Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the MTGO Market Report as compiled by Matthew Lewis. The report will cover a range of topics, including a summary of set prices and price changes for redeemable sets, a look at the major trends in various Constructed formats and a "Trade of the Week" section that highlights a particular speculative strategy with an example and accompanying explanation.

As always, speculators should take into account their own budgets, risk tolerances and current portfolios before buying or selling any digital objects. Please send questions via private message or post below in the article comments.

Redemption

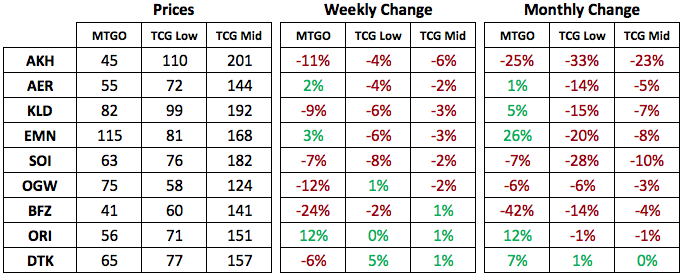

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of June 13, 2017. The TCGplayer low and TCGplayer mid prices are the sum of each set's individual card prices on TCGplayer, either the low price or the mid price respectively.

All MTGO set prices this week are taken from GoatBot's website, and all weekly changes are now calculated relative to GoatBot's "full set" prices from the previous week. All monthly changes are also relative to the previous month's prices, taken from GoatBot's website at that time. Occasionally, full set prices are not available, and so estimated set prices are used instead. Although both Aether Revolt (AER) and Kaladesh (KLD) are no longer available for redemption, their prices will continue to be tracked while they are in Standard.

Metamorphosis 2.0

Mark Rosewater laid out a large course correction for the game of Magic in his Mothership article this week. Anytime there are structural changes to how the game of Magic is published, those interested in the economics of Magic must pay attention. The changes will have an impact on how MTGO speculators should think about their strategies.

Right off the top, the return of the core set is notable. These sets have historically been a very fertile ground for speculators. The last core set, Magic Origins (ORI) contained the most expensive Standard card in recent memory, namely Jace, Vryn's Prodigy. Seven months after the release of ORI, Jace breached the 90-tix level as a format flagship while the Khans of Tarkir (KTK) fetchlands powered up Standard. This is an outlier to be sure, but the combination of being released in the summer and a set designed with less depth designed for newer players will ensure that Core sets maintain a price premium once Standard refreshes in the fall.

With a reprint ratio pegged at about half the set, there will be some risk of holding onto Modern staples into the summer. We'll have to see how this works out in practice; if it's just the odd valuable reprint, then it's a risk that speculators will bear without trouble. If a number of Modern cards get included every year, then speculators will have to reassess whether its worthwhile to carry this extra risk. Further study will be required when the first rebooted core set is released in 2018.

The next big change is the removal of small sets and the simplification of drafting to one large set per draft format. This completely simplifies how speculators should approach both booster and full set strategies. Timing the precise bottom on large sets will no longer be complicated by the draft structure of the format; boosters and sets will find a price bottom near the end of the draft format.

Although the buying window is clear, the selling window is complicated by the end of redemption under this new system. We don't yet have precise information on how redemption for large sets will work in the future, but I suspect this will be another shortening of the redemption window. In other words, I expect that redemption will end in the weeks after the set is no longer the newest draft set.

Regardless of the timing of the end of redemption, there will be a short-term opportunity on large-set speculation similar to how small set prices move. Buy full sets near the end of the drafting, then hold for a few weeks and sell prior to the end of redemption, when redeemers are looking to get the last bit of value out of their digital objects. Returns will not be dramatic, but in the 10 percent to 20 percent range seems reasonable based on my experience with AER.

The simplified booster strategy is basically identical to the old one, but with slightly different timing. Boosters from the prior draft set typically bottom during the week that the new set is released, and with only one set to choose from, there will be no choice about which set to buy boosters from. The holding window will be until the month before the next set is released, or when the price of three boosters reaches equilibrium with tix-only draft entry. This will be another low-risk, low-reward strategy that will yield steady returns four times a year.

The last basket-type strategy which I employ revolves around foil mythic rares. I've had success with AER foil mythic rares, and I expect that AKH will yield similar results down the road. It's not clear to me whether or not foil mythic rares will be a viable strategy for speculators going forward, but I'll be keen to test it out. There's no doubt in my mind it will still be suitable for players who want to use the new cards without suffering declining value. But for speculators, the buy-sell spread on foils and the potential of a four-month redemption window means the margin for error is narrow. I will be experimenting with this strategy going forward, and I will continue to report my results as it unfolds.

Standard

Not to be outdone by Mark Rosewater, Aaron Forsythe dropped another Standard ban in our laps this week with the removal of Aetherworks Marvel from the format. This is a great boon to Standard speculators that have been a little slow to sell off their cards heading into the summer lull. Marginal cards and strategies will get a second look, bolstering buying interest in these cards, while Ulamog, the Ceaseless Hunger and Marvel itself will both see declines in prices.

Interestingly enough, the announcement included the tidbit that their will be no banned and restricted announcement associated with the release of Hour of Devastation (HOU). It's not clear whether or not this is a permanent change, but going back down to four announcements per year would be welcome.

The original motivation of the set release announcement slot was to provide a way for Wizards to shake up the Modern metagame in advance of the Pro Tour. With no more Modern Pro Tour events to be concerned about, it's correct to make this change and reduce the frequency of these announcements. Standard is coming through a nearly unprecedented period of upheaval in this domain, so a return to infrequent announcements and lowered expectations around banning a card is a good move.

Trade of the Week

For a complete look at my recent trades, please check out the portfolio. There have been no trades this week, as I am on vacation.

Do you think there will be any significant gains in standard beyond yesterdays little spike? Or do you think things will drift back down since a lot of focus is on modern. In other words, would you sell profitbale and break even positions, and look to rebuy before the next pro tour?

In your opinion, do you think the speculating landscape has become more difficult over the past year or 2? Was there a golden age?

I’m sorry for the tardy response on these questions, but it looks like further gains have accrued to Standard cards this week. In general, this is the correct time to be selling Standard cards, particularly from sets that will rotate in the Fall, BFZ, OGW, SOI and EMN. I would not be looking to rebuy any cards from these sets, but I would be looking to stock up on cards from AER and KLD, possibly AKH as well.

Speculating is easier when the market is growing. I think we went through a particularly rough transition with the removal of Daily Events and the introduction of Treasure Chests. I think the market has adjusted to these changes, though a lot of the changes WoTC has made has eliminated or reduced the top down speculative strategies I prefer. Still, as long as changes are being made, there is opportunity in the market to adapt to the changes quickly.

as you indicated in the forums. Time to sell!