Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Another Pro Tour is officially in the books. Congratulations to any QS Insiders who managed to pick up some Hazoret the Fervents in advance of the grand event. Those who purchased their copies in the $5-$8 range will surely turn a profit.

That is, if they sell quickly enough. You see, I don’t anticipate the price tag to remain this high for long. Typically cards that spike from Pro Tour camera time fall back down to a new, albeit higher, plateau. With Hazoret spiking to $20, I anticipate he’ll settle down in the $12-$15 range. I may change this prediction if mono-red strategies drop in popularity once the metagame is better understood. But for now, with rotation just a few months away now, I can’t be bullish on any Pro Tour spikes.

Sell, Sell, Sell

In fact, I’d go as far as to say that you should liquidate almost any Standard card that popped over the weekend. This would include God-Pharaoh's Gift, Earthshaker Khenra, and Angel of Invention, the other big movers from the weekend. Take those profits and apply them elsewhere in order to lock in gains and remain invested.

For me personally, I owned virtually zero Standard cards going into the Pro Tour other than a couple random rares I received as throw-ins from generous sellers. I had a couple very busy weeks at work and on the home front, and I just couldn’t get myself psyched up for the event. But just because I didn’t place any Pro Tour bets doesn’t mean I haven’t been doing any selling. In fact, over the past few weeks my selling has outpaced my buying, generating positive cash flow for the first time in a while.

Now, I haven’t been selling because my outlook on Magic finance changed. Far from it. I’ve been selling for two reasons. First, one of my investment theses changed recently, triggering a need for me to exit a sizable position. And second, I have found my rhythm when it comes to flipping certain varieties of cards for quick, modest profits. I’ll go into both of these reasons in further detail.

Knowing When a Thesis Fails

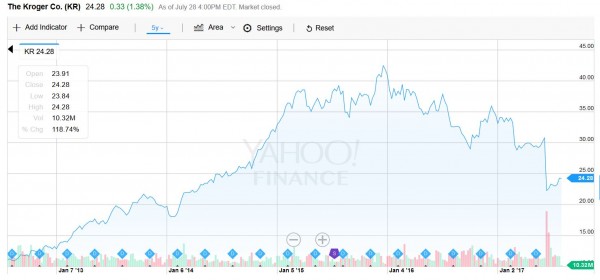

A few years ago my stock portfolio contained a large position in Kroger stock. The company was undervalued on a relative basis to the S&P 500 and it was the largest grocery store chain in the U.S., meaning it had a robust supply chain that could generate attractive margins. Margins even had a chance at improving with their foray into the naturals and organic segment of grocery.

The stock climbed in a slow, consistent fashion for a while. Then one day, Amazon made an announcement: they were looking into the grocery store market.

While this foreshadowed something that would not happen for years (i.e. Amazon’s acquisition of Whole Foods Market), I recognized that my thesis was being disrupted. I cashed out, missing out on some profits but content to make what I did. It turns out this was ultimately the correct decision, at least as of now.

I don’t always follow through on this, but when a thesis of mine is disrupted I re-evaluate the position seriously. I’ve done the same thing recently in MTG. A while back I made a bet on Magic Origins booster boxes. This was to be the last core set ever. The set contained some difficult-to-reprint flip planeswalkers. Frontier was going to drive up demand for these powerful but underappreciated cards. It was a perfect combination.

Things suddenly unraveled. First, Frontier lost its steam. The poster child card from a speculator’s standpoint was Jace, Vryn's Prodigy, which had a small spike in January 2017. Traction was lost, and the card now trades near its all-time low. Then Wizards announced the return of Core Sets—so much for being the last set ever.

Finally, Wizards also announced the new From the Vault: Transform. The set announcement site boasts, “In celebration of this versatile mechanic, we have assembled 15 of our favorite transforming cards in From the Vault: Transform. Each card represents a different aspect of power that comes with transformation, and each card has a story to tell.”

There’s only one story I care about here: we’re getting Magic Origins reprints. I don’t know which flip planeswalkers will be reprinted, but I am confident there will be at least one. The most logical inclusion would be Jace himself.

Based on all these events unfolding, I decided to take a small loss and bail on my Origins box investment. It pains me to do so, and when I purchased these boxes I promised myself I wouldn’t sell until 2020. But the prospects for this set have deteriorated badly this year.

While it’s likely these could sell for more in 2020 than they are selling for now, the relative growth of these boxes will pale in comparison to other opportunities and I’d much rather have the cash available to make other purchases. Think about it: my boxes are sitting there rotting while Reserved List cards continue to sell out and dual lands rise. I need to pick up what I want for my collection rather than sit on newer booster boxes.

