Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

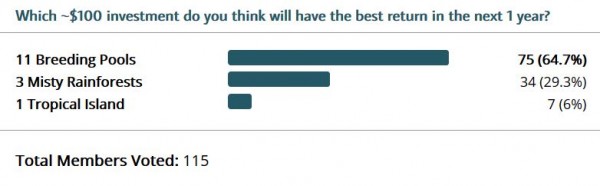

Four years ago this past Saturday, June 10th, I posted an innocuous question in the Quiet Speculation forums. "If you had to place a $100 bet on one of these three options, which would it be?” The choices were either 11 Breeding Pools, 3 Misty Rainforests, or 1 Tropical Island.

The goal of this case study was twofold. First, I thought it would be fun to test the collective mind that is Quiet Speculation. How good of a community are we at predicting the future? Second, I was looking for some guidance on where to invest some funds and was open to others’ opinions. The poll results today probably would not match the results from four years ago:

Many who voted provided some context around their decision. Did they think a card would be reprinted in the near term? How strong was the Reserved List? What was the health of Modern and Legacy? All viable questions that still can be applied even today. This week I want to revisit this study and add some new commentary given where prices stand in 2017!

How Did We Do?

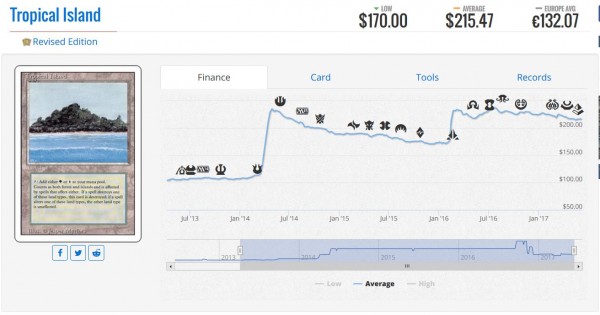

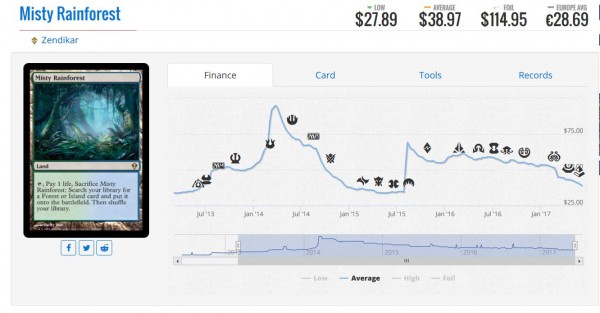

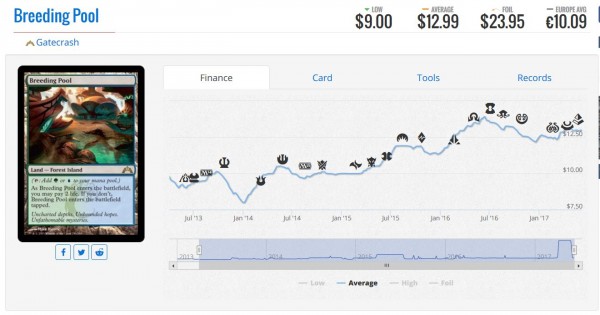

The actual question had a twelve-month time horizon. Therefore, the card that made the largest percentage gain from June 2013 to June 2014 would hypothetically have been the best option of the three. Let’s take a look at how each did over this particular time range.

