Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

While many QS Insiders were monitoring trends at the Pro Tour this past weekend, I had a rare opportunity to support the staff working the Quiet Speculation booth at Gencon. This was truly an eye-opening experience to me. Despite being a member of the community for many years, I had never actually tried the Ion Scanner technology.

Wow.

If you haven’t used it before, you really should check it out. I’m not going to write an article as an advertisement, but it’s worth at least emphasizing the technological advances in a couple paragraphs. I went through two Commander decks and scanned one card at a time in rapid fashion, discovering I had more value in these cards than I ever imagined. The applications are endless – buylisting, digging through bulk, trading, planning a strategy to sell at a GP, pricing cards on TCGplayer, etc. Needless to say, I was blown away.

While there, I discovered another trend I wanted to highlight. It is perhaps less flashy, but no less important to understand. This trend relates to quantities of a card available for sale on the open market, and how sometimes numbers aren’t what they seem.

The Biggest Boon at Gencon

As I arrived on site, I was given a tip from our technical team at Quiet Speculation: Dave & Adams Card World had a booth with boxes and boxes of $1-$20 cards. These cards were worth digging through because all of the prices were stickered and many were obsolete. Then I received a Direct Message from a Twitter follower emphasizing the exact same thing.

“If you haven’t hit them up, Dave and Adam card world [SIC] over by SCG has a mess of underpriced old school in their $25 and below boxes”

I became a man on a mission. The results did not disappoint. I found numerous $3-$5 cards from older sets that had spiked. Perhaps the best find was a pair of played $3 Angelic Voices from Legends.

I also found cheap copies of Bronze Horse, Kjeldoran Outpost, and Femeref Enchantress. They even had $3 Propagandas, which surprised me because that card isn’t exactly obscure and the price should be well known. Overall, it was a nice little windfall that helped subsidize some purchases I made for my personal collection.

While this information isn’t directly helpful to readers after-the-fact, I bring this up because I discovered something while sifting through Dave & Adams’s boxes. They had a ton of Alpha and Beta basic lands along with a healthy lot of HP commons and uncommons. This was an important realization, because historically I have judged the market supply of a card based on TCGplayer’s stock. Currently there are maybe 50 Alpha Swamps in stock. But Dave & Adams Card World easily had another couple dozen in their boxes. What’s more, their pricing was in the $17 range, quite competitive to the pricing on TCGplayer.

As another example, they had a few HP Alpha Burrowing in stock. While having three copies in a box doesn’t seem worth mentioning, this is 33% of the total stock on TCGplayer. Remove the two obviously overpriced copies, and the addition to the supply is even more significant.

Expanding the Point

Let’s take a step back for a moment and consider the implications. When I shop around for older cards, I often pay close attention to the supply on TCGplayer because I want to make sure I’m purchasing cards that will soon become nonexistent at reasonable prices. When I see an Alpha uncommon with three copies in stock, and one of them is way overpriced, I become very tempted to purchase one for myself “before it’s too late”. This is based on my hypothesis that in a few years, many Alpha cards will become nearly impossible to purchase at “reasonable” prices.

But my observation at Dave & Adam’s Card World’s booth last weekend causes me to pause and consider. TCGplayer getting wiped out of a card may not imply the card is gone from the market forever. Some shops may have some additional supply and not even realize it! I wonder if there are other vendors like D&A that have boxes of random $5 cards that contain Beta commons and uncommons or $15 cards that contain Alpha. How many Alpha basic lands are truly out there for sale, just not brought to inventory on major websites?

Perhaps these cards aren’t as rare as I thought? Perhaps there are more copies out there for players to use and collectors to purchase if only they could find them? I will point out that while I was digging through these boxes (for the second time), I was bumping elbows with guys from Hot Sauce Games. They had gotten wind of this gold mine and were purchasing stacks of SP and NM Old School cards. I was frustrated to have missed out on more gems, but at least the Hot Sauce Games guys will inventory these and hopefully bring them to online inventory. That should help alleviate demand pressures in the short term.

Here’s another example: there are currently 13 near mint copies of Arboria for sale on TCGplayer.

