Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the MTGO Market Report as compiled by Matthew Lewis. The report will cover a range of topics, including a summary of set prices and price changes for redeemable sets, a look at the major trends in various Constructed formats and a "Trade of the Week" section that highlights a particular speculative strategy with an example and accompanying explanation.

As always, speculators should take into account their own budgets, risk tolerances and current portfolios before buying or selling any digital objects. Please send questions via private message or post below in the article comments.

Redemption

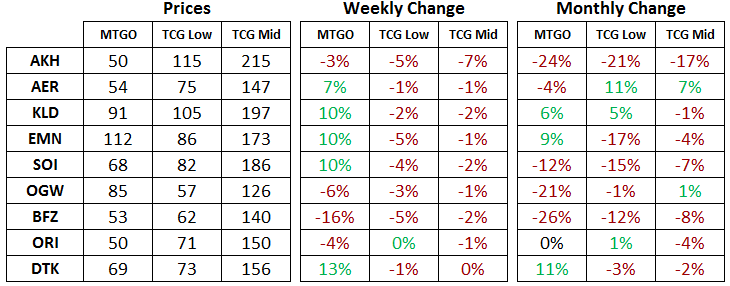

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of June 5, 2017. The TCGplayer low and TCGplayer mid prices are the sum of each set's individual card prices on TCGplayer, either the low price or the mid price respectively.

All MTGO set prices this week are taken from GoatBot's website, and all weekly changes are now calculated relative to GoatBot's "full set" prices from the previous week. All monthly changes are also relative to the previous month's prices, taken from GoatBot's website at that time. Occasionally, full set prices are not available, and so estimated set prices are used instead.

Standard

Amonkhet (AKH) sets continue to drop this week, off another 3% to sit at 50 tix. Although still dropping, the pace of decline is slowing so if you were thinking about buying sets of AKH, they are getting closer to a price floor. As a speculator, I'm keen to wait another week to see what happens but nibbling at this point or buying sets to play with is defensible.

Kaladesh (KLD) and Aether Revolt (AER) will no longer be redeemable when this article is published. It's no secret that redemption supports the price of cards on MTGO, but typically we only see the end of redemption for a set after it has left Standard. Having a set in Standard and there being no redemption for that set hasn't occurred since the troubled switch to Version 3 of the client back in 2008, so it will be very interesting to see what this does to the price of these sets.

In the meantime, one favorite strategy of mine is to consider cards that are a part of a cycle. There's no better cycle to consider right now than the KLD fast lands, since the bulk of the drafting of this set has wrapped up. Spirebluff Canal and Botanical Sanctum are heavily played in Standard in Temur Aetherworks decks and they have the prices to match. High prices can sometimes lead to higher prices, but at the moment these two lands are priced to perfection. In other words, there is not much upside in these.

At the other end of the spectrum is Inspiring Vantage. This card has bounced between 1 and 2 tix since KLD was released, and with Mardu Vehicles on the wane, it is swinging lower at the moment. As a buy-low candidate in Standard, this one has excellent pedigree as it shows up in Modern Burn decks. Being played in Modern provides a nice margin of safety, but there is still plenty of upside if it shows up in Standard.

Although a little more expensive, Concealed Courtyard and Blooming Marsh also see regular play in Modern. They've been in between the 2 and 3 tix level lately, so if you can pick off cheap copies of these two as well, you'll end up with a nice small basket of Modern-playable cards with upside exposure to Standard. These are all buys, but be cautious while prices adjust to the end of redemption.

Modern and Legacy

Grand Prix Vegas is looming and with it will be a spike in interest in both Modern and Legacy. If you've been holding Modern cards, consider this an excellent opportunity to sell down your positions in advance of the release of Hour of Judgement (HOU) in July. A new set is always the best time to be a buyer from a macro perspective, since players and bots alike are in need of tix. Keep that in mind over the next month and be sure to maintain an adequate level of liquidity.

Although I don't usually consider Legacy or Vintage, Tangle Wire is a card that has caught my eye in recent weeks. It has seen a massive drop from the 50 tix level a year ago all the way down to an all-time low of 7.5 tix today. This steep drop is unusual and I'd hesitate to assign a precise reason for the decline. There's no doubt the extra supply of these coming online from Treasure Chests has had some impact, but shifts in the metagame of the Eternal formats is likely the key reason. Keep an eye on this one for a potential rebound, especially with the introduction of the Weekend Challenges as driver of demand.

Temporal Mastery has also been a surprise. This Avacyn Restored (AVR) mythic rare was reprinted in Modern Masters 2017 (MM3) and saw prices as low as 1 tix in the past three months. With the original at over 5 tix and the reprint at 3 tix, there's been a lot of buying of this card as a result of the introduction of the competitive Commander format to MTGO. Don't be afraid to scoop up the reprint as budget-conscious players will bid up the price of the cheaper version. This card looks sets to continue higher.

Trade of the Week

For a complete look at my recent trades, please check out the portfolio. This week I started nibbling on the three cheapest KLD fast lands as detailed in the Standard section. The plan is to build a large position in these over time by shopping around and targeting cheap play sets. There's always a bot that will sell a particular card below the price of what the major bot chains are selling theirs for, so building a position slowly can keep your average buy price low. Trying to establish a large position overnight in playable cards will almost necessarily result in short-term price increase, which will raise your average buy price.

Slow accumulation avoids introducing this distortion into the market. Where it can fail is if there is a big change to the metagame, and the price of the card you are targeting spikes higher. This will happen from time to time, and its important to understand your reaction to these events. If you start chasing the trend because the market moved much faster than you anticipated, you will be pursuing a marginal opportunity. It's better to take a step back and move on to other targets than to stick to your guns after the market has moved. There's always another good opportunity waiting to be found.

I don't expect much change on these in the near term, so being patient with an eye to Fall Standard is the timeline at the moment. However, with Aetherworks Marvel continuing to be a force in the Standard metagame, there's always the chance that another round of bans occurs, resulting in a shakeup in the market. A good speculator will plan for the long term, but will also accept short-term windfalls when they occur.

Hey Matt, just wondering what your thoughts are about when we will see the full effect of the redemption cutoff for KLD-AEar. Should it be instanteneous or will it take like a week? As you said this kind of movement is new in recent history so it’s bot clear to me what to expect. Thanks for all your work!

We’ve seen a bit of a selloff in AER and KLD as of the last two days, with the EV of a booster going from 0.95 or so, down to 0.89 and 0.83; Torrential Gearhulk is down quite a bit in the last week, but notably is just back to where it was prior to the release of AKH.

I think some players definitely took the opportunity to sell their cards, but I am not seeing a crash so far.