Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the MTGO Market Report as compiled by Matthew Lewis. The report will cover a range of topics, including a summary of set prices and price changes for redeemable sets, a look at the major trends in various Constructed formats and a "Trade of the Week" section that highlights a particular speculative strategy with an example and accompanying explanation.

As always, speculators should take into account their own budgets, risk tolerances and current portfolios before buying or selling any digital objects. Please send questions via private message or post below in the article comments.

Redemption

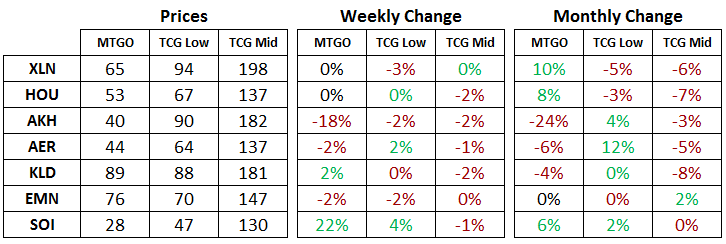

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of January 15, 2018. The TCGplayer low and TCGplayer mid prices are the sum of each set's individual card prices on TCGplayer, either the low price or the mid price respectively.

All MTGO set prices this week are taken from GoatBot's website, and all weekly changes are now calculated relative to GoatBot's "full set" prices from the previous week. All monthly changes are also relative to the previous month's prices, taken from GoatBot's website at that time. Occasionally, full set prices are not available, and so estimated set prices are used instead. Although Hour of Devastation (HOU), Amonkhet (AKH), Aether Revolt (AER), and Kaladesh (KLD) are no longer available for redemption, their prices will continue to be tracked while they are in Standard.

Standard

Despite my best efforts at predicting when Energy would get nerfed in Standard, Wizards of the Coast (WotC) moved aggressively this week to balance out Standard. I thought that February would be a better time to handle this move from a marketing perspective, but it looks like WotC felt it had no choice but to move now to try and restore some diversity to the format.

In the MTGO market, the bans have shaken up the valuation of Standard playable cards and prices are responding. The big surprise was the hit that red took with Ramunup Ruins and Rampaging Ferocidon permanently sidelined in the format. Chandra, Torch of Defiance and Hazoret the Fervent are down as a result, though one of the first undefeated decklists from Standard leagues has been revealed and both of these cards are present. Have a look.

Hazoret and Chandra are both powerhouse cards still, but the market has soured on them in the short term. Players looking to round out their collections should take advantage of the dip in price and the turmoil in Standard. It's possible that both of these cards don't recover their previous prices, but I would bet that these are too cheap right now.

Elsewhere, some of the early winners are The Scarab God, Torrential Gearhulk, Heart of Kiran, and Angel of Invention. It's not clear if the trends on these will continue, so if you are like me and don't have a deep insight into where Standard is headed, selling some copies of these would be prudent in light of their recent jumps in price.

In terms of Rivals of Ixalan (RIX), the preview events put enough product into the market to stoke brewers interest and prices went bananas over the weekend. Starting at 164 tix on Friday, the set peaked over the weekend at a whopping 273 tix. An aggressive speculator could have been buying up cards and reselling them over the weekend at a nice profit, even if we assume much larger buy and sell spreads than normal. If preview events are a permanent feature of set releases going forward, this will be a trade to watch out for.

Modern

RIX hasn't yet filtered into Modern in a big way, though the market is anticipating that Dredge will be benefiting from the new set. Blooghast has just about reached its highest price in a year despite being reprinted in Iconic Masters (IMA) recently, and a relatively obscure Tenth Edition uncommon named Goblin Lore has perked up and is now at 2 tix.

I think this is in reaction to the printing of Silent Gravestone, which on the surface looks like a bad Relic of Progenitus. It's cheap casting cost is the same, but actually hating the graveyard takes four colourless mana, so it's not at all suitable for Modern sideboards. Where Dredge gets utility from this deck is in the static ability that prevents targeting of cards in graveyards. This turns of two widely played graveyard hate cards in Surgical Extraction and Scavenging Ooze, and that's perfect for a deck like Dredge that's looking to fill and protect its graveyard.

