Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

If you’ve been living under a rock for the past couple weeks, you may have missed all the drastic moves in Kaladesh Inventions. In all, six different Inventions jumped by at least 45% in the past seven days, with Pithing Needle taking the headline.

That is a considerable move in these cards considering their high base! It’s easy for a card like foil Force Bubble to jump 370% simply because its base was only a buck. But for a card to be $49 and jump over 100% means a $50 move!

Granted, I doubt copies have sold at these new prices. The few speculators looking to get out quickly are still testing the market by gradually listing copies at elevated prices. Given the low supply of these Masterpieces, this trend is likely to continue.

But this creates some uncertainty. Should you jump in? How low will prices retract before a new, stable price is identified? Are there other Masterpieces likely to make similar moves? This week I want to break down the driving forces in this controversial market to conclude the right actions to take from here.

Buying Masterpieces: The Positive Factors

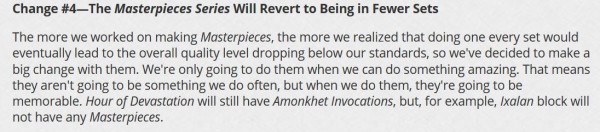

Multiple factors are driving the sudden surge in demand for these rarities. The primary catalyst is most likely Mark Rosewater’s “Metamorphosis 2.0” article published a month ago. Within he indicates a dire message for Masterpiece aficionados:

There you have it. From now on there will be fewer Masterpieces, and from the looks of it we’ll be taking off a good number of months before we see more. With so much uncertainty in the market (i.e there’s no telling when Masterpieces will return), we’re basically in a “what you see is what you get” scenario. Not much more product is being opened from Kaladesh block so whatever is on the market is likely to be it for a while.

I once argued that people should unload any Masterpiece cards from any set hand over fist. This was based on my hypothesis that the same money was essentially competing for all these varying high-dollar cards. The more that got printed, the more people would have to pick and choose their priorities. I saw this as a major headwind for this market when the reality was new Masterpieces every set.

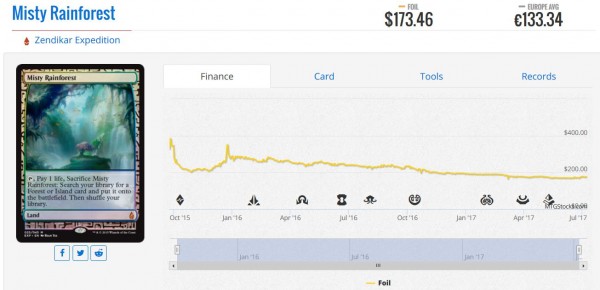

Many of the Expeditions had been suffering in price for months and I think this rampant printing of Masterpieces was a proximate cause. Hence why some of the most desirable lands dropped nonstop since their spike upon release. This trend could now reverse given the significant reduction in Masterpiece frequency.

Another positive factor driving Kaladesh Inventions prices is the simple lack of supply on the market. I don’t have any hard data to report, but I have a sneaking suspicion that far more Battle for Zendikar block was opened vs. Kaladesh block. And by the time you get to Aether Revolt, there is a sure lack of box-opening that took place.

Lastly, it’s worth mentioning the specific Commander allure for many of the Kaladesh Masterpieces released in the block. Commander players are known for seeking out foils and other expensive versions of cards for their decks. Naturally some of these players are prone to salivate at the beauty provided by the Inventions. Combine that with the ubiquity of some of these cards in EDH and you have a recipe for a robust market.

According to EDH REC, over 35,000 decks run Chromatic Lantern and over 50,000 decks use Lightning Greaves. Contrast this with the 13,000 decks that use a given fetch land such as Misty Rainforest and you begin to see why Inventions outshine the Expeditions. Sure, Expeditions have Legacy and Modern demand as well. But after witnessing these Invention spikes I’m inclined to believe most of it is driven by EDH speculation.

Now why did I use the term “EDH speculation” and not “EDH demand?” Well, let’s shift gears toward the more controversial negative factors surrounding this Masterpiece craze.

