Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

On a daily basis, I review MTG Stocks’ Interests page to track the largest movers in the market. This tracking doesn’t necessarily help me get in front of trends, but it at least keeps me abreast of market dynamics. This is valuable when constantly buying and selling cards.

One sub-page of MTG Stocks I don’t review nearly as often is the All-Time Highs/Lows page. But in reality, this is arguably the more valuable summary to review. Often times a card is bought out and its price is temporarily warped, making it seem ridiculously high on MTG Stocks.

That card may be hitting its all-time high, but that high only lasts one day. Most frequently a card that spikes proceeds to retract in the days following the buyout. Therefore, such cards don’t appear on the all-time high list for more than that 24 hour period, making most cards on this list a better representation of what is actually sustaining higher prices.

This week I’m going to review this underutilized page and flag cards that I think are a buy at all-time highs and cards I’d consider a potential sell. Such a review will reveal my thought process as I assess some of this market’s strength.

Buying at the Highs

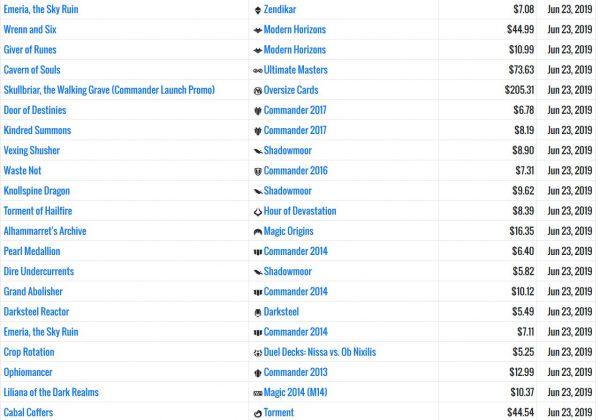

To start, here’s a partial list of June 23’s all-time highs, which is the list I’m referencing for this week’s article:

I want to focus first on the Modern Horizons all-time highs: Wrenn and Six and Giver of Runes. Both of these cards are making waves in tournament play, and their recent movement is a reflection of how easily a Modern Horizons card can pop. With the higher MSRP, the overlap with Core 2020 and War of the Spark, and so many single-printing cards, Modern Horizons is a gold mine of potential profits. A card from this set need only have some success in a Modern or Legacy list, and its price can pop like a coiled spring.

With this backdrop, I’d consider these two cards worth holding. I’m not that excited about them now that they’re $40+ and $10, respectively, but I don’t see them giving up recent gains either. It’s hard to buy a card at its all-time high, but if you want these for play I don’t think waiting around will do much unless you think their impact on Modern and Legacy will evaporate…in which case, why would you want them to begin with?

Another card on this list I would still buy at highs is Pearl Medallion.

In reality, the full cycle of Medallions is hot right now with Sapphire Medallion leading the charge. Card Kingdom has fairly aggressive buy prices on the Commander 2014 printings of these artifacts, and they are EDH gold as far as I’m concerned. Even though only Pearl Medallion showed up on June 23’s list, I see Jet Medallion hit its high June 22 and Sapphire Medallion hit its high June 19.

Unless Wizards does another mono-colored cycle of Commander decks (not likely), I don’t think they’d randomly throw these in a subsequent Commander product. I suppose they could show up in a Standard set at some point, but this is also doubtful.

Speaking of popular Commander cards, it’s not surprising to see Omnath, Locus of Mana hitting all-time highs. Wizards keeps printing new versions of Omnath—Omnath, Locus of Rage in Battle for Zendikar and Omnath, Locus of the Roil in Core Set 2020—but other than one From the Vault product, they won’t reprint the original version from Worldwake. This naturally drums up interest in the original version and I expect all three work well together in a Commander deck. Let’s not forget how rare mythics are from Worldwake, too. That set was released nearly ten years ago at this point, during a time when Magic wasn’t opened in the quantities it is today.

Selling Into The Highs

I don’t have a crystal ball and there’s no way I can predict what cards will be reprinted and what cards won’t be. But my thesis for selling certain cards at all-time highs boils down to two simple factors: a card is expensive due to being old and seldom reprinted, and it doesn’t have demand in formats where four copies are played in a deck.

One example of such cards is Alhammarret's Archive.

After bottoming throughout 2017, this card has steadily climbed to its current all-time high and is closing in on $20. The card seems like a casual player’s dream, doubling life gain and card draw is something we all appreciate. I know better than to blindly trust EDHREC’s numbers, but it appears the card does have some utility in Commander. That said, it’s not ubiquitous in the format and it definitely doesn’t see play in Modern or Legacy. So why is the card so expensive? The card was printed once, as a mythic rare, in Magic Origins—a four-year-old set that wasn’t opened a ton.

