Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the MTGO Market Report as compiled by Matthew Lewis. The report will cover a range of topics, including a summary of set prices and price changes for redeemable sets, a look at the major trends in various Constructed formats and a "Trade of the Week" section that highlights a particular speculative strategy with an example and accompanying explanation.

As always, speculators should take into account their own budgets, risk tolerances and current portfolios before buying or selling any digital objects. Please send questions via private message or post below in the article comments.

Redemption

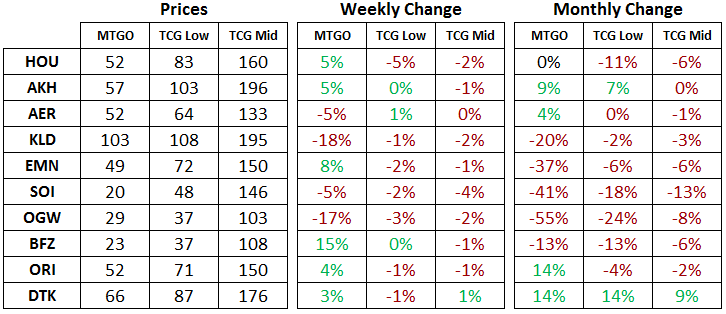

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of September 18, 2017. The TCGplayer low and TCGplayer mid prices are the sum of each set's individual card prices on TCGplayer, either the low price or the mid price respectively.

All MTGO set prices this week are taken from GoatBot's website, and all weekly changes are now calculated relative to GoatBot's "full set" prices from the previous week. All monthly changes are also relative to the previous month's prices, taken from GoatBot's website at that time. Occasionally, full set prices are not available, and so estimated set prices are used instead. Although both Aether Revolt (AER) and Kaladesh (KLD) are no longer available for redemption, their prices will continue to be tracked while they are in Standard.

Standard

Although Oath of the Gatewatch (OGW) dipped again this week, the other three rotating sets look to have established their price bottoms. After touching 45 tix last week, Eldritch Moon (EMN) has rebounded with a price just under 50 tix. Shadows over Innistrad (SOI) and Battle for Zendikar (BFZ) are still fluctuating around the 20-tix level.

AKH and HOU are both up five percent this week as drafting of these sets slow down and players and redeemers stock up on on the cards they need for the new Standard. This trend should continue for the next six weeks as the redemption cutoff date approaches in November.

Ixalan (XLN) will be released on Monday on MTGO, but Standard will be rotating after today's downtime. This makes for a strange few days where Standard will be comprised of KLD, AER, Amonkhet (AKH), Hour of Devestation (HOU) and reprinted cards like Opt and Duress. In particular, keep your eye on the check lands that have historically been printed in the core set. These lands will definitely be integrated into Standard manabases, so look for Glacial Fortress and friends to see some short-term buying activity before giving way to the flood of supply that XLN will bring into the market.

Portfolio Plan

At this critical juncture of the MTGO market, it's a good time to do some long-term thinking about how best to evolve the portfolio. Lately, I've been stocking up heavily on rotating sets. It will be clear by December whether or not this was a good strategy, but I firmly believe this will turn out to be an excellent spot to deploy tix.

The next area to assess will be the foil mythic rare strategy for AKH, HOU and XLN. This is an evolving strategy that relies on the economics of the MTGO market for its success. In the case of AKH and HOU, the end of redemption in November will put a squeeze on available supply, driving prices higher. At the moment, the portfolio returns on complete sets of foil mythic rares and after accounting for the buy/sell spread are 10 percent for AKH and 25 percent for HOU.

It's not clear what drives this difference, but if these returns were time weighted, it would be even more obvious that a set of foil mythic rares from HOU is going to be the winner relative to AKH. If XLN block mirrors the returns to AKH block, then clearly tix would be better deployed in the second set than in the first. Speculators would be better off holding onto their tix than buying foil mythic rares from XLN. The second set appears to have the advantage when it comes to the foil mythic rare strategy. Players should still feel free to buy their playsets knowing that they are preserving value in their purchase.