Buying Masterpieces: The Negative Factors

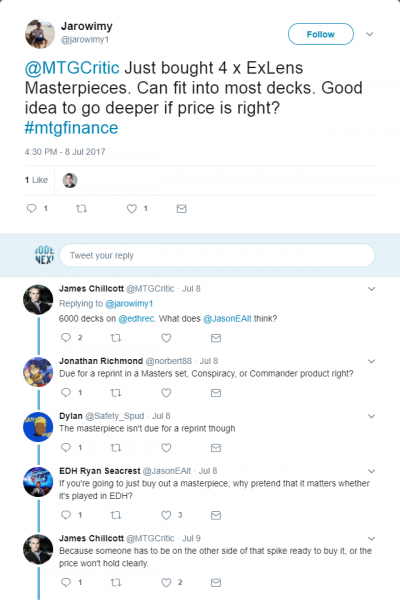

A considerable amount of demand for Kaladesh Inventions is stemming from speculation. I wish this was all natural demand stemming from EDH players’ interest to build the flashiest decks they can. But recent price movements have gone well beyond just this. Consider the Twitter conversation I read through last night:

I am going to keep this portion of my article neutrally toned. It is not my intent to pass judgment on the MTG finance community. I reference this dialogue because I think it accurately depicts what is transpiring in the Masterpiece market. People are recognizing the scarcity of these cards and their attractiveness in EDH, and gobbling up copies speculatively as a result.

Jarowimy puts it well: they have the copies they want for EDH but they may as well pick up some extra, right? Others chime in supporting the strategy. The result is summarized best by a different Tweet from Mr. MTG Finance himself, Jonathan Medina:

This isn't so complicated. The rise in the #MTGFinance meta-culture has created another sector of demand "spec-demand" which raises prices.

— Jonathan Medina (@MedinaMakesGame) July 7, 2017

This is happening over and over again. It wouldn’t surprise me if the majority of the Inventions that sold in the past 14 days went into speculators’ hands and not players’. Or maybe it’s both?

Are real people or #mtgfinance people buying MPs? Well both obvs... https://t.co/3epG2CDjVR — James Chillcott (@MTGCritic) July 7, 2017

Commander porn pic.twitter.com/DH6Xjm1jfV

— Jim Casale (@Phrost_) July 7, 2017

The fact that prices are being propped up by speculator demand is concerning to me. While these could be fine long-term holds, the short-term price will face headwinds as speculators look to bleed copies back into the market at a profit. In a way, it’s almost like a game of chicken. Speculators are likely to hold onto their copies as prices go higher and higher. But eventually someone will blink and list a bunch of copies for sale—then the undercutting will begin, leading to a retraction in prices.

This is precisely what I expect will happen. I myself have already “blinked.” While I didn’t make any large-scale purchases, I did pick up a few Masterpieces and have already sold one and listed another for sale on eBay. But is that what you should do? Hmmm…

What Next?

I’ll admit it’s very difficult to see through the fog and into the future. If you’ll grant me poetic license for a moment, “The Dark Side [of MTG finance] clouds everything” – Yoda. I can’t predict the prices EDH players are willing to bear as speculators look to squeeze profits out of their cards. I also can’t anticipate when enough speculators will “blink” and start undercutting each other fervently for a sale. Perhaps it never happens given how rare these are?

Personally, I’ll stick with my tried-and-true strategy. If I can sell cards for profit, I do so. Occasionally I hold onto certain pieces of my collection despite their appreciation; these are usually part of a deck or they represent nostalgia I continue to enjoy. I’ve done very well on my Juzám Djinns, for example, but I don’t sell them because I continue to play them in Old School.

But for these Masterpieces, I have no intent on playing them. I only bought a few, but I’m already itching to unload them to put my profits to work elsewhere.

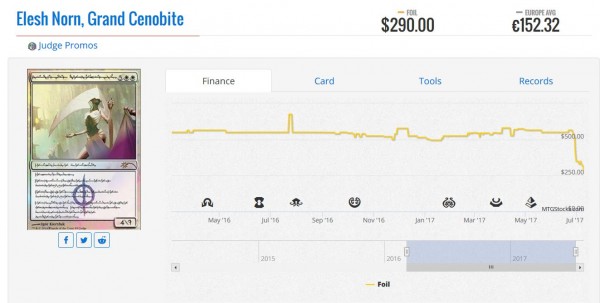

This high-turnover strategy ensures I minimize damage from reprinting and long-term headwinds such as speculator atrophy. After all, we only need Wizards of the Coast to release some fancy new Judge Promo Chromatic Lantern and suddenly the Invention printing has competition. For all we know, WOTC can get really lazy and just give out Inventions as Judge Promos in the future—they recycled the Phyrexian Elesh Norn, Grand Cenobite, after all, and this is destroying its price.

