Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the MTGO Market Report as compiled by Matthew Lewis. The report will cover a range of topics, including a summary of set prices and price changes for redeemable sets, a look at the major trends in various Constructed formats and a "Trade of the Week" section that highlights a particular speculative strategy with an example and accompanying explanation.

As always, speculators should take into account their own budgets, risk tolerances and current portfolios before buying or selling any digital objects. Please send questions via private message or post below in the article comments.

Redemption

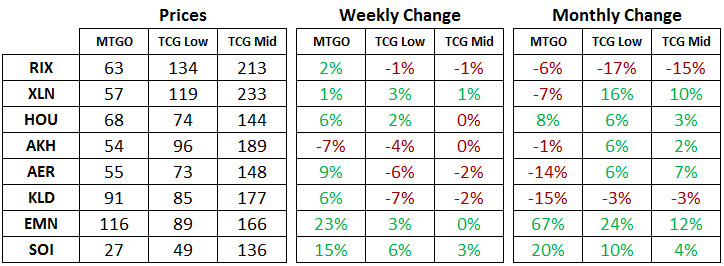

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of February 26, 2018. The TCGplayer low and TCGplayer mid prices are the sum of each set's individual card prices on TCGplayer, either the low price or the mid price respectively.

All MTGO set prices this week are taken from GoatBot's website, and all weekly changes are now calculated relative to GoatBot's "full set" prices from the previous week. All monthly changes are also relative to the previous month's prices, taken from GoatBot's website at that time. Occasionally, full set prices are not available, and so estimated set prices are used instead. Although Hour of Devastation (HOU), Amonkhet (AKH), Aether Revolt (AER), and Kaladesh (KLD) are no longer available for redemption, their prices will continue to be tracked while they are in Standard.

Masters 25

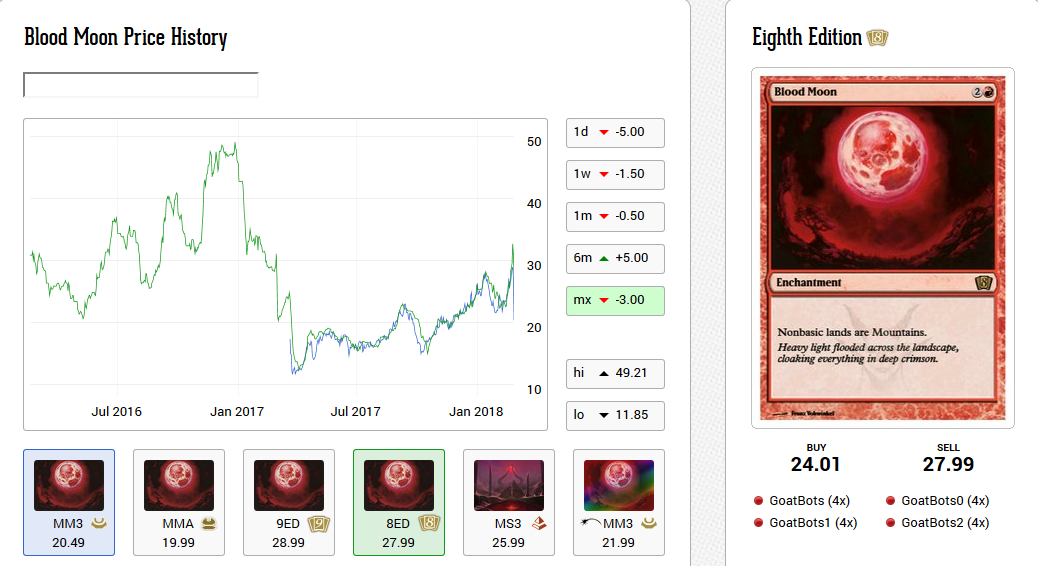

Previews for Masters 25 (A25) are rolling in this week, and I've pulled two recent examples of how card prices fare in the wake of a reprint on MTGO. The first is Blood Moon, a card that has seen multiple printings and is returning again in A25. The most recent reprint of this card is from Modern Masters 2017 (MM3), released last year. This version's price history is charted below along with a handy comparison to the price of the 8th Edition (8ED) version. The chart is courtesy of GoatBots.

