I bought about 20 Abrupt Decay when it was $5 or less. I got home with my newly purchased copies and stuck them into my personal collection binder, thinking I'd pull them out when they jumped to $10.

Then I forgot about those particular ones because I'd switched to a speculation box that I kept an Excel spreadsheet on. Between June and October of 2015 Abrupt Decay was worth more than $15. I sold zero copies in that time frame. Then it started to drop. By August of 2016 it was down to $10. Want to guess how many copies I sold then? Zero. Now it's been reprinted in Modern Masters 2017 and the original Return to Ravnica printing is right back down around $5.

So I invested $100 back in late 2012/early 2013, and four years later my gains are 0% (if I sold right now). I became complacent and ignored the risk of reprinting or changes in the metagame.

But I've learned my lesson from that. I now put all speculation targets into one "speculation box" and keep a running Excel spreadsheet of what I have in it. When I remove cards (whether to sell or trade), I make a note in the Excel sheet with the price I traded/sold them at. Hopefully many of you Insiders have already been doing that—if not, I suggest you take the time to inventory your investments properly before purchasing any more.

The other major lesson I learned from the Abrupt Decay debacle was to remind myself that all cards carry a risk of reprint (granted, Reserved List cards are much lower, but again, don't think it's 0%). That means selling with a good profit now ("locking in your profits") is better than maybe selling for a greater profit later.

Tracking Gains/Losses

Along with tracking your speculation targets, it's a good idea to track your gains and losses as well. It might seem time-consuming (and it can be initially), but you're putting your money into these cards, and you want to get more out than you put in. If you don't track it, how will you know if you've been successful? Even as I write this, I realize I could be doing a better job myself.

The other key advantage of this tracking is it could lead you toward or away from future speculation targets. Say you can look back and see that you've made a good bit of money on big Standard-legal dragons like Thundermaw Hellkite and Stormbreath Dragon. Based on that, you might have looked at Glorybringer's pre-order price and thought that $2 seems way too low for a card that powerful.

That example might seem obvious and making this connection might not require a detailed spreadsheet. But you might also find macro-level trends. Maybe you've had terrible luck speculating on control cards in general, and decide your intuition on those cards is less than reliable. Sure, you might feel bad if a card you thought would do well ends up doing spiking, but given the track record it's far more likely you'd have picked duds.

There's a reason that Google and Facebook are worth so much money and yet free to use. Data is valuable. More data is more valuable. So gathering as much data about your own investments seems like a no-brainer.

On the practical level, Trader Tools can be a helpful tool in this regard. Data collection can be time-consuming, so we want to automate as much as possible. It would be wise to first put your speculation targets into a Trader Tools list (which will update prices in real time). Once you have your specs entered you can export the list periodically and reformat it however you like in a spreadsheet application.

Then you have daily/weekly/monthly price tracking on your specs (depending how often you want to export). The beauty of using Trader Tools specifically is that it also includes buylist prices, so you could track both retail and buylist prices for the list and make decisions based on this.

Conclusion

Complacency is a danger to us all in many aspects of our life. However, one of the most dangerous subjects to become complacent on is our finances (and in this case our investments). The point of this article was not to scare people away from MTG finance, but to remind them of the dangers inherent in it and to suggest tools to help eliminate complacency when it comes to speculation.

Fantastic article! A great subject to touch upon. In my line of work, it is constantly hammered into our awareness that “Complacency Kills.” Very good to look at it from yet another perspective (i.e. Magic finance).

I know that I am certainly guilty of holding onto certain specs for far too long, especially when strong indicators (potential for banning, rotation out of the format, reprinting, etc.) are present. It’s a mistake you only need to make a few times, but it really helps to instill a mindset of staying vigilant and closely tracking your purchases, profits, and gains/losses.

Trader Tools is great because I’ll just create a specific list (or lists) reflecting my speculation targets, and then cross reference it with my speculation spreadsheet. Having the live retail/buylist numbers from Trader Tools to compare to my initial investment data (including target sale value) has really helped to reduce losses AND complacency.

Thanks for the article! Excellent subject and perspective.

Thanks. I have been rolling the premise for the article around for awhile and I’m glad you enjoyed it.