While I think a Judge Invention is unlikely, I’m not one to take on excessive exposure to this risk out of complacency. If I can move my Inventions at higher prices, I will. Then I’ll reassess the market. Perhaps there are other Inventions worth acquiring that haven’t spiked yet. As always, I seek to rinse and repeat. No one ever went bankrupt selling for a profit.

Wrapping It Up

Remember when the only way to get foil Wastelands was to drop hundreds of dollars on the Magic Player Rewards version? Then Wizards printed a Judge Promo in 2010, and then another in 2015, and then gave us foils in Eternal Masters last year. The repeated printings of premium Wastelands really took the wind out of the sails of these as specs for the long term.

I believe the same could very well happen with these Masterpieces. Wizards of the Coast realizes how popular they were and they know that with the right frequency, these can really supercharge sales of a given set. Do I think the Kaladesh Inventions will be outclassed overnight? Certainly not. But I’d be inclined to say that you shouldn’t stick these in a shoebox for five years and expect to come back to significant gains. That’s a possibility, but it’s far from guaranteed.

In the short term, you’re facing a different kind of dilemma: that of the speculator. With speculators drumming up FOMO (fear of missing out), the market is giving this knee-jerk reaction that is causing an even greater spike in prices. Everyone wants to make a buck and these Masterpieces are showcasing blowout gains on MTG Stocks day after day, driving even more attention to them. I wonder if this eventually fades and more copies enter the market than there are EDH players willing to pay these new, higher prices. If that happens, we’ll see a sizable pullback in pricing, negating much of the potential profits.

That’s why I’m looking to sell. Not all at once. Not desperately. I have prices in mind that I’d be happy to take, and if I can get them I’ll cash in and move on. Doing this ensures I am profitable on the Masterpiece endeavor without being left in the dust when a race to the bottom does begin.

In the meantime, be careful with the rhetoric you read on Twitter. Remember the motivations members of the MTG finance community have to drum up even more demand for cards they’re heavily invested in. Tread carefully, don’t be greedy, and you should do just fine navigating the market for the highly desirable cards.

…

Sigbits

- When I sort the Kaladesh Inventions by popularity on TCG Player the top match is Arcbound Ravager. This could very well be the next one to spike. SCG has only four in stock with an elevated price tag of $84.99. But there are a handful of copies below $80 that would need to be cleared out first in order to see a sizable price jump. Perhaps if you are taking some profits on your spiked Inventions, you could look to double-dip into this one if you’re feeling bold.

- Sindbad? Really?? Why is this uncommon from Arabian Nights now sold out at $14.99 on Star City Games’s site? Why is the cheapest copy on TCG Player $18? Well, market price is still only $6.25 so perhaps copies haven’t been selling at the new price and we’re seeing manipulation at play. But when I see Card Kingdom slap an $11 buy price on the card, I start to become a believer that demand is real. Anyone have any theories?

- As someone who is in in the market for Underground Sea, I can tell you that the market has been quietly moving on this and a few other dual lands. I’ve seen the number of sellers on TCG Player drift down lately, approaching seasonal lows. Star City Games has just 11 copies in stock themselves, with NM going for $399.99 and MP $299.99. More incredible is the fact that SCG remains sold out of Unlimited copies with a NM price tag of $699.99! This is approaching the same price as a piece of HP Power!

Nice Article. I deleted an entire section of this comment, just because it was getting too long….goes to show the complexity of this subject.

I am a Commander player and I play at 2 separate stores on the opposite side of town, and I rarely see any KLD inventions. I have been keeping an eye on prices cause I like to pick up a few things for my deck, but really want to catch these things at the bottom. Based on how little inventions I see, I feel like speculators are probably hording, propping up the prices a bit. However, high demand cards like the Swords are going to have a pretty solid price floor, probably $5-10 more than their original printings. If I were buying swords, and I could get the Invention version for $10 more, I would do it every time. The only exception would be if there was enough supply of inventions to push down the prices of the original versions also.