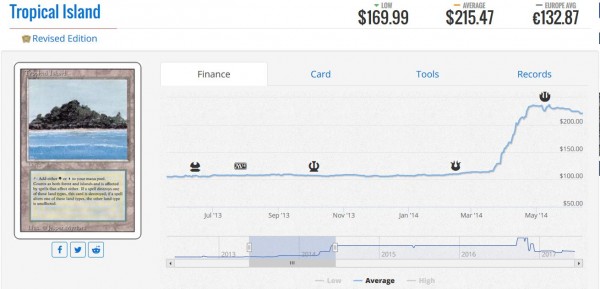

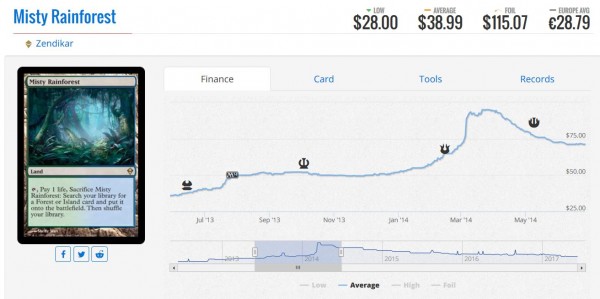

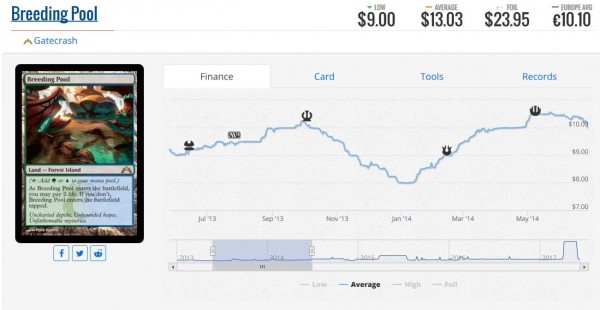

Looking at the numbers over the twelve-month range in question, we can estimate the percentage gains for each:

- Tropical Island: $100 -> $220 (+120%)

- Misty Rainforest: $35 -> $70 (+100%)

- Breeding Pool: $9.5 -> $10 (+5%)

The option most chosen by Quiet Speculation Insiders ended up being the poorest performer. We were all banking on continued growth in Modern and no one had anticipated the negative impact of the massive print run of Return to Ravnica block. From a start-to-finish standpoint, the dual land was the best performer. Yet it was the least chosen option from Insiders.

In other words, we struck out.

Longer-Term View

I don’t want to linger too long on the one-year analysis because it’s already history—water under the bridge, as it were. What I want to do now is zoom out even further to see how these three positions performed from June 2013 to today. Will the conclusions be any different?

Here are the approximate numbers:

- Tropical Island: $100 -> $215 (+115%)

- Misty Rainforest: $35 -> $39 (+11%)

- Breeding Pool: $9.50 -> $13 (+37%)

Well, the results didn’t really change that drastically at first glance. The popular QS Insider opinion came in second place rather than last place, at least. But still, the least selected option (the dual land) is the clear winner here over the longer period of time. Not surprisingly, the fetch land came in last place due to its reprint in Modern Masters 2017.

But let’s look at this data one more way—let’s compare the numbers from June 2014 (the end of the one-year case study) to June 2017.

- Tropical Island: $220 -> $215 (-2%)

- Misty Rainforest: $70 -> $39 (-44%)

- Breeding Pool: $10 -> $13 (+30%)

With this timeframe, Breeding Pool did gain the most! It would appear that in the middle of our case study, Tropical Island (along with most other relevant Reserved List cards) made a dramatic spike in price. But following that event, prices have done virtually nothing for three years. Thus when looking at the time range of June 2014 to June 2017, we see that Breeding Pool—which had no reprint—gradually grinded higher in price.

Making Some Predictions

With this data digest, we can start to make some predictions for the next few years. And the reality is, it’s very difficult to time things precisely enough. What I mean is, it’s impossible to determine when the next dual land spike will occur. For example, if I were to ask the same question today regarding where to invest money between these three options, the dual land will win if there’s another Reserved List spike in the next 12 months. If there isn’t, then it’s probable that the fetch land will jump most instead.

While I won’t pretend to be some all-knowing fortune teller, I do want to point out one curious trend on the dual land. It looks like when Tropical Island spiked during this case study, it did so in May 2014. From there, it took about 21 months of decaying value before the card jumped to new highs. Rather than rising gradually as other cards often do, it would appear dual land increases occur in dramatic episodes of rampant buyouts. Thus, the behavior we see on the chart.

The most recent dramatic spike occurred in February 2016. Since then, the card has been gradually pulling back after achieving overbought conditions. Buyouts will do that. If we apply the same 21-month window to allow the market to re-equilibrate and prepare to move higher again, we could extrapolate the next spike to occur in November 2017. While there is nothing special about the 21-month window in particular, this exercise does make me wonder if we’re not due for another spike in duals at some point in the next year.

If you had fresh cash to put to work and forced me to choose between these three options, I would probably have to go with duals. The reprint quantity suffocates growth on fetches and shocks. Meanwhile Reserved List cards are only getting harder to find with each passing month. Even now, some of the more popular dual lands in Legacy are seeing all-time highs without any dramatic buyouts. This is due to shifts in the metagame, indicating that Legacy demand can still move these prices despite the belief that it is a "dying format."