If the card continues to dodge reprint, then of course Alhammarret's Archive’s price can continue to steadily climb. But this seems like an easy card to reprint, either in a supplemental Commander set or even in Standard. After all, the card isn’t exactly too dangerous to put back into Standard, and it seems like low-hanging fruit for WotC if they’re looking to juice a set’s EV a little bit. There’s no need to panic sell this one, but you should be aware of its high price tag and vulnerability.

The next card on the all-time high list I’d consider selling is Ophiomancer.

This is a Gray Ogre that gives you one 1/1 snake. I suppose this is effective as a chump blocker, and you get the snake back every upkeep, meaning you can block each of your opponents’ biggest attackers (without trample). Or, more likely, you could sacrifice the snake to some greater effect every turn. But this card isn’t in many Commander lists on EDHREC. I suspect its price tag of $13 is due to its single printing back in Commander 2013.

I suppose if this dodges a reprint another six years, it’ll be more expensive than it is today. But it’s certainly easy to throw in a future Commander product. If I owned any copies, I’d think long and hard about the utility I’m getting out of this Human Shaman and consider converting that $13 into something more powerful or with more potential upside.

The most obvious sell on this list is Trained Cheetah.

This Portal: Three Kingdoms card was $3 for years and years and is only now, suddenly worth $160? I don’t think so. I smell a buyout. But the market price is $10, so I doubt we’ll see the Cheetah back to its former $3 price tag. That said, this card’s price is driven solely by rarity and collectability. I don’t even think this makes the cut in casual Cat decks. Sell them if you’ve got them. While you’re at it, sell Pale Bears at its high of $9 and Bear Cub at its high of $8.

Wrapping It Up

The all-time high list is really helpful in tracking real price movement of cards because it doesn’t shine a spotlight on buyouts. Sure, cards that are bought out that day show up on the list, but the majority of cards are steady climbers with real demand.

Since the stock market is at all-time highs and I’m looking to trim various positions into this strength, I thought I’d apply a similar thought process and examine which cards on the all-time high list are a buy and which are a sell. Sometimes the momentum and strength in demand are real, and a card hitting highs one day is likely to hit a new high the next. But not all all-time highs are created equally, and sometimes a card’s price gets too high for its utility and risk. An easy reprint of an obscure card printed in one set many years ago is quite risky to hold onto, and all-time highs can be an attractive exit point.

Right now, my general thought is that anything Modern Horizons is a buy or hold, even at highs. The most desirable cards from that set will be very hard to come by a couple years from now and I want to be a buyer while supply is high. Meanwhile, I’m bearish on anything related to bears (forgive the pun). I believe this trend won’t last, and even if it does, do we really think Pale Bears can sustain a $10 price tag? I’m not a believer.

Sell out of Bears, buy into Horizons, and you should be well positioned to ride higher highs and avoid any major pullbacks.

…

Sigbits

- Don’t get me wrong, there is a newfound demand for all these random Bears. But some of these prices are ludicrous and Card Kingdom isn’t chasing. They currently have a $0.90 buy price on Pale Bears and a $0.21 buy price on Striped Bears. These are certainly above bulk now, but still don’t get me all that excited.

- With recent spoilers, we’re also seeing Elemental cards gain interest from a tribal standpoint. Cards are exiting bulk and popping onto Card Kingdom’s buylist. This includes Roil Elemental ($0.80), Hellspark Elemental ($0.25), and War Elemental ($0.21). If you’ve got some time, dig through your bulk and pull out any Elemental cards you find—they just might fetch you a quarter each.

- I’m noticing a trend with International Collectors’ Edition cards on Card Kingdom’s buylist. It appears that even the most unexciting of commons are buylisting for around a buck nowadays. Healing Salve, Holy Strength, and Holy Armor will each fetch you a dollar cash if they’re near mint. It may be time to dig through your obscure websites and LGS to see if you can find any of these near bulk prices.

I have to disagree with you on a few of these Sig. Modern Horizons just released..supply is still quite limited so it makes sense that the cards that are the first to find a home in decks will reach highs. But supply will continue to grow, I am a seller of pretty much all MH cards currently. As for Ophiomancer, I imagine his uptick in demand is due to Yawgmoth EDH decks..as he provides a mana free token every turn, which is not all that common in black.