The big question I have is, what will these things look like in 3-5 years. Will they slowly drift down like the BFZ expeditions? Do they stay even, or is sword of fire and ice $200?

Still not really sure when I should pick up my set of swords. Anyway these are my thoughts. Love the article.

Peter,

Thanks for the comment and for the kind words. I sit here wondering the same things as you are…speculators are driving up prices on the one hand, but on the other hand these Masterpieces are special and will attract interest from EDH players. So the question will become what price can the market bear as prices scream higher? Unfortunately I can’t answer this definitively – but my gut tells me we won’t see a selloff in Inventions like we saw with Expeditions. Supply seems to be smaller and demand greater, plus speculation is rampant. You may be best buying what you want right away as long as it’s not something that was already bought out.

Best of luck to you in finding what you’re looking for. It’s certainly a complicated scenario!

Thanks,

Sig

you ask if people really buy it?

Yes, I sold my 4x opal for 170€/card on mcm. And that’s not the bottom.

A friend also with a pimped affinity sold his playset today for 180€/card on mcm.

Speculators don’t buy at that price.

Meanwhile Chromatic Lantern spiked about a week ago and still market price on TCG Player is just $60. The same few copies at $75+ have been listed for days now with no buyers.

Perhaps it depends on the card and the magnitude of the recent spike. Mox Opal is expensive but it was all along, and perhaps did not increase the same percentage as something like Chromatic Lantern, which hasn’t been selling as much at the “new price”. Just a hypothesis, it’s somewhat anecdotal but could explain the discrepancy.

I’d love to hear others’ experiences as well!

Thanks,

Sig

non moddern inventions are probably not real spikes. Here I can imagine a speculator saw all the spikes and concluded that chromatic lantern is good target.

I did this in the past too, see something spike, make a (wrong) theory and speculated on another target based on that.

I’m done with speculating on big cards. Too time consuming and too risky.

But this happens to be a set I bought for personal use. And I decided to start with the mox opals first because I was afraid they were going to spike first. I didn’t expect the price to be triple the price I bought it for, so I’m taking the money here.

That’s why I’m not sad that I didn’t buy more. Never worth the risk. But I do think my opinion at that time was correct and the mtgfinance consensus was wrong (see thread in forum).

Now the mtgfinance consensus says that this was difficult to predict, but I think it wasn’t.

I did not ask if people buy them. There are plenty of sold listings on ebay, though less than I would have expected. I am merely suggesting a hypothesis that speculators and big box openers are hording supply, and that the current prices are artificially inflated.

Peter,

I am with you on this. I suspect the same trend is occurring. Indeed some speculators have been very vocal with the quantities they have acquired over the past month or two. These speculators will want to sell into the spike, which will inundate the market with copies. The price will settle back down once the hype dies down…that’s my guess.

I’ll quote Jason: “If you’re going to just buy out a masterpiece, why pretend that it matters whether it’s played in EDH?”.

None of this is EDH demand. EDH players simply do not suddenly all jump on a card. It’s usually speculators or tournament players that cause a sudden spike. As such of course Lanterns don’t sell: it’s an EDH card that’s now too expensive for its target audience. And of course Mox Opals do sell: competitive players like to show off too and they tend to be more willing to put in big money. (There are of course exception, but not enough on the EDH side for it to be relevant).

Speculators are highly relevant to the prices of rare cards, an unfortunate, but true, fact. We’re all gambling on greater fools.

You’re probably right on that one. This is precisely why I sold all the MP’s I had bought (and that was only a few of them) into the hype. Though I think gradually EDH players will generate enough demand to float the MP’s higher…but that will take some time.

A lot of time most likely. From the subset casual players you need the subset that likes foils, from that subset you need the subset that doesn’t go for first print foil only and then you need the subset that is willing to spend the price it increases to on a single card. Would not be surprised if we’re talking 1 in 500 players ballpark here.

These cards are quite rare, but so is the player that wants them. Perhaps I am underestimating their numbers, but I honestly don’t see a strong demand here.

Nice job Sig. Another great article.

Thanks, Mike!