The next area for deploying tix in the near term will be into AKH and HOU boosters. These have been flirting with the 7-tix level, but once XLN is released on Monday, I expect a meaningful dip below that level. I will be a buyer for the portfolio in the next week and players and speculators should also be stocking up.

Notably, as a commenter pointed out in last week's article, the announcement of MTG Arena does add some uncertainty into this strategy. If MTG Arena is released in the next three months and drafting is available at a reduced cost on that platform, then the market for HOU and AKH boosters on MTGO will evaporate.

From my perspective, I think the possibility of MTG Arena making it out of beta testing and being released before the end of 2017 is extremely small. WotC has a poor track record when it comes to developing software, so it would be an astonishing turnaround in that capacity for a fully functional program to be released in such a short timeframe. At least for AKH and HOU boosters, I think this strategy will be perfectly safe.

The last good buying opportunity in the short- to medium-term will come from Modern singles. Look for Modern staples to go on sale over the coming weeks as players test out XLN Standard and Limited. Inevitably, a few Modern players will look to part with some cards in order to enter Draft Leagues and to get the cards they need for Standard. This is a great opportunity for speculators to buy up Modern staples.

It does require a little discretion, though, and purchasing decisions should be made on a case-by-case basis. Avoid cards that are going to be reprinted in Iconic Masters. Target high-quality staples that see play in multiple decks. Fringe or just playable cards should be avoided since these will be under steady supply pressure from Treasure Chests. A good example of a card to target is Scalding Tarn if it dips into the 20- to 25-tix range. This would be a pending buying opportunity that would require closer scrutiny.

On the selling front, the end of redemption for AKH and HOU in November means that these two sets will lose the price floor provided by redemption. Selling any cards from these sets that only get their value from redemption would be correct. In other words, move out of pure junk rares and mythic rares.

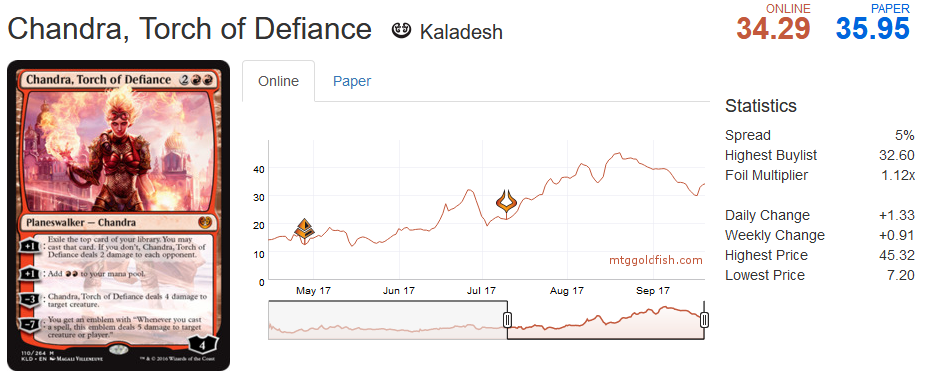

Standard playable cards and Standard staples are another matter. We've seen cards like Chandra, Torch of Defiance and Spirebluff Canal go on to new highs after the redemption cutoff date, so it's clear that Standard playability matters a lot more than the end of redemption.The portfolio has over twenty sets of each of AKH and HOU on its books, so I'll be considering what to do with these over the coming months.

Trade of the Week

For a complete look at my recent trades, please check out the portfolio. This week I took the plunge on a high priced Standard staple in Chandra, Torch of Defiance. Buying Standard cards at such an elevated price is not recommended for the faint of heart, but I'll explain my process and how I will manage the risk of buying such an expensive card.

Chandra is no question a Standard powerhouse that saw a ton of adoption after the release of HOU. It's clear the big uptrend took root at that time with the rise of Ramunap Red decks although it also shows up in Temur Energy decks. It's also been getting a boost from Modern as it shows up as a very complementary piece in Titan Shift decks. That deck has firmly established itself as a tier-one strategy in the Modern metagame.

