Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

A large vendor has made yet another major shift in their pricing scheme. I’ve written about them before, cautioning customers of rampant credit inflation risks. I even went as far as to say that it was inadvisable to hold any store credit at this store for any extended period of time. The risk of value-loss due to price inflation was so great.

Then they did something bold, unexpected, and one-hundred-percent necessary.

If you haven’t guessed already, the vendor is ABUGames. What they did was significantly reduce prices on many key staples. While they essentially invalidated my advice, I must say their move was absolutely necessary given the downward spiral they were navigating. Just when I thought the opportunities to arbitrage with ABUGames had evaporated, there’s now a huge group of cards worth acquiring via trade credit.

Let’s take a look at some examples. But remember: as soon as people start discovering this trend, the best opportunities will vanish. So if you see anything you like, make sure you jump on the cards as soon as possible. Take advantage of ABU’s policy that allows you to place an order for cards first, even before shipping your trade-in.

Price Drops Across the Board

I’ve become obsessed with ABUGames’s buylist. I used to check Card Kingdom’s list religiously, anticipating every single small tweak to their numbers. But now I’ve switched focus and spend the majority of my time reviewing ABU’s numbers.

Because of this research, you can take my word for it when I say that many prices on Legacy and Commander Reserved List cards have dropped significantly.

For example, ABUGames used to have their near mint Gaea's Cradles listed at $499.99. I know this because I was trying to acquire their played copies for a slightly-more-tolerable $399.99. I figured I could sell such copies on the market and net $240 in cash, meaning I could convert store credit into cash at a 60% rate. At the time, that was sadly attractive.

Now their prices are slashed about 15%. Near mint Cradles are listed at $424.99 and played $382.49. A solid drop.

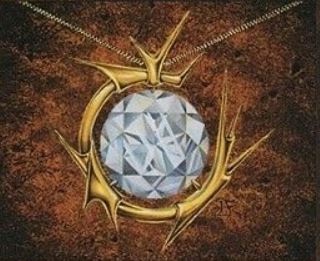

More interestingly was their move on Mox Diamond. I was actually ecstatic to trade in for a slightly played, signed copy they had a couple weeks ago. It was listed at $234.99. This was attractive because their near mint pricing was way higher, in the $300 range.

Now their near mint copies are listed at $236.25 and played copies at $179.99. Are you kidding me?! Market price on TCGplayer is $201.13! With ABUGames’s cash rewards program, I currently can get 15% off singles. So technically that means I could purchase these Mox Diamonds for under “market price” if I wanted to spend the cash. Of course, with credit, the pricing becomes that much more attractive!

But let’s talk about the most notable price drops of them all: dual lands. I firmly believe dual land prices have stabilized over the past couple weeks. There are signs that these cards are in-demand yet again as I see Card Kingdom’s hotlist has a couple popping up now and again. You can’t quite see the movement in price charts yet, but the flattening out we’ve seen over the past couple months is, to me, a very encouraging sign. I think they even dropped prices on Beta and Unlimited duals—something I thought would never happen.

I don’t remember all of ABUGames’s former dual land prices, but I can say with confidence that these prices have all dropped across the board. Suddenly if you’re sitting on store credit, you could do just fine cashing it out into their duals. And they sure have a lot of them available!

Finding That Trade-In

If these Legacy and Commander staples don’t interest you, don’t fret. I suspect you’ll find a lot of cards with lower prices now across the board. Their price on stuff like Serra's Sanctum dropped. I think even some of their Arabian Nights prices are down. $250 for a played Arabian Nights Erhnam Djinn still seems a bit high, but if you’re trying to acquire them without laying out cash, a trade-in may be worthwhile.

So all of this begs the question: if their sell prices on many key cards are down, are their buy prices also down? The answer is a resounding yes. But there are exceptions—you just gotta find them.

For example, I had a Beta Nevinyrral's Disk sitting in a deck. I had acquired it for $500 a few months ago thinking it would slot well in an Old School deck. But it really didn’t fit, so it ended up getting pulled out. Luckily ABUGames is completely out of stock on the Beta rare, so their trade-in credit number for played copies was $950.

In the old world I would have been lucky to convert that $950 credit into $500-$550 in cash. Now I am more optimistic about a profitable cash-out. I sent the card in and ordered four near mint Mox Diamonds in exchange. I’m hoping to sell the Moxes for around $160 each or perhaps $600 for the set. Even if I can’t move them so quickly, I think the Moxes will be easier to sell and far more liquid than the Disk, so the trade made sense in my mind.

It seems ABUGames still has some pretty solid trade credit numbers on other Alpha, Beta, and Unlimited cards as well. I’d encourage you to browse these numbers, and pay special attention to the played and heavily played numbers. I had a heavily played Unlimited Jayemdae Tome rotting in my binder and was happy to ship it to ABUGames for $58.10 in credit. These start at $35 on TCGplayer—with their new prices, I’m confident I can cash out of the $58.10 in credit and get very close to $35 in cash, perhaps even more. That’s an exchange I’ll take any day!

This works well because other vendors mark down their buy prices on played cards so severely. Card Kingdom will pay 40% of their near mint price on a heavily played card (I’d get $22.88 for my HP Tome). Channel Fireball pays 25% of their near mint price for moderately played, and 10% for damaged. Pretty sure they would have called mine damaged because it was a bit too rough to be MP.