Prior to the reprint, the 8ED version of Blood Moon ranged in price from 20 tix to nearly 50 tix, which you can see via the green line in the chart. When the reprint in MM3 (the blue line) arrived at the end of last March, the price of both versions dipped to under 15 tix. Since these are identical game pieces for playing Magic on MTGO, the two prices rarely differ by very much.

Going by this chart, buying Blood Moon at the start of MM3 drafting would have been an excellent financial decision. The price of these two versions and all the other versions bottomed at that time. Speculators and players alike should take note of this type of trend. I'll be readying some tix to buy up playable reprints when A25 hits in a few weeks.

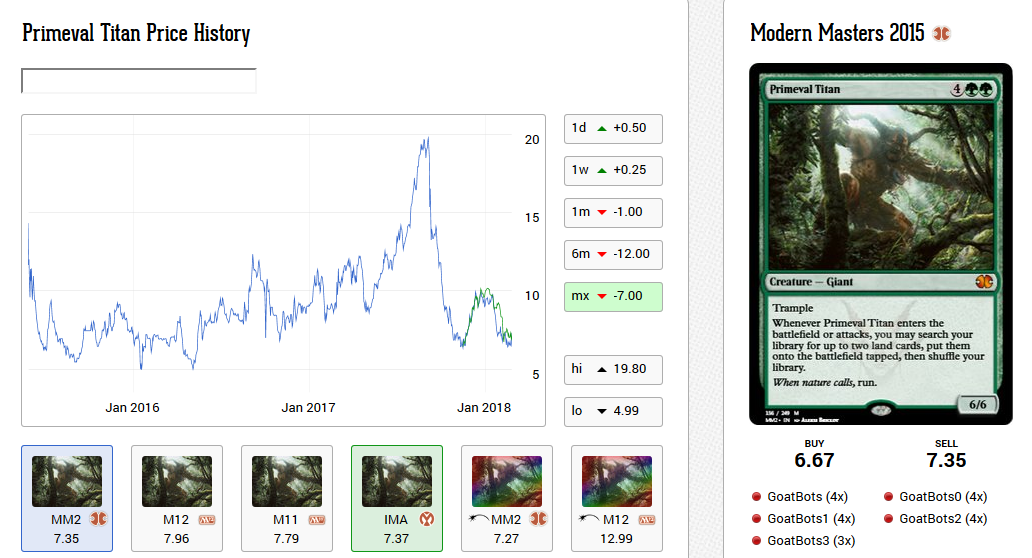

It's important to realize, though, that not all reprints are going to be slam dunks. Check out a similar chart below for Primeval Titan, again courtesy of GoatBots. The drop from 20 tix all the way down to 7 tix when Iconic Masters (IMA) was released this past November looked like a great buying opportunity. I loaded up on these, but the Modern metagame has turned against Primeval Titan and the card is back down to about 7 tix.

The takeaway from these two examples is that playability still matters when selecting speculative targets. You can't just buy up all the reprints and expect a profit on each of them. It's clear, though, that when A25 is released on MTGO, the opportunity will be there to scoop up cards at depressed prices, so readying a list of targets when the full card list is known will be a good idea.

Aside from Blood Moon, there are two other clear targets from the previews so far. Pyroblast and Hydroblast have been staples of the Pauper format since that format's inception. The last time these two cards were reprinted in a draft set was for Eternal Masters (EMA) back in June of 2016. Both of these cards were available for about 2 tix. Since the release of EMA, Hydroblast has spent most of its time in the 4 to 7 tix range with a recent spike to over 10 tix. While Pyroblast hasn't soared as high, it's mostly been in the 3 to 6 tix range. If these two cards go on sale again for about 2 tix I will be a heavy buyer.

Standard Boosters

Checking in on the booster market, RIX boosters have seen their value erode substantially over the past month, dropping almost 1 tix in price to now sit at 2.6 tix. Don't look for these to rebound in the near term unless Lee Sharpe decides to shake up the rate at which boosters are paid out in the Sealed and Draft Leagues. The prize structure of these leagues are subtly awarding more RIX boosters over XLN boosters, and this means the relative supply of RIX is increasing steadily over time. This has the natural consequence of a lower price, while XLN maintains its price at around 4 tix. If you are a player, remember to sell off your RIX boosters as soon as you get them, while holding onto your XLN boosters is fine.