With all of that in mind, Chandra, Torch of Defiance was on my radar as a card to keep an eye on. Ramunap Red and Temur Energy are two decks that will be played in the new Standard and Chandra will be a core piece in Ramanup Red and a strong option in Temur Energy.

When a mono-red deck is playable, it historically comes out of the gates in any new Standard as one of the decks to beat. Ramunap Red looks poised to continue that trend, so I was watching the price of Chandra very closely for the signs of a price bottom.

The way to look for a price bottom on MTGO is to pay close attention to available supply. If the market is well supplied at the current price level, then a price bottom in not imminent. One sign that points to a low supply is the presence of a card on MTGOTraders hot list. These are cards that MTGOTraders is paying close to full price for. They want to keep all cards in stock for their customers, so they put a premium on cards that they need to stock.

At a market price of 30 tix, Chandra was still on the hot list, so I took a look around for other signs of low supply. The next stop is to look at how many copies are available on MTGOLibrary's price wiki. This website serves many different bot chains, but they typically try to undercut the bigger bot chains by a little. When I checked the wiki, there were plenty of copies of Chandra available at 30 tix.

One note on the bots served by MTGOLibrary: they typically post buy and sell prices that don't match up with what is being offered during in-client transaction. I use these bots less and less as a result, since I can't rely on getting the posted prices. Still, it's useful to check on what the market is up to even if I don't use them for buying and selling cards anymore.

The last step in determining what is happening to the supply of a given card is to scan the classifieds in the MTGO client. I did a search for "Chandra, Torch Sell" to get a feel for the prices that were being posted. Most posted prices were above 30 tix. A normal level of supply would give a wider variety in prices, higher and lower, when compared to the market price. In this case, the lack of posted prices below 30 tix indicated a tight or low supply.

Taken as a whole, a price bottom appeared to have been forming, but was not yet established. This was a perfect time for me to add a playset into the portfolio in the evening and to reassess how the market evolved overnight. Sure enough, when the morning rolled around, the price had risen to 32 tix as the market appeared to be turning. Running through my checks again, there was not a meaningful change in any of the indicators, but it's hard to argue with a price bump.

Goatbots still had prices at about 31 tix, so that was my first stop in stocking up. Next, I picked off available copies on the classifieds under 32 tix. This got me to a total of five playsets, which was enough for the moment. The plan would be to watch the price carefully over the coming weeks and to observe how the Standard format evolves with the addition of XLN. If Ramunap Red decks are firmly in the upper tier of decks, I anticipate a return to the 40-tix level.

If Standard moves away from Chandra, a return into the 25- to 30-tix range will occur. If prices hit the 30-tix level in the coming weeks, it will be time to take a step back and reassess this trade.

I wanted to get in on the Chandra party. Picked up a single playset around 29, hoping that it would drift further down….it did not. I can see Chandra easily hitting 40-50 tix at some point in standard. Its card advantage, ramp, removal, and if you give it long enough a win condition. Besides the fact that Gideon and other powerhouse 4 drops are rotating out. Hopefully I can find a few more playsets on sale during release.

I forgot to ask, are you still using excel to scrape prices or do you just do it manually now?

I do it manually now.

I used to be able to scrape MTG stocks for TCG prices using Excel, but I’ve not been able to scrape goat. I used to rely on supernovabots for MTGO prices, but they are now defunct.

Basically, I haven’t put in the time and effort to figure out a solution in excel, or if it’s even possible. The one concession I have made is to move from daily prices when I had it fully automated to weekly prices entered manually.

Would be interested to know how you are/were using excel to scrape. I tried it, but because of the embedded stuff on most web pages these days it wasn’t working too well. I think Goatbots goes so far as to serve up pictures of the prices instead of actual text. I found a scraper plug-in for Chrome, but it has to be run manually each time, and the output is full of extra unnecessary data.

Yes, the embedded stuff makes it harder to scrape prices and maybe impossible using excel.