Standard Boosters

Last week, I highlighted the opportunity on RIX boosters that I anticipated. Although these peaked at close to 4 tix over the weekend, that increase was tied to the high expected value of the boosters and not to broader market forces. If you were able to sell on the weekend, then you reaped a nice short-term profit, but this was a stroke of luck and not anticipated on my part.

This week, I am reviewing the thesis and I have found it wanting. XLN boosters have strengthened in price and now sit at 3.5 tix. RIX boosters have come back down and now sit at 3.2 tix. A draft set on the secondary market goes for just a little over 10 tix, the equilibrium price.

Where my thesis was wrong was to trust the most recent historical data on HOU and AKH boosters. After HOU was released, AKH boosters dropped to 1.5 tix, and never recovered a price higher than 2.5 tix while AKH block was the current Draft format. This gave me a guide for what to expect with XLN boosters, and the recent price dip to 2.0 tix also suggested lower prices were possible.

What I didn't take into account is the awarding of RIX boosters in last week's preview events. This fundamentally altered the relative scarcity of RIX and XLN boosters. Instead of RIX boosters accruing value due to being relatively scarce like HOU boosters last summer, the injection of supply has mitigated the issue and the price of each booster is much closer as a result.

Relative scarcity is an important concept to consider. Looking back at how HOU and AKH boosters move in price, the initial drop in AKH at HOU's release was a result of the scarcity of HOU boosters in relation to AKH boosters. There were lots of AKH boosters around but not many HOU boosters, and prices followed suit.

Over time, AKH rose in price, while HOU trended down. This suggests that HOU boosters were not as scarce as they were when the set was released, which is a function of how prizes are awarded in leagues and drafts. It's difficult to perfectly balance prizes in terms of draft sets, so the market was gradually leaking AKH boosters while HOU boosters were filtering in.

With the same prize structure in place for XLN and RIX drafts and leagues, and this week's price action, I think the trend in the price of these boosters will continue. RIX should gradually decline and XLN will increase, with a draft set maintaining a price of around 10 tix (at least initially). If you took my advice and bought some RIX boosters last week to speculate on, it's better to get rid of them sooner rather than later. Both XLN and HOU boosters are attractive to me at current prices.

Trade of the Week

For a complete look at my recent trades, please check out the portfolio. This week, I have moved some of the foil mythic rares from XLN that I bought in the fall. The return on these is over twenty percent. The foil mythic rare strategy is definitely a tried and true method for generating positive returns. I'll be starting to buy foil mythic rares from RIX this week as the market gets more supply from Limited events.

Bloodghast and Goblin Lore’s increases are due to SaffronOlive’s Budget Magic video this week.

Thanks for the heads up! That looks like I definitely made a mistake in attribution. Cheers,

Matt

Matt, love your MTGO series. A question about the Foil Mythic Rare strategy you use…Is there a typical price level you target for the average foil mythic? Looking at MTGGoldfish, current prices for foil mythics range from 6 on the low end up to 26 for Kumena. How do you know where is a good point to buy in? Any rules of thumb you use? Has the ship sailed on Kumena?

Thanks,

Aaron

I’ve tracked historical average mythic rare prices since BFZ, but I’m not sure if it makes a big difference to be honest. Every set is different and the average price seems to vary too. Here’s a quick rundown of the average price in the first month of release

BFZ: 12.5

OGW: 11.8

SOI,EMN, KLD: These are skewed by the prerelease foils, so I won’t report them

AER: 10.7

AKH: 10.3

HOU: 11.3

XLN: 10.6

RIX: 14.5, currently on goat

RIX seems a little high at the moment. I’ve bought my playset, and the average price of the two purchases was 12.5 and 13.2 tix. I wouldn’t be so comfortable buying at 14.5 tix, but 12 or 13 is reasonable.

I’ll be waiting to see how prices evolve over the next week before I buy more.