If It Ain’t Broken, Don’t Fix It

My other source of recent selling has fortunately been far more successful. I don’t mind taking small losses now and again because I only need to win more often than lose in order to make money from this hobby. Fortunately, I have found a few patterns that have proven themselves worth pursuing to positive results.

First, there's the Masterpiece series. This premium set has been a well I have returned to time and again. First it was Lightning Greaves, then Chromatic Lantern, then Extraplanar Lens, and most recently Rings of Brighthearth. In each case I found that TCGplayer stock was nearing zero, I scoured the internet for one or two remaining copies, and then promptly sold them for modest profit into the hype that ensued.

Why am I not holding these for the long-haul? That’s not the thesis behind my investment. I don’t care for holding these cards for the long term—I would much rather take easy profits over the short term. Personally, I would much prefer a 20% gain over a one-week timeframe rather than a 50% gain over a one-year timeframe. The liquidity is just far more important to me, plus the short-term flipping minimizes downside risk.

You know that pattern we see when a card spikes, then sellers undercut each other as the card finds a new plateau? These Masterpieces may be flashy and rare, but they’re not immune to this same trend.

Similar to Masterpieces, I’ve found a similar trend with Commander-driven spikes. Just as stock on TCGplayer nears zero, I grab a few copies from scouring the internet and then proceed to cash out shortly thereafter. I did this recently with Mindmoil. I only managed to find one copy at the old price, but it was worth grabbing because I sold it to Card Kingdom as part of a larger buylist order.

I also flipped a couple of foil Cat cards: foil White Sun's Zenithes have been selling slowly at $8 on eBay and I just buylisted foil Raksha Golden Cubs for a small gain. I could hold these longer as well, but as before I enjoy taking profits when hype is high. I still have a couple bets on the Commander 2017 set, but cards I don’t have particularly high confidence in I like to sell for profit ASAP.

Lastly, I’ve been strategically flipping Old School cards as they spike to unbelievable prices. For example, when Citanul Druid spiked, I found a cheap one on Card Shark and buylisted it to Card Kingdom. In that same order I also shipped them a set of Spirit Links from Legends, a card that has maintained a crazily high price point.

These will likely keep going higher, but I was so shocked by the sudden price jumps that I felt obligated to cash out. I’m not a greedy investor, and as always I take profits when I can.

Wrapping It Up

You’re going to get 101 articles, tweets, and podcasts about the Pro Tour. There is a ton to discuss about Standard. What cards will maintain these new price points? Which cards will rise in popularity to combat mono-red strategies? What cards will lose utility come rotation? All of these thoughts will generate lively discussion going forward. The QS Discord will be an excellent place to stay engaged as people share their thoughts during this volatile time.

Personally, I’ve been uninterested in Standard for months now. Hopefully the launch of Ixalan and the upcoming rotation helps get me reengaged with the format. If that doesn’t, I'm certain that Return to Dominaria will. That very well could be the next set I buy packs of just to open! Time will tell.

But just because I didn’t speculate on the Pro Tour doesn’t mean I haven’t had any cards to sell. In fact, I’ve been selling fervently lately as I discover a rhythm to this market that has worked time and again. With these profits, I’ve even managed to move some more funds out of MTG and into my son’s Fidelity account.

I even reapplied a valuable lesson learned from the stock market: I trimmed my position in Home Depot upon news that Amazon was partnering with Sears to sell Alexa-enabled appliances. With those proceeds, I bought some stock in the ultimate MTG play: Hasbro stock. The recent sell-off could very well be a buying opportunity with so much on the horizon in the world of gaming.

All this to gradually approach my end goal: to fund my son’s college education through Magic: The Gathering. To do this I must continue selling and taking profits where I can. This will be an ever-present theme to my articles no matter the format or time of year.

…

Sigbits

- I don’t know what is driving Anaba Spirit Crafter’s price higher. There are two cards I expect to see from Homelands on MTG Stocks each week: Didgeridoo and Merchant Scroll. But now there’s this third card cracking the $2 mark. All I know is that Star City Games had 11 NM copies for sale at $0.49 so I grabbed them. I also picked up their Anaba Ancestors at the same price. If this is a Minotaur thing, then this other Reserved List one has potential to hit $2 too.

- One of my favorite Old School creatures is Flying Men. While these are only common, and have been reprinted in Time Spiral, the original Arabian Nights printing has gotten relatively costly. Star City Games is sold out at $5.99 and Card Kingdom’s buy price has been fairly aggressive.

- Want to know what’s bafflingly expensive? Check out the price of Alpha and Beta Llanowar Elves. They’re $39.99 and $19.99, respectively, for near-mint copies! That may seem crazy for a common, but thus the power of Old School and collectability!

Since no one wanted to comment on your article, I will.

Good job.