At another vendor’s booth, I found a couple copies of the card and picked one up for my collection. The cost was $7. When I tweeted this discovery, a follower indicated this vendor appeared “sold out” on their website.

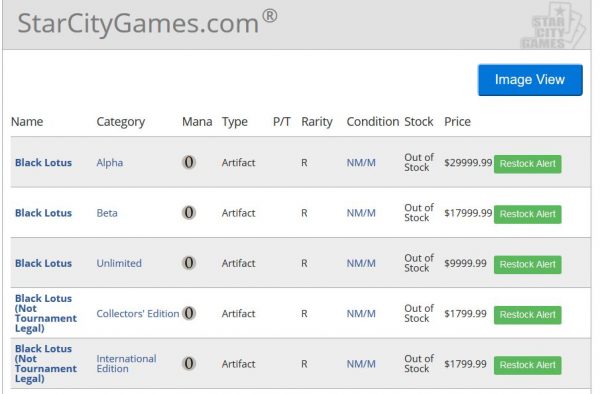

That’s strange. I know I saw multiples in a stack at the seller’s booth. I wonder if the vendor had removed these from their online inventory so they could sell them in person at Gencon. This seems to happen a lot, in fact. I often notice Star City Games’ stock on high-end cards such as Power go to zero across the board during major events. For example, it may be possible SCG has zero Black Lotuses in stock, but it seems equally likely they just pulled their online inventory to try and sell these cards at their Gencon booth.

Yet again, online stock of cards may not accurately reflect what is truly available on the market. You just need to know where to find them.

The Converse Can Also Be True

This trend can work in the opposite direction as well. Sometimes there is less supply than what seems to be available on the market. For example, Channel Fireball uses Crystal Commerce and can post their stock on their website and TCGplayer simultaneously. When a card is purchased from one site, their available quantities are automatically adjusted on the other site. I suspect other vendors do this as well.

While this seems negligible for small-time shops, this could make available supply at a larger vendor appear twice as big. Obviously a single individual would realize that an Alpha card in stock on TCGplayer is the same card as what is in stock on Channel Fireball’s website. But to the market as a whole, this could appear as though the available supply on a card is greater than what is actually for sale.

If I’m in the market for an Alpha Burrowing, I may check TCGplayer and see a damaged copy for $24.99 (obviously this is a bad price, but just for the sake of discussion). Let’s say I’m interested in purchasing it. Another Alpha player may be browsing Channel Fireball’s stock and see that same Burrowing on their website for $24.99. To both of us, we see an available copy of this card for sale. But in reality, only one person’s demand can be satisfied with that copy. Thus, the supply is insufficient to meet the demand despite an appearance that indicates otherwise.

Implications

What does this all mean? To me, I think this means we need to exercise caution when making purchasing decisions based on supply of a card. A card may seem low in stock, but there may be available copies out there to refuel the market. This means a predicted price spike due to buyout may not actually come to fruition as people dig out copies from slightly harder-to-find shops.

This is critical when dealing in very rare cards, such as Alpha uncommons. But it could also have implications when chasing buyouts of more heavily printed cards. Remember when I hyped Rainbow Vale because I realized how fun the card was in pack wars? The attention gained enough traction to send the card from $2 to $7.

I had thought all lightly played and near mint copies were pretty much purchased from the market. That was far from the case. I should have known a Fallen Empires card would have ample supply in random boxes of bulk across the country. Just a few months after peaking over $7, the card was back down to $3.50 as supply returned to the market. There’s a ton of Fallen Empires out there—we need to consider the hidden supply in addition to the TCGplayer supply when speculating on a card.

Remember when Revised Savannah Lions spiked? I had grabbed a dozen played copies from TCGplayer and flipped them all to Card Kingdom when the online shop had a $4.20 buylist for them. While near mint and lightly played copies are more expensive now, the played copies have slowly returned to the market. Card Kingdom’s buy price on Revised Savannah Lions now: $1.85. There’s a lot more Revised out there than people realize.