There are also only 104 sellers of Revised Underground Sea in stock. While that’s higher than it was during the last spike, I believe this represents a decline in stock relative to a few months ago. I’ve also been tracking Star City Games’ stock on the card recently, and have noticed a gradual decline of copies for sale. I wonder if we’re not due for another spike, perhaps catalyzed by GP Vegas? Note: it’s highly likely SCG took down most of their stock to bring with them to the Grand Prix, so chances are their in-stock numbers this week are artificially reduced.

I did hear on a recent MTG finance podcast that word on the street is some vendors are planning some significant buying on the GP floor in Vegas this week. I have no information to validate this claim, but it wouldn’t surprise me. With all the money in the room throughout the event, it’s the perfect time to make a move if you were planning on doing so.

If I had to pick a second choice, I would go with the shock lands next as a backup target. Star City Games is completely sold out of Gatecrash Breeding Pools and the card has finally gained some traction over the past few months. The same can be said for most of the other shocks. It would appear that finally, at last, after years and years of stagnation, the shock lands are moving in price. I don’t regret selling all mine a couple years ago though—the return on investment with these must be horrendous on an annualized basis. But perhaps that’s about to change if we don’t see a reprint in the next year or so?

Meanwhile, there are over 60 copies of Misty Rainforest in stock at Star City Games across Zendikar and Modern Masters 2017 printings. I do think the Zen fetches will recover eventually, but I would prefer to park my funds in duals—even with the extremely low likelihood of another reprint so soon after the last one. This should come as no surprise to my regular readers.

Wrapping It Up

A one-year case study from a while back reminded me of some of the ongoing decisions MTG investors face. I thought a revisit would be quite interesting given how poorly we as a community did at predicting the future back in 2013. When zooming out with a multi-year lens, it would appear that we did marginally better but still missed on the biggest gainer: the dual land. That said, all of the growth in duals happened within a narrow window of time, via a buyout. Prices never really dropped down after that.

With that being the case, I wonder if now, after many months of stagnation, duals could get another bump in price. Conditions are very different now than they were years ago, though:

- There are no longer Sunday Legacy Opens on camera every week (negative).

- Wizards of the Coast reduced the number of Legacy GPs across the globe (negative).

- Commander popularity is at an all-time high (positive).

- Old School MTG has exploded in popularity (positive).

I don’t know the breakdown in demand for dual lands between Legacy/Vintage players and Commander players. I believe demand from Commander players is fairly robust, especially given the advent of so many four-colored generals from Commander 2016. EDH REC also indicates the duals are heavily used, with Underground Sea appearing in nearly 5,000 decks. While their paper price may be prohibitive to some, others will justify the purchase of these mana-fixing lands to optimize their decks.

Weighing all the positives and negatives, I’ve decided I’d rather be a buyer than a seller of dual lands right now. There are likely better places to park money—Commander foils have been especially juicy in recent months. But if you had to pick between all the nonbasic two-colored lands in Magic to park some money, I think dual lands is a fine place to be. You’ll be able to enjoy use of the cards in your decks for years, with the possibility to spike a buyout and make some money along the way.

It’s been a while since we saw a spike, and I’m not sure if there’s one on the immediate horizon. But it only takes a few people to decide it’s time, and we could be looking at the next 100% increase in prices. Take advantage of the consolidation in price and you probably won’t regret it 12 months from now when we return to this case study again!

…

Sigbits

With Grand Prix Las Vegas on the horizon, I won’t look to SCG’s inventory online this week because quantities may be deceptively small. I’ll use TCG Player instead.

- Two. That’s the number of copies of Arabian Nights Sindbad in stock on TCG Player. Both are Lightly Played and both are listed at astronomically high prices. Please, whatever you do, don’t purchase these at $50. Market price still shows around five bucks, and $10 is a much more reasonable place for this card to settle.

- Despite being just a common from Ice Age, the number of Portents in stock on TCG Player is surprisingly small. When I filter down to the number of sellers with at least a playset for sale, we get down to less than 20. Full disclosure: you may be following my Portent antics on Twitter—I found a stack of copies from a single seller not long ago and have been selling them rapidly on eBay for between $6 and $7 a playset.

- Drop of Honey may soon be spiking. There are just ten sellers with a copy for sale on TCG Player and only four of them are Lightly Played. It won’t take much for a speculator to buy these up and list one for $200, forcing a “spike” in price. Just be careful if you partake in such a scheme, as you won’t likely be able to move copies at that price for quite a while. It’s probably best to just grab a copy now if you need one for play, and leave it at that.