Their near mint buy price on Unlimited Tome is very attractive at $60, but that means I would have gotten an insulting $7.80 in trade credit for my copy. Maybe they would have given me $19.50 if they graded it MP. ABUGames really is best in class when it comes to trade credit on MP and HP old cards.

With some research, I’m confident you’d be able to find other played or heavily played cards from Magic’s first three sets that can be flipped profitably for credit. Now that their prices are down, I no longer value their credit at 50-60%. Suddenly a 70% number isn’t so farfetched!

Hurry While Supplies Last

This move by ABUGames was brilliant. It will cause them some losses in the short term because I’m sure they offered aggressive buy numbers on the inventory they’re now marking down. But assuming they can get through the short-term, the price adjustments will bring in a flood of new business. Prices are definitely attractive now if you have trade credit, and even tempting with cash if you have a high enough loyalty discount.

I have just one caution to folks looking to take advantage of this shift. There’s opportunity now but that will dry up quickly. There’s going to be a lot of people cashing out credit into Mox Diamonds, Gaea's Cradles, and dual lands. Before you know it, ABUGames will be sold out of all these cards.

That’s not a terrible thing, I suppose, but it does mean the opportunity for attractive trades will be short-lived. From there, it will take time for the market to find equilibrium and copies to come back into inventory. It will be absolutely critical that ABUGames sticks to their new pricing strategy to avoid the return of unhealthy inflation. If they jack up their buy prices on Mox Diamond in response to selling out, they’ll end up back where they started. They will need to be very vigilant and deliberate with any price adjustments upward.

What does that mean for you? It means you will need to act fast if you want to get the best deals. And if you can’t move quickly enough, you’ll need to be patient to watch how things unfold at their site.

Maybe they’ll drop other prices, and you can jump on those cards—it wouldn’t kill them to, say, drop their price on Academy Rector. They have 41 played copies in stock for crying out loud! No one wants to pay $62.99 for these cards, even with credit. But $53.49 may suddenly get some interest. Maybe they’ll make another drastic shift and drop prices on the heavily played Beta and Unlimited stuff. If that happens, you’d better believe I’d be trading with them again to acquire key Old School cards for my decks!

In other words, if you don’t get to take advantage of the recent move you shouldn’t fret. There will be other opportunities because I highly doubt this is the last big price change ABUGames will make. They’re on the right track, but they’re going to make waves at their site with the recent adjustments and they will have to adjust further in time. Just make sure you have some cards ready to trade in so you’re ready to take advantage.

Perhaps you may even want to hold some store credit for a change!

Wrapping It Up

I know I write about ABUGames often, but their business model is so different from other stores that it merits a lot of discussion. No other store provides 100%+ trade credit bonuses on certain cards. No other vendor slashes prices so drastically across so many highly desirable cards. And while there’s plenty of arbitrage to be had at many stores, I think ABUGames’s current price adjustments yields some of the most attractive arbitrage opportunities in the game.

If you have some stuff you’ve been waiting to send in for trade credit, I’d encourage you to look at their new prices to see if any deals leap out at you. They had hundreds of dual lands rotting in their inventory before, but I bet you anything they’re going to become “sold out” in a few short weeks. With their new pricing, the deals with trade credit are so much more attractive.

So get on it! Let’s see how things unfold. While it is impossible to predict what will happen, I’m fairly confident in one thing. I’ll likely be writing another article about more price changes at ABUGames in the future!

…

Sigbits

- Let’s talk about some other cards that ABUGames still pays attractively on despite recent price drops. How about we start with the heavy hitter: Power. You can still get $2784 in trade credit for the least desirable piece of power, a Mox Pearl. That wasn’t too bad back when their credit could be converted to cash at a 60% rate. But now imagine getting 12 Mox Diamonds in trade, valued at $150 a piece. That’s $1800 cash, a great price for selling a played Pearl. Of course, ABUGames doesn’t have 12 Mox Diamonds in stock anymore… you’ll have to find other things to get!

- ABUGames isn’t paying as aggressively on low-end Alpha cards anymore, but they still have attractive credit numbers on the more desirable Alpha cards. Not that everyone has a stack of playable Alpha cards lying around, but if ABUGames has little-to-no stock of a given card, I suspect they didn’t adjust their buylist price lower. I have an Alpha Vesuvan Doppelganger and I noticed they still have the same trade credit numbers on this card: $1425 for played and $1140 for HP.

- Perhaps there’s another angle with foils. I’m not as familiar with the foil market, but I do see ABUGames still has some pretty decent trade credit numbers on played high-end foils. They pay $444 in store credit for a played foil Academy Rector, for example. While you can’t exactly get free arbitrage money buying the cheapest TCGplayer copy ($350) and flipping it for credit, it’s probably much easier to flip such a card to ABUGames for more liquid cards such as duals. Food for thought, if you’re sitting on some played foils you can’t sell.

Thanks for the thoughtful article! One thing I noticed a few weeks ago when I was trying to cash out my credit with them was that they often had extremely competitive prices on many Italian Legends and black-bordered foreign 4th edition cards – Resets for under $10 each, SP Angus Mackenzie for $115, SP All Hallow’s Eve for $175, etc. I don’t know if there are many deals left (I had a lot of credit to cash out), but it might be something to keep an eye on

Blake,

This is very insightful data. Have you compared their Italian Legends prices with what listings sell for on eBay? If the numbers are relatively close, then this is a spectacular way to exit credit…as long as you are patient when waiting for those sales.

Thanks for sharing!

Sig