Wrapping It Up

I am not trying to discourage people from looking at cards in sets with larger print runs. I’ve even written about how Revised and Fourth Edition cards offer real opportunity over the next few years. But I did want to emphasize an important point this week: there are more copies of a card on the market than you’d realize just looking at TCGplayer.

This became very apparent to me while browsing stores at Gencon. The fact that I could purchase a dozen Alpha Swamps from a single vendor without having any impact on the apparent market supply (i.e. TCGplayer) tells you just how deep the supply really goes. The copies are surely out there—people just need to dig for them. As a price spikes, it motivates more and more people to dig through their boxes and look for copies to list for sale.

Thus, after a buyout the price of a card retracts as that new supply hits the market. It happens all the time, but I got to witness firsthand some of the driving forces behind that price retraction. After finding a couple Angelic Voices, I submitted a buylist order to Card Kingdom for easy profit. If a few people follow suit from this past weekend, Card Kingdom will drop their buy price. This will reduce demand for the card as there will be less arbitrage available. I know people are familiar with this concept; it was just fascinating to me to witness firsthand how much of a card is really out there if one is willing to dig deeply enough. I’ll be keeping this in mind next time I speculate on a card strictly due to low supply on TCGplayer.

…

Sigbits

- I did notice Card Kingdom just recently added Bazaar of Baghdad to their hotlist. In doing so, they also upped their buy price on the Arabian Nights card from $900 to $1050. While prices remain volatile, I have noticed that the overall trajectory of Arabian Nights cards remains upward. This applies even to non-Reserved List cards like Flying Men.

- I noticed that Teferi, Hero of Dominaria took over as the most valuable card from Dominaria, surpassing Karn, Scion of Urza. However it’s interesting to note that their foil values are of the opposite trend. Karn’s foil buy price at Card Kingdom is $66 while Teferi’s is only $48. Perhaps this reflects Karn’s greater utility in other formats? Or does this mean Teferi’s foil price is too low? It’s an interesting observation.

- One of the other Reserved List cards I found in D&A’s $3 box was a single copy of Femeref Enchantress. I eagerly set that one aside knowing I could buylist it for much more. In fact, Card Kingdom is currently paying $7.25 on the card. It may even have greater upside if it finds a consistent home in the new “enchantments matter” Commander 2018 deck.

Good article, Sigmund. This is one of the reasons why I started writing the Hold ‘Em & Fold ‘Em series. Aside from ‘limited/capped’ supply, I think it’s as important to look at ‘true demand’ of cards from tournaments.

People should also keep in mind why Magic exists…

Curse of the Black Lotus

https://www.npr.org/sections/money/2015/03/11/392…

https://www.npr.org/sections/money/2015/03/11/392…

Link posting from phone didn’t work. Can you help me edit comments, Sigmund?

https://goo.gl/xVZ3zD

I def agree that the true value of a non-reserved list card is its playabilty and the number of players who play the formats its legal in. What’s your take on how non-player speculators impact the market on old school cards? How do you predict that the market will respond to this type of demand?

Hi Ben,

I think it’s fine. I totally understand people investing in Magic just for profit. It’s not the tournament players that I’m concerned about because Old School isn’t really a supported competitive format by Wizards.

Moreso, it’s the actual speculators that are at risk. They’re investing in cards that sometimes never see play in the competitive world which is what truly drives ‘demand’ in this game.

If it was purely collectibility, then we’re back to the sports cards and comic books days. And we saw those markets tank many years ago. This is another reason why I bring up the NPR episode.

As a competitive player, I’ll most likely never care about Arabian Nights Flying Men unless I become extremely wealthy. And even then, I’ll just start playing Vintage tournaments.

I def agree that the true value of a non-reserved list card is its playabilty and the number of players who play the formats its legal in. What’s your take on how non-player speculators impact the market on old school cards? How do you predict that the market will respond to this type of demand?

Trying to specifically reply to Edward Eng here ^^. Appears there’s a bug.

Thanks for another great article Sig. As always, you make a good point that will help guide my buying decisions.

Thanks, Ben! I don’t know why the comments didn’t behave this time around.

Thanks for the comments! Indeed the hidden supply of cards is certainly a factor we should consider when buying.