Speculators should take heart, though, with Masters 25 (A25) previews in full swing this week there will be a chance to speculate on Standard boosters in mid-March. Once A25 drafts start firing, the premium pricing on these will quickly drain the tix out of players accounts. If the format is a fun one, then it will be really tempting for players to sell their excess RIX and XLN boosters in order to fund their next draft of A25. This will generate a temporary price dip on Standard boosters.

That being said, I wouldn't be planning a large speculative purchase of RIX and XLN boosters. There will be steady selling pressure as the April release of Dominaria (DOM) gets closer. That will be the next substantial opportunity to speculate on RIX and XLN boosters, and the short-term blip caused by A25 will be small in comparison. Players could add a draft set or two into their collection, while speculators can try to work up to thirty to forty draft sets. The key will be to look for a good price to be a buyer; as it stands currently, 7.5 tix for two RIX boosters and one of XLN seems about right, though I might revise buy price target depending on how their prices evolve over the coming weeks.

Trade of the Week

For a complete look at my recent trades, please check out the portfolio. Celestial Colonnade saw a jump in price with the unbanning of Jace, the Mind Sculptor in Modern, almost touching 40 tix two weeks ago. Since then the price has crashed to under 25 tix, no doubt as a result of the fear of a reprint in A25. It's during preview week for any Masters set where imaginations and fear runs wild as players predict the reprint of any valuable card in their collection. Speculators are wise to consider the actual reprint risk and compare that to what is happening in the market, which is what I have done here, and I decided to buy a few play sets of the U/W creature land for the portfolio.

This is no slam dunk, as there definitely remains some reprint risk until the full list of cards from A25 is available. However, the selloff seemed very dramatic to me, and the risk of a reprint was outweighed by the reward of not being reprinted. Once the full card list is revealed, if Celestial Colonnade avoids being reprinted, I expect it will instantly shoot up into the the 27- to 30-tix range with the potential for further gains. If the card is in fact revealed as a reprint, then the price will drop into the teens.

The way to balance out these two possibilities is to estimate the risk of a reprint in percentage terms. But in order to do that one needs to thoughtfully consider how when and why a card is going to be reprinted. For me, the Worldwake (WWK) creature land cycle is a valuable vein of reprints to tap that Wizards of the Coast won't just push out the door because they can.

It's possible they will squeeze this cycle into a future Standard set in order to help sell that set, but I think the power level of these cards is quite high, and as a result, a reprint in Standard seems a slim possibility. A set like Modern Masters 2019 or A25 would be the perfect vehicle to reprint these, but the unbanning of Jace in Modern and his reprint in A25 means that this set has everything it needs to sell itself. If you think of reprints as being a source of value that needs to be used sparingly, then including a Modern-playable cycle of lands would be an unnecessary reprint at this time, and Wizards of the Coast would be better off saving this particular bullet for a future set.

With all that in mind, I put the risk of reprint in A25 at ten percent, which is a low number but not zero. When you put a number on the chance of a reprint and then you put a number on the upside and downside possibilities associated with being reprinted or not, the risk-reward ratio crystallizes quite neatly. Buying Celestial Colonnade right now at 23 tix has two possible outcomes from my perspective. Ten percent of the time it drops into the teens, let's say 13 tix for the moment. The other ninety percent of the time it rises to 28 tix. Thus, I am risking a loss of 10 tix ten percent of the time while the rest of the time I am expecting a gain of 5 tix. The risk-reward ratio is then 1 tix versus 4.5 tix, and this is a very comfortable ratio in my mind. (Do note, however, that the preceding calculations ignore transaction costs.)

Well Colonnade worked out well!

Yes, my timing seemed to be impeccable on this one! Too bad the spoiler for Twilight Mire and the other filter lands rolled out (eliminating the possibility of colonnade appearing in A25) just as my article was going live.

Hey Matt,

Whats your opinion on Verdurous Gearhulk and Heart of Kiran, ive got a large stock pile of those and they are only losing. Should I just take the massive hit or try to hold out for some recovery with the spring set? Also, will you be targeting modern staples during the M25 release? It doesn’t seem like a good time for standard staples.